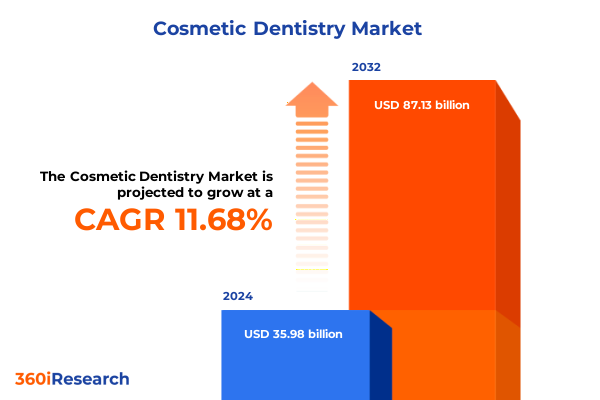

The Cosmetic Dentistry Market size was estimated at USD 39.98 billion in 2025 and expected to reach USD 44.42 billion in 2026, at a CAGR of 11.77% to reach USD 87.13 billion by 2032.

Setting the Stage for the Future of Cosmetic Dentistry by Exploring Core Trends, Drivers, and Strategic Opportunities Across the Industry Landscape

In the realm of oral health and aesthetic care, cosmetic dentistry has transcended its traditional boundaries to become an integral component of modern healthcare services. Once considered a luxury reserved for a select few, procedures aimed at enhancing smiles now enjoy widespread acceptance across diverse demographic groups. Patients today are increasingly attuned to the correlation between dental appearance and overall self-esteem, driving demand for services that blend artistry with clinical precision. Advances in materials science, digital imaging, and minimally invasive approaches have further democratized access, enabling clinicians to offer tailored solutions that align with individual preferences and functional requirements.

As the industry navigates a confluence of technological breakthroughs and shifting consumer behaviors, understanding the foundational trends is more critical than ever. This introduction lays the groundwork for exploring how patient expectations, regulatory changes, and supply-chain dynamics collectively shape the cosmetic dentistry landscape. By examining the interconnected forces at play, readers will gain clarity on the pivotal role that innovation, operational excellence, and strategic foresight must play in capturing growth opportunities and delivering premium patient experiences.

How Technological Innovations and Patient-Centric Service Models Are Redefining Cosmetic Dentistry Practices and Elevating Treatment Standards

The cosmetic dentistry sector is undergoing a radical transformation as cutting-edge technologies intersect with evolving patient preferences. Digital dentistry platforms powered by CAD/CAM systems and 3D printing are enabling precise customization, reducing turnaround times, and enhancing the predictability of clinical outcomes. Artificial intelligence algorithms now assist in treatment planning by analyzing intraoral scans and photorealistic simulations to recommend optimal restorative designs. Concurrently, patients’ desire for minimally invasive procedures has prompted practitioners to adopt laser-assisted techniques and bioactive materials that promote natural tissue regeneration and accelerate recovery.

Moreover, the proliferation of social media and telehealth services has redefined patient engagement. Virtual consultations and digital smile previews allow prospective patients to visualize results and make informed decisions before stepping foot in a clinic. This shift toward a more interactive and transparent care model fosters deeper trust between clinicians and patients, elevating satisfaction levels and driving repeat visits. Sustainability considerations are also coming to the forefront, with eco-friendly material selections and waste-reduction initiatives influencing laboratory protocols and clinical workflows. Together, these transformative shifts are setting the stage for a more accessible, personalized, and environmentally responsible practice of cosmetic dentistry.

Assessing the Ripple Effects of New 2025 United States Tariffs on Dental Materials and Equipment Supply Chains Within the Cosmetic Dentistry Sector

The introduction of new United States tariffs on dental materials and equipment in 2025 marks a significant juncture for cosmetic dentistry providers and suppliers. By imposing additional duties on imported porcelain ceramics, zirconia, and select high-precision milling machines, these trade measures have created upward pressure on input costs. Dental laboratories and manufacturers, faced with these elevated expenses, are reevaluating procurement strategies and exploring alternative sourcing arrangements to maintain competitiveness while safeguarding quality. Some clinics have reported longer lead times as suppliers adjust to revised shipping schedules and customs procedures.

In response, strategic partnerships between U.S. laboratories and domestic component producers have intensified, fostering investments in local manufacturing capabilities. While this shift supports supply-chain resilience, it also necessitates capital outlays for expanded production and quality-assurance testing. Ultimately, the 2025 tariff landscape underscores the importance of agile supply-chain management and forward-looking procurement policies. By closely monitoring regulatory updates and leveraging diversified supplier networks, industry participants can mitigate cost impacts and sustain the delivery of sophisticated cosmetic solutions to a discerning patient base.

Unveiling Critical Segmentation Perspectives to Illuminate Diverse Treatment Modalities, Material Choices, End Users, and Procedural Approaches in Cosmetic Dentistry

Insights derived from treatment-type segmentation reveal a multifaceted market encompassing cosmetic bonding, dental implants, gum contouring, teeth whitening, and veneers-with veneers further distinguished between composite and porcelain variants. Each modality presents distinct clinical pathways and aesthetic outcomes. Composite veneers offer a cost-effective, minimally invasive option that appeals to patients seeking rapid results, whereas porcelain veneers command a premium for superior color stability and durability. Dental implants, celebrated for their functional restoration of edentulous spaces, frequently feature in comprehensive smile makeovers alongside soft-tissue sculpting techniques.

When examined through the lens of material-type segmentation, the industry’s reliance on composite resin, gold alloy, porcelain, and zirconia becomes evident. Composite resin continues to be favored for its ease of handling and adaptability in chairside procedures. Gold alloys retain a niche for high-precision inlay and onlay restorations, prized for biocompatibility and longevity. Porcelain and zirconia ceramics dominate the fabrications of crowns, bridges, and veneers, balancing aesthetic finesse with mechanical resilience. End-user segmentation highlights the pivotal role of dental clinics as primary service providers, with specialized dental spas catering to holistic experiences and hospitals offering integrated surgical care for complex reconstructive cases.

Procedure-type segmentation further distinguishes invasive, minimally invasive, and non-invasive approaches. Minimally invasive protocols, such as microabrasion and resin infiltration, address esthetic concerns with minimal alteration to natural tooth structure, aligning with patient demand for conservative treatments. Invasive surgical interventions-including full-arch implant placement-remain critical for extensive rehabilitations. Meanwhile, non-invasive whitening and alignment solutions illustrate the expanding portfolio of patient-friendly options. Synthesizing these segmentation insights enables stakeholders to tailor service offerings, align resource allocation, and anticipate shifting consumer preferences within the cosmetic dentistry spectrum.

This comprehensive research report categorizes the Cosmetic Dentistry market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Material Type

- Procedure Type

- Technology

- End User

Mapping Regional Dynamics to Reveal How Demographic, Economic, and Cultural Factors Drive Cosmetic Dentistry Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the adoption and evolution of cosmetic dentistry services. In the Americas, heightened aesthetic awareness coupled with widespread insurance coverage for select procedures has fueled growth in metropolitan hubs and suburban practices alike. Patients benefit from extensive networks of dental clinics and specialized day-spa environments that blend clinical excellence with luxury experiences. Economic variations within Latin American markets also present opportunities for tiered service models, ranging from premium European-style veneers to budget-friendly chairside whitening solutions.

The Europe, Middle East & Africa region displays a heterogeneous landscape, with Western European nations leading in technology integration and regulatory rigor that upholds patient safety standards. Clinics across these markets often invest in cutting-edge CAD/CAM systems and biocompatible ceramic materials. Meanwhile, Gulf countries are witnessing a surge in high-end cosmetic practices driven by affluent consumer segments, whereas Africa’s cosmetic dentistry sector remains emergent, constrained by limited infrastructure but poised for expansion as access to training and capital improves. Over in Asia-Pacific, rapid urbanization, rising disposable incomes, and a cultural emphasis on smiles as symbols of success are converging to propel demand. Key markets such as China, India, Japan, and Australia report accelerated clinic openings, increased domestic production of dental materials, and fast adoption of tele-dentistry platforms that cater to remote consultations and follow-up care.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Dentistry market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Who Are Shaping the Competitive Landscape of Cosmetic Dentistry Through Partnerships and Product Development

Leading companies are shaping the cosmetic dentistry arena through strategic investments in research and development, acquisitions, and collaborative alliances. Global pioneers in dental consumables and equipment continuously refine material formulations to optimize esthetics and longevity. Firms specializing in digital workflow solutions bridge the gap between clinician intent and laboratory execution, offering integrated platforms that streamline case planning, design, and fabrication. At the same time, manufacturers of lasers and bioactive scaffolds are expanding the therapeutic toolkit available to practitioners, enabling minimally invasive procedures with superior healing profiles.

Partnerships between established dental groups and emerging biotech startups are accelerating the commercialization of next-generation regenerative therapies. Clinical trial data and real-world evidence are being leveraged to validate novel protocols for soft-tissue contouring and enamel remineralization. Venture capital interest in dental technology has also intensified, providing growth capital to firms focused on AI-driven diagnostics, tele-orthodontics, and patient engagement portals. Collectively, these corporate strategies underscore a competitive landscape where innovation capabilities, global distribution networks, and scalable digital solutions define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Dentistry market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Align Technology, Inc.

- Danaher Corporation

- Dentsply Sirona Inc.

- Envista Holdings Corporation

- GC Corporation

- Henry Schein, Inc.

- Ivoclar Vivadent AG

- Koninklijke Philips N.V.

- Planmeca Oy

- Straumann Group AG

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives and Tactical Guides for Industry Leaders to Accelerate Growth, Enhance Patient Engagement, and Optimize Operational Efficiencies

Industry leaders should prioritize the integration of digital technologies to enhance clinical precision and operational efficiency. Embracing cloud-based practice management systems, advanced imaging tools, and chairside milling solutions can significantly reduce treatment timelines and elevate patient satisfaction. Simultaneously, diversifying supply-chain partnerships between domestic manufacturers and trusted international suppliers will mitigate the impact of trade policy fluctuations and safeguard inventory levels. Clinicians and procurement executives must collaborate to establish long-term contracts with contingency clauses that address potential tariff escalations and shipping disruptions.

Investing in workforce upskilling is equally critical; ongoing training in emerging materials science and minimally invasive techniques ensures that practitioners remain at the forefront of therapeutic advancements. Developing patient education initiatives and immersive virtual consultations can strengthen engagement, cultivate trust, and differentiate service offerings in a crowded marketplace. Finally, adopting sustainable operational practices - from recyclable packaging to energy-efficient laboratory equipment - will resonate with environmentally conscious consumers and support broader corporate social responsibility goals. By executing these strategic imperatives, organizations can unlock new growth avenues, enhance margin performance, and solidify their reputations as market leaders.

Detailing a Robust Mixed Methods Approach Incorporating Expert Interviews, Quantitative Surveys, and Secondary Data Validation for Rigorous Market Insights

The study employed a robust mixed-methods research framework to ensure comprehensive coverage and analytical rigor. Primary research consisted of in-depth interviews with key opinion leaders, including practicing cosmetic dentists, laboratory technicians, and materials scientists. These qualitative insights were complemented by structured surveys of clinical and corporate stakeholders, capturing nuanced perspectives on technology adoption, procurement policies, and patient demand dynamics.

Secondary research drew upon peer-reviewed journals, professional association reports, and governmental publications to validate market observations and regulatory insights. Data triangulation techniques were used to reconcile disparities between sources and reinforce the credibility of findings. Geographic segmentation analysis integrated demographic indicators, healthcare infrastructure metrics, and regional trade data to provide a granular view of market maturity across global territories. Throughout the research process, standardized data-validation protocols and expert peer reviews were applied to maintain objectivity and minimize bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Dentistry market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Dentistry Market, by Treatment Type

- Cosmetic Dentistry Market, by Material Type

- Cosmetic Dentistry Market, by Procedure Type

- Cosmetic Dentistry Market, by Technology

- Cosmetic Dentistry Market, by End User

- Cosmetic Dentistry Market, by Region

- Cosmetic Dentistry Market, by Group

- Cosmetic Dentistry Market, by Country

- United States Cosmetic Dentistry Market

- China Cosmetic Dentistry Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Highlight Future Trajectories and Strategic Inflection Points in the Cosmetic Dentistry Sector

As the cosmetic dentistry field advances, the convergence of technological innovation, evolving patient preferences, and geopolitical dynamics will continue to drive transformation. Digital platforms will redefine clinical workflows and patient experiences, while material science breakthroughs promise more biocompatible and aesthetically refined solutions. Regional markets will diverge based on regulatory frameworks, economic conditions, and cultural attitudes toward dental aesthetics, underscoring the importance of tailored go-to-market strategies.

In summary, stakeholders equipped with an integrated understanding of emerging technologies, tariff implications, segmentation nuances, and competitive landscapes will be best positioned to capitalize on growth opportunities. Ongoing dialogue between clinicians, manufacturers, and policymakers will foster a more resilient and patient-centric ecosystem. By aligning strategic initiatives with data-driven insights and embracing agility in decision-making, industry participants can navigate the evolving cosmetic dentistry horizon with confidence and clarity.

Connect with Our Associate Director of Sales & Marketing to Secure Tailored Cosmetic Dentistry Market Insights and Empower Strategic Decision-Making

Engaging with Ketan Rohom, an experienced Associate Director of Sales & Marketing, offers decision-makers a direct pathway to unlock comprehensive insights and customized market analysis. This report not only delivers an in-depth look at current cosmetic dentistry dynamics but also equips stakeholders with actionable intelligence tailored to their strategic objectives. By partnering with Ketan Rohom, organizations can ensure that any remaining knowledge gaps are addressed through consultative discussions, bespoke data presentations, and timely updates as the landscape evolves.

Take advantage of this opportunity to solidify your competitive advantage by securing a full copy of the cosmetic dentistry market research report. Reach out to Ketan Rohom without delay to schedule a personalized briefing, explore licensing options, and obtain the detailed findings that will empower your teams to drive innovation, optimize supply chains, and enhance patient experiences. Let this comprehensive resource serve as the cornerstone of your strategic planning, enabling you to make informed decisions grounded in the latest industry intelligence.

- How big is the Cosmetic Dentistry Market?

- What is the Cosmetic Dentistry Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?