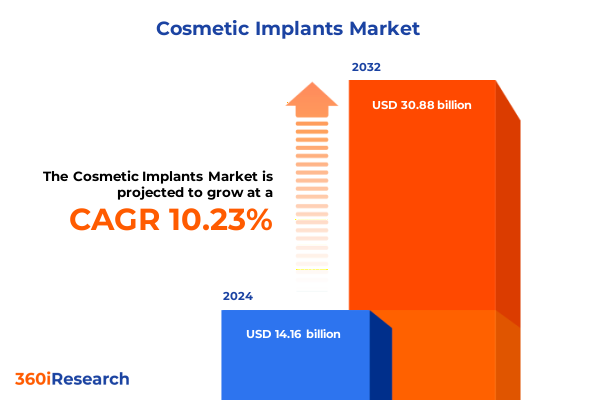

The Cosmetic Implants Market size was estimated at USD 15.41 billion in 2025 and expected to reach USD 16.78 billion in 2026, at a CAGR of 10.43% to reach USD 30.88 billion by 2032.

Delving into the Convergence of Patient-Centric Demands and Technological Advances Defining the Cosmetic Implants Industry

The cosmetic implants industry has matured into a sophisticated ecosystem where patient aspirations, technological breakthroughs, and regulatory environments converge. As aesthetic sensibilities evolve, practitioners and manufacturers alike are navigating an increasingly complex terrain characterized by demand for natural-looking enhancements and rising expectations around safety and long-term outcomes. Recent data indicate that breast augmentation remains the most prevalent cosmetic surgery in the United States, underscoring the centrality of implants in aesthetic practice and illustrating broader consumer appetite for aesthetic customization.

Moreover, the subtleties of facial contouring and body sculpting have become paramount, driven by social media influences and the desire for refined, individualized results. Industry statistics reveal a growing preference for procedures that harmonize with patient lifestyles and anatomical nuances, highlighting an imperative for innovation in both implant design and surgical technique. Consequently, this report delves into the nuanced factors shaping the market-from material science advances to shifting demographic profiles-offering decision-makers essential context for strategic positioning in 2025 and beyond.

Unpacking the Cutting-Edge Technologies and Patient-Driven Trends Reshaping Cosmetic Implants Procedures

The cosmetic implants landscape is experiencing transformative shifts fueled by a new generation of implant technologies and patient-led aesthetic ideals. In 2025, innovations such as ergonomically contoured shells and proprietary microtextured surfaces are redefining performance metrics around capsular contracture rates and implant longevity. Notably, the FDA’s 2024 approval of Motiva’s SmoothSilk shell design has amplified interest in seamless integration of implants with native tissues, reflecting a broader industry trend toward minimizing postoperative complications and enhancing tactile authenticity.

Simultaneously, holistic approaches to body aesthetics are gaining traction. Fat grafting techniques, originally developed for reconstructive purposes, are now incorporated alongside traditional implants to deliver hybrid outcomes. This trend toward combination therapies corresponds with a growing emphasis on natural, sustainable results and patient wellness. Concurrently, the advent of weight management drugs like Ozempic has altered patient profiles, prompting surgeons to adapt procedural offerings to address new patterns of tissue laxity and contour irregularities emerging from significant weight fluctuations.

Analyzing the Far-Reaching Consequences of U.S. Tariff Policies on Implant Manufacturing and Clinical Supply Chains

The imposition of new U.S. tariffs in early 2025 has introduced notable dynamics into the supply chain for cosmetic implants and ancillary surgical materials. Effective March 12, 2025, a 25% duty on steel and aluminum imports increased production costs for implant manufacturers utilizing derivative products that incorporate metal components, such as mold fixtures and shaping tools. Although certain pharmaceutical ingredients and packaging materials remain exempt, clinics have reported incremental cost pass-throughs ranging from 5–10% for import-reliant consumables, including surgical drapes and high-precision needles used in implant placement procedures.

In response, leading plastic surgery practices have pivoted toward domestic sourcing strategies. Some high-volume surgeons, such as Dr. Mark Epstein in New York, have publicly committed to exclusively using American-made implant components to stabilize pricing and mitigate supply chain volatility. As a result, the tariff environment is catalyzing a dual focus on reshoring and supply chain diversification, prompting both suppliers and providers to evaluate nearshoring partnerships and strategic inventory buffering to maintain operational continuity.

Revealing Critical Market Segments Across Implant Type, Material, Procedure Context, End-User Venue, and Patient Demographics

Segmenting the cosmetic implants market by implant type reveals distinct performance patterns and patient preferences. Breast implants dominate procedural volume, yet within this category, silicone cohesive gel variants are increasingly favored due to their superior tactile qualities and lower rippling incidence compared to saline alternatives. Facial implants-comprising cheek, chin, and jaw products-are capturing attention among younger demographics seeking refined contouring options. Meanwhile, gluteal implants, though less penetrated, demonstrate robust growth driven by body contouring trends in both aesthetic and reconstructive contexts.

Material-wise, silicone continues to outpace saline in revenue, attributed to its resilience and lower complication profile. Procedure segmentation further highlights an ascending share for reconstructive applications as breast reconstruction surgeries become more accessible and covered by a broader range of health plans. End-user analysis underscores the rise of ambulatory surgical centers as a preferred venue for aesthetic procedures, reflecting enhanced patient convenience, cost efficiencies, and tailored care settings. Gender and age segmentation also exposes valuable insights: while female patients represent the majority, male implant procedures are growing, particularly in facial implant segments targeting jawline enhancement. Age group data illustrate that 18–35-year-olds lead demand for aesthetic augmentations, while reconstructive surgeries skew toward older cohorts.

This comprehensive research report categorizes the Cosmetic Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Implant Type

- Material Type

- Procedure Type

- Gender

- Age Group

- End User

Exploring Distinct Market Drivers and Growth Patterns Across Americas, Europe Middle East & Africa, and Asia-Pacific Regions

Regional dynamics underscore divergent growth drivers and investment opportunities. In the Americas, robust demand remains anchored in the United States, with Canada emerging as a key secondary market buoyed by favorable reimbursement policies for reconstructive surgeries. Brazil also retains its position as an aesthetic powerhouse, propelled by a cultural affinity for body contouring procedures and a mature network of specialized clinics.

Europe, Middle East & Africa display differentiated trajectories: Western Europe benefits from established medical infrastructure and stringent regulatory frameworks that prioritize patient safety, while Eastern Europe serves as a cost-competitive destination for medical tourism. Concurrently, healthcare investment in the Middle East has elevated clinic capabilities, attracting inbound cosmetic surgery tourists; safety protocols and accreditation are pivotal in maintaining market confidence. Africa, although nascent, shows nascent interest in aesthetic procedures, particularly in South Africa and Nigeria.

Asia-Pacific stands out for its rapid adoption of both surgical and non-surgical enhancements. South Korea continues to lead with its “K-face” aesthetic ideal and integrated medical tourism ecosystem, while China’s rising middle class and shifting beauty norms fuel double-digit growth rates. Southeast Asian hubs like Thailand and Malaysia leverage competitive pricing and hospitality-driven tourism infrastructure to capture regional patient flows.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing the Strategies and Innovations Powering Leading Firms in the Cosmetic Implants Sector

Market leadership in cosmetic implants is characterized by strategic consolidation, technological prowess, and regulatory milestone achievements. The pharmaceutical giant behind Botox and Juvederm redefined portfolio depth through its 2020 acquisition of a leading implant manufacturer, bolstering its aesthetics footprint with cohesive gel and textured surface innovations. Complementing this, a major global medtech conglomerate recently introduced an exclusive range of high-volume breast implants for reconstruction, addressing a critical gap for post-mastectomy patients and reaffirming its commitment to surgical innovation.

In parallel, a specialized aesthetics company underwent a strategic asset acquisition, integrating its renowned breast implant portfolio into a broader regenerative medicine platform to accelerate fat grafting and hybrid augmentation techniques. Meanwhile, mid-sized players with deep clinical data from long-term postapproval studies continue to differentiate themselves through robust safety and efficacy evidence, supporting clinician confidence and patient satisfaction in both primary and revision settings. Collectively, these corporate maneuvers and R&D investments underscore a competitive landscape where scale, data-driven differentiation, and regulatory agility define the upper echelon of industry participants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Allergan plc

- Dentsply Sirona Inc.

- Establishment Labs S.A.

- GC Aesthetics Ltd

- Groupe Sebbin SAS

- HansBiomed Co., Ltd.

- Ideal Implant, Inc.

- Implantech Associates, Inc.

- Institut Straumann AG

- Johnson & Johnson

- Laboratoires Arion

- Matrix Surgical USA, LLC

- Mentor Worldwide LLC

- Nagor Ltd

- Polytech Health & Aesthetics GmbH

- Sebbin SAS

- Sientra, Inc.

- Silimed SA

- Spectrum Designs Medical, LLC

Implementing a Comprehensive Strategic Framework to Drive Innovation, Supply Chain Resilience, and Clinical Evidence

Industry leaders must prioritize a multifaceted approach to navigate emerging challenges and leverage growth avenues. Firstly, investing in advanced material science-particularly in microtextured and adaptive shell technologies-can reduce complication rates and meet evolving clinician preferences for natural feel. Secondly, expanding domestic manufacturing capabilities through partnerships or facility upgrades will mitigate tariff exposure and reinforce supply chain resilience in volatile trade climates.

Furthermore, cultivating data ecosystems that capture real-world outcomes-via postapproval surveillance and patient-reported metrics-will strengthen clinical evidence and support reimbursement negotiations. Integrating digital patient engagement platforms can also enhance pre- and postoperative care, elevating patient experience and fostering loyalty. Finally, exploring strategic alliances within the regenerative medicine space will enable holistic service offerings, combining implant-based and autologous tissue solutions to appeal to discerning patients seeking minimally invasive, long-lasting results.

Outlining the Rigorous Mixed-Methods Approach Underpinning Segmentation, Regulatory, and Tariff Analyses

This research leverages a mixed-methods approach, integrating primary qualitative interviews with key opinion leaders, including board-certified plastic surgeons and regulatory specialists, alongside secondary analysis of publicly available regulatory filings, journal publications, and trade data. The segmentation framework is constructed through hierarchical indexing of implant types, materials, procedural contexts, end-user settings, and patient demographics.

Quantitative inputs draw from annual procedural volume reports provided by the American Society of Plastic Surgeons and international equivalents, while tariff impact assessments utilize government announcements and supply chain cost modeling. Regional insights are synthesized through cross-referencing clinical tourism statistics and healthcare infrastructure investment reports. All data points undergo triangulation to validate consistency across multiple sources, ensuring robust, actionable conclusions for executive decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Implants Market, by Implant Type

- Cosmetic Implants Market, by Material Type

- Cosmetic Implants Market, by Procedure Type

- Cosmetic Implants Market, by Gender

- Cosmetic Implants Market, by Age Group

- Cosmetic Implants Market, by End User

- Cosmetic Implants Market, by Region

- Cosmetic Implants Market, by Group

- Cosmetic Implants Market, by Country

- United States Cosmetic Implants Market

- China Cosmetic Implants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Market Dynamics and Strategic Imperatives Shaping Future Growth in Cosmetic Implants

The cosmetic implants market in 2025 stands at a pivotal juncture, shaped by technological breakthroughs, evolving patient expectations, and shifting trade policies. As consumer demand for nuanced, natural-looking enhancements grows, the industry’s ability to innovate responsibly-balancing clinical safety with aesthetic excellence-will determine market winners. Concurrently, tariff dynamics necessitate proactive supply chain strategies to safeguard profitability and operational continuity.

Looking ahead, the convergence of implant and regenerative modalities, underpinned by robust real-world evidence, offers a transformative pathway to deliver personalized outcomes. Stakeholders who align their R&D investments, manufacturing footprints, and evidence-generation frameworks will be best positioned to navigate competitive pressures and capture sustained growth in this dynamic landscape.

Connect with Ketan Rohom to Secure the Definitive Cosmetic Implants Market Research and Propel Your Strategic Growth

Elevate your strategic positioning in the competitive cosmetic implants space by collaborating with Ketan Rohom, Associate Director of Sales & Marketing. Connect directly to acquire the comprehensive market research report and unlock detailed intelligence, including nuanced segmentation analysis, tariff impact assessments, and regional growth opportunities tailored to executive decision-makers. Seize this opportunity to gain an authoritative edge, refine your investment roadmap, and ensure your organization is fully equipped to anticipate market shifts and accelerate sustainable growth in the evolving cosmetic implants industry.

- How big is the Cosmetic Implants Market?

- What is the Cosmetic Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?