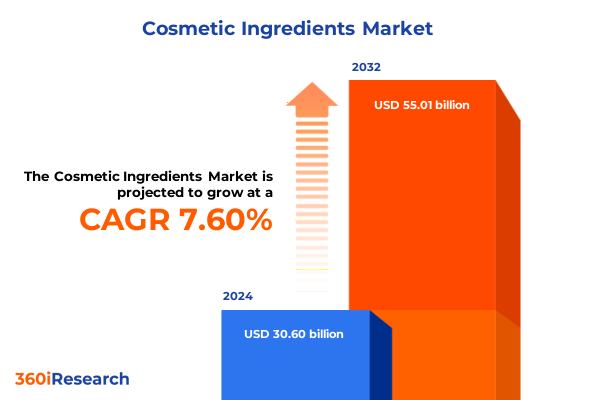

The Cosmetic Ingredients Market size was estimated at USD 32.73 billion in 2025 and expected to reach USD 35.00 billion in 2026, at a CAGR of 7.69% to reach USD 55.01 billion by 2032.

Unveiling the Key Drivers, Emerging Trends, and Market Dynamics Shaping the Global Cosmetic Ingredients Ecosystem to Empower Informed Strategic Decision Making

The cosmetic ingredients arena continues to evolve at an unprecedented pace, fueled by a convergence of scientific breakthroughs, shifting consumer expectations, and complex regulatory frameworks. As innovators harness biotechnology, green chemistry, and advanced delivery systems, stakeholders across the value chain-from raw material suppliers to finished goods manufacturers-must stay informed of the forces shaping market dynamics. Against this backdrop, a concise introduction lays the groundwork for understanding the critical factors that will determine future success and resilience.

By examining the interplay between innovation trajectories and consumer behavior, this executive summary offers a clear overview of the foundational trends propelling the sector forward. It highlights the emergence of sustainable sourcing as a nonnegotiable imperative and underscores the role of digital tools in enhancing transparency and traceability. Moreover, it situates recent tariff developments within a broader context of geopolitical uncertainty, emphasizing the need for agile supply chain strategies.

This introduction also sets expectations for the in-depth analyses that follow, illustrating how segmentation frameworks, regional nuances, and competitive positioning converge to influence strategic decision making. By framing these elements cohesively, executive leaders are equipped with a strategic lens through which to evaluate opportunities and anticipate risks, ultimately enabling more informed resource allocation and partnership decisions.

Examining the Profound Technological, Regulatory, and Consumer-Driven Transformations Reshaping the Cosmetic Ingredients Landscape for Future Innovation

Recent years have witnessed transformative shifts across technological methodologies, consumer preferences, and regulatory mandates, fundamentally altering the trajectory of the cosmetic ingredients market. Innovations in biotechnology now enable the scalable production of bioactive peptides and plant-based alternatives, offering potent functional benefits while reducing environmental impact. These advances create an imperative for ingredient developers to invest in research platforms capable of validating efficacy claims through rigorous in vitro and in vivo testing.

Parallel to technological progress, consumer values have pivoted decisively toward transparency, sustainability, and ethical sourcing. Social media scrutiny and third-party certification programs have elevated ingredient traceability from a niche concern to a mainstream imperative. As a result, brands are increasingly optimizing supply chains to support circularity initiatives, driving demand for recyclable or compostable packaging and ingredient traceability solutions.

Concurrently, evolving regulatory frameworks across major markets are imposing stricter safety and labeling requirements. The emphasis on post-market surveillance and adverse event reporting demands robust quality management systems and compliance protocols. Taken together, these transformative shifts underscore the need for stakeholders to balance innovation with stringent governance, ensuring that new product launches resonate with discerning consumers and adhere to the highest standards of safety and integrity.

Assessing the Economic, Supply Chain, and Strategic Implications of United States 2025 Tariff Measures on the Cosmetic Ingredients Sector

The implementation of targeted tariff measures in 2025 has introduced new cost considerations and strategic challenges for cosmetic ingredient companies reliant on global supply chains. By imposing additional duties on selected raw materials and semi-finished intermediates, these measures have elevated landed costs and prompted procurement teams to reassess sourcing strategies. As a consequence, regional suppliers and domestic production capabilities have gained renewed attention as viable alternatives to mitigate tariff exposure.

Moreover, the interplay between increased import duties and currency fluctuations has underscored the importance of dynamic pricing strategies. Manufacturers have had to absorb a portion of the incremental costs to maintain competitive positioning while communicating value propositions centered on performance and sustainability. This recalibration has accelerated collaborative R&D efforts aimed at identifying tariff-exempt substitutes without compromising product efficacy.

In addition, the tariffs have catalyzed advancements in logistical optimization. Companies are leveraging advanced analytics to forecast inventory requirements more accurately, consolidate shipments, and explore alternative transportation corridors. Such initiatives not only reduce overhead but also build resilience against future policy shifts. Collectively, the cumulative impact of the 2025 tariff landscape emphasizes the necessity for integrated supply chain planning, strategic vendor diversification, and proactive cost management.

Delving into the Diverse Ingredient-Based, Functional, and Application-Driven Segmentation Frameworks Uncovering Pathways in the Cosmetic Ingredients Market

A nuanced segmentation approach reveals distinct pathways for targeting market opportunities and aligning product development with specific consumer and formulation requirements. When viewed through the lens of ingredient origin, there is a clear differentiation between naturally sourced compounds-such as botanical extracts, essential oils, and mineral-based actives-and synthetic alternatives. The latter category further divides into biotechnology-derived molecules, including fermentation-based lipids and peptides, and petrochemical-based chemicals that offer consistent quality and scalability. Understanding these distinctions enables formulation scientists to balance performance goals with sustainability considerations.

Equally important is the breakdown by functional classification, which categorizes ingredients into active compounds, colorants and pigments, and functional excipients. Active compounds encompass a spectrum of specialized chemistries-from anti-aging peptides and anti-inflammatory molecules to exfoliating acids, hydration enhancers, skin brighteners, and ultraviolet filters-each addressing target concerns in modern skincare. The palette of colorants and pigments spans effect pigments like interference, metallic, and pearl varieties; inorganic powders such as chromium oxides, ferric ferrocyanide complexes, iron oxides, titanium dioxide, ultramarine pigments, and zinc oxide; as well as natural dyes and organic pigment classes suited for clean-label color cosmetics. Functional excipients complete formulations through emollients and conditioning agents, emulsifiers and stabilizers, fragrances and aroma compounds, preservatives that ensure microbial safety, surfactants and cleansing agents, and rheology modifiers like thickening agents.

Lastly, an application-oriented perspective segments end uses into color cosmetics, fragrances, hair care, oral care formulations, and skin care systems. This multidimensional framework provides market participants with a strategic blueprint for prioritizing R&D investment, tailoring marketing narratives, and optimizing production capabilities to meet the unique demands of each segment.

This comprehensive research report categorizes the Cosmetic Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Type

- Application

Exploring the Nuanced Regional Dynamics, Consumer Preferences, and Regulatory Environments Shaping Cosmetic Ingredient Demand across Key Global Markets

Regional dynamics exert a profound influence on ingredient demand, regulatory compliance, and innovation trajectories. In the Americas, consumer interest in multifunctional products and clean formulations has surged, driven by a strong emphasis on efficacy and wellness. North American regulations continue to evolve rapidly, particularly with respect to transparency in labeling and adverse event reporting, pushing companies to enhance safety documentation and supply chain visibility.

Across Europe, the Middle East, and Africa, stringent safety standards and comprehensive regulations like the European Cosmetic Regulation have set a global benchmark for ingredient approval and usage restrictions. Within this region, sustainability and circularity goals have spurred innovations in bio-based materials and zero-waste manufacturing. Meanwhile, emerging markets in the Middle East and Africa demonstrate growing appetite for premium formulations, leading to an increased need for localized manufacturing partnerships to optimize cost structures and expedite market entry.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes have fueled demand for advanced skincare and personalized beauty solutions. Regulatory harmonization efforts across key markets-such as ASEAN Cosmetic Directives-are streamlining market access, while investments in ingredient innovation hubs have accelerated the commercialization of novel actives. These diverse regional insights highlight the importance of tailoring product portfolios and go-to-market strategies to align with local consumer preferences, compliance criteria, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Investment Priorities, and Collaborative Ventures of Leading Industry Players Driving Innovation in Cosmetic Ingredients

Industry leaders are deploying a range of strategic initiatives to maintain competitive momentum and capture emerging growth pockets. Legacy chemical producers have ramped up their investment in biotechnology platforms, forming partnerships with contract research organizations and academic institutions to co-develop high-potency bioactive molecules. Meanwhile, specialty ingredient suppliers are forging alliances with digital health firms to integrate data-driven efficacy claims and sensor-enabled delivery systems into next-generation personal care formats.

A number of leading players have also prioritized portfolio diversification, acquiring or licensing niche technology assets in areas such as encapsulation, microemulsion delivery, and probiotic stabilization. These moves enable faster commercialization of differentiated product lines while hedging against single-source dependency. In parallel, top-tier companies are enhancing sustainability reporting, securing third-party certifications for carbon neutrality and responsible sourcing, and expanding take-back programs for packaging recapture.

Furthermore, collaboration across the value chain is emerging as a critical success factor. Formulation houses are convening cross-functional working groups with ingredient suppliers, contract manufacturers, and brand partners to streamline end-to-end product development. By aligning on quality metrics, performance benchmarks, and compliance milestones, these consortia accelerate time to market and minimize iterative reformulation, reinforcing the competitive positioning of involved stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Specialty Silicones, LLC

- ACTIVON Co., Ltd.

- Ajinomoto Co., Inc.

- Asahi Kasei Corporation

- Ashland Inc.

- BASF SE

- Beiersdorf AG

- Cargill, Incorporated

- Celim Biotech Co., Ltd.

- Clariant International Ltd.

- Croda International PLC

- Daito Kasei Kogyo Co., Ltd.

- DSM-Firmenich AG

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Gattefossé SAS

- Givaudan SA

- ICHIMARU PHARCOS Co., Ltd.

- INEOS Group Holdings S.A.

- INKOS Co., Ltd.

- Kao Corporation

- KCC Corporation

- Lanxess AG

- LyondellBasell Industries N.V.

- Merck KGaA

- Mitsubishi Corporation Life Sciences Limited

- Nouryon Chemicals Holding B.V.

- Roquette Frères S.A.

- Sasol Limited

- Saudi Basic Industries Corporation

- Seiwa Kasei Co., Ltd.

- Sensient Technologies Corporation

- Shin-Etsu Chemical Co., Ltd.

- Solvay SA/NV

- SSH Korea

- STOCKMEIER Holding SE

- Sumitomo Corporation

- Sunjin Beauty Science

- Symrise AG

- The Dow Chemical Company

- The Lubrizol Corporation

- Wacker Chemie AG

Proposing Actionable Strategies and Roadmaps to Navigate Market Complexity, Leverage Emerging Opportunities, Maintain Competitive Advantage in Cosmetic Ingredients

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders should adopt a multifaceted action plan. First, prioritizing investment in advanced ingredient discovery platforms will unlock novel actives with superior safety and efficacy profiles. By integrating high-throughput screening, predictive modeling, and sustainable biosynthesis, organizations can accelerate pipeline development and differentiate their offerings.

Second, fostering resilient supply chain ecosystems through strategic diversification of sourcing partners and manufacturing locations will reduce exposure to geopolitical and tariff fluctuations. Establishing regional centers of excellence for both raw material procurement and finished product manufacturing ensures agility and continuity under shifting trade policies.

Third, strengthening consumer trust through enhanced transparency initiatives and third-party validation will amplify brand reputation. Implementing blockchain or advanced track-and-trace solutions for ingredient provenance, while securing recognized eco-certifications, signals a genuine commitment to ethical and sustainable practices.

Finally, aligning R&D and marketing efforts to address evolving consumer mindsets-such as demand for personalized formulations, microbiome-friendly actives, and holistic wellness integration-will drive sustained growth. By weaving these strategic threads into a cohesive roadmap, industry leaders can navigate complexity, seize competitive advantages, and position themselves for long-term leadership in the cosmetic ingredients sector.

Detailing Data Collection, Validation Techniques, and Analytical Frameworks That Support the Insights and Conclusions of Cosmetic Ingredients Research

The research underpinning this analysis combines an extensive review of publicly available scientific literature, regulatory filings, and patent databases with in-depth primary interviews conducted across multiple stakeholder groups. Secondary data sources included peer-reviewed journals, government regulations, industry trade publications, and corporate financial disclosures. This comprehensive data collection provided a solid foundation for identifying key trends and mapping innovation pathways.

Complementing the secondary research, a series of structured interviews and workshops were held with R&D directors, formulators, procurement specialists, and regulatory affairs leaders from leading cosmetic ingredient suppliers and brand owners. These sessions yielded qualitative insights into strategic priorities, pain points, and emerging areas of collaboration.

Data validation was achieved through triangulation, cross-referencing quantitative findings against external benchmarks and expert perspectives to ensure robustness. Analytical frameworks such as SWOT analysis, value chain mapping, and technology readiness assessments were applied to organize insights logically and highlight critical inflection points. Together, this methodology delivers a rigorous, transparent foundation for the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Ingredients Market, by Ingredient Type

- Cosmetic Ingredients Market, by Type

- Cosmetic Ingredients Market, by Application

- Cosmetic Ingredients Market, by Region

- Cosmetic Ingredients Market, by Group

- Cosmetic Ingredients Market, by Country

- United States Cosmetic Ingredients Market

- China Cosmetic Ingredients Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Takeaways to Illuminate the Future Trajectory and Opportunities within the Cosmetic Ingredients Ecosystem

The synthesis of technological advancements, consumer demand shifts, and regulatory developments paints a clear picture of a market in transition. Emerging bioactive innovations offer promising avenues for differentiation, while heightened consumer scrutiny calls for unwavering commitment to transparency and sustainability. Tariff-related cost pressures underscore the strategic importance of supply chain resilience and diversified sourcing.

By leveraging a multidimensional segmentation framework, stakeholders can more precisely target product development and marketing strategies across ingredient origin, functional classification, and application domains. Regional nuances further accentuate the necessity of tailored go-to-market approaches and compliance roadmaps.

Ultimately, success in the cosmetic ingredients space will hinge on the ability to integrate R&D agility, operational robustness, and consumer-centric transparency into a unified strategic vision. The imperative for collaboration-both across the value chain and within cross-functional teams-cannot be overstated. As the landscape continues to evolve, the insights and recommendations captured in this summary will equip decision makers with the foresight and tactical guidance needed to thrive.

Reach Out to Ketan Rohom to Secure Your Customized Copy of the Cosmetic Ingredients Report and Gain Actionable Insights for Strategic Advantage

We recognize the dynamic nature of cosmetic ingredient innovation and the importance of timely, in-depth insights for strategic planning. To explore the full scope of emerging trends, regulatory developments, and competitive strategies within this evolving landscape, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By securing your customized report, you will gain access to granular analyses, expert perspectives, and actionable guidance tailored to the specific needs of your business objectives. Reach out today to obtain your personalized copy and unlock the strategic intelligence required to stay ahead of industry shifts and maximize growth potential.

- How big is the Cosmetic Ingredients Market?

- What is the Cosmetic Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?