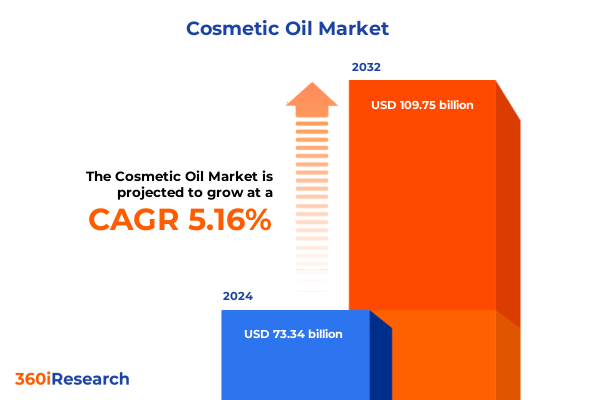

The Cosmetic Oil Market size was estimated at USD 77.18 billion in 2025 and expected to reach USD 81.18 billion in 2026, at a CAGR of 5.15% to reach USD 109.75 billion by 2032.

Unveiling the Dynamic World of Cosmetic Oils: Exploring Market Evolution, Consumer Demand Transformations, and Emerging Opportunities Driving Growth Through 2025

The cosmetic oil landscape stands at a pivotal moment, as evolving consumer values and technological advances converge to redefine product formulations and market engagement. Natural and multifunctional oils have transcended their traditional emollient roles to become central ingredients in holistic skincare and haircare routines, driven by a growing desire for transparency, sustainability, and efficacy. This shift has been amplified by a broader industry movement toward clean beauty standards, where brands are expected to substantiate every ingredient’s origin, performance, and environmental footprint to meet consumer expectations for ethical and eco-friendly solutions.

Meanwhile, the digital revolution is reshaping how cosmetic oils are discovered, formulated, and delivered to end users. Artificial intelligence-based skin diagnostics coupled with direct-to-consumer e-commerce platforms are enabling personalized beauty regimens, where recommendations for botanical oils and synthetic esters alike are tailored to individual skin profiles and concerns. This hyper-personalization is reinforcing brand-consumer relationships, as data-driven insights guide product innovation and marketing strategies. As we step into 2025, these interconnected forces-natural ingredient prioritization, sustainability imperatives, and digital transformation-form the foundation of a new era in cosmetic oils, offering unprecedented opportunities for brands willing to adapt and innovate.

Navigating Transformative Shifts in Cosmetic Oil Industry: Sustainability, Ingredient Innovation, and Digital Disruption Redefining Market Dynamics

The cosmetic oil sector is experiencing transformative shifts that transcend mere ingredient swaps, encompassing systemic changes in sourcing, regulation, and consumer engagement. Sustainability has emerged as more than a marketing claim; it has become a strategic imperative, compelling companies to seek carbon-neutral supply chains and circular packaging solutions to satisfy discerning, eco-conscious consumers. Meanwhile, ingredient innovation is accelerating through biotech and synthetic alternatives, as brands explore lab-grown oils that replicate the beneficial properties of argan, jojoba, and olive extracts while reducing reliance on vulnerable global supply chains affected by trade volatility and climate risks.

Concurrently, the onset of digital disruption has reshaped product development and customer interactions. Advanced analytics and AI-enabled lifecycle management tools are being deployed to forecast geopolitical shifts, optimize procurement strategies, and personalize consumer experiences. By leveraging predictive modeling, brands can proactively manage inventory, mitigate tariff exposure, and respond swiftly to emerging trends. These converging transformations are not isolated; rather, they reinforce one another, forging a resilient and agile ecosystem that demands nimble strategic planning and continuous innovation. As these tectonic shifts redefine competitive advantage, stakeholders across the value chain must embrace adaptive approaches to thrive in an increasingly complex market landscape.

Assessing the Cumulative Impact of 2025 United States Tariffs on Cosmetic Oils: Supply Chain Disruptions, Cost Pressures, and Strategic Adaptation

In 2025, the United States has implemented several tariff measures that collectively exert pressure on cosmetic oil supply chains and cost structures. On February 1, additional tariffs of 10% on Chinese imports took effect, intensifying cost challenges for brands reliant on oils such as sunflower and niacinamide sourced from Asia, while the removal of the de minimis exemption for parcels under $800 from China and Hong Kong means that every low-value shipment is now subject to duties-altering the calculus for direct-to-consumer imports and small-batch specialty oils. Concurrently, 25% tariffs on Mexican and Colombian products were postponed, but remain under negotiation, creating ongoing uncertainty for oils produced in Mexico’s agave regions or Colombia’s cacao derivatives.

Amid this landscape, the U.S. government has granted exemptions for key cosmetic ingredients under Annex II of the Reciprocal Tariff order, shielding certain mineral oils, emulsifiers, and active ingredients like azelaic and benzoic acid from duties, while leaving specialty vegetable oils largely exposed to new levies. These tariff dynamics are driving companies to reassess sourcing strategies, expand regional manufacturing footprints, and explore alternative suppliers. The net result is a complex mosaic of cost pressures and regulatory carve-outs that requires meticulous planning and agile adaptation by all industry participants, from raw material suppliers to finished goods manufacturers.

Unlocking Key Segmentation Insights in Cosmetic Oils: Analyzing Type Diversification, Distribution Channel Trends, and End User Preferences

The cosmetic oil market is intricately stratified by source, distribution channels, and end-use contexts, each segment revealing unique drivers of demand and innovation. Among the oils themselves, animal-derived variants such as fish oil and lanolin coexist with mineral, synthetic, and a rich portfolio of vegetable oils including argan, coconut, jojoba, and olive. Synthetic offerings like silicone oil and synthetic esters often provide predictability in performance and supply stability, while natural oils resonate with consumers seeking authenticity and functional benefits from antioxidants and essential fatty acids. Mineral oils, long established for their emollient properties, face scrutiny amid the clean beauty movement but continue to hold relevance in cost-sensitive formulations.

Distribution channels further diversify market trajectories, as online pathways driven by brand websites and third-party e-commerce platforms unlock global reach and personalized engagement, enabling niche and indie players to compete alongside established names. Pharmacies serve as trusted advisors for therapeutic and dermatological oils, while supermarkets and hypermarkets provide mass-market accessibility and affordability. Lastly, the division between personal and professional care reveals divergent purchasing patterns: personal care consumers gravitate toward multifunctional, convenience-driven products, whereas professional users in salons and spas prioritize high-performance, concentrated formulations tailored to specialized treatments, reinforcing the need for bespoke ingredient blends and technical support.

This comprehensive research report categorizes the Cosmetic Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- Application

- Distribution Channel

Uncovering Regional Dynamics in Cosmetic Oils: Distinct Market Drivers and Opportunities Across Americas, EMEA, and Asia-Pacific Regions

Regional landscapes for cosmetic oils exhibit distinct growth drivers and competitive dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific zones. In the Americas, particularly North America, the clean beauty revolution propels demand for plant-based and certified oils, supported by a robust direct-to-consumer infrastructure and advanced e-commerce ecosystems that facilitate product discovery and personalized offerings. Local brands are reinforcing their appeal with traceable ingredient sourcing and refillable packaging models that resonate with environmentally conscious consumers.

The Europe Middle East & Africa region is characterized by stringent regulatory frameworks, including the Modernization of Cosmetics Regulation Act in the U.S. counterpart and the EU’s evolving EC No 1223/2009 revisions, which emphasize transparency, safety, and sustainability. European consumers exhibit high expectations for eco-certifications and ethical supply chains, while brands navigate reciprocal tariff threats and due diligence requirements to maintain market access. Meanwhile, the Middle East’s luxury segment drives uptake of premium oils like argan and prickly pear seed, leveraging high-net-worth consumer spending.

In Asia-Pacific, traditional oil-based beauty rituals are being reimagined through modern innovation. Nations such as India and China blend centuries-old practices with cutting-edge formulations, fostering growth in hibiscus, sesame, and moringa oils. Rapid digital penetration and rising disposable incomes underwrite expansion, as localized product development and micro-branding capture region-specific consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Players in the Cosmetic Oil Market: Strategic Positioning, Innovation Leadership, and Competitive Landscape Analysis

Within the competitive arena of cosmetic oils, a diverse array of companies is shaping industry innovation and market positioning. Global conglomerates leverage scale and research capabilities to pioneer novel extraction techniques and biotech-derived oils, often testing laboratory-grown alternatives to mitigate supply chain volatility and environmental concerns. These established players also drive consolidation through strategic acquisitions of niche brands that excel in specialized oil formulations and sustainable sourcing.

Meanwhile, mid-sized enterprises and indigenous specialists differentiate by focusing on traceability, farm-to-bottle transparency, and region-specific exotic oils. They form close partnerships with local cooperatives to secure high-quality ingredients such as Brazilian babassu and African marula, reinforcing community development and ethical practices. Smaller, agile start-ups harness direct feedback loops via social media and experiential marketing to validate novel oil blends, tapping into micro-trend cycles accelerated by influencer-driven platforms. This fragmentation coexists with ongoing emphasis on vertical integration, as companies seek greater control over cultivation, processing, and distribution to ensure consistency and compliance while protecting margins in a tariff-sensitive climate.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Amorepacific Corporation

- Avon Products Inc.

- Beiersdorf AG

- Coty Inc.

- Estée Lauder Companies Inc.

- Givaudan S.A.

- Johnson & Johnson.

- Kao Corporation

- L'Oréal S.A.

- Marico Limited

- Procter & Gamble Co.

- Revlon Inc.

- SEPPIC S.A.

- The Estée Lauder Companies Inc.

- Unilever PLC.

Strategic Roadmap for Industry Leaders: Actionable Recommendations to Navigate Challenges and Capitalize on Growth in the Cosmetic Oil Sector

To navigate the evolving cosmetic oil landscape, industry leaders must adopt a multifaceted strategy rooted in resilience, innovation, and consumer centricity. First, diversifying supply sources across geographies and investing in regional processing capabilities will mitigate tariff exposure and logistical disruptions, ensuring a steady flow of critical raw materials. Implementing dual-sourcing strategies for both natural and synthetic oils enhances agility when confronted with regulatory or climatic uncertainties.

Second, embedding sustainability at the core of product and packaging development will resonate with increasingly conscious end users. Brands should prioritize transparent provenance, comply with emerging regulations like MoCRA and the EU’s product information system, and explore circular economy models such as refillable and biodegradable formats. Third, leveraging advanced analytics and AI-driven lifecycle management will enable real-time visibility into inventory, cost structures, and demand forecasts, facilitating proactive pricing strategies and tailored promotions.

Finally, cultivating deep partnerships with professional channels and digital platforms will foster omnichannel cohesion, allowing for seamless transitions between personalized online experiences and expert-driven professional care services. By combining scientific rigor with authentic storytelling, companies can strengthen brand loyalty, capture premium positioning, and accelerate sustainable growth across diverse market segments.

Comprehensive Research Methodology Employed in Cosmetic Oil Market Analysis: Integrating Qualitative Expertise and Rigorous Data Collection Techniques

This analysis integrates a robust research framework combining primary and secondary methodologies to ensure comprehensive market insights. Primary research involved in-depth interviews with key stakeholders across the value chain, including raw material suppliers, formulators, brand executives, and channel partners, to capture real-world perspectives on supply challenges, consumer preferences, and regulatory impacts. These qualitative insights were complemented by an extensive online survey targeting end users and professional care practitioners to validate emerging trends and usage patterns.

Secondary research drew upon authoritative sources such as industry journals, regulatory filings, sustainability reports, and credible news outlets. Data triangulation was performed through cross-verification of tariff announcements, trade policy documents, and exemption lists published by government agencies. Additional context was obtained from leading beauty intelligence platforms and ESG performance indices, ensuring the analysis reflects the latest developments in sustainability, ingredient innovation, and digital adoption. This dual-approach methodology underpins the report’s rigorous narrative, balancing nuanced qualitative observations with verified factual evidence to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Oil Market, by Type

- Cosmetic Oil Market, by Function

- Cosmetic Oil Market, by Application

- Cosmetic Oil Market, by Distribution Channel

- Cosmetic Oil Market, by Region

- Cosmetic Oil Market, by Group

- Cosmetic Oil Market, by Country

- United States Cosmetic Oil Market

- China Cosmetic Oil Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Insights on Cosmetic Oil Industry Trajectory: Synthesizing Trends, Challenges, and Strategic Imperatives for Sustainable Growth

The cosmetic oil domain in 2025 is characterized by converging dynamics of sustainability demands, regulatory shifts, and technological innovation. As consumers increasingly seek transparent, ethically sourced, and multifunctional formulations, brands are challenged to balance performance with environmental stewardship. Meanwhile, the evolving tariff landscape imposes new cost variables that necessitate agile supply chain strategies and selective investment in exempted ingredients.

Ultimately, the sector’s trajectory will hinge on the ability of stakeholders to foster collaborative ecosystems that prioritize traceability, circular design, and data-driven personalization. By aligning product portfolios with the latest regulatory requirements, deploying AI-powered insights, and reinforcing supply resilience, companies can unlock new avenues for differentiation and growth. Moving forward, success in the cosmetic oil market will depend on a holistic approach-one that integrates consumer passion for clean beauty with the operational rigor required to thrive in a complex global trade environment.

Connect with Our Associate Director to Secure Your Comprehensive Cosmetic Oil Market Report and Drive Strategic Decisions with In-Depth Industry Insights

Are you ready to transform your strategic approach and stay ahead of market shifts in the cosmetic oil industry? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, for exclusive access to the comprehensive market research report that will empower your decision-making with actionable insights and competitive analysis.

Secure order details, customized packages, and expert guidance to leverage data-driven strategies for long-term growth. Connect directly with Ketan to discuss how this report can address your specific business challenges, identify untapped opportunities, and drive innovation in your product portfolio. Elevate your market intelligence by engaging with a dedicated expert who understands the nuances of the cosmetic oil landscape and is committed to delivering tailored recommendations that align with your strategic objectives.

Don’t miss the chance to gain a competitive edge-contact Ketan today to purchase the full report and unlock the critical insights needed to navigate evolving consumer trends, regulatory complexities, and emerging market dynamics with confidence.

- How big is the Cosmetic Oil Market?

- What is the Cosmetic Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?