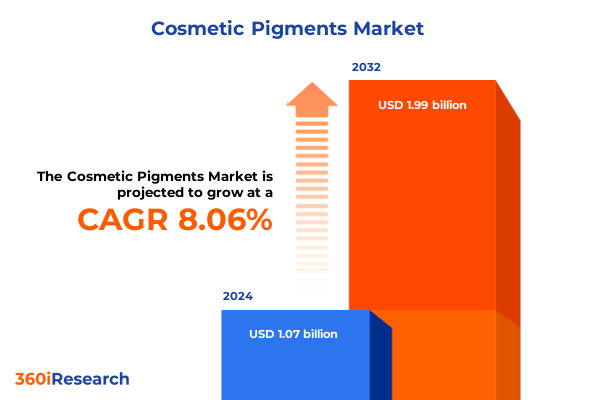

The Cosmetic Pigments Market size was estimated at USD 1.15 billion in 2025 and expected to reach USD 1.24 billion in 2026, at a CAGR of 8.06% to reach USD 1.99 billion by 2032.

Unveiling the dynamic world of cosmetic pigments with an authoritative overview of evolving market forces, technological strides, and consumer drivers

Pigments are colored insoluble substances that are nearly chemically inert in their applied carrier, apart from ultramarine blue and manganese violet. They deliver high coloring power and stability across light and temperature conditions, making them indispensable in cosmetic formulations. Inorganic pigments, derived from minerals and oxides, provide strong coverage and safety profiles, while organic pigments offer a broader spectrum of hues and vibrancy for decorative applications. Regulations across major markets mandate stringent purity and impurity limits, ensuring consumer safety and product consistency.

As global beauty trends evolve, consumer demand has shifted toward transparency, sustainability, and efficacy. Influenced by economic pressures and digital platforms, consumers increasingly prioritize brands that offer clean, non-toxic, and value-driven color solutions. Generative AI and social media channels drive research-oriented purchasing behaviors, particularly among younger demographics, encouraging manufacturers to innovate with eco-friendly and ethically sourced pigment technologies to meet these rising expectations.

Charting transformative shifts shaping cosmetic pigment innovation through sustainability imperatives, breakthrough technologies, and emerging consumer demands

Stringent regulations and environmental mandates are accelerating the shift toward sustainable pigment solutions. Regulatory bodies in key markets enforce bans on certain synthetic colorants and impose limits on heavy metal impurities, prompting cosmetic brands to explore natural and bio-engineered pigments. These measures not only uphold safety standards but also serve as catalysts for innovation in pigment sourcing, formulation, and supply chain transparency, reshaping the competitive landscape.

Technological breakthroughs such as microencapsulation and advanced extraction techniques have broadened the palette of natural pigments, overcoming historic performance constraints. Sensient Cosmetic Technologies’ microencapsulation of chlorophyll enables light-sensitive green pigments to maintain vibrancy for over a year in foundations, while BASF’s silicon dioxide–coated titanium dioxide offers an iron oxide–free alternative with exceptional UV stability. These innovations mitigate fading and enhance product claims of longevity and safety, setting new benchmarks in formulation capabilities.

Cumulative impact of 2025 United States trade tariffs on cost structures, supply chains, and market dynamics in the cosmetic pigments sector

The implementation of a baseline 10% tariff on all U.S. pigment imports, alongside levies reaching up to 54% on key manufacturing hubs like China, has introduced cost pressures that echo through raw material sourcing, manufacturing footprints, and pricing strategies. Industry associations warn that elevated duties could compress margins and disrupt product development timelines as companies seek to front-load shipments or reroute supplies to minimize tariff burdens.

Major producers have begun adjusting their commercial frameworks in response. Sun Chemical has introduced a tariff surcharge on affected color materials to offset increased costs, reflecting a direct pass-through of duty expenses to customers. Concurrently, exporters from regions such as Brazil have experienced contract cancellations amid fears of tariff enforcement, underscoring the importance of supply chain agility and diversified sourcing in mitigating exposure to trade volatility.

Revealing segmentation insights by pigment type, form, application, and end use drivers shaping strategies across the cosmetic pigments arena

When dissected by pigment type, inorganic materials such as chromium oxide greens, iron oxides, titanium dioxide, and ultramarine blues retain primacy in formulations that demand high coverage, stability, and regulatory compliance, while organic dye pigments and lake pigments deliver vivid, customizable hues that resonate with premium decorative cosmetics. In form, these pigments present as liquid dispersions that integrate seamlessly into emulsifications and specialty effect oils, alongside powder forms that enable pressed compacts, loose powders, and spray applications across makeup and skincare platforms.

Application-centric segmentation further differentiates the market into extenders and fillers that ensure texture and consistency, mass colorants that provide core pigment content, opacifying agents that balance translucency, special effect pigments that introduce pearlescence and multi-chromatic yields, and UV filters that extend functionality beyond aesthetics. The end-use spectrum encompasses decorative cosmetics subsegments including eye, face, lip, and nail offerings, haircare systems, skincare lines covering moisturizers and sun protection, and toiletries such as oral care and body wash, illustrating how pigment selection aligns with both performance and consumer expectations across diverse personal care categories.

This comprehensive research report categorizes the Cosmetic Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pigment Type

- Form

- Application

- End Use

Highlighting pivotal regional insights across Americas, EMEA, and Asia-Pacific to inform localized strategies in the cosmetic pigments sector

In the Americas, the drive toward clean beauty and regulatory compliance has propelled demand for both mineral and plant-derived pigments. North American consumer preferences for cruelty-free and high-performance color solutions have prompted local producers to expand capacities in iron oxide, titanium dioxide, and lake pigment manufacturing. Simultaneously, trade tensions have led some companies to near-shore production to Mexico or Canada to alleviate tariff exposure, reflecting a broader trend toward supply chain resilience and cost optimization.

In EMEA, stringent European Union regulations banning specific synthetic colorants and emerging restrictions on heavy metals have driven extensive reformulation with certified natural and bio-sourced pigments, while Middle Eastern and African markets emphasize ethically sourced mica, positioning sustainability and supply chain transparency as paramount decision criteria. Across Asia-Pacific, manufacturers benefit from robust production ecosystems in China, India, and Southeast Asia, with many international brands shifting procurement and manufacturing facilities to the region to take advantage of favorable trade agreements and lower production costs, especially in light of U.S. tariff surcharges and evolving consumer demands for botanical and biotechnology-derived pigments.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering key company insights by examining strategic responses, innovation portfolios, and sustainability commitments of leading pigment manufacturers

Sun Chemical has responded to escalating duty costs by introducing a tariff surcharge on both imported and domestically produced color materials, underscoring how major suppliers are recalibrating pricing frameworks to maintain margin stability amid volatile trade policies. This measure reflects a broader industry pattern of duty pass-through as companies prioritize transparency and supply chain continuity in their customer agreements.

BASF has advanced its sustainability agenda with the launch of low-emission iron oxide pigments under the Scopeblue label, achieving a 35% carbon footprint reduction over traditional products. Complementing this initiative, the company offers low-VOC aqueous dispersions certified for stringent environmental standards, reinforcing its commitment to eco-efficient pigment solutions across coatings and personal care applications.

Sensient Technologies is accelerating investments in naturally sourced colors, shifting away from synthetic carriers in response to regulatory and legislative pressures in North America and Latin America. This strategic pivot is supported by robust growth in the company’s natural colors division, affirming how leading pigment producers leverage product innovation to align with clean beauty mandates and consumer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALTANA AG

- BASF SE

- Clariant International Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DayGlo Color Corp.

- DIC Corporation

- ECKART GmbH

- Ferro Corporation

- Geotech International B.V.

- Huntsman Corporation

- Kobo Products, Inc.

- Koel Colours Private Limited

- LANXESS AG

- Merck KGaA

- Neelikon Food Dyes & Chemicals Limited

- Sensient Technologies Corporation

- Sudarshan Chemical Industries Limited

- Sun Chemical Corporation

- Toshiki Pigment Corporation

- Venator Materials PLC

Actionable recommendations for industry leaders to navigate regulatory shifts, optimize pigment portfolios, and accelerate sustainable growth

Companies should diversify their supplier networks and consider near-shoring or regional production hubs to reduce exposure to unpredictable tariff regimes. Strategic partnerships with alternative feedstock providers and enhanced logistics planning can mitigate disruption risks while maintaining consistent ingredient quality. Investing in real-time trade compliance systems will enable rapid adaptation to new tariff announcements and regulatory changes, safeguarding both cost structures and delivery timelines.

To stay ahead of consumer and regulatory demands, industry leaders must accelerate investment in green pigment technologies and bio-sourced alternatives. Research and development efforts should prioritize microencapsulation, nano-dispersion, and enzyme-assisted extraction to achieve performance parity with synthetics. Additionally, proactive engagement with regulatory bodies and certification programs will ensure timely compliance, reinforce brand trust, and unlock new market opportunities in segments prioritizing sustainability and safety.

Outlining the comprehensive research methodology combining primary interviews, secondary data analysis, and regulatory reviews to ensure robust insights

Our research methodology integrates qualitative primary interviews with pigment manufacturers, raw material suppliers, and industry experts to capture evolving practices and expectations. Complementing this, secondary data analysis leverages trade publications, regulatory filings, and technical journals to validate market drivers and supply chain factors. We conducted a thorough review of tariff schedules, regulatory frameworks, and sustainability standards to contextualize strategic imperatives. This triangulated approach ensures a robust, multi-dimensional perspective on the cosmetic pigments landscape, supporting the integrity and depth of our insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Pigments Market, by Pigment Type

- Cosmetic Pigments Market, by Form

- Cosmetic Pigments Market, by Application

- Cosmetic Pigments Market, by End Use

- Cosmetic Pigments Market, by Region

- Cosmetic Pigments Market, by Group

- Cosmetic Pigments Market, by Country

- United States Cosmetic Pigments Market

- China Cosmetic Pigments Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing conclusions on the evolving cosmetic pigments landscape while highlighting strategic imperatives for innovation, resilience, and sustainability

The cosmetic pigments landscape is poised at the intersection of innovation and regulation, with sustainability imperatives and technological breakthroughs driving new opportunities. While tariffs have introduced cost volatility and supply chain complexity, they have also incentivized companies to strengthen regional resilience and diversify sourcing. The convergence of consumer demand for clean, high-performance colorants and regulatory mandates for safe, eco-friendly pigments underscores the need for agile strategies that balance compliance with competitive differentiation. By embracing sustainable formulation technologies, dynamic supply chain models, and proactive regulatory engagement, stakeholders can navigate volatility and secure long-term value in this evolving market.

Connect with Associate Director Ketan Rohom to secure your market research report and drive strategic decisions in the cosmetic pigments industry

To explore how these in-depth insights and strategic analyses can inform your product development and market positioning, connect with Associate Director Ketan Rohom. He brings extensive expertise in pigment technologies and market trends to help you leverage the full report’s findings. Reach out today to secure your copy and drive more informed, confident decision-making in the cosmetic pigments industry

- How big is the Cosmetic Pigments Market?

- What is the Cosmetic Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?