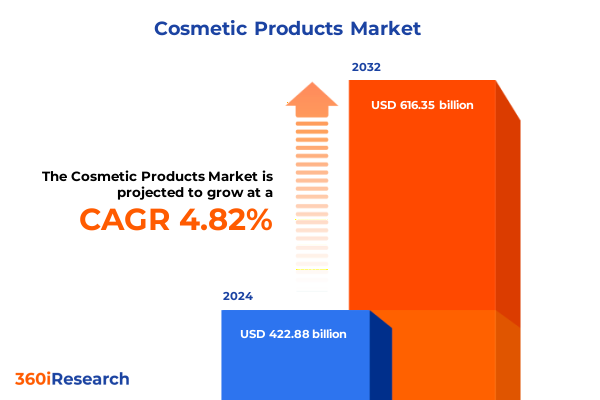

The Cosmetic Products Market size was estimated at USD 442.02 billion in 2025 and expected to reach USD 462.04 billion in 2026, at a CAGR of 4.86% to reach USD 616.35 billion by 2032.

Emerging Consumer-Driven Forces Are Redefining the Cosmetic Products Landscape through Innovation, Sustainability, and Strategic Market Diversification

The cosmetic products market is undergoing a period of rapid evolution driven by heightened consumer expectations, visionary brand strategies, and an expanding array of distribution channels. Novel formulations and cutting-edge delivery systems are reshaping how consumers perceive and engage with personal care routines. As a result, industry leaders are increasingly focused on delivering sustainable, efficacious, and personalized solutions that resonate with modern lifestyles. Against this backdrop, regulatory frameworks are adapting to new ingredient standards and clean beauty mandates, further influencing product development and marketing approaches.

Simultaneously, digital platforms are transforming the path to purchase. Social commerce, live streaming, and influencer partnerships are creating immersive brand experiences that amplify reach and foster deeper customer connections. These digital ecosystems not only enhance visibility but also provide real-time feedback loops, enabling agile iteration of product offerings. By leveraging advanced analytics and consumer insights, companies can anticipate emerging preferences and tailor their portfolios to align with shifting demands. Consequently, agility and adaptability have become essential competencies for organizations seeking to secure competitive advantage and sustained growth in a crowded marketplace.

Revolutionary Sustainability, Personalization, and Digital Engagement Are Catalyzing the Next Chapter of Cosmetic Industry Innovation

The cosmetic industry is experiencing transformative shifts that extend far beyond traditional product introductions. A profound commitment to sustainability is prompting brands to reevaluate sourcing, packaging, and supply chain operations to meet both regulatory requirements and consumer values. In tandem, advances in biotechnology and green chemistry are accelerating the development of eco-friendly formulations that deliver high performance without compromising environmental integrity. This synergy between ethical responsibility and scientific innovation marks a pivotal chapter in the broader narrative of beauty care.

Moreover, personalization has emerged as a key differentiator. Brands are harnessing artificial intelligence and machine learning to craft bespoke skincare and haircare regimens grounded in individual lifestyles, genetic profiles, and environmental factors. This approach not only enhances consumer loyalty but also elevates efficacy perceptions. Additionally, omnichannel engagement models are blurring the lines between online and in-store experiences, integrating augmented reality try-on tools, virtual consultations, and interactive kiosks. As a result, the consumer journey is evolving into a seamless, data-informed ecosystem that empowers informed choices and strengthens brand relationships.

Comprehensive Assessment of 2025 US Tariff Measures Reveals Significant Supply Chain Resilience Strategies and Cost Structure Adjustments

In 2025, the United States implemented a series of tariffs targeting imported raw materials and finished cosmetic goods, catalyzing a reconfiguration of global supply chains. These measures, enacted under Section 301 and related trade provisions, increased duties on select formulations, active compounds, and packaging components. Consequently, domestic manufacturers faced elevated input costs that compelled reassessments of sourcing strategies. Many companies responded by diversifying procurement channels, seeking alternative suppliers in cost-competitive regions, and accelerating local production initiatives to mitigate tariff impacts.

The cumulative effect of these trade policies has been twofold. Firstly, upward pressure on retail prices prompted a recalibration of premium versus mass market positioning, compelling brands to justify value propositions through enhanced formulation transparency and performance claims. Secondly, the disruptions spurred collaborative partnerships across the value chain, as ingredient suppliers, contract manufacturers, and logistics providers united to develop tariff-resilient frameworks. While these adaptations incurred initial investment demands, they also fostered greater supply chain resilience and operational flexibility that are poised to deliver long-term strategic benefits.

Intricate Multi-Dimensional Segmentation Reveals Actionable Differentiation Pathways across Product Types, Channels, Pricing, Demographics, and Ingredients

Understanding the cosmetic products market through a segmentation lens reveals nuanced insights that inform strategic decision making. When analyzed by product type, bath & shower offerings encompass bath soaps, body washes, and shower gels, while color cosmetics cover eye makeup, face makeup, and lip products. Fragrance assortments span men’s, women’s, and unisex compositions, and hair care is categorized into conditioners, hair colors, shampoos, and treatment products. Skin care extends across body care, facial care, and hand & foot care, with facial care further segmented into cleansers, moisturizers, and toners. This granular delineation enables brand managers to pinpoint consumer preferences and tailor innovations that resonate with specific routine steps.

Examining distribution channels elucidates the evolving dynamics of market reach. Offline retail remains anchored by pharmacies and drug stores, specialty stores, and supermarkets and hypermarkets, whereas online channels include brand websites, direct selling platforms, and e-commerce marketplaces. Meanwhile, price tiers-luxury, premium, and mass-reflect divergent consumer willingness to invest in product efficacy and brand prestige. Demographic variables such as gender (female, male, unisex) and age group (adults, seniors, teenagers) provide further clarity on purchasing motivations. Finally, ingredient type segmentation into natural and synthetic underscores the critical role of formulation narratives in driving consumer trust and perceived value. Together, these layered insights inform launch strategies, portfolio optimization, and targeted communication campaigns.

This comprehensive research report categorizes the Cosmetic Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gender

- Age Group

- Ingredient Type

- Distribution Channel

Diverse Regional Dynamics in the Americas, EMEA, and Asia-Pacific Highlight Unique Regulatory Drivers, Consumer Preferences, and Growth Opportunities

Regional dynamics play a central role in shaping competitive and consumer landscapes. In the Americas, robust demand for fragranced personal care and professional hair care services has been buoyed by premiumization trends and loyalty-driven experiential retail models. Manufacturers are capitalizing on localized R&D to introduce formulations tailored to varied climatic conditions and multicultural consumer profiles.

In Europe, Middle East & Africa, regulatory stringency and sustainability mandates have accelerated adoption of clean beauty standards, eco-certified packaging, and cruelty-free testing protocols. Meanwhile, Middle Eastern countries exhibit growing interest in artisanal and luxury fragrances, while African markets demonstrate potential in natural and herbal product lines.

Asia-Pacific continues to drive global growth through skincare innovation and advanced supply chain integration. Korean and Japanese brands are pioneering multifunctional and high-efficacy serums, and Southeast Asian vendors are leveraging indigenous ingredients. Across these diverse geographies, digital affinity and mobile commerce are reshaping purchase behaviors, underscoring the importance of cohesive omni-regional digital strategies.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Acquisitions, Direct-to-Consumer Models, and Sustainability Leadership Propel Top Cosmetic Product Companies to the Forefront

Key players in the cosmetic products sector are deploying multifaceted growth strategies to secure market leadership. Leading global conglomerates are investing heavily in strategic acquisitions and joint ventures that expand geographic footprints and diversify product portfolios. At the same time, nimble challenger brands are leveraging direct-to-consumer models and social media engagement to rapidly scale niche offerings. Both cohorts are intensifying R&D investments in biotechnology and novel delivery systems, aiming to differentiate through superior efficacy and user experience.

In addition, sustainability positioning has become a core competitive lever. Companies are publicizing ambitious net-zero commitments, renewable packaging initiatives, and circularity programs. Simultaneously, enhanced transparency regarding ingredient sourcing and supply chain traceability is fostering deeper consumer trust. Finally, collaborative innovation platforms that unite academic institutions, material science specialists, and formulators are accelerating the translation of research breakthroughs into commercial products. These collective efforts underscore the diverse strategic approaches shaping the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Amway Corporation

- Beiersdorf AG

- Chanel S.A.

- Ciaté Ltd.

- Coty Inc.

- Johnson & Johnson

- Kao Corporation

- L'Oréal S.A.

- LVMH Moët Hennessy Louis Vuitton S.E.

- Mary Kay Inc.

- Natura &Co Holding S.A.

- Revlon, Inc.

- Seed Beauty, LLC

- Shiseido Company, Limited

- The Estée Lauder Companies, Inc.

- The Procter & Gamble Company

- Unilever PLC

Proactive Sourcing Diversification, Data-Driven Personalization, and End-to-End Sustainability Are Essential for Future-Proofing Cosmetic Businesses

Industry leaders must adopt a proactive stance to navigate evolving market dynamics and capitalize on emerging growth vectors. Embracing a flexible sourcing strategy that combines local production hubs with diversified international suppliers will mitigate tariff-induced cost volatility and strengthen supply chain resilience. Concurrently, investing in advanced analytics platforms will empower more precise demand forecasting and inventory management, reducing waste and improving responsiveness to consumer trends.

Moreover, integrating sustainability throughout product life cycles-from ingredient selection to end‐of‐life packaging solutions-will resonate with environmentally conscious consumers and differentiate brands in a crowded marketplace. Leaders should also prioritize personalized consumer experiences, leveraging AI-driven consultation tools and data‐informed formulation customization to cultivate loyalty and enhance perceived value. Finally, developing agile omnichannel strategies that seamlessly connect online and offline touchpoints will ensure holistic engagement, driving conversion and retention.

Comprehensive Multi-Method Research Combining Secondary Analysis, Primary Interviews, Quantitative Surveys, and Expert Triangulation Ensures Robust Market Insights

This research employs a rigorous, multi-method approach to ensure accuracy and relevance. Secondary data collection included comprehensive reviews of industry publications, regulatory filings, patent databases, and financial reports. To validate and enrich findings, primary research was conducted through in-depth interviews with key stakeholders, including brand executives, formulators, distributors, and regulatory experts. Quantitative surveys of end-users provided additional perspective on usage patterns, purchasing drivers, and emerging preferences.

Data triangulation techniques were applied to reconcile disparate sources and enhance confidence in qualitative and quantitative insights. Segmentation frameworks were defined in collaboration with domain specialists, ensuring that product, channel, pricing, demographic, and ingredient categorizations accurately reflect market realities. Finally, synthesis workshops with cross-functional teams facilitated peer review and debrief sessions to refine strategic implications and recommendations, delivering a robust foundation for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Products Market, by Product Type

- Cosmetic Products Market, by Gender

- Cosmetic Products Market, by Age Group

- Cosmetic Products Market, by Ingredient Type

- Cosmetic Products Market, by Distribution Channel

- Cosmetic Products Market, by Region

- Cosmetic Products Market, by Group

- Cosmetic Products Market, by Country

- United States Cosmetic Products Market

- China Cosmetic Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Strategic Agility, Collaborative Innovation, and Data-Driven Personalization Will Determine Market Leadership in the Dynamic Cosmetic Products Sector

In summary, the cosmetic products market stands at an inflection point where consumer expectations, technological advancements, and regulatory shifts converge to reshape industry paradigms. Brands that effectively integrate sustainability, personalization, and omnichannel engagement into their core strategies will seize competitive advantage and foster enduring consumer relationships. Meanwhile, resilient supply chain architectures and diversified sourcing will mitigate geopolitical and tariff-related risks, safeguarding operational continuity.

Looking ahead, those organizations that prioritize innovation in formulation science and leverage advanced data analytics will be best positioned to anticipate and respond to evolving market demands. Collaboration across the value chain-spanning ingredient suppliers, contract manufacturers, and digital platforms-will further accelerate the translation of insights into impactful product launches. Ultimately, the ability to balance strategic agility with long-term vision will determine which players thrive in the dynamic landscape of the cosmetic products market.

Unlock Strategic Intelligence and Accelerate Business Growth by Engaging with Ketan Rohom to Access the Comprehensive Market Research Report

To explore a comprehensive view of these cosmetic product trends, engage with Ketan Rohom, Associate Director of Sales & Marketing, to access the detailed market research report that delivers strategic intelligence, competitive analysis, and key growth opportunities essential for informed decision making and accelerated business success. Connect today to unlock actionable findings and position your organization at the forefront of the evolving cosmetic products market.

- How big is the Cosmetic Products Market?

- What is the Cosmetic Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?