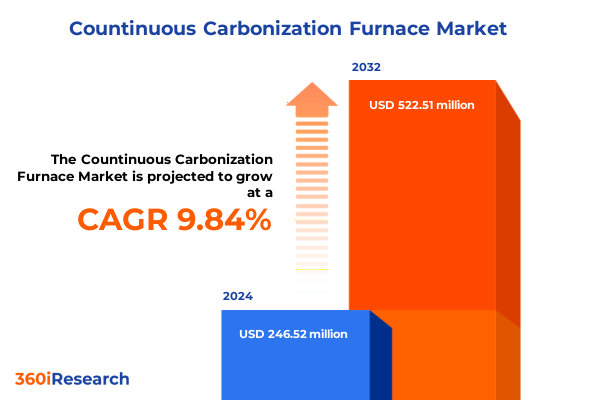

The Countinuous Carbonization Furnace Market size was estimated at USD 269.50 million in 2025 and expected to reach USD 295.59 million in 2026, at a CAGR of 9.91% to reach USD 522.51 million by 2032.

Revolutionizing Organic Waste Management with Continuous Carbonization Furnaces to Unlock Sustainable Biochar and Renewable Energy Opportunities Globally

The drive toward sustainable processing of organic waste and the need for high-value carbon products has elevated the significance of continuous carbonization furnaces within diverse industrial landscapes. Continuous furnaces surpass batch operations by offering uninterrupted production flows, which align closely with the imperatives of modern manufacturing. In a market valued at nearly USD 239 million in 2023, continuous carbonization furnaces accounted for more than two-thirds of industry revenues, reflecting their operational efficiency and automation capabilities. As industries seek scalable solutions for converting biomass, plastics, and other feedstocks into biochar, carbon black, and other high-value derivatives, continuous systems stand out for their superior energy efficiency and reduced labor requirements.

Emerging Automation, IoT Integration, and Advanced Material Innovations are Catalyzing a Shift in Continuous Carbonization Furnace Operations

The landscape of continuous carbonization furnace technology is undergoing transformative shifts driven by digitalization, materials innovation, and environmental policy. Leading manufacturers are integrating automation and Internet of Things solutions to facilitate real-time monitoring, predictive maintenance, and process optimization, enabling furnace operators to achieve consistent product quality while minimizing downtime. Simultaneously, advances in refractory materials and high-performance alloys are enhancing thermal efficiency and extending maintenance cycles, reducing total cost of ownership. Policy developments such as the proposed Foreign Pollution Fee Act of 2025 are further incentivizing investment in low-emission furnace designs by imposing import tariffs calibrated to the carbon intensity of manufacturing processes. These converging forces are reshaping procurement strategies and fueling a wave of innovation across the value chain.

Understanding How Recent U.S. Tariff Actions on Steel, Alloy Components, and Industrial Machinery Are Reshaping Continuous Furnace Supply Chains and Procurement Strategies

The introduction of additional tariffs on steel and derivative steel articles effective March 12, 2025, has raised the ad valorem duty rate by 25 percent on key furnace components, amplifying procurement costs for continuous carbonization furnace manufacturers and end users within the United States. In parallel, the extension of Section 301 measures has imposed a 25 percent tariff on specialized alloys and refractory materials crucial to high-temperature processing equipment, while an auto tariff proclamation of 25 percent on industrial machinery parts undercuts traditional supply chains. In response, industry participants are reconfiguring sourcing strategies to prioritize domestic steel suppliers and modular furnace designs that reduce tariff exposure. Concurrently, R&D programs are intensifying to develop alternative low-cost materials and to enhance furnace efficiency, thereby mitigating the financial impact of rising import duties.

Deep Dive into Product, Feedstock, and Capacity Segmentation Reveals Tailored Continuous Carbonization Furnace Solutions for Diverse Industrial Needs

Insights into market segmentation reveal distinct performance dynamics across furnace types and configurations. Within the continuous furnace segment, belt-type, rotary kiln, and screw furnaces each deliver unique advantages. Belt-type systems, spanning fixed-bed and moving-bed configurations, excel at processing uniform feedstocks with high throughput, whereas rotary kilns-both direct-fired and indirect-fired-offer versatile thermal profiles suited to varied material characteristics. Screw furnaces, available in single- and double-screw designs, provide compact footprints and efficient mixing for high-moisture feedstocks. Material segmentation underscores the primacy of biomass-subdivided into agricultural and forestry residues-as the dominant feedstock, complemented by coal variants and emerging streams such as plastic polymers and industrial sludge. Demand within end-user industries spans agriculture, chemicals, energy, metals, and pharmaceuticals, driving furnace design evolution to meet sector-specific purity and yield requirements. Application segmentation highlights the growing role of activated carbon and biochar alongside traditional charcoal and coke outputs. Capacity tiers, from sub-10 TPH units to above-20 TPH systems, align with the operational scale of agricultural cooperatives, industrial processors, and energy producers. Distribution channels range from direct OEM sales and distributor networks to nascent online procurement platforms, reflecting the maturing digital marketplace.

This comprehensive research report categorizes the Countinuous Carbonization Furnace market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Furnace Type

- Capacity

- Feedstock Type

- Product Type

- Heating Mechanism

- End-User Industry

- Distribution Channel

Analyzing Regional Market Drivers and Policy Incentives Shaping Demand for Continuous Carbonization Furnaces Across the Americas, EMEA, and Asia-Pacific

Regional market performance varies significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. North America’s appetite for green energy solutions and agricultural biochar has propelled the U.S. segment to a valuation exceeding USD 33 million in 2023, with ongoing adoption driven by environmental regulations and farm-based sustainability initiatives. In the EMEA region, stringent emissions targets under the European Green Deal and carbon neutrality mandates are catalyzing demand for advanced carbonization technologies, with projected growth rates outpacing global averages, supported by robust government incentives for renewable energy and waste-to-energy projects. Asia-Pacific retains the largest share of global furnace installations, led by China, India, and Indonesia, where abundant biomass resources and initiatives to improve rural energy infrastructure sustain a 31.54 percent regional revenue share.

This comprehensive research report examines key regions that drive the evolution of the Countinuous Carbonization Furnace market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Equipment Manufacturers and Coating Technology Leaders Driving Innovation and Competitive Advantage in Continuous Carbonization Furnace Markets

The competitive landscape is characterized by a blend of specialized OEMs and diversified engineering firms. GreenPower Ltd has distinguished itself through its biomass carbonization plant offerings and modular continuous furnace lines. Beston Group Co. Ltd leverages its global service network to deliver both batch and continuous solutions. Chinese manufacturers, including Zhengzhou Belong Machinery and Zhengzhou Shuliy Machinery, drive cost-competitive continuous rice husk and palm shell carbonization systems optimized for feedstock local to Southeast Asia. Henan Chengjinlai and Henan Sunrise Biochar Machine pursue innovation in screw furnace designs and compact biochar units to serve emerging market segments. Materials and coating suppliers such as Brycoat Inc., Höganäs AB, and General Magnaplate further contribute by enhancing equipment longevity through advanced thermal spray technologies. Collectively, these companies are forging partnerships and channel alliances to broaden geographic reach and to introduce integrated service offerings that span installation, training, and after-sale support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Countinuous Carbonization Furnace market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANDRITZ AG

- Beneny Group

- GEMCO Energy

- Gongyi Hongrun Machinery Equipment Co.,Ltd.

- GreenPower

- Henan Gomine Industrial Technology Co., Ltd.

- Henan KaiBang Machinery Manufacturing Co., Ltd.

- Henan Ling Heng Machinery Co., Ltd.

- Henan Olten Environmental Sci-Tech Co., Ltd.

- Henan Zhengyang Machinery Equipment Co., Ltd.

- Mingyang Machinery

- Mitsubishi Heavy Industries, Ltd.

- Shuliy Machinery

- Tenova S.p.A.

- Yushunxin

- Zhengzhou Fanda Machinery Co., Ltd.

- Zhengzhou Shuliy Machinery Co. Ltd.

Strategic Roadmap for Manufacturers and End Users to Leverage Digitalization, Supply Chain Resilience, and Policy Engagement for Competitive Advantage

Industry leaders should prioritize the integration of digital process controls and IoT-enabled analytics to capture real-time performance metrics and to facilitate predictive maintenance that reduces unplanned downtime. By diversifying material sourcing strategies and establishing partnerships with domestic steel and refractory suppliers, organizations can insulate themselves from tariff volatility and ensure continuity of operations. Investment in R&D to explore alternative heat-resistant alloys and low-cost insulation formulations will enhance furnace efficiency while mitigating exposure to import duties. Companies should also engage proactively with policymakers to shape favorable regulations and to secure incentives for low-carbon equipment. Finally, forging strategic alliances across the value chain-from feedstock suppliers to end-user cooperatives-will unlock new markets and drive volume growth through bundled service and maintenance agreements.

Comprehensive Research Framework Leveraging Secondary Analysis, Primary Interviews, Data Triangulation, and Scenario Modeling to Deliver Robust Market Insights

This research combines comprehensive secondary analysis of industry publications, government trade bulletins, and company financial disclosures with primary interviews conducted with furnace OEM executives, end-user procurement managers, and materials suppliers. Data triangulation techniques were employed to reconcile divergent estimates and to validate segmentation frameworks. Quantitative modeling of tariff impacts and regional growth rates was augmented by qualitative scenario analyses to assess policy and technological risk factors. The segmentation approach encompasses furnace type, feedstock, end-user industry, application, capacity, and distribution channel, ensuring a granular understanding of market dynamics. The methodology adheres to rigorous standards for data integrity, transparency, and replicability, supporting decision-making across strategic, operational, and investment functions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Countinuous Carbonization Furnace market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Countinuous Carbonization Furnace Market, by Furnace Type

- Countinuous Carbonization Furnace Market, by Capacity

- Countinuous Carbonization Furnace Market, by Feedstock Type

- Countinuous Carbonization Furnace Market, by Product Type

- Countinuous Carbonization Furnace Market, by Heating Mechanism

- Countinuous Carbonization Furnace Market, by End-User Industry

- Countinuous Carbonization Furnace Market, by Distribution Channel

- Countinuous Carbonization Furnace Market, by Region

- Countinuous Carbonization Furnace Market, by Group

- Countinuous Carbonization Furnace Market, by Country

- United States Countinuous Carbonization Furnace Market

- China Countinuous Carbonization Furnace Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesis of Technological, Policy, and Supply Chain Trends Underpinning the Future Trajectory of the Continuous Carbonization Furnace Sector

Continuous carbonization furnaces are emerging as pivotal enablers of sustainable waste valorization and carbon product manufacturing across multiple industries. Market evolution is being shaped by technological advances in automation, regulatory pressures on emissions and carbon footprints, and supply chain realignment in response to evolving tariff regimes. Successful players will be those that harness digital tools, secure resilient material supply networks, and engage collaboratively with policy stakeholders. As the industry transitions toward greater efficiency and environmental compliance, the continuous furnace segment is poised to maintain its leadership due to its scalability, operational consistency, and capacity to integrate emerging technologies.

Unlock Your Competitive Edge with Personalized Market Insights and Expert Support from Ketan Rohom

Don’t miss the opportunity to gain a strategic advantage in the continuous carbonization furnace market by accessing the full research report. Connect today with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and secure your organization’s roadmap to sustainable growth.

- How big is the Countinuous Carbonization Furnace Market?

- What is the Countinuous Carbonization Furnace Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?