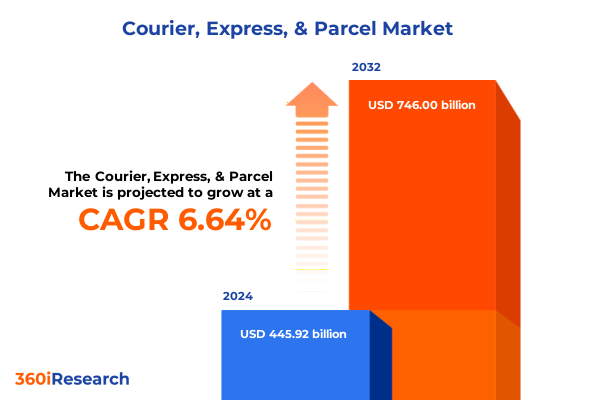

The Courier, Express, & Parcel Market size was estimated at USD 473.65 billion in 2025 and expected to reach USD 503.63 billion in 2026, at a CAGR of 6.70% to reach USD 746.00 billion by 2032.

Unveiling the Foundations of Today’s Courier, Express, and Parcel Ecosystem by Analyzing Key Drivers, Technological Innovations, and Competitive Dynamics

In an era defined by instantaneous connectivity and on-demand delivery, the courier, express, and parcel services sector stands at the forefront of global logistics innovation. Rapidly evolving e-commerce dynamics, heightened consumer expectations for same-day and next-day delivery, and the relentless push toward cost efficiency have driven service providers to rethink traditional paradigms. What began as a simple point-to-point delivery model has blossomed into a sophisticated network that integrates digital platforms, intelligent routing algorithms, and dynamic capacity management to meet diverse customer needs.

Against this backdrop, technological advancements in robotics, artificial intelligence, and Internet of Things connectivity are elevating operational performance and transparency. Carriers are investing heavily in automated sortation centers, drone trials, and predictive analytics to forecast demand spikes and optimize last-mile operations. Meanwhile, the growing focus on environmental sustainability has spurred experimentation with electric fleets, carbon-offset programs, and alternative fuels to satisfy both regulatory requirements and eco-conscious consumer segments. As market participants embrace these transformative trends, competitive differentiation will hinge upon seamless integration of digital services, supply chain agility, and a relentless focus on customer experience.

Identifying Major Forces Reshaping the Courier, Express, and Parcel Market Through Digitalization, Sustainability, and Evolving Consumer Expectations

The landscape of parcel delivery is undergoing fundamental transformation as disruptive technologies and shifting consumer mindsets redefine industry benchmarks. Digitalization has emerged as a catalyst for change, empowering carriers to deploy advanced tracking capabilities and self-service digital portals. These innovations grant shippers unprecedented visibility into each stage of the delivery journey, fostering trust and unlocking opportunities for real-time exception management. Moreover, the convergence of artificial intelligence and machine learning is enabling dynamic route optimization and predictive maintenance, reducing transit times and minimizing unplanned downtime.

Parallel to the rise of digital tools, heightened consumer awareness of environmental impacts is driving widespread adoption of green logistics practices. From optimizing load consolidation to trialing biofuels and electric vehicles in urban corridors, carriers are actively seeking pathways to decarbonize operations without sacrificing service levels. Regulatory frameworks in key markets are accelerating this shift, introducing low-emission zones and carbon reporting mandates that place a premium on environmental performance. Consequently, leading providers are forging sustainability partnerships and integrating eco-friendly options into their service portfolios, appealing to enterprises and end customers who increasingly value ethical supply chain practices.

Assessing the Cumulative Effects of 2025 United States Tariffs on Cross-Border Shipments, Cost Structures, and Service Level Adaptations

The imposition of new tariff regimes by the United States in 2025 has exerted significant pressure on cross-border courier, express, and parcel services. Heightened duties on key import commodities have elevated landed costs for businesses, prompting many shippers to absorb partial cost increases or negotiate alternative routing strategies. As a result, carriers are recalibrating their pricing structures, introducing tiered tariff surcharges, and collaborating with private courier consolidators to maintain service affordability without compromising reliability.

In response to escalating trade tensions, service providers have diversified their route portfolios to mitigate exposure to high-tariff corridors. This has led to increased adoption of northern border land crossings and enhanced feeder services from Canadian and Mexican hubs, which offer more favorable duty regimes. Additionally, carriers are engaging in strategic partnerships with freight forwarders to re-engineer end-to-end supply chains, seamlessly blending air, sea, and land transport to optimize cost and transit time. These adaptations underscore the sector’s resilience and its ability to pivot rapidly in the face of tariff-induced disruptions.

Revealing In-Depth Segmentation Across Type, Service Model, Shipment Category, Destination, Delivery Speed, Volume, Transportation Mode, and End-User Verticals

Segmentation analysis reveals the intricate tapestry of demand patterns across the courier, express, and parcel market. When dissected by type, Courier Services underscore rapid local deliveries for critical documents, while Express Services prioritize expedited regional and national shipments, and Parcel Services address a broad spectrum of package sizes. Layering in service models, Business-to-Business engagements dominate bulk and contractual shipments, Business-to-Consumer offerings cater to individual e-commerce deliveries with tailored tracking experiences, and Consumer-to-Consumer lanes reflect the growth of peer-to-peer marketplaces and localized shipping exchanges.

Shipment typology further differentiates market behavior: Document Shipments remain a staple for legal and financial sectors, Heavy Shipments-comprising both Freight and Machinery-drive specialized operational capabilities, and Parcel Shipments span the vast majority of goods sold online. The interplay of destination-based segmentation exposes divergent operational strategies; Domestic networks leverage extensive road and rail routes, whereas International corridors depend heavily on integrated air and sea linkages to connect global commerce.

Delivery speed is another critical axis, with Economy Delivery serving cost-sensitive bulk consignors, Next-day Delivery and Overnight Delivery fulfilling time-sensitive business needs, and Same-day Delivery unlocking ultra-fast fulfillment for metropolitan consumers. Shipment volume segmentation distinguishes Bulk Consignment operations, which demand palletized logistics, from Multi Item shipments that utilize standardized parcel sortation systems, and Single Item consignments often requiring personalized handling. Transportation mode analysis highlights the role of Air Transportation in rapid global reach, Rail Transportation for cost-effective ground transit, Road Transportation underpinning first- and last-mile solutions, and Sea Transportation anchoring heavy-load and long-haul routes. Lastly, end-user verticals such as Banking, Financial Services & Insurance; Consumer Goods; Food & Beverage; Healthcare; Logistics & Transportation; and Manufacturing each impose unique regulatory, packaging, and traceability requirements, driving targeted service innovations and specialized handling protocols.

This comprehensive research report categorizes the Courier, Express, & Parcel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service Type

- Shipment Type

- Destination

- Delivery Speed

- Shipment Volume

- Mode Of Transportation

- End-User

Mapping Regional Dynamics in Courier, Express, and Parcel Services Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Market Nuances

Regional dynamics in the courier, express, and parcel sector vary considerably across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting distinct growth horizons and operational complexities. In the Americas, robust e-commerce penetration has fueled demand for sophisticated last-mile solutions, prompting carriers to invest in urban micro-fulfillment centers and electric delivery fleets. North American cross-border trade flows, underpinned by comprehensive free trade agreements, continue to support bi-directional parcel movement, while Latin American markets grapple with infrastructure constraints and regulatory fragmentation that influence service consistency.

Across Europe Middle East & Africa, a dense web of transnational corridors necessitates integrated multimodal networks. Western Europe has witnessed rapid adoption of parcel lockers and click-and-collect mechanisms to relieve urban congestion. Meanwhile, emerging economies in the Middle East and Africa are experiencing accelerated mobile commerce growth, driving new partnerships between global logistics providers and local postal authorities to extend service footprints beyond major metropolitan hubs.

In the Asia-Pacific region, hyper-growth markets in Southeast Asia and India are reshaping capacity planning and network expansion strategies. Rapid urbanization and mobile-first consumer behaviors have intensified demand for same-day and next-day deliveries in megacities. Concurrently, carriers are establishing regional consolidation centers in strategic ports and inland gateways to streamline transshipment processes and capitalize on intra-regional trade agreements. These initiatives underscore the imperative to tailor operational models to diverse regulatory frameworks and infrastructural realities across each region.

This comprehensive research report examines key regions that drive the evolution of the Courier, Express, & Parcel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Initiatives, Technology Adoption, and Alliances Shaping Competitive Positioning of Leading Global Courier, Express, and Parcel Service Providers

Leading players in the courier, express, and parcel segment are deploying differentiated strategies to capture emerging opportunities and defend market share. Global network operator DHL has intensified its focus on digital freight platforms and decarbonization targets, collaborating with renewable energy suppliers to electrify final-mile fleets in key European cities. FedEx has leveraged its hub-and-spoke architecture to integrate ground and air networks seamlessly, while piloting data-driven capacity allocation to scale up rapid-response capabilities during peak seasons.

Meanwhile, UPS has expanded its strategic partnerships with e-commerce marketplaces and introduced modular delivery lockers to enhance consumer convenience. Amazon Logistics continues to disrupt traditional models by scaling in-house last-mile operations and testing alternative delivery modes such as autonomous vehicles and drones. Regional postal incumbents are also embracing competition by modernizing sorting centers and entering joint ventures with express carriers to unlock cross-border synergies. Collectively, these initiatives reflect a market landscape where technological leadership, operational resilience, and strategic alliances define corporate ascendancy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Courier, Express, & Parcel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1 Express Delivery Service Inc.

- Allied Express Transport Pty Ltd.

- Aramex International LLC

- Associated Courier Inc.

- BDP International Inc.

- BHF Couriers Express Pty Ltd.

- Cardinal Logistics Management Corporation

- CMA CGM Group

- Courier Express Limited

- DB Schenker

- Delhivery Limited

- Deutsche Post DHL Group

- DTDC Express Ltd.

- Emirates Skycargo by Emirates Group

- FedEx Corporation

- Japan Post Holdings Co., Ltd.

- JHT Global Logistics Ltd.

- La Poste SA

- Poste Italiane S.p.A

- Qantas Airways Ltd.

- SF Holding Limited

- ShipBob, Inc.

- United Parcel Service Inc.

- Yamato Transport Company, Ltd.

- Yusen Logistics Global Management Co., Ltd.

Delivering Recommendations for Industry Leaders to Optimize Operations, Enhance Customer Experience, Embrace Sustainability, and Adopt Innovative Technologies

Industry leaders must embrace a multifaceted approach to sustain growth and drive competitive advantage. First, optimizing network design through data-driven route planning and dynamic asset allocation can yield substantial cost efficiencies and minimize carbon footprints. By integrating real-time traffic analytics with predictive demand models, carriers can reduce empty mileage and enhance on-time performance. Secondly, investing in customer-centric digital tools-such as AI-powered chatbots for instant support and self-service mobile applications for seamless booking-can deepen engagement and foster loyalty in a crowded marketplace.

Moreover, sustainability commitments should transition from aspirational pledges to actionable initiatives. Deploying electric vehicles where infrastructure permits, collaborating with renewable energy providers, and embedding circular packaging solutions will resonate with increasingly eco-conscious consumers and satisfy regulatory imperatives. Finally, forging strategic alliances-whether through joint ventures with regional couriers, partnerships with technology startups, or integration with multimodal freight providers-can expand service portfolios and mitigate geopolitical risks. These recommendations offer a roadmap for industry executives to navigate evolving market complexities and catalyze long-term value creation.

Explaining the Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, Expert Validation, and Rigorous Quality Control Protocols

This research relies on a rigorous, multi-tiered methodology designed to ensure accuracy, relevance, and actionable insights. Primary data was collected through in-depth interviews with senior executives across major courier, express, and parcel companies, as well as discussions with industry analysts, regulatory officials, and leading e-commerce platforms. These qualitative inputs were triangulated with extensive secondary research, including corporate annual reports, trade publications, and regulatory filings, to validate emerging trends and strategic imperatives.

Quantitative analysis complemented these efforts by examining shipment volumes, service-level performance, and cost structures across multiple regions. Expert validation sessions were conducted to refine key findings and challenge underlying assumptions. Throughout the process, stringent quality control protocols-including peer reviews, data consistency checks, and transparency of source attribution-were employed to maintain the highest research standards. This robust framework underpins the credibility of the insights and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Courier, Express, & Parcel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Courier, Express, & Parcel Market, by Type

- Courier, Express, & Parcel Market, by Service Type

- Courier, Express, & Parcel Market, by Shipment Type

- Courier, Express, & Parcel Market, by Destination

- Courier, Express, & Parcel Market, by Delivery Speed

- Courier, Express, & Parcel Market, by Shipment Volume

- Courier, Express, & Parcel Market, by Mode Of Transportation

- Courier, Express, & Parcel Market, by End-User

- Courier, Express, & Parcel Market, by Region

- Courier, Express, & Parcel Market, by Group

- Courier, Express, & Parcel Market, by Country

- United States Courier, Express, & Parcel Market

- China Courier, Express, & Parcel Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Drawing Conclusions on the Future Trajectory of Courier, Express, and Parcel Services Through Synthesizing Key Trends, Challenges, and Strategic Imperatives

As the courier, express, and parcel ecosystem advances into an era defined by instantaneous fulfillment and heightened sustainability expectations, stakeholders must proactively adapt to shifting paradigms. The synergy of digital transformation, green logistics practices, and agile network architectures will determine which service providers thrive amid intensifying competition. Furthermore, the persistent influence of regulatory changes, including trade policies and environmental mandates, necessitates continuous scenario planning and strategic flexibility.

Looking ahead, technological innovations such as autonomous delivery vehicles, blockchain-enabled traceability, and hyperlocal fulfillment models promise to further disrupt conventional operations. Service differentiation will increasingly rely on the ability to offer seamless omnichannel experiences, transparent pricing, and customizable delivery options. In this context, carriers that align strategic investments with evolving customer demands and regulatory frameworks will secure sustainable growth and reinforce their market leadership.

Contact Ketan Rohom Today to Secure Exclusive Access to the Comprehensive Market Research Report on Courier, Express, and Parcel Services

To explore how your organization can capitalize on these critical market insights and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full market research report. Ketan Rohom brings extensive expertise in guiding enterprises through complex strategic decisions in the Courier, Express, and Parcel domain, ensuring that each recommendation is tailored to your unique operational realities and growth ambitions.

By engaging directly with Ketan Rohom, you will gain access to proprietary data analyses, in-depth stakeholder interviews, and actionable frameworks that are not available through public channels. Don’t miss this opportunity to transform your logistics strategy and drive long-term value in 2025 and beyond.

- How big is the Courier, Express, & Parcel Market?

- What is the Courier, Express, & Parcel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?