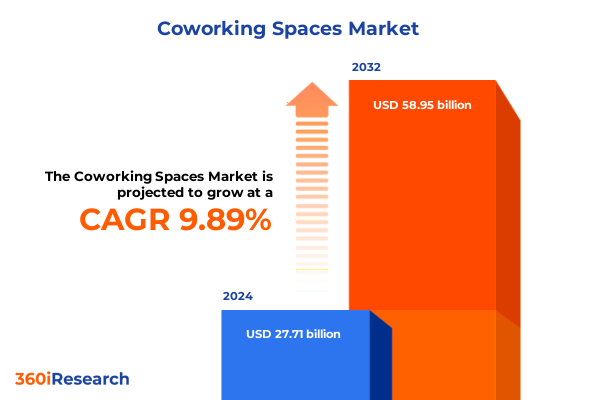

The Coworking Spaces Market size was estimated at USD 30.45 billion in 2025 and expected to reach USD 33.26 billion in 2026, at a CAGR of 9.89% to reach USD 58.95 billion by 2032.

Setting the Stage for Tomorrow’s Flexible Work Ecosystem by Exploring Emerging Trends, Stakeholder Dynamics, and Market Drivers That Propel Growth

The coworking industry has evolved from a niche concept for freelancers to a mainstream ecosystem that supports organizations of all sizes. What began as shared desks in boutique spaces has burgeoned into a sophisticated network of flexible offices, driving collaboration, innovation, and productivity across geographies. This executive summary introduces the foundational themes of the report by highlighting the market’s accelerating momentum, the diversity of consumer needs that underpin demand, and the structural factors shaping growth trajectories.

In recent years, stakeholders from entrepreneurs to multinational corporations have recognized the strategic value of coworking as more than a cost-saving measure. Flexible leases, community-driven environments, and technology-enabled amenities have transformed how companies approach real estate and talent management. This introduction provides a roadmap for navigating the report, outlining how each subsequent section delves into critical forces-from macroeconomic pressures to foundational segmentation-that collectively define the contours of the industry’s future.

Uncovering the Profound Evolution of Hybrid Work, Technological Integration, and Sustainability Priorities That Redefine the Coworking Experience

The coworking landscape has undergone significant transformation driven by evolving workplace philosophies, technological convergence, and unprecedented global events. Hybrid work models, forged in response to the pandemic, have become a lasting norm rather than a temporary adjustment. Organizations now see the value of dispersing their workforce into flexible hubs closer to residential areas to bolster employee wellbeing and reduce commute times. Simultaneously, advanced digital infrastructures such as IoT-enabled meeting rooms, AI-driven space management platforms, and seamless mobile integrations have elevated service expectations.

Moreover, sustainability imperatives now inform both real estate choices and operational protocols, with many operators retrofitting existing buildings or pursuing net-zero certified developments. Community engagement has also reached new heights, as coworking entities curate events, workshops, and networking opportunities that rival traditional professional associations. These transformative shifts are fundamentally recalibrating the relationship between space providers, members, and the broader commercial real estate ecosystem, setting the stage for a more interconnected and resilient industry.

Examining the Complex Consequences of 2025 United States Tariffs on Procurement Costs, Construction Timelines, and Operator Margins

The introduction of heightened United States tariffs in 2025 has had a multifaceted impact on the coworking sector, influencing both supply chain costs and real estate development timelines. Equipment and furnishing prices have risen as import duties on office furniture, hardware components for smart building systems, and specialized fit-out materials exert inflationary pressure on operational budgets. Operators dependent on globally sourced modular furniture or cutting-edge audiovisual installations have had to reassess procurement strategies and pass through incremental costs to membership fees in some markets.

On the construction side, tariffs on steel and aluminum have extended project timelines by disrupting material availability and inflating subcontractor rates. This dynamic has led some developers to explore local manufacturing partnerships or seek alternative materials to maintain design standards and budget constraints. Ultimately, the cumulative effect of these policy measures has been a squeeze on margin structures for both established operators and new entrants, prompting a wave of contract renegotiations and, in certain cases, a strategic pivot toward markets less exposed to tariff-driven cost volatility.

Deciphering How Service Types, Membership Models, Organizational Scales, Operational Frameworks, and Industry Specializations Drive Distinct User Preferences and Provider Strategies

Analyzing the market through the lens of service offerings reveals a clear hierarchy of preferences and usage patterns. Dedicated desk memberships continue to attract professionals seeking predictability and personalization in their work environment, while hot desk options cater to highly mobile freelancers valuing flexibility. Meeting rooms remain essential for both internal collaborations and client engagements, underlining the importance of on-demand spaces within a broader portfolio. Private offices serve as the go-to solution for small teams and enterprises requiring privacy and branding opportunities, and virtual office services allow organizations to establish a prestigious business address without physical presence.

From the perspective of membership models, the report highlights how enterprise clients drive large-volume contracts and demand bespoke service levels, contrasting with freelancers whose month-to-month plans favor agility. Small teams, positioned between these extremes, often seek hybrid packages that combine private and shared space elements. Organizational size further influences provider selection, with large organizations prioritizing standardized processes and global network access, while small and medium enterprises are more attuned to cost-effective solutions and community engagement. Examining operational models uncovers that franchise-based spaces leverage standardized branding and support, independent operators excel in curating local community culture, and managed spaces offer corporate-backed consistency with scale-driven efficiencies. Differentiating by industry focus surfaces patterns of niche specialization-from creative sectors that prize aesthetic-infused environments to finance organizations that demand compliance-ready facilities, healthcare clients prioritizing privacy and hygiene protocols, and technology firms seeking high bandwidth and prototyping amenities.

This comprehensive research report categorizes the Coworking Spaces market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Membership Type

- Operational Model

- Organization Size

- Industry

Exploring Distinct Regional Growth Patterns and Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific Coworking Markets

Regional dynamics in coworking adoption reveal marked contrasts shaped by economic development, cultural norms, and regulatory landscapes. Within the Americas, established markets such as the United States and Canada demonstrate saturation in major urban centers, prompting operators to explore suburban and secondary cities. Latin American growth corridors, particularly in Brazil and Mexico, showcase rising demand driven by burgeoning startup ecosystems and digital entrepreneurship.

Across Europe, the Middle East, and Africa, Western European capitals maintain leadership in occupancy rates and innovation pilots, while emerging hubs in Eastern Europe and the Gulf Cooperation Council countries attract investment through governmental incentives and creative city initiatives. In Africa, early-stage markets exhibit rapid evolution, with local operators experimenting with hybrid coworking–incubator models. Turning to the Asia-Pacific, mature markets such as Australia and Japan balance high-quality fit-outs with stringent safety standards, whereas Southeast Asian urban centers like Singapore, Jakarta, and Bangkok capitalize on digital nomad policies and government-backed tech zones to accelerate adoption.

This comprehensive research report examines key regions that drive the evolution of the Coworking Spaces market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing How Leading Operators Leverage Brand Scale, Localized Community Curation, and Strategic Alliances to Differentiate Their Coworking Portfolios

Leading operators in the coworking sector demonstrate diverse strategic approaches to expansion and differentiation. Global brands capitalize on extensive footprints to offer one-stop solutions and standardized experiences, leveraging cross-border membership reciprocity to cater to multinational clients. At the same time, rapidly scaling regional players have sharpened their competitive edge through technologically advanced space management platforms, integrating member apps that facilitate booking, community engagement, and ancillary service procurement.

Independent local operators continue to thrive by infusing spaces with unique cultural and design elements, fostering tight-knit communities that resonate with specific demographic segments. Strategic partnerships with real estate developers, hospitality groups, and educational institutions have also emerged as prevalent growth tactics, enabling companies to tap into built-in customer bases and diversify revenue streams. Additionally, a new wave of specialized providers focuses exclusively on industry verticals, from health-tech labs to creative incubators, capitalizing on domain-specific requirements and networking synergies to command premium pricing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coworking Spaces market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 91springboard Community Services Private Limited

- Awfis Space Solutions Private Limited

- COhatch LLC

- CommonGrounds Workplace LLC

- Convene Inc.

- Expansive Workspace LLC

- Impact Hub Global GmbH

- Industrious LLC

- IWG plc

- Mindspace India Private Limited

- Office Evolution Franchising, Inc.

- Premier Workspaces LLC

- Regus

- Serendipity Labs Inc.

- Servcorp Limited

- Talent Garden S.p.A.

- The Hive Global Group Limited

- Ucommune Group Ltd

- Venture X Franchising LLC

- WeWork Inc.

Formulating a Balanced Playbook That Merges Digital Infrastructure, Community Engagement, and Diversified Services to Build Resilient Coworking Ventures

Forward-thinking industry leaders should prioritize an integrated approach that balances technological innovation with human-centric experiences. Investing in scalable digital platforms will streamline operations and enhance member engagement, but these tools must complement-not replace-the social infrastructure that underpins community building. Operators should consider forging partnerships with local governments to benefit from urban revitalization incentives and align with corporate sustainability goals by pursuing green certifications and resource-efficient design.

Moreover, diversifying revenue streams beyond desk rentals is critical. Hosting specialized training sessions, wellness programs, and corporate offsites can unlock ancillary income while fortifying member loyalty. Tailoring membership tiers with flexible add-on services will address varied client requirements and buffer against market fluctuations. In regions where regulatory headwinds, such as import tariffs or zoning restrictions, threaten margins, proactive supply chain localization and multi-market portfolio balancing can mitigate risk. Finally, embedding an experimentation mindset-through pilot projects and data-driven A/B testing-ensures that adaptations to changing member behaviors are calibrated and scalable.

Outlining the Rigorous Mixed-Methods Framework Integrating Executive Interviews, Surveys, and Secondary Validation for Robust Market Analysis

This study employed a mixed-methods approach combining primary stakeholder interviews, operator surveys, and secondary data triangulation. In-depth discussions were conducted with C-level executives from leading coworking companies, real estate developers, and corporate users to capture firsthand perspectives on strategic priorities and emerging challenges. Concurrently, a structured questionnaire gathered quantitative data from a broad cross-section of space providers, encompassing varied service types, membership models, and geographic footprints.

Complementary secondary sources included industry whitepapers, regulatory filings, and real estate transaction databases to verify market trends and contextualize survey findings. Data validation techniques, such as consistency checks and outlier analysis, were applied to ensure robustness. The research team also monitored policy developments, including tariff announcements and urban planning initiatives, to assess their real-time implications. Finally, insights were iteratively reviewed with an advisory panel of sector specialists to align conclusions with practical industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coworking Spaces market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coworking Spaces Market, by Service Type

- Coworking Spaces Market, by Membership Type

- Coworking Spaces Market, by Operational Model

- Coworking Spaces Market, by Organization Size

- Coworking Spaces Market, by Industry

- Coworking Spaces Market, by Region

- Coworking Spaces Market, by Group

- Coworking Spaces Market, by Country

- United States Coworking Spaces Market

- China Coworking Spaces Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Distilling Key Strategic Imperatives That Empower Stakeholders to Thrive by Aligning Flexibility, Innovation, and Resilience in Coworking Ecosystems

The coworking industry stands at a pivotal juncture where flexibility, technology, and community converge to reshape the future of work. As hybrid models become entrenched and regulatory landscapes evolve, operators must navigate complexity with agility and foresight. Insights from this report underscore the imperative for a data-driven strategy that harmonizes operational excellence with member-centric innovation. The interplay of service diversification, regional nuances, and macroeconomic forces demands a holistic understanding to drive sustainable growth.

In conclusion, those who proactively adapt their business models-embracing digital enhancements, cultivating robust communities, and mitigating external cost pressures-will emerge as leaders in this dynamic ecosystem. By leveraging the strategic insights provided, stakeholders can confidently chart a course that balances short-term performance with long-term resilience, ultimately redefining the possibilities of coworking in a rapidly changing world.

Unlock Exclusive Strategic Insights by Partnering with Ketan Rohom to Acquire the Most Comprehensive Coworking Industry Research Report

Engaging with Ketan Rohom presents an opportunity to unlock the full potential of your organization’s future in coworking spaces. As an industry expert in sales and marketing, Ketan can guide you through the nuances of applying rich market insights to your strategic planning and operational rollout. By procuring this comprehensive market research report, your team gains access to curated data, actionable intelligence, and thought-provoking analysis that will inform every decision you make. Whether you seek to optimize membership models, refine your regional footprint, or respond proactively to shifting tariff landscapes, direct dialogue with Ketan will ensure you translate high-level findings into measurable business outcomes.

I invite you to reach out to schedule a personalized briefing where we can explore custom scenarios tailored to your organizational goals, examine bespoke segment-level deep dives, and discuss competitive benchmarking insights derived from leading coworking operators. Aligning research-driven insights with executive decision-making processes has never been more critical as the industry navigates transformative trends and regulatory developments. Partnering with Ketan will not only provide you with the latest intelligence but also position you to lead with confidence in an increasingly complex and competitive marketplace.

Take the next step today by connecting with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full report. By doing so, you’ll arm your team with the knowledge, strategies, and foresight needed to thrive in the dynamic world of coworking for years to come.

- How big is the Coworking Spaces Market?

- What is the Coworking Spaces Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?