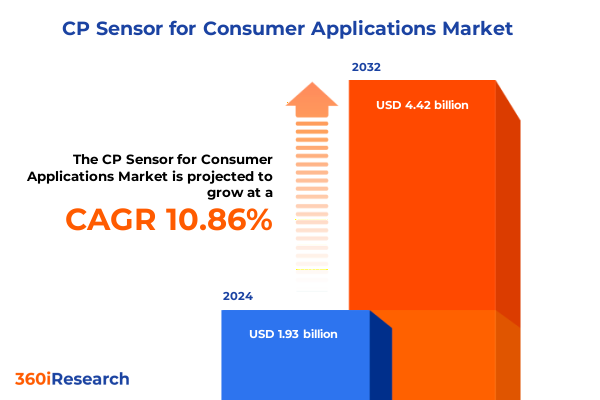

The CP Sensor for Consumer Applications Market size was estimated at USD 2.14 billion in 2025 and expected to reach USD 2.38 billion in 2026, at a CAGR of 10.88% to reach USD 4.42 billion by 2032.

Unveiling the critical role and technological evolution of capacitive pressure sensors in shaping next-generation consumer electronics experiences

Capacitive pressure sensing technology has emerged as a cornerstone of modern consumer electronics, offering precise detection of pressure variations through changes in capacitance. By converting mechanical pressure into an electrical signal, these sensors enable intuitive user interfaces, safety mechanisms, and environmental monitoring across a wide array of applications. From the subtle feedback in smartphone touchscreens to critical measurements in wearable health monitors, capacitive pressure sensors deliver the low-power, high-sensitivity performance demanded by today’s sophisticated devices.

Over the past decade, the fusion of miniaturization techniques and advanced semiconductor fabrication has driven broad adoption of capacitive pressure sensors in devices where accuracy and reliability are paramount. Concurrently, the surge in connected home systems and IoT-enabled medical devices has elevated expectations for sensor robustness, responsiveness, and seamless integration. This confluence of technology advancement and end-user demand has propelled capacitive pressure sensing from a niche component to a pervasive technology underpinning key consumer experiences.

This executive summary provides a holistic overview of the transformative forces shaping the capacitive pressure sensor sector within consumer applications. We examine major shifts in technology and market dynamics, assess the cumulative impact of U.S. tariffs enacted in 2025, unpack key segmentation and regional insights, profile leading companies, and offer strategic recommendations. Finally, we detail our research methodology, synthesize findings in the conclusion, and outline a clear path for engaging with senior research leadership to acquire the full report.

Identifying the major technological and market dynamics that are transforming the landscape for consumer-focused capacitive pressure sensors

The consumer sensing landscape has been fundamentally altered by a rapid acceleration in the deployment of connected devices and the integration of advanced data analytics. Internet of Things (IoT) ecosystems now demand pressure sensors that not only deliver high fidelity signals but also communicate seamlessly with cloud-based platforms. As a result, manufacturers are embedding wireless communication modules directly on sensor packages, enabling real-time monitoring and predictive maintenance functionalities that extend far beyond traditional point-of-use measurement.

At the same time, breakthroughs in materials science have ushered in a new era of flexible and printable sensing substrates. Manufacturers are leveraging polymer-based capacitive layers and stretchable electronics to develop sensors that conform to non-planar surfaces such as curved automotive interiors and collapsible smart home devices. This form factor innovation allows consumer products to evolve from static housings to adaptive designs that respond dynamically to user interactions and environmental stimuli.

Furthermore, the convergence of machine learning algorithms with sensor signal processing has given rise to sensor fusion architectures, where capacitive pressure data is combined with optical, piezoelectric, and thermal inputs to derive richer contextual insights. This multi-modal sensing approach enhances product differentiation by enabling gesture recognition, biometric authentication, and environmental mapping within a single device. As cost pressures mount and consumer expectations rise, the ability to deliver enhanced functionality through integrated sensing solutions will define the next wave of competitive advantage.

Innovation in sustainable manufacturing practices also marks a significant shift. Stakeholders are adopting lead-free materials and low-temperature processing to reduce environmental impact, while supply chain optimization efforts are focused on minimizing carbon footprints and ensuring component traceability. These transformative trends are reshaping not only how capacitive pressure sensors are designed but also how they are produced and distributed globally.

Assessing how 2025 United States trade tariffs have reshaped costs supply chains and strategic decisions across the consumer pressure sensor ecosystem

Beginning in August 2025, the United States government implemented a sweeping 25% tariff on imported goods from Japan and South Korea, citing trade imbalances and national security considerations. Given that both countries are pivotal suppliers of semiconductor wafers, packaging materials, and precision components essential to capacitive pressure sensor manufacturing, this policy has materially increased input costs for U.S. producers and importers of consumer-grade sensors. The levy applies broadly across electronics, encompassing microcontrollers and MEMS devices integral to sensor function.

However, subsequent clarifications introduced partial exemptions for consumer electronics. While finished smartphones and laptops were ostensibly shielded, these items were simply reclassified to face a targeted 20% tariff linked to broader import categories. This reclassification has created confusion among manufacturers and distributors, forcing supply chain redesigns to accommodate shifting cost structures and compliance requirements. The net effect is that sensor-embedded consumer products continue to experience tariff exposure, albeit at a reduced rate.

The cumulative impact of these measures has manifested in dual pressures: margin compression for established original equipment manufacturers and heightened cost barriers for emerging entrants. In response, a growing number of stakeholders are accelerating reshoring initiatives, bolstered by federal incentives under the CHIPS and Science Act. These efforts aim to localize critical stages of sensor production, from wafer fabrication to final assembly, thereby mitigating the uncertainty associated with tariff policy volatility.

As tariffs persist, strategic adaptation has become imperative. Companies are diversifying component procurement to alternative Asian markets such as Vietnam and India, pursuing joint ventures with U.S. foundries, and investing in additive manufacturing techniques to reduce reliance on imported substrates. These adjustments underscore the resilience and agility required to navigate trade complexities while continuing to meet escalating consumer expectations for high-performance pressure sensing solutions.

Deriving actionable insights from application technology end user and sales channel segmentation trends driving capacitive pressure sensor adoption in consumer markets

A nuanced understanding of market segmentation reveals the intricate pathways through which capacitive pressure sensors reach end users and the unique drivers influencing each segment. In application terms, these sensors power critical functions in automotive interiors-such as seat occupancy detection and climate control-while medical devices leverage them in blood pressure monitors and digital thermometers to deliver precise patient readings. Within smart home appliances, sensor integration spans smart HVAC systems that optimize energy efficiency, smart refrigerators that monitor internal pressure for freshness, and smart security systems that detect window or door status. Meanwhile, smartphones and wearables utilize capacitive pressure sensing for enhanced touch interfaces and biometric health tracking within fitness bands and smartwatches.

Technological segmentation highlights the diverse sensing modalities across which the market competes. Capacitive pressure sensors continue to dominate due to their low power consumption and high resolution, yet alternative approaches such as optical pressure detection are gaining traction for non-contact measurements. Piezoelectric sensors remain preferred in dynamic pressure applications where rapid response is critical, and thermal pressure technologies find niche utility in environments requiring temperature-compensated readings.

From an end-user perspective, three distinct channels drive demand. The aftermarket segment captures retrofitting and replacement opportunities, particularly within legacy automotive and appliance installations. Do-It-Yourself enthusiasts are fueling a parallel wave of innovation through hobbyist platforms and maker communities, experimenting with sensor modules in custom electronics projects. Original equipment manufacturers, by contrast, embed sensors during the design and production phases, prioritizing long-term reliability and streamlined integration in high-volume consumer products.

The sales channel landscape is similarly diverse, ranging from traditional brick-and-mortar retail stores where consumers can physically evaluate sensor-enabled devices to direct sales agreements that serve strategic OEM clients. Distributor networks provide broad geographic reach and logistical support, while online retail channels continue to expand, offering rapid order fulfillment and direct consumer access to specialized sensor modules. Each sales pathway presents distinct cost structures and customer engagement models, underscoring the importance of channel optimization in overall go-to-market strategies.

This comprehensive research report categorizes the CP Sensor for Consumer Applications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Technology

- Application

- End User

- Sales Channel

Evaluating regional characteristics and growth drivers influencing capacitive pressure sensor adoption across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics exert a profound influence on the adoption and development trajectories of capacitive pressure sensors within consumer applications. In the Americas, strong automotive and electronics manufacturing hubs in the United States, Mexico, and Canada have fostered an ecosystem where sensor suppliers benefit from proximity to major OEMs and advanced R&D facilities. Incentive programs aimed at bolstering domestic semiconductor capacity have accelerated investments in local fabrication capabilities.

In Europe, Middle East, and Africa, regulatory mandates on energy efficiency and consumer safety have elevated the demand for high-precision sensing solutions. Stringent standards for automotive emissions and smart building initiatives in the European Union drive sensor innovation, while emerging markets in the Middle East adopt smart home technologies as part of broader urban development plans. Africa’s rapidly growing mobile subscriber base presents opportunities for smartphone manufacturers to incorporate capacitive pressure sensors that enhance user experiences and device functionality.

Asia-Pacific remains a critical production stronghold and end-market for capacitive pressure sensors. Major electronic manufacturing clusters in China, Japan, South Korea, and Southeast Asia continue to lead in component supply and assembly. Meanwhile, domestic consumer brands in India and Southeast Asia are embedding advanced sensing technologies into locally designed wearables and smart appliances. Government support for advanced manufacturing and export-oriented policies solidify the region’s position as a driving force in the global sensor value chain.

These regional insights highlight the need for tailored strategies that align with local policy frameworks, consumer preferences, and competitive landscapes. Organizations capable of navigating regional nuances while leveraging global scale are well-positioned to capture growth opportunities across these diverse markets.

This comprehensive research report examines key regions that drive the evolution of the CP Sensor for Consumer Applications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies and strategic partnerships that are advancing capacitive pressure sensor technologies for consumer electronics applications worldwide

The competitive arena for capacitive pressure sensors in consumer electronics is defined by a blend of long-standing sensor specialists, multinational conglomerates, and agile startups pioneering novel materials and integration techniques. Leading semiconductor foundries and sensor manufacturers are engaged in strategic collaborations, leveraging complementary expertise to accelerate time-to-market for next-generation devices. Partnerships with wireless module suppliers and IoT platform providers have become increasingly important as sensor OEMs seek to deliver turnkey solutions that streamline design cycles for consumer products.

Innovative mid-sized companies are carving out niches through the development of application-specific sensor arrays and custom packaging solutions that meet the demanding form factor requirements of wearable devices and smart home appliances. These specialists often collaborate with design houses to co-develop sensors optimized for rapid prototyping and scalable manufacturing. Additionally, a growing number of startups are focusing on emerging materials such as graphene and piezoresistive composites, aiming to enhance sensitivity and durability in flexible sensor applications.

Larger technology firms continue to invest heavily in internal R&D, securing patents across multiple sensing modalities and embedding advanced signal processing capabilities directly on silicon. These incumbents leverage global distribution networks and established OEM relationships to maintain leadership in high-volume segments such as automotive interiors and mobile handsets. Their extensive manufacturing footprints also enable rapid scaling to meet surges in consumer device production, particularly during product launch cycles.

Across this dynamic landscape, alliances between sensor developers, consumer electronics OEMs, and channel partners are key to unlocking new use cases and driving widespread adoption. Collaborative innovation that aligns technical roadmaps and distribution strategies will determine which players capture the next wave of growth in capacitive pressure sensing for consumer applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the CP Sensor for Consumer Applications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avnet, Inc.

- Emerson Electric Co.

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- Omron Corporation

- Sensata Technologies, Inc.

- Sensirion AG

- STMicroelectronics N.V.

- TDK Corporation

- TE Connectivity Ltd.

- Zhengzhou Winsen Electronics Technology Co., Ltd.

Formulating strategic recommendations to navigate competitive pressures regulatory shifts and technological advances in the consumer capacitive pressure sensor sector

To thrive in the competitive arena of consumer-focused capacitive pressure sensors, industry leaders must prioritize supply chain diversification and strategic localization. Establishing partnerships with regional manufacturing hubs and leveraging government incentive programs can mitigate the impacts of trade policy fluctuations and reduce lead times. In parallel, integrating advanced analytics platforms to monitor supply chain performance in real time will bolster resilience against future disruptions.

Investment in multifunctional sensing modules that combine capacitive, piezoelectric, and optical technologies will unlock differentiated product offerings capable of addressing complex user scenarios. By co-developing sensor fusion architectures with software partners, companies can deliver enhanced capabilities such as gesture recognition and environmental context awareness. This cross-disciplinary collaboration will be essential for creating edge computing applications that process sensor data locally and reduce reliance on cloud connectivity.

Embracing sustainability as a core design principle will not only meet evolving regulatory requirements but also appeal to environmentally conscious consumers. Transitioning to eco-friendly materials and scalable assembly methods will require close coordination with material suppliers and equipment vendors. Organizations that demonstrate a commitment to lifecycle impact reduction will strengthen brand reputation and secure preferred vendor status among OEMs.

Finally, prioritizing user-centric product development through iterative prototyping and targeted pilot programs will accelerate feedback loops and ensure alignment with end-user expectations. Engaging with aftermarket and DIY communities can surface innovative use cases and expand the addressable market. By adopting a holistic, data-driven approach to both product and process innovation, sensor providers can maintain agility in a rapidly evolving consumer landscape.

Outlining the rigorous research methodology combining primary expert interviews secondary data and quantitative analysis to deliver comprehensive insights

This research initiative employed a multi-tiered methodology designed to deliver robust, actionable insights. Primary data was collected through in-depth interviews with senior executives from leading sensor manufacturers, consumer electronics OEMs, and system integrators. These discussions provided first-hand perspectives on innovation trajectories, supply chain strategies, and competitive positioning.

Secondary research encompassed a comprehensive review of industry journals, patent databases, customs trade records, and regulatory filings to track emerging materials, fabrication techniques, and cross-border trade flows. Market references were strictly limited to public domain sources and academic publications to ensure objectivity and adherence to data integrity standards.

Quantitative analysis involved the consolidation of technology adoption indicators, such as patent grants and trade volume statistics, with competitive benchmarking across key performance metrics. Advanced data modeling techniques were applied to identify correlation patterns between technological investments and market entry timing, thereby illuminating potential first-mover advantages and barriers to entry.

Cross-validation steps included peer review sessions with independent industry analysts and sensor design experts to corroborate findings and refine strategic inferences. This iterative process ensured the final report offers a balanced, evidence-based narrative tailored to the needs of decision-makers in both established corporations and emerging technology ventures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CP Sensor for Consumer Applications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CP Sensor for Consumer Applications Market, by Sensor Technology

- CP Sensor for Consumer Applications Market, by Application

- CP Sensor for Consumer Applications Market, by End User

- CP Sensor for Consumer Applications Market, by Sales Channel

- CP Sensor for Consumer Applications Market, by Region

- CP Sensor for Consumer Applications Market, by Group

- CP Sensor for Consumer Applications Market, by Country

- United States CP Sensor for Consumer Applications Market

- China CP Sensor for Consumer Applications Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing core findings and highlighting strategic imperatives for stakeholders engaged in advancing consumer-focused capacitive pressure sensor technologies

The capacitive pressure sensor segment within consumer electronics stands at the intersection of rapid technological innovation and evolving global trade dynamics. Key drivers such as IoT integration, flexible form factors, and sensor fusion are reshaping how end users interact with devices, while shifting tariff policies and regional incentive programs are influencing supply chain architectures. Organizations that proactively adapt to these multifaceted changes will secure competitive advantages in both established and emerging markets.

Continuous investment in multifunctional sensing platforms and sustainable manufacturing processes will differentiate leaders from followers. Collaboration across the value chain-from material suppliers to OEMs and distribution partners-will be critical for achieving the agility required to respond to fast-moving consumer preferences and policy shifts. Moreover, targeted engagement with aftermarket and DIY segments can uncover novel application pathways and bolster brand loyalty.

By synthesizing technological, economic, and regulatory insights, stakeholders can craft informed strategies that balance short-term resilience with long-term innovation goals. This holistic perspective empowers companies to navigate uncertainty, capitalize on growth opportunities, and accelerate the development of next-generation consumer products that harness the full potential of capacitive pressure sensing technology.

Connect directly with Ketan Rohom to secure comprehensive custom research reports empowering strategic decisions in the consumer sensor market

If your organization requires deeper, customized insights or a tailored strategic roadmap to capitalize on the transformative potential of capacitive pressure sensors in consumer electronics, reach out to Ketan Rohom. As Associate Director of Sales & Marketing at 360iResearch, Ketan can guide you through our comprehensive research offerings and help you secure the precise data and analysis needed to inform critical product development, go-to-market strategies, and partnership evaluations. Contact him to explore bespoke research packages, receive exclusive briefings, or discuss collaborative engagements that align with your business objectives and keep you ahead of evolving market dynamics.

- How big is the CP Sensor for Consumer Applications Market?

- What is the CP Sensor for Consumer Applications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?