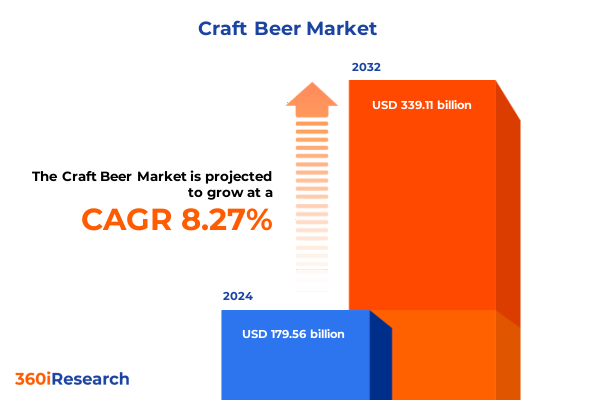

The Craft Beer Market size was estimated at USD 192.01 billion in 2025 and expected to reach USD 205.32 billion in 2026, at a CAGR of 8.46% to reach USD 339.11 billion by 2032.

Setting the Stage for a Transformative Exploration of the 2025 United States Craft Beer Landscape Driven by Innovation Sustainability and Consumer Trends

The United States craft beer sector has entered a pivotal chapter, characterized by mature consumer bases, intensified competition, and an unwavering drive toward innovation. Over the past decade, microbreweries and regional craft producers have elevated production standards, fostered brand authenticity, and cultivated deep connections with local communities. As market dynamics shift, new players continue to challenge established brewers, while forward-thinking operators embrace advanced brewing techniques, experiment with novel ingredients, and leverage digital platforms to engage consumers more meaningfully.

This landscape is now defined not only by the diversity of beer styles but also by the intersection of premiumization and sustainability imperatives. Consumers increasingly seek brands that align with their values, favoring environmentally responsible brewing processes, transparent sourcing, and packaging choices that reduce ecological footprints. Simultaneously, craft enthusiasts are eager for innovative flavor profiles that blend traditional brewing craftsmanship with unconventional ingredients, driving a continuous cycle of experimentation and discovery.

Within this context, our executive summary outlines the transformative shifts shaping today’s craft beer universe, assesses the impact of newly implemented U.S. tariffs on production and pricing, delves into key segmentation and regional insights, highlights leading companies and collaborative ventures, and delivers actionable recommendations. A clear understanding of these factors will empower industry leaders to navigate complexity, harness emerging opportunities, and strategically position their brands for sustained growth amidst evolving consumer expectations.

Uncovering the Pivotal Transformations Redefining the Craft Beer Industry Including Sustainability Innovations Digital Engagement and Authentic Experiences

The craft beer industry’s evolution is underpinned by transformative shifts that extend far beyond new recipes. At the heart of these changes lies an accelerating commitment to environmental stewardship. Breweries are investing in water-reduction technologies, adopting renewable energy sources, and piloting closed-loop systems that repurpose spent grain. Packaging innovations-such as lightweight cans and recyclable glass alternatives-are gaining traction as producers respond to consumer demand for lower carbon footprints, while tapping initiatives encourage on-site consumption to minimize transport emissions.

Digital engagement has similarly emerged as a cornerstone for differentiation. From hyper-targeted social media campaigns to interactive taproom experiences powered by augmented reality, craft brewers are leveraging technology to deepen brand loyalty. Direct-to-consumer e-commerce channels and subscription models have proliferated, allowing small batches to reach national audiences and creating more predictable revenue streams. Real-time data analytics from point-of-sale systems enable brewers to fine-tune production schedules and tailor limited-edition releases to fast-evolving consumer tastes.

Flavor innovation and experiential marketing continue to redefine expectations. Experimental series blending exotic hops, barrel-aging with locally sourced spirits, and cross-collaborations with artisanal food and beverage artisans have become staples of the modern craft portfolio. These immersive experiences, often hosted in destination brewpubs or at curated festivals, have elevated consumer loyalty, creating communities of brand ambassadors who share their discoveries through user-generated content and peer networks. In this era of heightened competition, authenticity and creativity remain the most potent catalysts for brand differentiation.

Analyzing the Comprehensive Effects of Newly Imposed United States Tariffs on Craft Beer Supply Chains Production Costs and Consumer Pricing in 2025

In 2025, a new wave of U.S. tariffs targeted key imported items for the brewing sector, notably aluminum for cans, specialized glass for bottles, and certain hop varietals favored by experimental brewers. These levies, enacted in response to broader trade negotiations, have led many craft operators to reevaluate sourcing strategies. Domestic suppliers of aluminum and glass have responded with capacity investments, but the lag time for scaling manufacturing and retrofitting facilities has introduced persistent supply-chain bottlenecks.

The immediate consequence has been an uptick in production costs, which has rippled through packaging and logistics segments. Some brewers have shifted to a greater reliance on kegs for on-premise distribution to mitigate the impact of higher can and bottle prices. Others have experimented with alternative materials and smaller packaging formats, including crowler offerings and refillable vessels. These adaptations underscore the industry’s agility but also highlight the tension between cost containment and the premium positioning that craft brands strive to maintain.

As brewers pass a portion of these added expenses onto consumers, price sensitivity has emerged as a salient factor. While core enthusiasts remain willing to absorb modest increases in exchange for novelty and quality, casual drinkers have begun to seek value propositions in standard-priced products or turn to alternative beverages. This dynamic has prompted brands to refine communication strategies, emphasizing provenance, brewing artistry, and sustainable credentials as justifications for premium pricing tiers.

Exploring the Nuanced Segmentation Dimensions That Shape Consumer Preferences and Distribution Strategies in the Craft Beer Marketplace

Understanding the craft beer market demands a clear view of how diverse segmentation dimensions converge to shape consumer preferences and channel strategies. Product type segmentation reveals that ales-ranging from the rich malt character of amber and brown ales to the vibrant hop profiles of pale ales-continue to anchor core portfolios. IPAs, subdivided into robust double IPAs, haze-forward New England IPAs, and sessionable variants, represent the high-growth frontier, captivating both seasoned hop enthusiasts and newcomers through far-reaching flavor innovations. Traditional lagers such as Märzen and pilsner have experienced a renaissance among purists seeking crisp, balanced profiles, while darker styles like porters and stouts, especially imperial and oatmeal variations, have retained their status as craft staples during cooler seasons.

Packaging preferences further define market contours, with bottles still commanding a sense of authenticity and craft heritage, while aluminum cans have surged in popularity due to portability and environmental appeal. Kegs maintain prominence within bars and restaurants, offering cost-effective volume pricing and fostering on-tap brand visibility. Distribution channels mirror this packaging dichotomy: off-trade venues-convenience stores, liquor shops, and supermarkets-favor shelf-stable formats that cater to quick-purchase occasions, whereas on-trade settings like bars and restaurants leverage draft presentations to create immersive brand experiences.

Demographically, the 21–30 age cohort is drawn to adventurous, limited-edition releases and digital engagement touchpoints; the 31–40 segment values premium, flavor-forward varieties such as New England IPAs and barrel-aged stouts; consumers aged 41–50 exhibit loyalty to well-established brands offering balanced ales and lagers; and those 51 and older often seek classic, approachable styles with a focus on quality craftsmanship. Price-range distinctions-spanning standard, premium, and super-premium brackets-enable brewers to segment offerings, with super-premium lines leveraging small-batch prestige and artisanal narratives to justify higher price points. Together, these multi-layered segmentation insights illuminate nuanced consumer journeys and guide strategic portfolio and channel decisions.

This comprehensive research report categorizes the Craft Beer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging

- Consumer Age Group

- Distribution Channel

Highlighting Regional Nuances in Craft Beer Consumption Distribution and Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a powerful influence on craft beer consumption patterns, distribution models, and growth trajectories. In the Americas, the United States remains the epicenter, with hyper-local breweries thriving in metropolitan hubs and secondary markets alike; Canada’s burgeoning craft community mirrors its southern neighbor’s emphasis on sustainable practices and experimental brews, while Latin American craft scenes gain momentum by integrating indigenous ingredients and cultural heritage into beer styles.

Within Europe, Middle East & Africa, the diversity of regulatory environments and consumer tastes gives rise to varied approaches. Western Europe’s mature markets continue to value traditional styles and seasonal festivals, with sustainability certifications becoming a key differentiator. The Middle East’s craft beer segment, though nascent, leverages tourism-driven demand and relaxed licensing in select nations to introduce global‐style beers adapted to local palates. In Africa, urban centers host emerging microbreweries that blend craft sensibilities with regional grains and spices.

Asia-Pacific presents one of the most dynamic growth frontiers, as nascent craft sectors in Australia, Japan, and South Korea blend Western brewing techniques with local ingredients-yuzu hops, rice, and indigenous botanicals-to create unique flavor profiles. Southeast Asia’s liberalizing alcohol regulations facilitate taproom openings and microbrewery partnerships, while rapid urbanization drives on-trade expansion in major cities. These regional insights underscore the importance of tailoring product development, branding narratives, and channel strategies to local preferences and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Craft Beer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing the Competitive Landscape Spotlighting Leading Craft Beer Producers Innovators and Strategic Collaborations Fueling Industry Growth

The competitive fabric of the craft beer industry is woven by both established pioneers and disruptive newcomers. Boston Beer Company continues to leverage scale and brand diversity across its Samuel Adams portfolio, while Sierra Nevada maintains a leadership position through its commitment to sustainable brewing and year-round staples. Stone Brewing’s emphasis on bold flavor intensity and decentralized taproom network has set a benchmark for experiential brand engagement, and smaller regional players, such as Tröegs Independent Brewing and Founders Brewing Co., have carved out loyal followings by innovating within specialized style segments.

International craft brewers like BrewDog and Mikkeller have also made significant inroads into the U.S. market, introducing avant-garde styles and collaborating with domestic breweries to fuse global brewing philosophies. Strategic collaborations among large brewers and craft brands-such as Anheuser-Busch’s investments in Goose Island and 10 Barrel Brewing, and Heineken’s partnership with Lagunitas-have expanded distribution reach while preserving craft authenticity through autonomous operations and localized innovation labs.

In parallel, a wave of consolidations and minority-equity investments by industry heavyweights underscores the sector’s maturation. While some craft brewers resist acquisition to maintain independence, others view strategic partnerships as pathways to capital infusion, operational expertise, and global distribution networks. This dynamic equilibrium between autonomy and alliance shapes the ongoing narrative of competition, collaboration, and capacity expansion within the craft beer ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Craft Beer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abita Brewing Company

- Alaskan Brewing Company

- Anheuser-Busch InBev

- Athletic Brewing Company

- Bell’s Brewery, Inc.

- Boston Beer Company

- Brooklyn Brewery, Inc.

- Constellation Brands, Inc.

- D. G. Yuengling & Son, Inc.

- Deschutes Brewery, Inc.

- Dogfish Head Brewery, Inc.

- Duvel Moortgat USA, Inc.

- Gambrinus Company

- Grupo Modelo, S.A. de C.V.

- Kirin Holdings Company, Limited

- Molson Coors Beverage Company

- New Belgium Brewing Co.

- New Glarus Brewing Company

- Oskar Blues Brewery, LLC

- Sierra Nevada Brewing Co.

- Stone Brewing Co.

- The Boston Beer Company, Inc.

- Tröegs Independent Brewing, LLC

- Tsingtao Brewery Group

Delivering Strategic Actionable Recommendations for Industry Stakeholders to Navigate Consumer Trends Supply Chain Complexities and Sustainability Imperatives

To thrive amid escalating competition and shifting regulatory landscapes, industry leaders should prioritize an integrated approach that aligns innovation, sustainability, and consumer engagement. First, invest in agile research and development pipelines that harness consumer analytics to inform limited-release programs and keep pace with evolving taste preferences. Emphasizing rapid prototyping of small-batch offerings can fuel excitement, generate social media buzz, and uncover new revenue streams without significant capital outlays.

Second, strengthen supply chain resilience by diversifying sourcing of critical inputs-from exploring alternative hop suppliers to partnering with domestic packaging producers-and by implementing predictive demand planning systems. Negotiating flexible contracts with bottling and canning partners will mitigate the impact of tariff-driven cost fluctuations and ensure seamless production continuity. Concurrently, pursue greener operational methodologies, such as waste-to-energy initiatives and water recycling, to fortify sustainability credentials and appeal to eco-conscious consumers.

Finally, adopt omnichannel marketing strategies that blend traditional on-premise activations with robust digital experiences. Curate personalized loyalty programs, leverage data-driven email campaigns, and integrate augmented reality labels to deepen consumer connections. Forge strategic alliances with complementary beverage and culinary brands to co-create cross-industry events and pairings that amplify reach. By executing this multifaceted roadmap, industry leaders will position their organizations to capture value, differentiate their portfolios, and secure enduring consumer loyalty.

Outlining the Research Methodology Including Data Collection Analytical Framework and Validation Techniques Employed in Craft Beer Industry Analysis

This analysis draws upon a rigorous, mixed-method research framework designed to capture both quantitative trends and qualitative insights. Primary research involved in-depth interviews with brewery executives, procurement managers, and distribution partners across key U.S. regions, supplemented by consumer focus groups segmented by age cohort and price sensitivity. These engagements provided firsthand perspectives on strategic priorities, operational challenges, and emerging taste drivers.

Secondary research sources included industry journals, sustainability reports, and regulatory filings, ensuring a well-rounded view of tariff policies, packaging innovations, and digital marketing evolutions. Data triangulation techniques were applied to reconcile discrepancies and validate findings, while cross-referencing trade association statistics and public company disclosures enhanced accuracy. An iterative review process, involving peer audits and expert consultations, further strengthened the robustness of thematic conclusions.

Analytical frameworks such as SWOT and Porter’s Five Forces structured the competitive and market-structure evaluations, while a segmentation-based lens guided the deep-dive into product, packaging, channel, demographic, and pricing dimensions. By integrating multiple methodologies and ensuring methodological transparency, this report provides stakeholders with credible, actionable insights rooted in both empirical evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Craft Beer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Craft Beer Market, by Product Type

- Craft Beer Market, by Packaging

- Craft Beer Market, by Consumer Age Group

- Craft Beer Market, by Distribution Channel

- Craft Beer Market, by Region

- Craft Beer Market, by Group

- Craft Beer Market, by Country

- United States Craft Beer Market

- China Craft Beer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusive Insights on Emerging Opportunities and Challenges Shaping the Future Trajectory of the Craft Beer Sector Amid Evolving Market Dynamics

The craft beer sector stands at a crossroads where innovation, sustainability, and strategic agility converge to shape its forward trajectory. Emerging opportunities-from the expansion of direct-to-consumer channels to the proliferation of eco-centric brewing practices-offer pathways to deepen consumer engagement and unlock new revenue models. At the same time, challenges such as tariff-induced cost pressures, intensifying competition, and shifting demographic preferences necessitate proactive adaptation and continuous refinement of core strategies.

Key insights underscore the importance of nuanced segmentation and regional customization. Brands that tailor offerings by style, packaging, and price point while embedding authentic narratives into local markets will resonate most deeply with discerning drinkers. Similarly, companies that balance the preservation of artisanal credibility with strategic partnerships and capacity investments can achieve scale without diluting brand identity.

Looking ahead, the most successful craft brewers will be those that integrate sustainability as a business imperative rather than a marketing add-on, leverage digital ecosystems to forge meaningful relationships, and remain fearless in their pursuit of flavor innovation. By synthesizing these drivers into a coherent strategic vision, industry players will be well-positioned to capitalize on the evolving craft beer renaissance and chart a path to long-term growth.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Craft Beer Market Research Report and Propel Informed Decision Making

To secure a comprehensive market research report tailored to your strategic objectives and gain unparalleled clarity on emerging craft beer trends, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He stands ready to guide you through our insights, discuss how the findings align with your growth imperatives, and customize deliverables to fit your decision-making timelines. Engaging directly will ensure you receive the most relevant data, actionable frameworks, and expert support necessary to outpace competitors in today’s dynamic craft beer marketplace

- How big is the Craft Beer Market?

- What is the Craft Beer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?