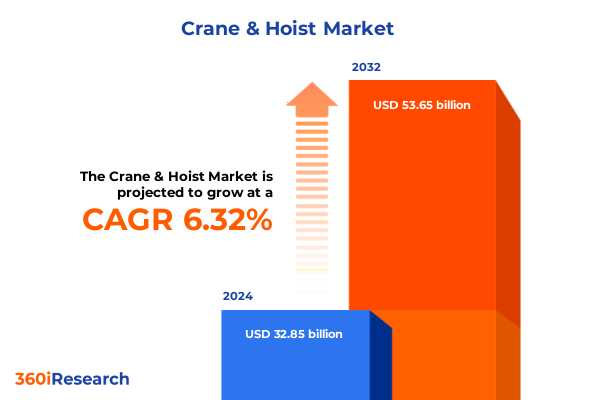

The Crane & Hoist Market size was estimated at USD 34.65 billion in 2025 and expected to reach USD 36.54 billion in 2026, at a CAGR of 6.44% to reach USD 53.65 billion by 2032.

Discovering the Pivotal Role of Crane and Hoist Systems in Accelerating Industrial Growth While Overcoming Evolving Infrastructure and Safety Demands

In today’s rapidly evolving industrial environment, crane and hoist systems underpin the backbone of production, construction, and logistics operations worldwide. Organizations rely on these critical lifting solutions to streamline workflows, enhance safety performance, and support the ever-expanding scale of infrastructure projects. Through decades of innovation, the crane and hoist sector has continually responded to the dual pressures of efficiency imperatives and stringent regulatory frameworks, positioning itself at the vanguard of heavy-duty material handling progress.

As global supply chains grow more intricate and the demand for accelerated project timelines intensifies, industry stakeholders must align on a unified understanding of the core challenges and opportunities shaping the market. By examining foundational drivers such as technological advancement, shifting regional investments, and evolving labor considerations, leaders can identify the strategic levers required to maintain competitive advantage. This executive summary lays the groundwork for those critical discussions by contextualizing current market conditions and mapping the primary considerations for informed decision-making.

Unveiling the Revolution of Digital Integration Sustainability Focus and Automation in Modern Crane and Hoist Applications

The crane and hoist market is witnessing transformative shifts driven by digitalization, sustainability mandates, and the relentless pursuit of operational agility. Industry 4.0 principles have permeated traditional lifting solutions, prompting the integration of smart sensors, predictive analytics, and real-time performance monitoring. As a result, downtime reduction and condition-based maintenance have become key differentiators for equipment manufacturers and end users alike.

Concurrently, environmental regulations and corporate net-zero commitments are influencing material selection and powertrain design, steering the market toward electric and hybrid configurations. These advancements not only reduce carbon footprints but also enhance workplace ergonomics through lower noise levels and smoother operational profiles. Furthermore, the rise of modular and mobile lifting architectures has enabled rapid deployment across remote project sites, fostering unprecedented project scalability.

Together with ongoing labor skill shortages, these dynamics underscore the need for workforce reskilling and the strategic adoption of automated operation modes. By embracing semi-automated and fully automated solutions, businesses are unlocking significant productivity gains, while also mitigating safety risks. Ultimately, these cumulative technological and regulatory forces are reshaping competitive boundaries, elevating players who can deliver integrated, intelligent lifting ecosystems.

Analyzing the Layered Effects of 2025 United States Tariff Policies on Supply Chains Material Costs and Procurement Strategies in Crane and Hoist Operations

Throughout 2025, the intricate web of United States tariffs has exerted a profound cumulative impact on the global crane and hoist industry. Broadly applied levies on key steel and aluminum inputs, in conjunction with Section 301 duties on certain imported machinery components, have augmented costs for both original equipment manufacturers and distributors. This policy landscape has compelled many stakeholders to reevaluate supply chain architectures, balancing nearshoring initiatives against inventory buffer strategies to hedge against escalating duty burdens.

As raw material expenses climb, equipment designers have pursued alternative alloys and composite materials, seeking to preserve structural performance while mitigating price volatility. In parallel, strategic sourcing from tariff-exempt jurisdictions has emerged as a viable offset, though extended lead times and logistical complexities persist. Consequently, procurement teams are adopting more dynamic sourcing frameworks, including multi-tier supplier ecosystems that enhance flexibility across fluctuating trade conditions.

Moreover, end users have encountered pass-through price adjustments, with project contractors and facility operators absorbing or reallocating the increased capital expenditures. To manage budgetary pressures, many have extended equipment lifecycles through enhanced maintenance programs, leveraging advanced diagnostics to extract maximal value from existing fleets. Collectively, these adaptive measures highlight the market’s resilience in navigating a taxing trade environment that continues to evolve with shifting geopolitical priorities.

Deconstructing Diverse Equipment Architectures Across Installation Types Hoist Technologies Operation Modes and End-User Verticals

The market’s multifaceted segmentation offers critical insight into how lifting solutions are tailored to diverse operational requirements and end-user demands. Based on installation type, demand diverges between fixed platforms installed in permanent facilities and mobile configurations that facilitate rapid redeployment across construction sites or logistics yards. This distinction underscores the strategic balance between robust capacity needs and the agility required for dynamic project landscapes.

Hoist type segmentation further refines equipment selection, encompassing electric, hydraulic, manual, and pneumatic variants. Electric hoists continue to gain traction in environments prioritizing energy efficiency and precision control, while hydraulic systems maintain their niche in high-tonnage applications. Manual hoists remain relevant for lightweight, budget-conscious deployments, and pneumatic options deliver reliable performance in hazardous or explosion-proof settings.

Operation mode classifications delineate fully automatic, manual, and semi-automatic control schemes. Fully automatic systems represent the cutting edge of risk mitigation, integrating advanced safety interlocks and programmable control logic. Manual operation endures in scenarios where human judgment and tactile feedback are paramount, whereas semi-automatic solutions blend operator oversight with mechanized assistance to optimize throughput.

Crane type provides a granular lens into structural design choices. Gantry cranes, articulated as full gantry, portable, or semi gantry, address varying footprint and mobility demands. Jib cranes, whether articulating, free standing, or wall mounted, serve localized material handling with precision reach. Mobile cranes offer all terrain, rough terrain, and truck mounted platforms to tackle diverse site conditions. Overhead cranes, in double girder and single girder formats, excel in high-density facility operations, and tower cranes, through hammerhead, luffing jib, and self-erecting variants, elevate towering construction projects.

Capacity range segmentation further informs project alignment, spanning up to 5 ton applications for light assembly through 5-20 ton midrange requirements and above 20 ton heavy-duty installations. End-user categories illuminate market focus areas, with construction applications-commercial, industrial, and residential-driving significant uptake, while logistics and warehousing sites harness automated material flows. Manufacturing verticals, including automotive, electronics, food and beverage, and pharmaceuticals, demand specialized lifting configurations, and the mining, metals, and oil and gas sectors require robust resilience against harsh operating environments.

This comprehensive research report categorizes the Crane & Hoist market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation Type

- Hoist Type

- Operation Mode

- Crane Type

- Capacity Range

- End User

Mapping Distinct Growth Drivers Regulatory Landscapes and Investment Priorities Across Key Global Regions

Regional dynamics play a pivotal role in shaping global growth trajectories for crane and hoist solutions. In the Americas, robust infrastructure spending and the resurgence of domestic manufacturing have fueled demand for both fixed and mobile systems. Government-backed investment initiatives aimed at modernizing transportation networks and industrial facilities have also propelled procurement of advanced lifting equipment, particularly in electric and hybrid configurations.

Europe, the Middle East, and Africa present a complex tapestry of market drivers, ranging from stringent carbon reduction targets in Western Europe to rapid urbanization in the Gulf Cooperation Council nations and infrastructure recovery in select African economies. Regulatory emphasis on workplace safety and energy efficiency has accelerated the adoption of automated control modes and condition monitoring technologies. Additionally, geopolitical sensitivities around trade and tariffs have led regional distributors to bolster local aftermarket services, ensuring continuity of operations amid cross-border constraints.

The Asia-Pacific region continues to command a significant share of global deployment, powered by expanding industrial hubs in China, Southeast Asia, and India. Mega construction projects, encompassing smart city initiatives and port expansions, have spurred demand for tower cranes and heavy-capacity mobile cranes. At the same time, rising labor costs in key Asian economies are catalyzing investments in semi-automatic and fully automatic hoist solutions, enabling manufacturers to maintain productivity while addressing workforce availability challenges.

This comprehensive research report examines key regions that drive the evolution of the Crane & Hoist market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Differentiators and Innovation Pathways Among Top Crane and Hoist Market Participants

Leading industry participants have each charted distinct strategic pathways to capture emerging opportunities and bolster competitive resilience. One global OEM has prioritized digital platform development, offering cloud-based asset management systems that integrate seamlessly with plantwide IoT architectures. This approach has facilitated proactive maintenance offerings and subscription-based service models that align with operator budgets and uptime objectives.

Another major manufacturer has doubled down on product modularity, launching configurable lifting modules that reduce lead times and simplify installation across diverse site conditions. Their strategy hinges on extensive aftermarket support networks, ensuring rapid spare parts delivery and field service capabilities. A different regional specialist has leveraged joint ventures with steel producers to secure preferential raw material access, mitigating the impact of tariff escalations while fostering localized manufacturing footprints.

Several tier-two suppliers have distinguished themselves through niche expertise in explosion-proof pneumatic hoists and ultra-lightweight aluminum jib cranes, serving specialized end users in petrochemical and cleanroom environments. By focusing on differentiated product innovation and targeted end-user training programs, these companies have carved defensible market positions. Meanwhile, select distributors have expanded beyond purely transactional relationships, providing integrated project management services that encompass site assessments, equipment commissioning, and operator certification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crane & Hoist market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABUS Kransysteme GmbH

- Cargotec Corporation

- Columbus McKinnon Corporation

- Demag Cranes & Components GmbH

- GH Cranes & Components, S.L.

- Kito Corporation

- Konecranes Oyj

- Liebherr-International Deutschland GmbH

- Morris Material Handling, Inc.

- SANY Heavy Industry Co., Ltd.

- SWF Krantechnik GmbH

- Terex Corporation

- The Manitowoc Company, Inc.

- Yale Materials Handling Corporation

Implementing Digital Ecosystems Supply Chain Diversification Workforce Development and Sustainability Metrics for Competitive Advantage

Industry leaders can harness several actionable insights to navigate current and forthcoming challenges. Prioritizing investment in digital ecosystems not only elevates equipment reliability but also generates recurring revenue through value-added service contracts. Organizations should assess the scalability of cloud-native platforms and prioritize open architecture solutions that simplify third-party integrations.

Moreover, diversifying supply chains by engaging multiple tier-one and regional suppliers can mitigate trade-related disruptions, especially in light of fluctuating tariffs. By cultivating supplier partnerships that emphasize transparency and flexibility, procurement leaders can secure preferential terms while sustaining agility in response to geopolitical shifts. Embracing alternative materials and modular product designs will further enable rapid adaptation to raw material cost fluctuations.

Workforce development remains critical; leaders must deploy robust training curricula that encompass digital tool proficiency, safety protocols, and advanced maintenance techniques. Collaborative partnerships with technical institutions and industry associations can accelerate skill upskilling, ensuring operational excellence. Finally, embedding sustainability metrics into product roadmaps and operational benchmarks will resonate with evolving stakeholder expectations and regulatory requirements, driving long-term competitive differentiation.

Detailing a Rigorous Triangulation Approach Combining Primary Interviews Facility Observations and Secondary Document Analysis

This research synthesis integrates both primary and secondary methodologies to ensure comprehensive market coverage and analytical rigor. Primary insights derive from structured interviews with industry executives, supply chain managers, and site operation leads, providing frontline perspectives on emerging challenges and solution effectiveness. These qualitative inputs were complemented by on-site facility observations, which validated reported equipment utilization patterns and maintenance practices.

Secondary data sources included publicly available regulatory documents, industry white papers, and open-access engineering journals. Cross-validation techniques were applied to reconcile discrepancies between company disclosures and third-party analyses, reinforcing the robustness of our findings. Furthermore, proprietary databases on trade flows and tariff schedules were leveraged to quantify the evolving impact of policy changes on procurement behaviors.

Data synthesis employed triangulation frameworks, mapping thematic convergences across diverse inputs to identify high-confidence trends. Statistical analysis of operational metrics informed segment-level insights, while scenario-planning exercises explored potential inflection points tied to regulatory and technological shifts. The combined methodological approach ensures that strategic recommendations are grounded in empirical evidence and reflect the nuanced realities of the global crane and hoist landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crane & Hoist market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crane & Hoist Market, by Installation Type

- Crane & Hoist Market, by Hoist Type

- Crane & Hoist Market, by Operation Mode

- Crane & Hoist Market, by Crane Type

- Crane & Hoist Market, by Capacity Range

- Crane & Hoist Market, by End User

- Crane & Hoist Market, by Region

- Crane & Hoist Market, by Group

- Crane & Hoist Market, by Country

- United States Crane & Hoist Market

- China Crane & Hoist Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Technological Evolution Trade Dynamics and Regional Demand Variations to Chart the Future of Lifting Solutions

The crane and hoist industry stands at the nexus of technological innovation, regulatory evolution, and shifting trade dynamics. As organizations strive for greater efficiency and resilience, the integration of digital monitoring systems, sustainable powertrains, and modular designs is accelerating. Tariff-induced cost pressures have prompted agile sourcing strategies and material innovation, underscoring the market’s capacity to adapt under duress.

Segmentation insights reveal that customization by installation type, hoist technology, operation mode, crane architecture, capacity range, and end-user vertical will remain foundational to competitive positioning. Regionally, the Americas, EMEA, and Asia-Pacific markets each exhibit distinct investment drivers, regulatory constraints, and demand profiles, emphasizing the need for geographically nuanced go-to-market plans.

Ultimately, industry leaders who embrace digital transformation, supply chain resilience, workforce upskilling, and sustainability integration will be best positioned to capitalize on emerging opportunities. The insights presented herein form a strategic compass for navigating the complexities of today’s crane and hoist market and securing long-term operational excellence.

Seize Comprehensive Intelligence and Expert Guidance from Ketan Rohom to Propel Your Crane and Hoist Strategy

Elevate your strategic decision-making by securing a comprehensive market research report from Associate Director, Sales & Marketing Ketan Rohom today. Harness in-depth analyses, expert commentary, and actionable insights tailored to the dynamic crane and hoist industry. Empower your organization with the knowledge needed to navigate evolving regulatory environments, supply chain complexities, and technological disruptions. Connect with Ketan Rohom to unlock customized advisory support and obtain the intelligence that will drive your competitive advantage in an increasingly complex marketplace. Transform data into strategic growth by reaching out now to acquire your definitive guide to the crane and hoist market landscape.

- How big is the Crane & Hoist Market?

- What is the Crane & Hoist Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?