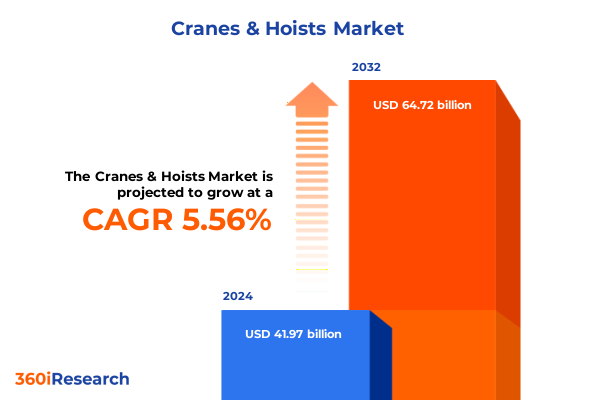

The Cranes & Hoists Market size was estimated at USD 44.18 billion in 2025 and expected to reach USD 46.54 billion in 2026, at a CAGR of 5.60% to reach USD 64.72 billion by 2032.

Unveiling the Evolution and Strategic Significance of Cranes and Hoists in Today’s Industrial, Construction, and Infrastructure Development Environments

The cranes and hoists industry stands as a pillar of modern infrastructure and industrial capability, underpinning projects that range from towering urban construction to complex manufacturing operations. As global economies continue to prioritize efficiency and safety in lifting and handling heavy loads, the market’s evolving technologies, stringent regulatory requirements, and shifting customer demands are converging to redefine competitive advantage. Stakeholders must now navigate an environment characterized by rapid digital integration, heightened sustainability expectations, and a multifaceted regulatory landscape.

Against this backdrop, an executive summary offers a concise yet comprehensive lens through which to view the most significant forces shaping the sector. It distills critical intelligence on market transformations, assesses the impact of recent policy measures, and unpacks the nuanced segmentation driving demand. By grounding the analysis in both qualitative insights and observable industry trends, this introduction establishes the foundation for a deeper exploration of the opportunities and challenges that will guide strategic decision-making.

As you progress through this summary, you’ll gain clarity on transformative market shifts, the ramifications of emerging trade policy, and the segmentation and regional dynamics essential for capitalizing on growth prospects. With these insights, industry leaders can formulate robust strategies to navigate complexity and secure enduring competitive strength.

Exploring the Transformative Technological, Regulatory, and Market Disruptions Reshaping the Cranes and Hoists Sector Globally

Over the past decade, transformative shifts have redefined the cranes and hoists landscape, fueled by breakthroughs in automation, the proliferation of digital platforms, and an intensified focus on sustainability. Artificial intelligence–enabled predictive maintenance solutions now minimize unplanned downtime while maximizing asset utilization, driving a paradigm shift from reactive to proactive service models. Concurrently, the integration of Internet of Things sensors and telematics has created an unprecedented level of transparency across the equipment lifecycle, empowering operators and fleet managers with real-time performance data.

Regulatory frameworks have also undergone a metamorphosis, with tightened safety standards and emissions regulations compelling manufacturers to innovate in materials, powertrains, and control systems. This push for lower environmental impact is accelerating the adoption of electric-powered and hybrid systems, compelling incumbents and new entrants alike to invest heavily in research and development.

Meanwhile, global supply chains are experiencing profound realignments as companies seek resilience in the face of geopolitical tensions and logistical disruptions. Nearshoring and strategic sourcing initiatives are gaining momentum, reshaping procurement strategies and partnerships. Taken together, these converging forces are catalyzing a new era of efficiency, reliability, and environmental stewardship in the cranes and hoists market, setting the stage for competitive differentiation through technological leadership and operational excellence.

Dissecting the Extensive Ramifications of 2025 United States Tariff Measures on Cranes and Hoists Procurement and Supply Chains

In 2025, the United States implemented a series of tariff measures targeting key imported components used in cranes and hoists, including certain grades of steel and proprietary electronic modules. These tariffs, averaging 15 to 25 percent on specified headings, have exerted upward pressure on raw material and component costs. As a result, domestic manufacturers and international suppliers face a recalibration of price structures and supply routes to mitigate margin erosion and preserve competitive pricing.

Beyond immediate cost inflation, the tariffs have catalyzed strategic sourcing shifts, prompting many OEMs to reassess supplier relationships and diversify procurement geographies. Some organizations are responding by establishing regional fabrication facilities to leverage lower tariff exposure, while others are exploring alternative materials or component designs to reduce dependence on tariffed imports. At the same time, end users are increasingly receptive to refurbished and remanufactured equipment, attracted by more favorable total cost of ownership calculations in the wake of elevated new-equipment prices.

These dynamics also carry implications for aftermarket services, as higher equipment acquisition costs drive greater demand for extended maintenance contracts and modernization programs. Service providers that can offer transparent cost-saving analyses and flexible financing solutions are positioned to capture incremental value. Ultimately, the 2025 tariff environment underscores the importance of adaptive supply chain strategies, innovative sourcing, and value-added service models in maintaining market competitiveness.

Deriving Actionable Insights from Equipment Type, Load Capacity, Power Source, Control Method, and End-Use Industry Dimensions

A granular examination of segmentation dimensions reveals critical demand drivers as well as pockets of growth potential across equipment types, load capacities, power sources, control methodologies, and end-use industries. Within equipment type, fixed cranes-including bulk-handling, hammerhead, overhead, stacker, telescopic, and tower cranes-remain integral to heavy industrial and port operations, whereas mobile cranes such as carry deck, crawler, floating, rough terrain, and truck-mounted units address the need for flexibility across construction, energy, and mining sites. Hoists, encompassing electric chain, hand chain manual, lever chain, and pneumatic powered variants, continue to support precision lifting within manufacturing and warehousing contexts.

Load capacity is another pivotal consideration. Units under 100 tons dominate applications involving light to medium duty tasks, while segments ranging from 100 to 500 tons sustain a broad spectrum of heavy construction and industrial lifting needs. High-capacity assets between 500 and 1,000 tons, as well as those exceeding 1,000 tons, are essential for specialized infrastructure projects and energy sector installations, where reliability and safety are non-negotiable.

Power source preferences are evolving in tandem with sustainability imperatives. Battery-operated systems are gaining traction in indoor and emission-sensitive environments, while electric-powered solutions are valued for lower lifetime operational costs. Hydraulic systems maintain relevance in situations demanding high precision and force. Meanwhile, control method-spanning fully automatic, semi-automatic, and manual operations-aligns closely with workforce skill levels, safety requirements, and the degree of process complexity. Collectively, these segmentation insights equip decision-makers with a nuanced understanding of where to prioritize investment and tailor offerings to meet the diverse needs of end-use industries, from automotive and construction to energy and utilities, logistics and warehousing, manufacturing, mining, oil and gas, and shipping and ports, including specialized subsegments within power generation and distribution, renewables, and utilities.

This comprehensive research report categorizes the Cranes & Hoists market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Crane Load Capacity

- Power Source

- Control Method

- End Use Industry

Unearthing Differential Growth Patterns and Evolving Market Dynamics across the Americas, Europe, Middle East & Africa and Asia-Pacific Regions

Regional considerations bring further clarity to market dynamics, as geographic corridors exhibit distinct drivers and constraints. In the Americas, infrastructure renewal initiatives, robust construction pipelines, and the presence of advanced manufacturing clusters underpin sustained demand for both fixed and mobile lifting solutions. North American operators, in particular, are emphasizing lifecycle cost management and digital service integration, while Latin American markets are witnessing investments in port modernization and mining infrastructure.

Europe, the Middle East & Africa showcase a bifurcated landscape, with Western European countries driving adoption of automation and green technologies under stringent emissions regulations, whereas Middle Eastern and African markets focus on large-scale oil and gas, mining, and logistics projects requiring high-capacity and ruggedized equipment. In this region, modular designs and remote monitoring capabilities are increasingly prized as means to optimize uptime in remote or resource-constrained environments.

In Asia-Pacific, the rapid pace of urbanization, expansion of renewable energy installations, and strategic Belt and Road–linked infrastructure projects are fueling demand across all equipment types and capacity ranges. China’s domestic manufacturers are ramping up technology integration, while markets such as India and Southeast Asia are investing heavily in port, power generation, and industrial expansion. Across this region, flexibility, service network reach, and localized manufacturing partnerships are proving decisive in capturing growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Cranes & Hoists market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Competitive Advantages and Innovation Trajectories of Leading Global Cranes and Hoists Manufacturers

Leading original equipment manufacturers and service providers are forging competitive differentiation through innovation, service excellence, and strategic partnerships. Manufacturers with integrated digital platforms can deliver remote diagnostics and predictive maintenance, transforming traditional service models into subscription-based offerings. Conversely, companies that excel in modular design and rapid customization are capturing demand in specialized sectors such as mining, oil and gas, and renewable energy infrastructure.

Strategic partnerships between OEMs and technology firms are also proliferating, enabling deeper integration of AI-driven performance analytics and augmented reality–assisted field maintenance. These collaborations are shortening development cycles for next-generation hoisting solutions and enhancing the quality of remote training programs. Meanwhile, alliances with logistics and distribution partners are optimizing spare parts availability, thereby reducing lead times and enhancing overall asset uptime.

Merger and acquisition activity remains a critical lever for scaling global service networks and accelerating entry into high-growth regional markets. Companies that balance organic R&D investment with targeted acquisitions of niche technology providers are best positioned to deliver comprehensive, end-to-end solutions. As competition intensifies, the ability to offer holistic lifecycle management-encompassing equipment financing, modernization, and recycling services-will be a key differentiator for market leaders seeking to drive revenue diversification and customer retention.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cranes & Hoists market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABUS Kransysteme GmbH

- ACE World Companies

- ANDRITZ AG

- BG Lift S.r.l.

- Brehob Corporation

- Böcker Maschinenwerke GmbH

- Columbus McKinnon Corporation

- Conductix-Wampfler GmbH

- Crane 1 Services

- Eilbeck Cranes

- Furukawa Unic Corporation

- GGR Group Ltd.

- Gorbel Inc.

- Great Lakes Lifting Solutions

- Henan SPT Machinery Equipment Co., Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Hoeflon International B.V.

- Hoist & Crane Service Group

- Hoist UK

- Hoosier Crane Service Company

- Integrity Crane Services, Ltd.

- Jayco Hoist & Cranes Mfg. Co.

- Jekko s.r.l.

- Kato Works Co., Ltd.

- KB Crane Co., Ltd.

- Kobelco Construction Machinery Co., Ltd.

- Konecranes, Inc.

- Maeda Seisakusho Co., Ltd.

- Movex S.L.

- Overhead Crane & Conveyor Service Corp.

- Palazzani Industrie S.p.A.

- Palfinger AG

- Pelloby Premier Cranes

- Sany Heavy Industry Co., Ltd.

- Sennebogen Maschinenfabrik GmbH

- Shandong Cathay Machinery Co., Ltd.

- Street Crane Company Limited

- Sumitomo Heavy Industries Ltd.

- Tadano Ltd.

- Terex Corporation

- The Crosby Group LLC

- Weihua Group

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

Charting Strategic Pathways and Actionable Recommendations for Industry Leaders to Thrive in the Evolving Cranes and Hoists Market

To navigate the evolving competitive terrain, industry leaders should prioritize a multi-pronged strategy that emphasizes digital transformation, supply chain resilience, and customer-centric service models. Investing in advanced analytics and remote monitoring capabilities will enable predictive maintenance programs that significantly reduce unplanned downtime and optimize total cost of ownership for end users. Additionally, adopting modular, upgradeable equipment architectures can accelerate time to market for new product features and facilitate easier retrofits as regulatory requirements evolve.

Supply chain diversification represents another imperative. By establishing regional manufacturing or assembly hubs, companies can mitigate tariff exposure, reduce shipping lead times, and enhance responsiveness to local market demands. Collaborative partnerships with local suppliers and service providers will further reinforce supply chain agility and support aftermarket service expansion.

Finally, embedding sustainability into both product design and operational practices will be crucial for meeting increasingly stringent environmental regulations and customer expectations. Leadership teams should integrate lifecycle assessments into their development processes, optimize energy efficiency through innovative power source adoption, and explore circular economy initiatives for end-of-life equipment. These measures will not only address compliance requirements but also unlock new revenue streams through green certifications and eco-friendly service packages.

Outlining Robust Primary, Secondary, and Analytical Methodologies Underpinning the Comprehensive Cranes and Hoists Market Research

This research synthesizes insights drawn from a comprehensive blend of primary and secondary methodologies. Primary data collection involved in-depth interviews with senior executives from OEMs, distributors, end users, and industry consultants to capture firsthand perspectives on technology adoption, regulatory impacts, and service innovation. Complementing this qualitative input, a quantitative survey of lifting equipment operators and maintenance managers provided detailed visibility into purchase criteria, operational challenges, and aftermarket service requirements.

Secondary research encompassed analysis of industry journals, technical whitepapers, regulatory filings, and customs databases to trace emerging trends in material costs, tariff shifts, and competitive landscapes. Data validation was achieved through triangulation, cross-referencing company disclosures, public policy announcements, and trade association statistics. Additionally, scenario-based modeling and bottom-up forecasting techniques were employed to test the robustness of strategic hypotheses under varying macroeconomic and geopolitical conditions.

Expert panel reviews and iterative feedback loops ensured that the findings reflect real-world applicability and sectoral nuances. This blended methodological approach underpins the rigor and credibility of the insights presented, equipping decision makers with confidence in the strategic implications and recommendations derived herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cranes & Hoists market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cranes & Hoists Market, by Equipment Type

- Cranes & Hoists Market, by Crane Load Capacity

- Cranes & Hoists Market, by Power Source

- Cranes & Hoists Market, by Control Method

- Cranes & Hoists Market, by End Use Industry

- Cranes & Hoists Market, by Region

- Cranes & Hoists Market, by Group

- Cranes & Hoists Market, by Country

- United States Cranes & Hoists Market

- China Cranes & Hoists Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Reflections on Market Imperatives, Strategic Outlook, and Future Prospects for the Cranes and Hoists Industry

The critical intersection of technological advancement, regulatory evolution, and shifting trade policies has indelibly reshaped the cranes and hoists industry. Organizations that proactively embrace digital innovation, diversify supply chain footprints, and embed sustainability into their core strategies are poised to outpace competitors and capture emerging market opportunities. Concurrently, the 2025 tariff landscape underscores the importance of adaptive sourcing and value-added service offerings to mitigate cost pressures and enhance customer loyalty.

Segmentation insights reveal differentiated demand patterns across equipment types, capacity ranges, and end-use industries, providing a roadmap for product portfolio optimization and targeted marketing. Regional analyses highlight the necessity of localized strategies, whether that involves robust service networks in North America, sustainability-focused solutions in Europe, or flexible partnership models in Asia-Pacific. Finally, the competitive intelligence on leading companies points to a future where agility, collaboration, and holistic lifecycle management will define market leaders.

As the industry advances into its next phase of growth, the ability to translate these insights into strategic actions will determine long-term success. By aligning investment priorities with clear segmentation, regional priorities, and technological imperatives, stakeholders can position themselves to drive innovation, reduce operational risk, and deliver unparalleled value to customers.

Engage Directly with Our Associate Director to Secure the Definitive Cranes and Hoists Market Report for Informed Strategic Decision-Making

For tailored insights and an in-depth understanding of the dynamic cranes and hoists market, engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your copy of the definitive market research report. This comprehensive resource delivers nuanced analysis, strategic intelligence, and actionable recommendations designed to inform your most critical decisions. Reach out today to explore customizable data packages, discuss your specific informational needs across technology segments and regions, and ensure your organization remains at the forefront of innovation and growth in the cranes and hoists sector.

- How big is the Cranes & Hoists Market?

- What is the Cranes & Hoists Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?