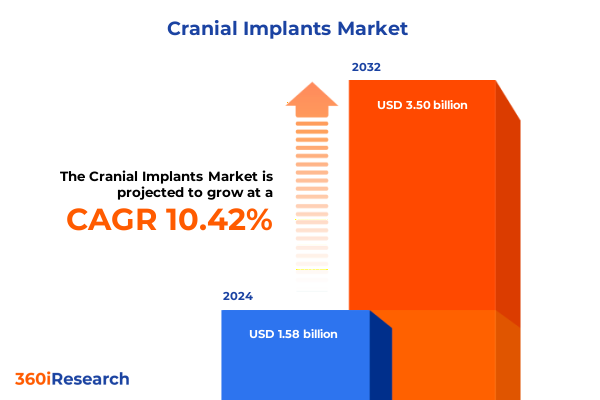

The Cranial Implants Market size was estimated at USD 1.74 billion in 2025 and expected to reach USD 1.92 billion in 2026, at a CAGR of 10.45% to reach USD 3.50 billion by 2032.

A Comprehensive Overview of Cranial Implant Technologies Revolutionizing Neurosurgical Reconstruction Through Precision and Biocompatible Innovation

The landscape of cranial implant technology has undergone a profound transformation driven by advances in materials science, digital manufacturing, and regulatory standardization. Historically, reconstructive neurosurgery relied on off-the-shelf implant solutions that often required intraoperative adjustments and carried heightened risks of poor fit and postoperative complications. However, modern additive manufacturing techniques now enable patient-specific cranial implants that conform precisely to complex skull geometries, significantly improving surgical outcomes and reducing the potential for revision procedures. In April 2024, for instance, the FDA granted clearance for 3D Systems’ VSP PEEK cranial implant, marking a milestone in point-of-care additive manufacturing by allowing surgical teams to design and produce biocompatible patient-specific implants using up to 85% less material than traditional machining methods.

Beyond precision fit, the materials underpinning cranial implants have also evolved. Titanium alloys remain a mainstay for their mechanical strength and osteointegration properties, while polymeric alternatives such as PEEK (polyetheretherketone) offer imaging artifact-free profiles that facilitate postoperative diagnostics. These developments are underpinned by emerging consensus standards: ASTM F3604-23, finalized in December 2024, provides uniform validation methods for powder-bed fusion processes in orthopedic and craniofacial devices, ensuring consistent quality across suppliers. Collectively, these innovations set the stage for a new era in neurosurgical reconstruction where customization, biocompatibility, and regulatory alignment converge to deliver superior patient care.

How Innovations in 3D Printing Digital Health Integration and Personalized Manufacturing Are Driving Radical Change in Cranial Implant Solutions

The trajectory of cranial implant solutions has shifted dramatically as industry leaders integrate digital health platforms, advanced biomaterials, and decentralized manufacturing strategies. Whereas early customization efforts focused primarily on computer numerical control machining, today’s surgical teams leverage digital scan data, machine learning algorithms, and cloud-based surgical planning tools to design and validate implants before production. Notably, the integration of augmented reality in preoperative workflows has demonstrated real-time guidance benefits, reducing needle passes by 54% and lowering radiation exposure by 41% during CT-guided interventions, underscoring the potential of digital augmentation to optimize both safety and efficiency.

Concurrently, additive manufacturing at the point of care is reshaping supply chain models. The establishment of in-house 3D printing labs within hospitals and ambulatory surgical centers empowers clinicians to produce implants on demand, shortening lead times and bypassing traditional distribution bottlenecks. This decentralized approach not only aligns with growing preferences for personalized medicine but also mitigates the risks of global supply chain disruptions, a lesson reinforced by recent tariff-induced challenges. Moreover, the combination of AI-driven design tools and hybrid manufacturing-merging powder-bed fusion with CNC machining-enables a balance of intricacy and mechanical robustness previously unattainable. As a result, the ecosystem of cranial implants is transitioning from a predominantly contract manufacturing paradigm toward agile, clinician-driven production networks where collaboration between surgeons, engineers, and regulatory experts defines the next frontier of innovation.

Examining the Widespread Effects of 2025 US Medical Device Tariffs on Cranial Implant Supply Chains Costs and Healthcare Delivery Networks

The implementation of tariffs on medical device imports in early 2025 has had cascading consequences for cranial implant availability, costs, and supply chain resilience. In April 2025, the U.S. administration introduced a universal 10% duty on all medical device imports, effectively removing previous exemptions and imposing punitive levies up to 54% on Chinese exports and 20% on European imports under reciprocal tariffs for perceived unfair trade practices. These measures, aimed partly at encouraging domestic manufacturing, have instead strained an industry reliant on specialized components and raw materials sourced globally.

In response, major device manufacturers have reported substantial financial headwinds. Medtronic, for instance, projects that tariffs could increase its cost of goods sold by as much as $950 million in fiscal year 2026, with only a portion of that impact mitigated through supply chain adjustments. Similarly, Johnson & Johnson’s MedTech division anticipates a $400 million tariff-induced cost burden this year, underscoring the breadth of the challenge. Healthcare providers and trade associations have sounded alarms over potential service disruptions: the American Hospital Association formally petitioned the administration for medical device exemptions, warning that tariff-driven price increases and delivery delays could compromise patient care.

Moreover, specialized analytics firms have highlighted the systemic risks of prolonged trade conflicts. iData Research cautions that with duties potentially reaching 145% on certain components, manufacturers face escalating procurement costs and inventory shortages that could undermine both surgical schedules and innovation pipelines. As policymakers and industry stakeholders navigate this complex environment, the imperative for strategic sourcing diversification, supplier collaboration, and advocacy for targeted exemptions has never been clearer.

Unveiling Critical Segmentation Dynamics in Cranial Implant Markets Based on Product Types Materials Indications End Users and Distribution Channels

Cranial implant market dynamics are intricately influenced by distinct segmentation parameters that reflect both clinical requirements and commercial channels. When comparing product types, implants crafted to patient-specific geometries through additive manufacturing demonstrate enhanced surgical precision and reduced operation times relative to off-the-shelf prefabricated solutions. This dichotomy drives surgeons to weigh the benefits of custom fit against the logistical convenience of standardized plate availability.

Material selection further nuances market trajectories. While titanium alloys continue to dominate due to their proven biocompatibility and mechanical strength, polymeric options such as polyetheretherketone have surged in adoption for their radiolucent properties and compatibility with advanced imaging protocols. Ceramic alternatives also garner interest for specific use cases requiring minimal biological reactivity and long-term dimensional stability.

Clinical indications segment the market according to patient needs. Congenital cranial defects often necessitate meticulously contoured implants designed for pediatric anatomies, whereas trauma-induced reconstructions demand robust solutions capable of restoring structural integrity under acute conditions. Tumor-related resections present unique challenges in balancing oncological clearance with aesthetic contour restoration, prompting the development of hybrid implants that integrate tumor-specific cutouts and fixation features.

End users of cranial implants are evolving alongside the products themselves. Hospitals remain the primary channel for complex neuro-cranial procedures, yet ambulatory surgical centers have increasingly adopted streamlined cranioplasty workflows for select cases, capitalizing on efficiency gains and cost containment. Distribution channels reflect these shifts: established offline medical device distributors continue to serve large healthcare systems, while direct-to-consumer online platforms for implant ordering and digital surgical planning have emerged, enabling more agile procurement for specialty practices.

This comprehensive research report categorizes the Cranial Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Indication

- End User

- Distribution Channel

Exploring Geographic Variations in Cranial Implant Adoption Regulation and Infrastructure Across Americas Europe Middle East Africa and Asia Pacific

Regional considerations play a pivotal role in shaping the adoption and evolution of cranial implant technologies. In the Americas, robust neurosurgical infrastructure and well-established reimbursement frameworks have fostered early uptake of high-precision additive-manufactured implants. North American healthcare providers benefit from streamlined FDA regulatory pathways and an extensive network of point-of-care manufacturing facilities, positioning the region as a global innovation hub for patient-specific cranial solutions.

Conversely, Europe, the Middle East, and Africa present a heterogeneous regulatory landscape where medical device approval processes and tariff exposures vary widely. While nations in Western Europe adhere to harmonized Medical Device Regulation (MDR) standards, the imposition of reciprocal U.S. tariffs on European exports has intensified supply chain complexities and elevated costs for local hospitals. Meanwhile, manufacturers in emerging EMEA markets face the dual challenge of aligning with evolving EU-MDR requirements and securing access to advanced materials and digital manufacturing platforms.

Asia-Pacific stands out for its rapid infrastructure development and regulatory modernization efforts that streamline domestic device approvals. Creative medical device firms across East Asia and Southeast Asia are capitalizing on these reforms to introduce cost-effective polymeric implants and localized 3D printing services. Additionally, tele-neurosurgery platforms are gaining traction in India and Brazil, enabling remote surgical planning and international collaboration that transcend regional boundaries. The combination of lower manufacturing costs, growing neurosurgical capacity, and government incentives for domestic production underscores APAC as one of the fastest-growing arenas for cranial implant innovation.

This comprehensive research report examines key regions that drive the evolution of the Cranial Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Competitive Dynamics Among Leading Cranial Implant Manufacturers Shaping Innovation and Market Positioning Globally

A diverse set of industry participants drives the competitive landscape of cranial implants, ranging from established medtech conglomerates to specialist innovators. Stryker has reinforced its cranial portfolio through targeted acquisitions and product launches, including patient-specific PEEK implants developed in collaboration with leading neurosurgeons to optimize the bone-to-implant interface. Beyond implant materials, the company’s Q Guidance System with Cranial Guidance Software offers integrated surgical planning and intraoperative navigation, further cementing its neurosurgical ecosystem credentials.

Zimmer Biomet leverages additive expertise acquired through the Paragon 28 transaction to enhance its cranioplasty offerings, focusing on polymeric implant workflows that integrate seamlessly with existing imaging and planning infrastructures. Johnson & Johnson’s DePuy Synthes division continues to expand its bioceramic and bioresorbable implant lines, targeting both functional restoration and aesthetic enhancement in craniofacial procedures. Medtronic, despite reporting significant tariff-related cost impacts, remains committed to diversifying its supply base and advancing custom titanium implant production through strategic partnerships.

Specialist firms such as OssDsign and Xilloc Medical differentiate on biomimetic ceramics and modular service models that deliver end-to-end design, validation, and manufacturing. Renishaw’s recent investment in expanding additive capacity and augmented-reality navigation modules underscores the growing importance of software-driven value propositions. Meanwhile, 3D Systems continues to pioneer point-of-care additive manufacturing platforms, marrying AI-driven design automation with regulatory compliance frameworks to streamline implant development. Together, these players illustrate a market in which technological leadership, supply chain agility, and comprehensive service offerings dictate competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cranial Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aesculap Implant Systems LLC

- Anatomics Pty Ltd.

- B. Braun Melsungen AG

- Biocomposites Ltd.

- Biomet Inc.

- evo GmbH

- Integra LifeSciences Holdings Corporation

- KLS Martin Group

- Matrix Surgical USA

- Medicon eG

- MedShape Inc.

- Medtronic Navigation Inc.

- Medtronic plc

- Medtronic Sofamor Danek

- OssDsign AB

- Osteomed LLC

- SHS International Ltd.

- Stryker Corporation

- Stryker Craniomaxillofacial

- Synoste GmbH

- Xilloc Medical B.V.

- Zimmer Biomet Holdings Inc.

Strategic Initiatives and Best Practices for Industry Leaders to Navigate Technological Regulatory and Supply Chain Challenges in Cranial Implant Development

To navigate the dynamic cranial implant market, industry leaders should prioritize supply chain resilience by diversifying component sourcing and forging strategic partnerships with regional manufacturers to mitigate tariff-induced cost volatility. Implementing dual-source procurement strategies for critical raw materials and leveraging free trade agreements can further buffer against policy uncertainties. In parallel, allocating resources to expand point-of-care additive manufacturing capabilities within key hospital systems and ambulatory centers will reduce lead times and enhance clinical collaboration.

Investments in digital health integration-encompassing AI-driven design platforms, surgical planning software, and augmented reality-guided interventions-will amplify the clinical value proposition of cranial implants and create more seamless surgeon workflows. Encouraging cross-functional teams comprising engineers, clinicians, and regulatory specialists to co-develop next-generation materials and modular implant systems can accelerate time to market and strengthen intellectual property portfolios. Simultaneously, engagement with regulatory bodies and active participation in standards development for additive-manufactured devices will ensure that emerging technologies align with evolving quality and safety benchmarks.

Finally, a focused expansion into high-growth regions such as Asia-Pacific through localized manufacturing partnerships and tele-neurosurgery initiatives will unlock new customer segments while optimizing cost structures. By combining strategic sourcing, digital innovation, regulatory advocacy, and geographic diversification, industry leaders can solidify their competitive positions and drive sustainable growth in the cranial implant domain.

An In-Depth Explanation of the Rigorous Qualitative Quantitative and Expert Validation Methodologies Underpinning Cranial Implant Market Research

The research underpinning this comprehensive analysis of the cranial implant sector employs a multi-stage methodology integrating both qualitative and quantitative approaches. Extensive secondary research involved the review of peer-reviewed journals, industry whitepapers, regulatory filings, and patent databases to identify technological trends, material innovations, and evolving standards in additive manufacturing and biomaterials. Publicly available tariff schedules, trade commission rulings, and corporate financial disclosures were analyzed to assess the cumulative impact of U.S. trade policies on device supply chains and cost structures.

Primary research comprised structured interviews with key opinion leaders, including neurosurgeons specializing in complex cranioplasty, purchasing directors at leading healthcare institutions, and research scientists engaged in biomimetic material development. In addition, expert workshops facilitated scenario planning exercises to validate the potential outcomes of emerging trade policies and regulatory shifts. Quantitative data points were triangulated with proprietary back-testing models to ensure consistency across varied sources.

Data validation and quality assurance protocols were applied throughout the research lifecycle, encompassing cross-verification of material performance metrics, regulatory timelines, and competitive intelligence profiles. The result is a robust, evidence-based framework that synthesizes market dynamics, technological capabilities, and policy influences to deliver actionable insights tailored to decision-makers in medical device manufacturing and healthcare delivery.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cranial Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cranial Implants Market, by Product Type

- Cranial Implants Market, by Material

- Cranial Implants Market, by Indication

- Cranial Implants Market, by End User

- Cranial Implants Market, by Distribution Channel

- Cranial Implants Market, by Region

- Cranial Implants Market, by Group

- Cranial Implants Market, by Country

- United States Cranial Implants Market

- China Cranial Implants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Insights on Technological Trends Competitive Pressures Regulatory Impacts and Strategic Opportunities in Cranial Implants

In conclusion, the cranial implant sector stands at the intersection of material science innovation, digital manufacturing evolution, and nuanced regulatory frameworks. Customizable, additive-manufactured implants have shifted the paradigm from one-size-fits-all solutions to patient-specific interventions that minimize surgical complications and optimize postoperative outcomes. Yet, these advances coexist with significant trade policy headwinds that challenge supply chain stability and cost efficiency.

The resulting environment demands that manufacturers invest in diversified sourcing strategies, adopt point-of-care production models, and engage proactively with regulatory authorities to shape standards for emerging materials and additive processes. Concurrently, the competitive landscape is defined by collaborations between established medtech majors and specialist innovators, underscoring that comprehensive service ecosystems-from imaging and planning to implant fabrication-are now table stakes.

Looking ahead, success in the cranial implant market will hinge on the ability to integrate AI-driven design tools, scale decentralized manufacturing, and tailor solutions to diverse clinical and geographic contexts. By capitalizing on these convergent trends, stakeholders can deliver superior patient care, manage cost pressures, and secure long-term growth in an industry defined by rapid technological and policy-driven evolution.

Connect with Ketan Rohom to Secure Your Comprehensive Cranial Implant Market Research Report and Gain Actionable Insights for Strategic Decision Making

To unlock the full depth of strategic insights, detailed data analyses, and expert commentary that will empower your organization to stay at the forefront of cranial implant innovation and navigate evolving regulatory and trade landscapes, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan combines a thorough understanding of market dynamics with a consultative approach designed to tailor solutions to your unique business priorities and will guide you through the options for acquiring the comprehensive report. Reach out to schedule a consultation and secure your copy of the definitive cranial implant market research report today.

- How big is the Cranial Implants Market?

- What is the Cranial Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?