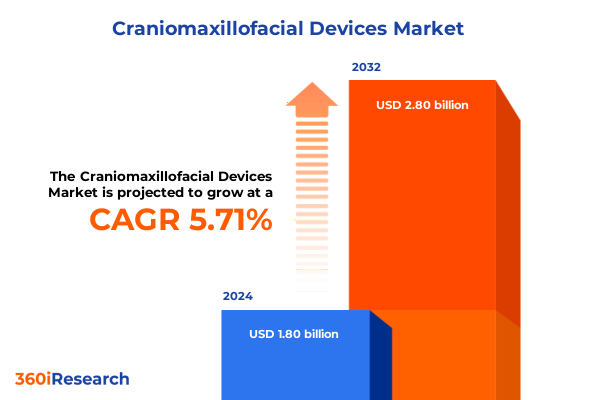

The Craniomaxillofacial Devices Market size was estimated at USD 1.89 billion in 2025 and expected to reach USD 1.98 billion in 2026, at a CAGR of 5.81% to reach USD 2.80 billion by 2032.

Setting the Stage for Innovation in Craniomaxillofacial Devices by Unveiling Critical Trends Shaping Patient Outcomes and Surgical Precision Globally

The craniomaxillofacial device landscape has undergone a profound evolution, spurred by technological breakthroughs and shifting clinical demands that are redefining patient care standards. As surgeons and healthcare systems seek ever-greater precision and customization for facial reconstruction and trauma management, the integration of advanced materials and digital workflows has become indispensable. Rapid prototyping and additive manufacturing techniques now enable the production of patient-specific implants with micron-level accuracy, thereby minimizing surgical time and enhancing postoperative outcomes. Moreover, the trend toward minimally invasive procedures is driving the development of streamlined instruments and modular fixation systems that cater to complex anatomical challenges.

In parallel, regulatory bodies have refined approval pathways to accommodate innovations in biofabrication and computer-aided design, ensuring that safety and efficacy benchmarks keep pace with emerging practices. Consequently, interoperability between imaging modalities, design software, and implant fabrication platforms has emerged as a pivotal factor for device developers aiming to capture market attention. In this context, the current executive summary provides a holistic overview of the forces reshaping the craniomaxillofacial device sector, illuminating how groundbreaking technologies, policy developments, and clinical preferences converge to chart the course for the next era of facial reconstructive surgery.

Revolutionary Advances and Paradigm Shifts in Craniomaxillofacial Device Development Driving Personalized Surgical Solutions and Material Innovations

Over the past decade, the craniomaxillofacial arena has experienced transformative shifts driven by the convergence of additive manufacturing and digital design, unleashing unprecedented opportunities for patient-specific treatments. Additive technologies such as fused deposition modeling and powder bed fusion have transitioned from prototyping applications to full-scale production of anatomically tailored implants, allowing surgeons to anticipate fit and function with greater confidence than ever before. At the same time, stereolithography and CAD/CAM processes have enhanced preoperative planning by enabling virtual surgical rehearsal and automated machining of titanium and polymeric constructs.

Furthermore, regulatory frameworks have adapted to accommodate the rapid pace of innovation, introducing streamlined 510(k) and CE marking pathways for next-generation materials like bioresorbable polymers and high-performance ceramics. As a result, device manufacturers are increasingly forging partnerships with clinical centers to co-develop bespoke solutions that leverage advanced imaging data and machine learning algorithms for design optimization. Moreover, the integration of intraoperative navigation and augmented reality tools is revolutionizing surgical workflows, allowing practitioners to visualize complex anatomies in real time and make data-driven decisions on implant positioning and fixation strategies. These paradigm shifts collectively underscore the sector’s trajectory toward highly personalized, digitally enabled care models.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Supply Chain Dynamics and Competitive Positioning in Craniomaxillofacial Devices

The introduction of heightened United States tariff measures in early 2025 has triggered a series of adjustments across global supply chains for craniomaxillofacial implants and associated instruments. Tariffs levied on imported metallic inputs and polymer feedstocks have compelled manufacturers to reevaluate supplier networks, prompting some to diversify sourcing toward regional partners in North America. In parallel, these levies have increased the appeal of domestic production capabilities, spurring investment in localized additive manufacturing hubs that reduce reliance on cross-border logistics.

Moreover, downstream stakeholders including hospitals and ambulatory surgical centers are now recalibrating procurement strategies, negotiating long-term agreements with domestic fabricators to secure price stability and ensure timely delivery of critical surgical devices. Consequently, product developers are redirecting research focus toward materials and processes that mitigate tariff exposure, such as advanced PEEK formulations and in-house milling operations. Over time, this strategic realignment is anticipated to foster greater vertical integration, with leading device companies expanding their manufacturing footprint within the United States to preserve competitive positioning and reinforce supply chain resilience.

Illuminating Product, Application, Technology, Material, and End User Segmentation Insights Underpinning Innovation Pathways in Craniomaxillofacial Devices

Illuminating key segmentation insights reveals how different product categories are steering innovation pathways within the craniomaxillofacial field. In the domain of bone plates and bone screws, manufacturers are optimizing geometric profiles and surface treatments to accelerate osseointegration and reduce stress shielding, while mesh constructs continue to evolve through novel pore architectures that support tissue in-growth. Surgical instruments are also undergoing refinement, with ergonomic designs and disposable options enhancing procedural efficiency and cost management. From an application standpoint, the management of craniofacial trauma remains a critical focus area, yet the rising demand for dental surgery solutions and orthognathic interventions underscores the market’s expanding clinical breadth, with reconstructive surgery representing an intricate segment demanding the highest degree of customization.

Technological segmentation highlights the ascendancy of 3D printing modalities-including fused deposition modeling, powder bed fusion, and stereolithography-in delivering bespoke implant geometries, complemented by the precision of CAD/CAM methods such as laser sintering and milling alongside traditional shaping techniques. Material-based insights underscore the strategic balance between bioresorbable polymers like PGA, PLA, and PLGA, high-strength ceramics including alumina, hydroxyapatite, and zirconia, and established biomaterials such as PEEK and titanium, each offering unique biomechanical and biocompatibility profiles. Finally, end user segmentation distinguishes the evolving roles of ambulatory surgical centers, dental clinics, and hospitals, where procedural preferences, purchasing cycles, and reimbursement frameworks collectively shape product adoption patterns.

This comprehensive research report categorizes the Craniomaxillofacial Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Material

- Application

- End User

Exploring Regional Distinctions and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific Craniomaxillofacial Device Markets

Regional dynamics exert a profound influence on the strategic priorities and adoption curves within the craniomaxillofacial landscape. In the Americas, robust healthcare infrastructure and established reimbursement schemas underpin rapid uptake of patient-specific implants, while a growing network of specialized surgical centers accelerates clinical validation of additive manufacturing solutions. Furthermore, competitive pressures and collaborative research initiatives among leading medical institutions drive continuous refinement of high-performance materials.

Conversely, Europe Middle East and Africa exhibits a complex mosaic of regulatory harmonization efforts alongside cost-containment imperatives, prompting device innovators to optimize process efficiencies and demonstrate clear value propositions. This environment, combined with an emphasis on cross-border clinical studies and centralized approval pathways, fosters a balanced interplay between innovation and economic sustainability. Meanwhile, Asia Pacific is characterized by dynamic growth fueled by medical tourism, expanding middle-class demographics, and government-led investment in advanced healthcare infrastructure. As a result, market participants in this region are rapidly adopting biofabrication techniques and forging partnerships with domestic research institutions to localize production and satisfy rising procedural volumes.

This comprehensive research report examines key regions that drive the evolution of the Craniomaxillofacial Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Collaborative Innovations Among Leading Craniomaxillofacial Device Manufacturers Shaping the Industry’s Future Landscape

Leading companies within the craniomaxillofacial device sphere are distinguishing themselves through a combination of strategic collaborations, targeted acquisitions, and in-house innovation centers. Collaborative alliances between implant manufacturers and imaging technology firms are enhancing preoperative planning capabilities, while joint ventures with material science experts are expediting the development of next-generation bioresorbable polymers and ceramics. Mergers and acquisitions have also reshaped the competitive landscape, as larger device corporations integrate niche innovators specializing in additive manufacturing or advanced biomaterials to broaden their technology portfolios.

In addition, several key players have invested in proprietary digital platforms that streamline the design-to-production pipeline, enabling real-time adjustments to implant geometries based on intraoperative feedback. This emphasis on end-to-end digital workflows is further reinforced by strategic partnerships with software providers to ensure regulatory compliance and data security. Consequently, these companies not only reinforce their technological leadership but also create barriers to entry for smaller competitors. As a result of these concerted efforts, the competitive arena is increasingly defined by the ability to deliver integrated solutions combining software, material science, and manufacturing expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Craniomaxillofacial Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems, Inc.

- B. Braun Melsungen AG

- GPC Medical Ltd.

- Inion Oy

- Johnson & Johnson Services, Inc.

- Karl Leibinger Medizintechnik GmbH & Co. KG

- KLS Martin Group

- Medtronic plc

- OsteoMed, LLC

- Stryker Corporation

- Xilloc Medical B. V.

- Zimmer Biomet Holdings, Inc.

Recommendations for Industry Leaders to Enhance Innovation, Strengthen Collaboration, and Fortify Supply Chain Resilience in Craniomaxillofacial Device Sector

Industry leaders must adopt a multi-faceted approach to remain at the forefront of craniomaxillofacial innovation. First, strengthening partnerships with clinical research centers provides direct access to patient data and procedural insights, thereby informing product design refinements and accelerating regulatory approvals. In conjunction with this, investing in flexible manufacturing platforms-capable of seamlessly transitioning between additive and subtractive processes-will ensure adaptability to fluctuating supply chain conditions and tariff environments.

Furthermore, establishing strategic alliances with digital solution providers can facilitate the integration of intraoperative imaging, augmented reality guidance, and machine learning–driven analytics into a cohesive surgical ecosystem. Such collaborations not only enhance procedural precision but also generate valuable data streams that inform continuous product optimization. Finally, enhancing supply chain resilience through geographic diversification of raw material suppliers and onshore fabrication facilities will safeguard against geopolitical and regulatory disruptions. By implementing these recommendations, industry leaders can position themselves to capitalize on evolving clinical needs and maintain a sustainable competitive edge.

Framework Outlining Expert Interviews, Detailed Data Collection, and Stringent Validation Techniques Supporting Craniomaxillofacial Device Research

This research draws upon a robust framework that integrates expert interviews, detailed data collection, and stringent validation techniques to ensure the highest level of accuracy and relevance. Initially, in-depth qualitative discussions were conducted with surgeons, biomedical engineers, and regulatory specialists to capture firsthand perspectives on emerging clinical challenges and technology adoption barriers. Subsequently, extensive secondary research was performed, synthesizing peer-reviewed publications, conference proceedings, and regulatory filings to map the trajectory of material and design innovations.

Quantitative insights were then derived through a systematic aggregation of procedural data provided by leading healthcare facilities and device manufacturers, complemented by pricing benchmarks and procurement cycle analyses. Throughout this process, cross-functional validation rounds were executed, engaging stakeholders across the value chain to confirm the integrity of the findings. Finally, the cumulative insights were distilled into thematic narratives and actionable frameworks that deliver a clear understanding of the strategic imperatives shaping the craniomaxillofacial device domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Craniomaxillofacial Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Craniomaxillofacial Devices Market, by Product Type

- Craniomaxillofacial Devices Market, by Technology

- Craniomaxillofacial Devices Market, by Material

- Craniomaxillofacial Devices Market, by Application

- Craniomaxillofacial Devices Market, by End User

- Craniomaxillofacial Devices Market, by Region

- Craniomaxillofacial Devices Market, by Group

- Craniomaxillofacial Devices Market, by Country

- United States Craniomaxillofacial Devices Market

- China Craniomaxillofacial Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Illuminate Future Directions and Strategic Priorities for Craniomaxillofacial Device Innovation and Market Evolution

In synthesizing the diverse insights from technological breakthroughs, tariff-driven supply chain realignments, and nuanced segmentation perspectives, a coherent vision for the future of craniomaxillofacial devices emerges. The proliferation of additive manufacturing and digital design tools is set to redefine surgical precision while expanding the scope of personalized care. Concurrently, regional variations underscore the importance of adaptable market strategies that align with local regulatory frameworks and healthcare infrastructures.

Key strategic priorities include advancing multi-material implants, embedding digital surgical guidance systems, and reinforcing supply chain agility to mitigate external shocks. Collaboration between device innovators, clinical practitioners, and regulatory authorities will be paramount in harmonizing safety standards with rapid innovation cycles. Ultimately, decision-makers equipped with these integrated insights will be well positioned to navigate the complexities of this dynamic sector and to unlock new opportunities for patient-centered treatment solutions.

Take the Next Step Today by Engaging with Ketan Rohom to Unlock Comprehensive Craniomaxillofacial Device Market Intelligence Tailored to Your Strategic Needs

Ready to elevate your strategic decision-making, Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) stands ready to guide you through the nuances of this comprehensive craniomaxillofacial device analysis. By engaging directly with Ketan Rohom, you will gain unparalleled access to the full suite of insights covering transformative technologies, tariff impacts, detailed segmentation, and regional dynamics. This tailored dialogue ensures that you can align your product development roadmap and go-to-market strategies with the latest industry intelligence.

Take advantage of this opportunity to secure a competitive advantage; Ketan Rohom is prepared to provide you with customized data extracts, thematic deep dives, and actionable recommendations drawn from rigorous research methodologies. Whether you require in-depth understanding of 3D printing advancements, material innovations, or supply chain resilience frameworks, this report provides the clarity needed to make informed investment and partnership decisions. Reach out to Ketan Rohom today to discuss how this research can be integrated into your strategic planning and drive long-term success in the evolving craniomaxillofacial device arena.

- How big is the Craniomaxillofacial Devices Market?

- What is the Craniomaxillofacial Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?