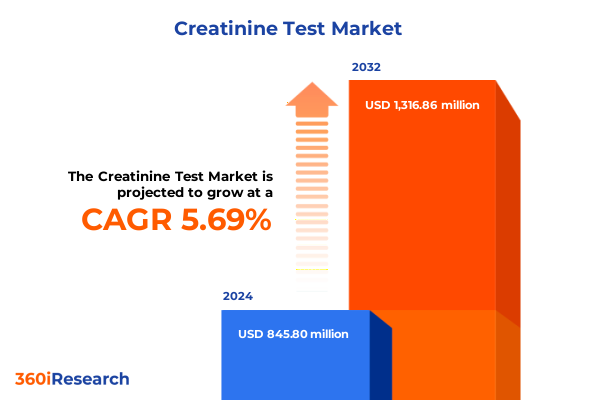

The Creatinine Test Market size was estimated at USD 887.57 million in 2025 and expected to reach USD 934.75 million in 2026, at a CAGR of 5.79% to reach USD 1,316.86 million by 2032.

Exploring the Pivotal Importance of Accurate Creatinine Testing in Enhancing Patient Outcomes and Guiding Clinical Decision Making Within Healthcare Settings

The measurement of creatinine levels remains a cornerstone of assessing renal function and guiding clinical decision making across diverse patient populations. As a metabolic waste product excreted by the kidneys, creatinine serves as a reliable indicator of glomerular filtration rate, with even modest deviations prompting further diagnostic evaluation. Over the past decade, rising incidences of chronic kidney disease and acute kidney injuries have underscored the necessity for precise, timely creatinine testing. This has driven healthcare providers, diagnostic laboratories, and point-of-care facilities to prioritize accuracy, speed, and accessibility in their testing protocols.

In this rapidly evolving environment, the adoption of advanced methodologies and integrated diagnostic platforms has reshaped how creatinine measurements inform patient management. Innovations such as rapid assays, streamlined workflows, and digital connectivity now empower clinicians to detect renal impairment earlier and adjust treatment regimens more effectively. Consequently, stakeholders across hospitals, research institutions, and outpatient settings are reevaluating their testing strategies to balance clinical efficacy with operational efficiency. This introduction sets the stage for a comprehensive exploration of the shifts, challenges, and opportunities that define the current creatinine testing landscape.

How Technological Innovations and Regulatory Advances Are Redefining the Landscape of Creatinine Testing Practices and Patient Management Strategies

Recent years have witnessed transformative shifts that extend far beyond incremental improvements in analytic precision. One of the most impactful changes has been the proliferation of point-of-care platforms capable of delivering serum creatinine results within minutes instead of hours. This rapid turnaround has proven invaluable in emergency departments and critical care units, enabling proactive interventions that can mitigate the progression of acute kidney injury. Meanwhile, routine laboratory tests have benefited from high-throughput analyzers that integrate seamlessly with laboratory information systems, reducing manual labor and error rates.

On the regulatory front, updated guidelines from agencies such as the FDA have introduced more stringent validation requirements, particularly for enzymatic assays that claim enhanced specificity over traditional Jaffe methods. Concurrently, digital health ecosystems have begun to integrate creatinine data into comprehensive patient dashboards, leveraging artificial intelligence to flag anomalies and predict disease trajectories. Taken together, these technological, regulatory, and digital innovations are fundamentally redefining how creatinine testing underpins patient management and drives value across healthcare.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Supply Chains, Costs, and Innovation in Creatinine Testing

In 2025, the United States implemented a series of tariff adjustments targeting imported medical devices, reagents, and ancillary equipment essential to creatinine testing. These measures aimed to strengthen domestic manufacturing and reduce dependency on foreign suppliers, yet they also introduced cost pressures for laboratories and point-of-care providers that rely on specialized reagents and kits. Many diagnostic manufacturers faced increased production expenses, prompting a reevaluation of pricing strategies and supply chain configurations to maintain competitiveness while safeguarding quality.

Despite these challenges, the tariff landscape has spurred a wave of strategic investments in local production capabilities and alternative sourcing models. Several reagent suppliers accelerated partnerships with US-based manufacturers to mitigate duty impacts, while some global players opted to establish regional assembly facilities. In parallel, diagnostic laboratories and hospitals explored bulk procurement agreements and long-term contracts to lock in favorable terms. These adaptations have not only stabilized reagent availability but have also catalyzed innovation in assay design, as manufacturers seek to reduce raw material dependencies without compromising analytical performance.

Unveiling Critical Segmentation Perspectives Across Test Types, End Users, Technologies, Applications, Products, and Distribution Channels

A nuanced understanding of market segmentation illuminates how diverse testing needs and end-user requirements shape the creatinine testing ecosystem. Within test types, serum creatinine assays dominate routine screening, offering both point-of-care and laboratory-based workflows to accommodate rapid diagnostics and high-volume throughput. Urine creatinine measurements serve specialized purposes, with 24-hour collections enabling precise clearance calculations and spot tests providing convenient snapshots of renal output. Emerging interest in whole blood assays underscores a push toward truly integrated, near-patient testing solutions.

End-user segmentation further clarifies where testing demand originates. Academic institutes drive innovation through investigative studies, while diagnostic laboratories-both hospital-based and standalone-serve as the backbone for large-scale screening and quality-controlled analytics. Hospitals, distinguished by private and public ownership, deploy creatinine testing across inpatient, outpatient, and emergency contexts, and research laboratories leverage specialized assays to explore novel biomarkers and therapeutic monitoring protocols.

Technological segmentation highlights the competitive interplay among enzymatic methods, ion selective electrodes, the classic Jaffe reaction, and spectrophotometric techniques. Each approach balances factors such as specificity, ease of automation, and reagent costs. Enzymatic assays, for example, have split into amperometric and colorimetric variants to meet distinct sensitivity and throughput needs, while kinetic and manual Jaffe formats persist in laboratories that prioritize cost efficiency. Spectrophotometric technologies continue to attract interest for their versatility across multiple analytes.

Applications of creatinine testing encompass clinical diagnosis of acute kidney injury and chronic kidney disease, real-time drug monitoring for nephrotoxic or therapeutic agents, investigative research protocols, and performance optimization in sports medicine. Kits and reagents are tailored to these end uses, with laboratory kits engineered for high-precision workflows and point-of-care counterparts designed for portability. Analyzers and controls round out the product portfolio, ensuring standardized performance across diverse laboratory and clinical settings.

Distribution channels play a critical role in meeting user preferences and operational models. Direct sales relationships foster personalized support for large hospital networks, while national and regional distributors extend reach to mid-tier laboratories. Online channels, spanning company websites and e-commerce platforms, cater to smaller practices and research teams seeking convenience and rapid replenishment of consumables.

This comprehensive research report categorizes the Creatinine Test market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Product

- Distribution Channel

- Application

- End User

Examining Regional Dynamics and Growth Drivers Shaping the Creatinine Testing Market Across Americas, EMEA, and Asia-Pacific

Regional dynamics in creatinine testing reveal distinct growth drivers and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In North America, advanced healthcare infrastructure and high adoption rates of point-of-care platforms support continued expansion of rapid creatinine assays. The presence of well-established diagnostic chains and collaborative research initiatives further accelerates the integration of novel technologies.

In Europe, Middle East & Africa, diverse regulatory environments dictate varying approval timelines and reimbursement landscapes. While Western European markets embrace cutting-edge enzymatic assays and digital connectivity, emerging African and Middle Eastern nations focus on expanding basic laboratory capabilities and establishing quality control frameworks. Cross-border partnerships and investments aim to elevate regional testing standards and ensure equitable access to diagnostic resources.

Asia-Pacific stands out for its rapid healthcare digitization and increasing public health investments, which underpin a growing appetite for both laboratory-based and near-patient creatinine tests. Urban centers in China, Japan, and India are at the forefront of adopting automated analyzers, whereas Southeast Asian and Oceanic markets exhibit rising demand for cost-effective, portable testing kits. Overall, regional differences in regulatory policies, healthcare funding, and infrastructure continue to shape the pace and direction of creatinine testing advancements.

This comprehensive research report examines key regions that drive the evolution of the Creatinine Test market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Players Driving Innovation in Creatinine Testing Solutions

Leading diagnostic and life science companies are driving innovation through strategic alliances, targeted R&D investments, and selective portfolio expansions. Global instrument manufacturers collaborate with reagent suppliers to optimize assay performance on proprietary platforms, while specialist kit providers harness synthetic chemistry breakthroughs to deliver greater assay stability and sensitivity. Partnerships between multinational corporations and regional distributors ensure that novel technologies reach both urban centers and remote healthcare facilities.

Competitive positioning is influenced by factors such as assay specificity, automation compatibility, and digital integration. Established firms differentiate through comprehensive support networks and value-added services, whereas nimble start-ups focus on niche applications like sports medicine or point-of-care convenience. Mergers and acquisitions continue to reshape the landscape, with larger entities absorbing innovative juniors to bolster their enzymatic and immunoassay capabilities. Simultaneously, collaboration with academic institutions and contract research organizations fuels early-stage innovation and accelerates time to market.

In addition to core assay development, companies are investing in data analytics and connectivity solutions that transform raw creatinine measurements into actionable insights. Cloud-based platforms enable real-time performance tracking, quality control alerts, and longitudinal patient monitoring, aligning with broader trends toward personalized medicine and digital health ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Creatinine Test market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abcam PLC by Danaher Corporation

- Anamol Laboratories Pvt. Ltd.

- Arbor Assays Inc.

- ARKRAY, Inc.

- Aviva Systems Biology Corporation

- Bio-Rad Laboratories, Inc.

- BTNX Inc.

- Cleveland Clinic

- Eagle Biosciences, Inc.

- F. Hoffmann-La Roche AG

- Fujifilm Corporation

- House Of Diagnostics

- Labcorp Holdings Inc

- Merck KGaA

- Metropolis Healthcare Limited

- Nova Biomedical Corporation

- Practo Technologies Private Limited

- Quantimetrix Corporation

- QuidelOrtho Corporation

- Randox Laboratories Ltd.

- Randox Laboratories Ltd.

- RayBiotech, Inc.

- Sekisui Medical Co., Ltd.

- Siemens AG

- Sysmex Europe SE

- Teco Diagnostics, Inc.

- Thermo Fisher Scientific Inc.

Developing Forward-Looking Strategies and Tactical Recommendations to Enhance Market Position and Operational Excellence in Creatinine Testing

Industry leaders can capitalize on emerging opportunities by adopting a multifaceted strategic approach that aligns innovation with operational resilience. Prioritizing the expansion of point-of-care offerings will address the growing demand for immediate results in emergency and outpatient settings, while partnerships with technology providers can facilitate seamless integration of creatinine data into electronic health records and decision support tools. Concurrently, investing in local reagent production or forging long-term supply agreements will mitigate the effects of trade policy fluctuations and enhance supply chain agility.

To strengthen market position, organizations should engage proactively with regulatory bodies and professional societies to shape favorable validation guidelines and reimbursement frameworks. Collaborations with academic and research institutions can uncover new clinical applications, such as drug safety monitoring or performance optimization in athletics. Moreover, implementing sustainability initiatives in reagent manufacturing and packaging design will resonate with stakeholder expectations and support environmental stewardship goals.

Finally, companies should leverage advanced analytics to monitor global testing trends, identify underserved segments, and tailor value propositions accordingly. By combining technical excellence with robust customer support and differentiated digital services, industry leaders can secure a competitive edge and sustain long-term growth in the evolving creatinine testing landscape.

Detailing Comprehensive Research Methodology Incorporating Data Sources, Analytical Frameworks, and Validation Protocols for Credible Insights

The research methodology underpinning this analysis integrates rigorous data validation, systematic triangulation, and expert insight to ensure credibility and relevance. Secondary research comprised a comprehensive review of peer-reviewed journals, regulatory publications, company annual reports, and clinical guidelines to establish a foundational understanding of assay technologies, clinical applications, and industry trends. Concurrently, primary research involved in-depth interviews with laboratory directors, clinical pathologists, procurement managers, and technology developers to capture nuanced perspectives on market dynamics and unmet needs.

Analytical frameworks included segmentation matrices, value chain mapping, and competitive benchmarking to delineate market structure and identify key drivers. Qualitative data were synthesized through thematic analysis, while quantitative inputs underwent statistical validation to detect patterns and outliers. Data points were cross-referenced through multiple sources to mitigate biases and enhance robustness. A dedicated market intelligence team conducted iterative reviews and validation workshops with subject matter experts to refine findings and ensure alignment with real-world operational considerations.

This blended approach provides decision-makers with actionable insights that reflect both macro-level trends and granular user requirements, equipping stakeholders to navigate strategic, operational, and regulatory complexities in creatinine testing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Creatinine Test market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Creatinine Test Market, by Test Type

- Creatinine Test Market, by Technology

- Creatinine Test Market, by Product

- Creatinine Test Market, by Distribution Channel

- Creatinine Test Market, by Application

- Creatinine Test Market, by End User

- Creatinine Test Market, by Region

- Creatinine Test Market, by Group

- Creatinine Test Market, by Country

- United States Creatinine Test Market

- China Creatinine Test Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Summarizing Key Takeaways and Emphasizing the Strategic Importance of Ongoing Innovation and Collaboration in the Creatinine Testing Landscape

Across this executive summary, several key themes emerged that define the contemporary creatinine testing landscape. First, the imperative for rapid, precise assays has never been greater, driving innovation in point-of-care platforms and laboratory automation. Second, geopolitical factors and trade policy adjustments underscore the criticality of supply chain resilience and local production capabilities. Third, a multifaceted segmentation across test types, end users, technologies, applications, products, and channels reveals that tailored solutions are essential to meet diverse clinical and operational needs.

Regional disparities highlight the importance of adapting strategies to local regulatory environments, healthcare infrastructure, and market maturity. The competitive arena continues to evolve, with established players and emerging innovators vying for leadership through strategic collaborations, M&A activity, and digital offerings. Looking ahead, actionable recommendations centered on supply chain diversification, strategic regulatory engagement, and sustainability initiatives will empower companies to navigate uncertainties and capitalize on new growth avenues.

By synthesizing these insights, stakeholders are better positioned to align their investments and operational models with evolving clinical requirements and market dynamics, ensuring that creatinine testing remains a reliable, indispensable tool in safeguarding renal health and advancing patient care.

Connect with Associate Director Ketan Rohom to Gain Exclusive Access to In-Depth Creatinine Testing Market Research and Drive Strategic Growth

To delve deeper into these insights and equip your organization with a competitive edge, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will guide you through the comprehensive report’s findings and tailor recommendations to your strategic priorities in diagnostics and clinical care. Reach out today to secure exclusive access to the full analysis, uncover untapped opportunities, and accelerate your innovation journey in creatinine testing.

- How big is the Creatinine Test Market?

- What is the Creatinine Test Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?