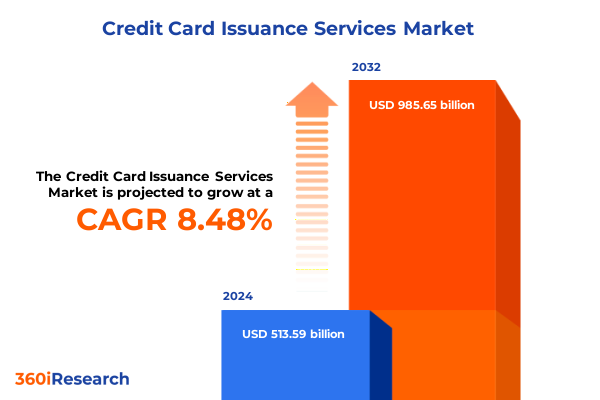

The Credit Card Issuance Services Market size was estimated at USD 555.24 billion in 2025 and expected to reach USD 600.28 billion in 2026, at a CAGR of 8.54% to reach USD 985.65 billion by 2032.

Exploring the Evolution of Credit Card Issuance Services in a Digital-First Economy to Illuminate Foundational Trends and Market Drivers

The credit card issuance services sector has undergone a remarkable transformation as traditional banking frameworks converge with advanced digital platforms. What once began as a straightforward lending mechanism has evolved into a highly integrated ecosystem where issuers collaborate with technology partners to deliver seamless customer experiences. In this digital-first economy, the interplay between user-friendly interfaces, data-driven personalization, and stringent security protocols has reshaped core service models, prompting providers to reimagine the value proposition of credit products.

Moreover, broader shifts in consumer expectations-for faster approvals, frictionless onboarding, and context-sensitive rewards-have influenced how banks, credit unions, and fintech entities craft their issuance strategies. As regulatory landscapes tighten around data privacy and disclosure standards, institutions are investing in scalable infrastructures that support real-time analytics, omnichannel engagement, and robust compliance frameworks. Ultimately, this dynamic milieu sets the stage for a new era of innovation where agility, collaboration, and customer centricity define competitive advantage.

Deciphering the Technological, Regulatory, and Consumer-Driven Transformations Redefining Credit Card Issuance Services in the Modern Financial Landscape

The financial services industry is encountering transformative shifts prompted by rapid technological advances, changing regulatory paradigms, and evolving consumer behavior. Artificial intelligence and machine learning have emerged as pivotal enablers, allowing issuers to refine credit underwriting, detect fraud with greater precision, and deliver personalized product recommendations. At the same time, open banking initiatives and application programming interfaces have facilitated seamless integrations between banks and third-party service providers, yielding innovative credit solutions that extend beyond conventional plastic cards.

From a regulatory standpoint, heightened scrutiny on transparency and fair lending practices has spurred issuers to adopt more rigorous risk management frameworks, while digital identity verification standards have accelerated the adoption of biometric and tokenization technologies. Concurrently, consumers have grown accustomed to flexible payment options such as buy-now-pay-later and embedded financing, challenging traditional reward structures and prompting providers to iterate on their loyalty schemes. In this environment, the ability to pivot swiftly in response to technological breakthroughs and policy developments is rapidly becoming a strategic imperative for issuers seeking to sustain growth.

Analyzing the Direct and Indirect Effects of United States 2025 Tariff Policies on Credit Card Production, Costs, and Service Operations Nationwide

United States tariff measures implemented in 2025 have exerted multifaceted impacts on the credit card issuance ecosystem, primarily through increased costs for raw materials and technology components sourced internationally. Issuers relying on premium metal cards and secure chip modules have experienced elevated production expenses, compelling many to evaluate the trade-offs between cost and customer experience. As a result, some providers have shifted toward alternative card materials or optimized supply chain routes to mitigate the direct financial pressures induced by new import duties.

Beyond manufacturing, tariff-driven cost adjustments have rippled through service operations, influencing the pricing of white-label issuance platforms and co-branded partnership arrangements. In response, several institutions have renegotiated vendor contracts and explored nearshoring options to preserve margin structures. These strategic realignments have underscored the importance of supply chain resilience and procurement agility, reinforcing the notion that tariff policies can catalyze broader operational realignments throughout the credit card issuance value chain.

Unveiling Key Insights from Segmentation Across Card Types, Issuer Categories, Application Use Cases, and Consumer Profiles Driving Service Differentiation

Insight into the credit card issuance market reveals nuanced differentiation when viewed through the lens of card type, where business credit cards focus on expense management tools and spend controls tailored for corporate clients, while personal credit cards emphasize consumer rewards, user-friendly digital features, and credit-building utilities. When issuer categories are considered, traditional banks continue to leverage scale and trust, credit unions differentiate through community-centric service models, and non-banking financial companies introduce agile, technology-driven platforms often characterized by rapid onboarding and innovative loyalty structures.

Examining end-use applications uncovers that balance transfers remain a strategic mechanism for issuers to attract financially savvy consumers seeking debt consolidation, whereas business expenses drive demand for integrated reporting and automation capabilities. Everyday spending and grocery purchases underscore the appeal of cash-back and tiered reward programs, while online shopping and travel and leisure categories spotlight partnerships with e-commerce ecosystems and airline alliances. Lastly, consumer type segmentation indicates that businesses prioritize tailored credit lines and spend analytics, while personal users seek intuitive mobile engagement and flexible repayment options, illustrating how a one-size-fits-all approach no longer suffices in a diversified market.

This comprehensive research report categorizes the Credit Card Issuance Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Issuers

- End-Use Applications

- Consumer Type

Highlighting Regional Dynamics and Growth Drivers across the Americas, Europe, Middle East and Africa, and Asia-Pacific Credit Card Markets

Regional dynamics paint a complex portrait of opportunity and challenge across the global credit card issuance landscape. In the Americas, established infrastructure and high consumer credit adoption support innovation in digital and mobile-first payment solutions, with Latin American markets offering growth potential through financial inclusion initiatives and partnership-driven expansion. Meanwhile, Europe, Middle East and Africa present a multifaceted regulatory mosaic-from PSD2-driven open banking in Europe to emerging digital ecosystems in the Gulf Cooperation Council-requiring issuers to adapt strategies to localized compliance requirements and consumer payment behaviors.

In contrast, the Asia-Pacific arena stands at the forefront of digital wallet integration and super-app proliferation, where rapid smartphone penetration and government-led digital identity programs facilitate accelerated adoption of virtual card issuance and real-time payment networks. Throughout these regions, collaboration between issuers, fintechs, and payment networks remains critical, as providers seek to customize offerings in line with regulatory frameworks, consumer trust paradigms, and evolving infrastructure landscapes.

This comprehensive research report examines key regions that drive the evolution of the Credit Card Issuance Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning, Innovation Portfolios, and Collaborations of Leading Credit Card Issuance Service Providers and Stakeholders

Leading providers in the credit card issuance sector are distinguished by their strategic alignment with technology partners, commitment to seamless customer experiences, and capacity to forge influential alliances. Established banks have invested heavily in upgrading legacy systems to cloud-native architectures and microservices-based issuance platforms, enhancing scalability and feature velocity. At the same time, credit unions have differentiated through localized digital services and member-centric loyalty programs, leveraging community trust to foster higher engagement rates.

Emerging non-banking financial companies have accelerated innovation cycles by integrating artificial intelligence for credit decisioning and deploying mobile-first card issuance workflows that minimize friction. In addition, co-branding collaborations-whether with retail chains, travel platforms, or fintech startups-continue to expand market reach and enrich reward ecosystems. This strategic convergence of innovation, partnership, and customer-centric design underscores how market leaders are reshaping competitive boundaries and setting new benchmarks for service excellence in credit card issuance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Credit Card Issuance Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Express Company

- ANZ Banking Group

- Banco Bradesco S.A.

- Banco Santander, S.A.

- Bank of America Corporation

- Barclays PLC

- Capital One Financial Corporation

- Citigroup Inc.

- Commonwealth Bank of Australia

- Discover Financial Services

- HSBC Holdings PLC

- ING Group

- Itaú Unibanco Holding S.A.

- JPMorgan Chase & Co.

- Lloyds Banking Group

- Mastercard International Incorporated

- Royal Bank of Canada

- Standard Chartered Bank

- Sumitomo Mitsui Financial Group

- The Bank of Nova Scotia

- Toronto-Dominion Bank

- U.S. Bancorp

- UBS Group AG

- Wells Fargo & Company

- Westpac Banking Corporation

Formulating Actionable Strategies for Industry Leaders to Navigate Competitive Pressures, Regulatory Demands, and Digital Disruption in Card Issuance

To thrive amidst intensifying competition and evolving regulatory pressures, industry leaders must embrace a multipronged approach centered on technology enablement, customer intimacy, and operational resilience. Prioritizing investments in advanced analytics and machine learning can not only refine risk management but also support hyper-personalized product recommendations and loyalty schemes that foster deeper customer relationships. Moreover, digitization of the end-to-end issuance lifecycle-from virtual card provisioning to real-time spend alerts-will be vital for reducing time-to-market and enhancing user satisfaction.

Simultaneously, issuers should forge strategic alliances with fintech innovators and payment networks to co-create differentiated offerings, while also cultivating in-house expertise in emerging standards such as tokenization and decentralized identity. Finally, building a flexible operating model that can quickly respond to tariff adjustments, supply chain disruptions, and regulatory updates will ensure long-term competitiveness. By aligning technology, partnerships, and governance frameworks, organizations can secure a sustainable edge in the rapidly evolving credit card issuance arena.

Detailing the Methodological Framework Incorporating Qualitative and Quantitative Research Approaches for Comprehensive Market Analysis

Our research methodology blends rigorous qualitative interviews with leading issuers, technology providers, and regulatory bodies alongside quantitative analysis of market behavior and consumer sentiment. Primary engagements included in-depth discussions on technology roadmaps and partnership models, complemented by surveys assessing end-user preferences for card features and channels. These insights were further validated through an extensive review of publicly available regulatory filings, industry consortium reports, and academic studies on payment innovations.

Quantitative data collection leveraged proprietary transaction-level datasets, enabling segmentation by card type, issuer category, end-use application, and consumer profile. Robust data cleansing protocols and statistical techniques were applied to ensure the integrity and reliability of findings. Ultimately, the convergence of primary expertise and secondary data sources underpins a comprehensive framework that illuminates both current market realities and future strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Credit Card Issuance Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Credit Card Issuance Services Market, by Card Type

- Credit Card Issuance Services Market, by Issuers

- Credit Card Issuance Services Market, by End-Use Applications

- Credit Card Issuance Services Market, by Consumer Type

- Credit Card Issuance Services Market, by Region

- Credit Card Issuance Services Market, by Group

- Credit Card Issuance Services Market, by Country

- United States Credit Card Issuance Services Market

- China Credit Card Issuance Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings to Drive Informed Decision-Making for Stakeholders in the Evolving Credit Card Issuance Services Ecosystem

The analysis synthesizes how digital transformation, regulatory evolution, and shifting consumer behaviors are converging to redefine credit card issuance services globally. Key observations include the rising importance of real-time analytics for risk mitigation, the strategic role of partnerships in expanding product portfolios, and the necessity of tailoring offerings to differentiated user segments and regional nuances. Collectively, these insights underscore a sector in transition-one where agility, innovation, and customer centricity will dictate future leadership.

For stakeholders seeking to capitalize on emerging opportunities, the imperative is clear: embrace a data-centric mindset, cultivate collaborative ecosystems, and reinforce operational frameworks capable of absorbing policy and market fluctuations. By internalizing these core findings, organizations can chart a resilient path forward and harness the full potential of the rapidly evolving credit card issuance landscape.

Engaging with Ketan Rohom to Access In-Depth Insightful Credit Card Issuance Services Research Tailored to Strategic Business Objectives

We appreciate your interest in obtaining a thorough analysis of the credit card issuance services landscape. To explore the full breadth of insights, case studies, and strategic guidance laid out in our comprehensive report, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Engage today to secure unparalleled market intelligence tailored to your organization’s growth objectives and stay ahead of emerging industry trends in credit card issuance services.

- How big is the Credit Card Issuance Services Market?

- What is the Credit Card Issuance Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?