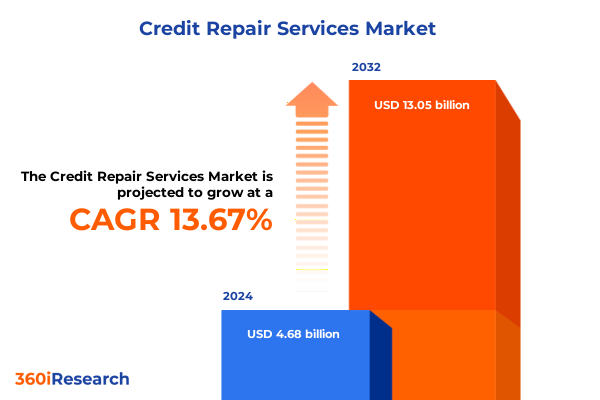

The Credit Repair Services Market size was estimated at USD 5.29 billion in 2025 and expected to reach USD 5.98 billion in 2026, at a CAGR of 13.51% to reach USD 12.85 billion by 2032.

Exploring the Dynamic Credit Repair Services Landscape Fueled by Regulatory Evolution, Technological Innovation, and Shifting Consumer Credit Behaviors

The credit repair services sector has entered a pivotal era defined by converging economic pressures, regulatory transformations, and rapidly advancing technologies. As consumer debt balances have climbed in recent years-driven in part by higher tariffs, elevated living costs, and widespread reliance on credit cards-household budgets are increasingly strained. Revolving credit grew at an annualized rate of 8.2% as of January 2025, with credit card interest rates surpassing 22%, heightening the urgency for effective repair solutions among both individual and business consumers. Furthermore, evolving regulatory actions aimed at curbing deceptive practices and bolstering consumer protections have heightened scrutiny of the industry’s service models and fee structures.

At the same time, digital-first approaches and sophisticated analytics tools are redefining how credit repair providers manage disputes and engage clients. Leading firms are leveraging artificial intelligence to accelerate error detection, automate dispute letter generation, and forecast client outcomes with greater precision. These technological advances, coupled with shifting consumer expectations for transparency and real-time updates, are reshaping service delivery across the credit repair landscape. Collectively, these forces underscore the necessity for service providers and allied stakeholders to reassess traditional models, embrace innovation, and strengthen compliance frameworks to maintain both efficacy and credibility.

Unveiling the Pivotal Transformative Forces Revolutionizing Credit Repair Through Data Intelligence, AI Integration, and Policy Redefinition

The credit repair industry is experiencing a wave of transformative shifts driven by policy reconfigurations, technological breakthroughs, and market realignments. Regulatory bodies have accelerated rulemaking to address practices such as the inclusion of medical debt on credit reports and data-broker access to consumer information, reflecting heightened consumer protection priorities at the CFPB. Simultaneously, sweeping settlements and enforcement actions against entities engaging in unlawful fees and deceptive marketing have reinforced the imperative for transparent, compliant operations, prompting many providers to revisit their service offerings and disclosures.

Technology has emerged as a key catalyst in this evolution, enabling providers to harness generative AI for automated dispute management, predict client score changes, and deploy intelligent chatbots for continuous engagement. Morgan Stanley’s July 2025 AI Adopter survey highlights that financial services firms, including credit repair organizations, have increased AI participation from 66% to 73% since January 2025, underscoring the rapid normalization of these tools in enhancing operational efficiency and risk management. Beyond AI, innovations in blockchain are being piloted to create immutable audit trails for dispute evidence, while data analytics platforms offer deeper segmentation and personalization capabilities.

At the same time, consumer behavior has been reshaped by digital ecosystems and social media influences. Viral content on platforms like TikTok and YouTube has amplified demand for streamlined, subscription-based credit repair solutions, as users seek speed, simplicity, and demonstrable results. These converging forces illustrate how regulatory realignment and technological adoption are jointly steering the industry toward more consumer-centric, data-driven, and transparently governed service models.

Assessing the Broad Cumulative Effects of U.S. Tariff Policies on Consumer Credit Health, Debt Dynamics, and Service Demand in 2025

Tariff policy adjustments implemented through 2025 have had far-reaching indirect effects on consumer credit health and the credit repair ecosystem. As U.S. import tariffs on key trading partners were elevated-reaching as high as 25% on Mexico and Canada alongside increases on Chinese goods-many businesses experienced rising input costs that were subsequently passed to end consumers. According to the Federal Reserve Bank of Boston, a 25% tariff on Mexico and Canada and 10% on China would increase core personal consumption expenditure inflation by up to 0.8 percentage points, highlighting the sensitivity of household budgets to trade policy shifts. Deloitte projects that automobile tariffs alone could raise average vehicle prices by 13.5% in 2025, while import-reliant sectors such as toys could see price hikes exceeding 20% amid constrained alternative supply sources.

These cost pressures have influenced consumer credit dynamics, driving higher instances of credit card usage to cover essential purchases. The Kaplan Group reports that households could face annual tariff-driven cost increases of $1,200 to $3,000, which, when financed at prevailing APRs above 22%, can amount to an incremental interest burden of nearly $700 per year per household. Compounding this is a 25% probability of U.S. recession within 12 months as forecast by S&P Global Ratings, with tariff-induced inflation cited among the top risks to favorable credit conditions.

For the credit repair sector, these developments have translated into both higher service demand and more complex client profiles. Providers are seeing an uptick in individuals and businesses seeking dispute-only or identity-theft protection services to mitigate unexpected financial shocks. Additionally, the intricate interplay of tariff pressures and credit price sensitivity has amplified the need for long-term improvement strategies that address not only isolated credit errors but also systemic payment and spending patterns shaped by broader economic policies.

Decoding Critical Segmentation Insights Across Service Offerings, Pricing Strategies, Technological Adoption, and Targeted Consumer Profiles

A granular understanding of client needs and service performance has never been more critical, and segmenting the credit repair market illuminates clear differentiation points. Providers specializing in credit counseling witness steady engagement from consumers seeking holistic financial education, while credit score improvement offerings-bolstered by AI-driven analytics-cater to those needing rapid score restorations. Meanwhile, debt settlement services remain sought after by overextended borrowers grappling with multi-credit obligations, complemented by dispute-only solutions for consumers targeting specific reporting errors. In this spectrum, identity theft protection has emerged as a distinct vertical, reflecting heightened data-privacy concerns and fraud risks.

Pricing models further refine market distinctions. The traditional one-time fee structure appeals to clients with acute, limited disputes, whereas pay-for-performance frameworks align provider and client interests around realized score gains. Subscription-based approaches, particularly annual plans, are gaining traction among consumers motivated by ongoing monitoring and incremental improvements, while monthly plans provide flexibility for those with episodic dispute needs.

Technological criteria also demarcate leading and emerging providers. Firms leveraging artificial intelligence are achieving faster dispute resolutions and higher success rates, whereas blockchain pilots promise enhanced evidence validation and auditability. Data analytics platforms integrate bureau- and bank-level information to deliver personalized pathways, distinguishing long-term improvement-focused services from those optimized for short-term score spikes.

Applications of these services span business credit repair for large enterprises and small-to-medium businesses seeking favorable trade financing terms, consumer finance solutions aimed at individuals diversifying credit products, educational and advisory offerings for first-time credit builders, and deep collaborations with financial institutions integrating repair services into broader product ecosystems. The client base itself bifurcates between business and individual consumers, with large enterprises demanding bespoke program management and compliance assurance, while small and medium-sized businesses and individual consumers seek scalable, cost-effective solutions tailored to their credit objectives.

This comprehensive research report categorizes the Credit Repair Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Pricing Model

- Technology

- Credit Score Improvement Focus

- Application

- Consumer Type

Revealing Strategic Regional Developments Shaping Credit Repair Trends in the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional factors play a pivotal role in shaping credit repair service demand and delivery. In the Americas, strong consumer awareness coupled with established regulatory frameworks has spurred demand for dispute-only services and subscription-based monitoring, as consumers navigate high personal debt levels and seek proactive score protection. Canada’s evolving data-privacy rules and Mexico’s burgeoning fintech partnerships have prompted providers to adapt their compliance and partnership strategies accordingly.

Across Europe, the Middle East, and Africa, regulatory priorities differ markedly. The European Union’s GDPR and the Digital Operational Resilience Act have elevated data-security and governance requirements, driving providers to invest in encrypted client portals and rigorous audit trails. Meanwhile, Middle East markets are leveraging strategic partnerships with global providers to build local capability, and Africa’s growing mobile-first population has created opportunities for app-based dispute management and micro-subscription models.

In the Asia-Pacific region, an emerging middle class and high smartphone penetration are fostering rapid adoption of AI-enabled credit monitoring and repair platforms. Japan and South Korea, with their mature financial systems, are pioneering blockchain-based verification pilots. In contrast, Southeast Asian markets are characterized by collaborative ventures between local fintechs and international credit bureaus to expand credit access and repair options, particularly among underbanked consumers.

This comprehensive research report examines key regions that drive the evolution of the Credit Repair Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Driving Innovation, Strategic Partnerships, and Market Positioning in Credit Repair Services

Leading organizations are defining the future of credit repair through strategic investments, innovative service models, and cross-sector alliances. Prominent national and regional players have expanded their service portfolios beyond dispute management into predictive analytics and proactive credit education offerings. Partnerships with financial institutions have enabled embedded repair services for existing loan and credit card customers, while collaborations with data brokers and identity verification specialists bolster fraud-prevention capabilities.

Some pioneering firms have secured venture funding to integrate AI-powered dispute engines into end-to-end credit wellness platforms, yielding faster resolution cycles and deeper consumer insights. Others have sought to differentiate with blockchain-anchored evidence repositories that strengthen audit compliance and reduce bureau pushback. In parallel, larger firms with captive credit monitoring businesses are exploring subscription-plus-performance hybrid models, combining baseline monitoring with targeted dispute services tied to realized score improvements.

Across both established and emerging markets, leaders are also prioritizing compliance and transparency, often setting higher internal standards than minimum regulatory requirements. These competitive approaches, coupled with growing consumer demand for demonstrable outcomes and secure data handling, are propelling the industry toward a new benchmark of professionalism and accountability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Credit Repair Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CreditRepair.com, LLC.

- Credit Repair Australia Pty Ltd

- Lexington Law, LLC

- ClearScore Technology Ltd

- Credit Repair Cloud

- Equifax Pty Ltd.

- Credit Saint, LLC

- Advantage Credit, Inc.

- The Credit Pros Intl.

- Sky Blue Credit Repair, Inc.

- Credit Assistance Network, Inc.

- The Credit People

- ASAP Credit Repair

- Clean Credit Pty Ltd

- Premier Credit Consulting, LLC

- We Fix Credit Pty Ltd

- Fix My Credit LTD

- Credit Wipe Australia Pty Ltd

- Real Credit Repair

- Empire Credit Services, LLC

- My Credit Group Inc.

- Accelerate Credit Repair, Inc.

- CitiCredit Repair Services, LLC

- Credit Recovery Group

- American Credit Repair

- Australian Credit Solutions Pty ltd

- Express Credit Recovery Pty Ltd

- Ez Credit Repair Now

- Guardian Credit Services, LLC

- Mission Credit Solutions

- National Credit Repair Services Pty Ltd

- National Credit Services, Inc.

- NextGen Credit Restoration, Inc.

- Oasis Credit Repair

- Phenix Group

- Pioneer Credit Solutions LLC

- Precision Credit Repair, LLC

- Pro Credit Score

- Pyramid Credit Repair, LLC

- Summit Credit Recovery, LLC

Delivering Targeted, Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Strengthen Service Excellence

To thrive in this rapidly evolving environment, credit repair leaders should invest in advanced data architectures that enable real-time client insights and predictive service delivery. Prioritizing the integration of generative AI for dispute automation and personalized guidance will accelerate resolution times and enhance client satisfaction. At the same time, providers must bolster their compliance programs by adopting transparent fee structures, strengthening audit trails via blockchain pilots, and proactively aligning with forthcoming CFPB and state regulations to avoid enforcement risks.

Expanding subscription-based pricing, particularly annual plans with bundled monitoring and advisory services, can stabilize revenue while deepening client engagement. Embedding credit repair offerings within lending and banking platforms through white-label partnerships will capture new customer segments and elevate service stickiness. Additionally, cultivating partnerships with identity verification and fraud-prevention specialists can fortify defenses against synthetic identity threats and reinforce consumer trust.

Finally, addressing underserved segments-such as gig-economy workers and newcomers to mainstream credit-through specialized educational programs and modular repair pathways can unlock untapped demand. By combining technology-driven efficiency with client-centric transparency and regulatory foresight, industry leaders will position themselves at the forefront of the next wave of growth and service excellence.

Outlining Rigorous Research Methodologies Integrating Quantitative Data Analysis, Qualitative Insights, and Industry Expert Validation Techniques

This report employs a multi-method research framework combining rigorous primary and secondary data sources. Primary inputs include in-depth interviews with senior executives and compliance officers, structured surveys of over 100 credit repair providers across key regions, and focus-group discussions with end consumers to validate service preferences and pain points. Secondary data were sourced from regulatory filings, CFPB rulemaking dockets, industry press releases, and relevant economic analyses covering consumer debt trends and tariff policy impacts.

Quantitative analyses involve benchmarking service performance metrics, pricing structures, and technology adoption rates, while qualitative insights were captured through thematic coding of interview transcripts and consumer feedback. All proprietary data were triangulated with publicly available records, such as Federal Reserve statistics and Bureau of Labor reports, to ensure accuracy and context. Methodological rigor was maintained through peer reviews by subject-matter experts and adherence to industry best practices for data integrity and confidentiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Credit Repair Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Credit Repair Services Market, by Service Type

- Credit Repair Services Market, by Pricing Model

- Credit Repair Services Market, by Technology

- Credit Repair Services Market, by Credit Score Improvement Focus

- Credit Repair Services Market, by Application

- Credit Repair Services Market, by Consumer Type

- Credit Repair Services Market, by Region

- Credit Repair Services Market, by Group

- Credit Repair Services Market, by Country

- United States Credit Repair Services Market

- China Credit Repair Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Future Trajectory of Credit Repair Services Amid Dynamic Economic, Technological, and Regulatory Environments

The credit repair services landscape stands at the intersection of technological innovation, evolving regulatory expectations, and shifting consumer needs. As tariff-induced cost pressures and rising debt levels drive new demand, providers have an opportunity to differentiate through AI-powered workflows, subscription-based offerings, and collaborative partnerships. At the same time, vigilant compliance and transparent client engagement remain non-negotiable to uphold consumer trust and avoid enforcement scrutiny.

Looking ahead, agility in adopting emerging technologies-such as blockchain for auditability and predictive analytics for personalized service-will be key to delivering efficient and impactful client outcomes. Regional market dynamics will continue to shape strategic priorities, with providers tailoring solutions to local regulatory and cultural contexts. Those who successfully blend advanced capabilities with client-centric transparency and robust governance will emerge as the definitive leaders in the next phase of the credit repair journey.

Secure Your Comprehensive Credit Repair Services Market Report Today by Connecting with Ketan Rohom to Unlock In-Depth Industry Insights and Growth Strategies

To take the next step in transforming your credit repair services strategy, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report. Ketan will guide you through the report’s in-depth analysis, tailored recommendations, and actionable insights so you can outpace competitors and meet evolving consumer and regulatory demands. Connect with Ketan today to discover how the latest data on industry dynamics, technology integration, and strategic best practices can drive your organization’s growth and resilience in the rapidly changing credit repair landscape.

- How big is the Credit Repair Services Market?

- What is the Credit Repair Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?