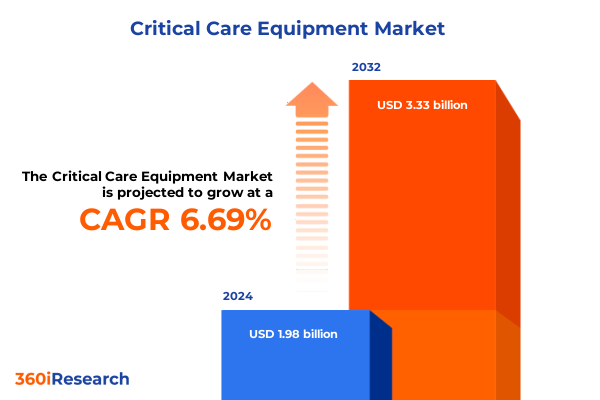

The Critical Care Equipment Market size was estimated at USD 2.11 billion in 2025 and expected to reach USD 2.24 billion in 2026, at a CAGR of 6.77% to reach USD 3.33 billion by 2032.

Unlocking the Critical Care Equipment Landscape Through Strategic Insights Into Growth Drivers Market Dynamics and Future Industry Trajectories

The critical care equipment sector stands at the nexus of technological innovation and evolving clinical demands, driving a need for comprehensive understanding of its multifaceted dynamics. This analysis embarks on an exploration of the foundational factors shaping the market, offering stakeholders an informed vantage point from which to navigate opportunities and challenges alike.

Beginning with an overview of core definitions and the scope of devices integral to contemporary intensive care settings, our introduction delineates the parameters of the study. By framing the examination within the context of broader healthcare priorities-patient safety, operational efficiency, and resource optimization-it becomes clear how strategic insights into critical care equipment can guide decision making at both organizational and policy levels.

Building on this contextual foundation, the study outlines the objectives and methodological rigor underpinning the analysis. Emphasis is placed on delivering an executive summary that encapsulates key findings without delving into numerical market estimations. The stage is set for deeper dives into transformative trends, regulatory impacts, segmentation nuances, and actionable recommendations, ensuring that readers gain clarity on the forces redefining the future of critical care.

Transformational Technological and Regulatory Shifts Revolutionizing Critical Care Equipment Delivery Patient Outcomes and Operational Efficiencies

Over the past decade, technological breakthroughs and regulatory realignments have converged to reshape the critical care equipment landscape in profound ways. Advanced digital integration, powered by the Internet of Medical Things (IoMT), has fostered real-time patient monitoring capabilities that extend beyond traditional ward boundaries. This transition not only enhances clinicians’ situational awareness but also enables earlier intervention, reducing the incidence of adverse events and length of stay.

Concurrently, artificial intelligence and machine learning applications have begun to augment diagnostic precision and predictive analytics. By leveraging large datasets, these tools offer nuanced insights into patient trends, tailoring ventilator settings and infusion protocols to individual physiological profiles. The convergence of connectivity and smart algorithms underscores a shift from reactive care to proactive management, fundamentally transforming operational paradigms.

Meanwhile, tightening regulatory frameworks-driven by an emphasis on cybersecurity, interoperability standards, and evidence-based performance validation-have compelled manufacturers to adopt more rigorous development processes. In parallel, growing emphasis on infection prevention has accelerated the adoption of disposable components, balancing clinical efficacy with safety considerations. Together, these transformative shifts highlight a sector in dynamic evolution, poised for continued innovation and heightened scrutiny.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Supply Chains Manufacturing Costs and Strategic Sourcing Decisions

The imposition of new United States tariffs in 2025 has elicited far-reaching implications for the critical care equipment supply chain. Import duties on key components and finished devices have elevated landed costs, prompting many health systems and manufacturers to reassess procurement strategies. In some instances, hospitals have experienced budgetary pressures as equipment acquisitions incur higher upfront expenditures.

As a consequence, original equipment manufacturers have accelerated efforts to localize production or diversify component sourcing. These strategic pivots aim to mitigate tariff‐induced cost escalations while preserving supply continuity. Additionally, some global players have negotiated regional assembly partnerships, leveraging free trade zones and bilateral agreements to circumvent punitive duties.

Looking ahead, ongoing policy dialogues between industry associations and government agencies may yield targeted exemptions for essential medical devices. Such outcomes could alleviate immediate strain on healthcare providers and support the domestic manufacturing workforce. However, uncertainty remains regarding the duration and scope of tariff measures, underscoring the importance of flexible procurement frameworks and adaptive supply chain management for all stakeholders.

Comprehensive Analysis of Critical Care Equipment Market Segmentation Revealing Product Mobility and Usage Patterns Driving Clinical Application Scenarios

A detailed segmentation analysis reveals the nuanced architecture of the critical care equipment market, differentiated by both product typology and mobility attributes. Within the realm of capital equipment, the landscape is dominated by sophisticated systems such as defibrillators, infusion pumps, patient monitors, and ventilators. Defibrillator offerings bifurcate into automated external and manual variants, each addressing distinct emergency response workflows. Infusion pump portfolios span elastomeric, syringe, and volumetric platforms, accommodating a spectrum of therapeutic delivery requirements. Patient monitoring systems further diversify into multi-parameter and single-parameter configurations that align with intensive and step-down care environments. Moreover, the dichotomy between invasive and non-invasive ventilators continues to shape critical respiratory support, with innovation focused on enhancing patient comfort and synchrony with machine cycles.

In parallel, disposable equipment represents another pillar of market segmentation, encompassing catheters, oxygen masks, and syringes paired with needles. These single-use items are pivotal for infection control and streamlined clinical workflows, driving steady demand across acute care settings. Transitioning to mobility considerations, fixed installations-whether standalone or wall-mounted-are favored in traditional intensive care units, supporting centralized monitoring hubs. Conversely, portable solutions such as cart-mounted devices and handheld instruments expand the reach of critical care, facilitating rapid response in emergency departments, transport scenarios, and remote care stations.

Altogether, this segmentation framework illuminates how product type and mobility converge to inform procurement priorities, clinical application, and ultimately patient outcomes across diverse care settings.

This comprehensive research report categorizes the Critical Care Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mobility

- Distribution Channel

- End User

Regional Dynamics Shaping Adoption and Investment Trends in Critical Care Equipment Across Americas EMEA and Asia Pacific Healthcare Ecosystems

Regional variations significantly influence the trajectory of critical care equipment adoption, with Americas, Europe Middle East & Africa, and Asia-Pacific each exhibiting distinct market characteristics. In the Americas, robust healthcare infrastructure and well-established reimbursement models have accelerated uptake of advanced monitoring and life-support devices. High per-capita healthcare expenditure and strong emphasis on early intervention underpin the procurement of next-generation capital equipment.

By contrast, the Europe Middle East & Africa region grapples with heterogeneous regulatory landscapes and variable public funding mechanisms. While Western Europe has demonstrated steady integration of digital health solutions, certain Middle Eastern markets are rapidly scaling intensive care capacity to meet emerging public health imperatives. Resource constraints in segments of Africa have fueled demand for cost-effective disposable items, underscoring the importance of adaptable supply chains.

Asia-Pacific stands out for its accelerated growth momentum, driven by rising healthcare investments and government initiatives to enhance critical care infrastructure. In nations with burgeoning middle classes, the prevalence of chronic diseases and demographic shifts are propelling demand for sophisticated devices. At the same time, local manufacturing hubs are expanding, supported by favorable policies designed to reduce reliance on imports and bolster regional self-sufficiency.

These regional insights illuminate how variations in funding, policy, and infrastructure shape equipment adoption pathways and inform strategic market entry and expansion decisions.

This comprehensive research report examines key regions that drive the evolution of the Critical Care Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Organizations Driving Innovation Strategic Partnerships and Competitive Dynamics in the Global Critical Care Equipment Industry

The global critical care equipment sector is defined by a competitive ecosystem of established multinationals and emerging niche innovators. Key industry players have intensified their focus on digital transformation, integrating AI-enabled analytics and cloud-based platforms to deliver end-to-end patient surveillance solutions. Collaborations between device manufacturers and software developers have emerged as a pivotal strategy, enhancing interoperability and aligning product roadmaps with evolving clinical protocols.

Strategic partnerships, including co-development agreements and joint ventures, are reshaping competitive dynamics. By pooling R&D resources, leading organizations are accelerating time-to-market for advanced ventilator modules and next-generation defibrillator algorithms. Meanwhile, some players have acquired specialty disposables firms to fortify their consumables portfolios, securing recurring revenue streams and broadening their market reach across acute care settings.

In addition, sustainability considerations are prompting companies to innovate around reusable components and eco-friendly materials, aligning product development with institutional ESG goals. Those that leverage modular design principles not only reduce environmental impact but also offer scalable solutions that adapt to diverse clinical environments. Through these combined efforts, the sector’s leading stakeholders are cultivating competitive differentiation while anticipating the future needs of healthcare providers worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Critical Care Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Danaher Corporation

- Drägerwerk AG & Co. KGaA

- Fresenius SE & Co. KGaA

- GE HealthCare Technologies Inc.

- Johnson & Johnson

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Mindray Medical International Limited

- Nihon Kohden Corporation

- ResMed Inc.

- Roche Holding AG

- Siemens Healthineers AG

- Stryker Corporation

Actionable Strategic Recommendations Guiding Industry Leaders to Navigate Supply Chain Disruptions Regulatory Challenges and Technological Integration Trends

Industry leaders must adopt a multifaceted strategy to navigate supply chain volatility and evolving regulatory landscapes. Investing in diversified sourcing networks will mitigate the risk of import duty shocks and component shortages, ensuring continuity of critical care device availability. Concurrently, establishing regional assembly hubs can reduce lead times and foster closer collaboration with local healthcare institutions.

Embracing digital interoperability standards and cybersecurity best practices is essential to enhance device connectivity and safeguard patient data. By participating in industry consortia, organizations can shape vendor-neutral protocols that advance seamless communication across multi-vendor ecosystems. Additionally, leveraging predictive maintenance powered by real-time telemetry can optimize asset utilization and minimize unplanned equipment downtime.

Moreover, forging strategic alliances with hospitals, research institutions, and technology partners will accelerate co-innovation of patient-centric solutions. Incorporating modular design frameworks allows for rapid customization and scalability, addressing diverse clinical workflows across regions. Finally, embedding sustainability metrics into product development cycles not only aligns with institutional ESG mandates but also appeals to a growing segment of environmentally conscious healthcare purchasers. Implementing these actionable recommendations will position industry leaders to capitalize on emerging opportunities and fortify their market leadership.

Rigorous Research Methodology Emphasizing Data Triangulation Primary Expert Engagement and Robust Secondary Analysis Protocols

The research methodology underpinning this report combines rigorous primary and secondary approaches to deliver a holistic perspective on the critical care equipment market. Primary insights were garnered through structured interviews with clinical specialists, biomedical engineers, and procurement executives, providing firsthand context on operational priorities and technology adoption barriers.

Complementing these engagements, secondary analysis was conducted across a curated selection of peer-reviewed journals, regulatory filings, industry whitepapers, and relevant government publications. Each data point underwent a triangulation process to validate consistency and accuracy, ensuring that conclusions reflect the latest market realities without reliance on proprietary estimation models.

Segmentation variables were defined through an iterative review of device classifications and mobility use cases, aligning with prevailing clinical taxonomies. Regional categorizations correspond to standard healthcare zones, facilitating comparative analysis across Americas, Europe Middle East & Africa, and Asia-Pacific. Throughout the process, quality control measures, including expert peer review and data integrity audits, were employed to uphold methodological rigor. This comprehensive approach ensures that findings and recommendations are robust, transparent, and directly applicable to strategic decision marking within the critical care equipment domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Critical Care Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Critical Care Equipment Market, by Product Type

- Critical Care Equipment Market, by Mobility

- Critical Care Equipment Market, by Distribution Channel

- Critical Care Equipment Market, by End User

- Critical Care Equipment Market, by Region

- Critical Care Equipment Market, by Group

- Critical Care Equipment Market, by Country

- United States Critical Care Equipment Market

- China Critical Care Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings and Insights to Illuminate Future Pathways and Strategic Imperatives in the Critical Care Equipment Sector

This executive summary has synthesized the sector’s pivotal developments, from technological breakthroughs and regulatory shifts to supply chain realignments and segmentation insights. The exploration of 2025 tariff impacts underscores the importance of agile sourcing strategies and regional production capabilities in maintaining affordability and continuity of critical care equipment.

Segmentation analysis has elucidated how capital and disposable product categories intersect with fixed and portable deployment modalities, guiding procurement priorities and clinical workflows. Regional perspectives have further highlighted the heterogeneity of adoption drivers across Americas, Europe Middle East & Africa, and Asia-Pacific, informing tailored market entry and expansion strategies.

Competitive profiling has revealed a landscape where digital integration, strategic alliances, and sustainable design principles are increasingly differentiating leading players. Against this backdrop, the recommendations provided offer a roadmap for mitigating risks, accelerating innovation, and reinforcing market positioning.

Ultimately, the insights contained herein equip stakeholders with a clear understanding of current dynamics and future imperatives, enabling informed decision making and strategic planning. By embracing the outlined opportunities and addressing identified challenges, organizations can shape the evolution of critical care delivery and secure a competitive edge in a rapidly advancing industry.

Empowering Decision Makers with Exclusive Access to In Depth Market Intelligence Through Personalized Consultation with a Senior Sales and Marketing Executive

For a bespoke consultation and to secure privileged access to the full critical care equipment market intelligence report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. This personalized dialogue will enable you to explore granular insights, clarify specific queries, and unlock tailored strategies that align with your organizational objectives. Leveraging this opportunity will equip your team with actionable data and expert guidance needed to drive innovation, optimize procurement, and capitalize on emerging opportunities across the critical care equipment landscape.

- How big is the Critical Care Equipment Market?

- What is the Critical Care Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?