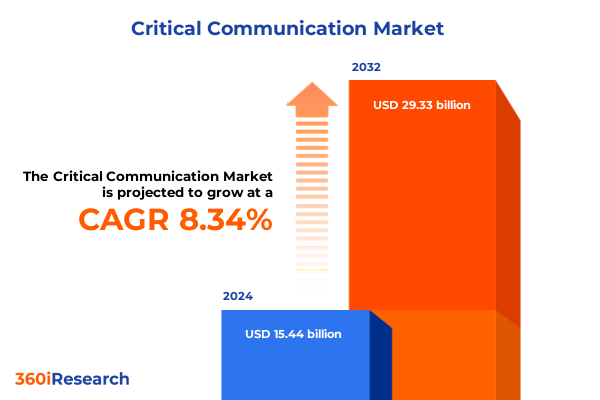

The Critical Communication Market size was estimated at USD 16.65 billion in 2025 and expected to reach USD 17.97 billion in 2026, at a CAGR of 8.42% to reach USD 29.33 billion by 2032.

Positioning Critical Communications at the Crossroads of Technological Evolution and Geopolitical Uncertainty to Drive Strategic Decision Making

In an era defined by rapid technological breakthroughs and mounting geopolitical tensions, critical communications networks serve as the backbone of public safety, defense operations, and industrial continuity. Stakeholders across government agencies, private enterprises, and first-responder organizations increasingly demand robust, scalable, and secure connectivity solutions that deliver real-time data exchange under the most challenging conditions. Against this backdrop, the integration of cloud-native architectures, edge computing, and next-generation radio technologies is transcending legacy constraints, reshaping expectations, and elevating the strategic importance of resilient communication infrastructures.

This executive summary provides a clear lens into the forces shaping the critical communications landscape, spotlighting transformative technological shifts, regulatory impacts, and evolving competitive dynamics. By synthesizing qualitative expert interviews, primary survey data, and secondary intelligence from leading industry bodies, the analysis underscores emerging value pools and anticipates areas of competitive advantage. Decision-makers will gain actionable insights into how to navigate supply chain complexities, optimize technology portfolios, and align with regulatory imperatives to maintain operational readiness and mission success.

Embracing Paradigm Shifts in Connectivity Infrastructure as Emerging Technologies Redefine Mission-Critical Network Architectures

The critical communications ecosystem is undergoing a fundamental metamorphosis fueled by converging innovation vectors. Hybrid networking paradigms that seamlessly combine traditional land mobile radio systems with broadband LTE and private 5G deployments are dismantling historical silos, delivering unprecedented capacity for voice, video, and data convergence. Simultaneously, the ascendancy of cloud-native network functions and containerized application stacks is enabling agile software rollouts, scalable orchestration, and automated updates, which collectively shorten development cycles and facilitate rapid feature deployment.

Meanwhile, advancements in artificial intelligence–powered threat detection and network performance analytics are empowering operators with near–real-time visibility into spectrum utilization, user mobility patterns, and security posture. These capabilities not only bolster network resilience against cyberintrusions and physical disruptions but also lay the groundwork for predictive maintenance and autonomous fault remediation. As organizations increasingly embrace digital twinning and augmented reality overlays for field operations, the imperative for ultra-reliable low-latency communications intensifies, driving heightened R&D investment and collaboration between network vendors and end users.

Unpacking the Ripple Effects of Recent Tariff Policies on Hardware Procurement Supply Chains and Service Delivery Efficiency Across North America

In early 2025, the United States enacted a suite of tariffs targeting imported critical communications components, including ruggedized radios, specialized antennas, and certain semiconductor elements. These trade measures, aimed at bolstering domestic manufacturing while addressing strategic supply chain vulnerabilities, have led to an average cost increase of approximately 12 percent for frontline hardware procurements. The ripple effect of these price escalations has prompted network operators and system integrators to reevaluate sourcing strategies, accelerate qualification of alternative suppliers, and intensify negotiations on long-term contracts to mitigate budgetary impacts.

Beyond hardware, service providers are encountering higher input costs for managed network maintenance and spectrum management solutions, given the tariff-induced price adjustments on diagnostic equipment and software-defined radio platforms. This cumulative financial pressure has catalyzed a shift toward modular upgrade frameworks that decouple hardware refresh cycles from software licenses, enabling cost amortization over longer operational lifecycles. Furthermore, to preserve backward compatibility and protect existing capital investments, market participants are forging strategic partnerships with domestic OEMs and contract manufacturers to localize component production and streamline compliance with import regulation.

Revealing Actionable Market Segmentation Insights That Illuminate Demand Drivers Across Technology Solutions and Industry Verticals

Segmentation analysis reveals distinct adoption patterns based on solution type, technology framework, end-use verticals, network infrastructure models, and application domains. Hardware continues to represent the majority share of initial investment, yet services expertise and software-defined tools are emerging as critical differentiators for ongoing network optimization. Hybrid systems that integrate mission-critical voice with broadband mobile data are gaining traction alongside established land mobile radio offerings, while LTE solutions serve as a bridge toward fully realized private broadband networks. Organizations in defense and military operations prioritize ultra-secure, hardened architectures, whereas industrial and manufacturing entities focus on seamless interoperability and predictive maintenance. In mining and energy sectors, ruggedized connectivity and real-time surveillance capabilities drive demand for end-to-end managed services. Transportation agencies are aligning with public-private partnership models to expand network coverage, and utility operators are implementing scalable remote monitoring solutions for critical asset tracking. Across network infrastructures, private networks are increasingly favored for secure localized deployments, while public networks remain essential for wide-area coverage and interoperability. Within application scopes, command and control communications underpin mission effectiveness, emergency and disaster response functions leverage real-time surveillance integrations, and remote operations use embedded asset tracking to enhance site safety protocols.

This comprehensive research report categorizes the Critical Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Technology

- Network Type

- Deployment Type

- Application

- End-Use Industry

- Distribution Channel

Identifying Regional Dynamics Shaping Critical Network Deployment Strategies Amid Diverse Regulatory and Economic Landscapes Globally

Regional dynamics continue to shape critical communications priorities as the Americas, Europe Middle East and Africa, and Asia Pacific navigate divergent regulatory frameworks, investment climates, and technological maturity curves. In the Americas, government initiatives to modernize public safety networks and bolster domestic manufacturing supply chains have spurred robust private network rollouts, particularly in metropolitan areas vulnerable to natural disasters. Meanwhile, EMEA region stakeholders balance stringent data privacy regulations with accelerated adoption of hybrid cloud models, resulting in a proliferation of managed service contracts and multi-vendor ecosystem partnerships. Asia Pacific markets exhibit rapid uptake of private LTE and 5G deployments within industrial clusters, driven by aggressive infrastructure investment programs and national focus on Industry 4.0 imperatives.

Cross-regional interoperability standards and global spectrum harmonization efforts are progressively reducing market fragmentation, yet capital allocation remains tightly linked to localized risk assessments and sovereign security considerations. End-user agencies in each region continue to seek scalable solutions that accommodate multifunctional use cases-from emergency response coordination to critical asset maintenance-underscoring the universal demand for resilient, low-latency networks that can adapt to both urban and remote operational theaters.

This comprehensive research report examines key regions that drive the evolution of the Critical Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Market Players Strategies Highlighting Innovation Partnerships and Competitive Positioning in Critical Communications Ecosystem

Key industry participants are extending their competitive moats through novel partnerships, targeted acquisitions, and platform-centric innovation. Leading network infrastructure vendors are integrating advanced edge computing capabilities into their hardware portfolios, while software providers focus on open API ecosystems to facilitate cross-platform interoperability. Service integrators are embedding AI-driven analytics within managed offerings to deliver predictive insights and automated network optimization. In parallel, defense-focused solution providers are leveraging secure enclave technologies and quantum-resistant encryption modules to meet stringent security requirements of government contracts. Collaborative alliances between chipset manufacturers and radio system designers are accelerating time-to-market for next-generation devices, and start-up consortia are challenging incumbents by introducing specialized solutions for critical asset tracking and emergency communications. These strategic maneuverings underscore a broader industry trend toward holistic, end-to-end solutions that transcend point offerings and deliver measurable operational outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Critical Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Ascom Holding AG

- AT&T Inc.

- BAE Systems plc

- Barrett Communications Pty Ltd

- Belden Inc.

- Cisco Systems, Inc.

- Cobham Limited by Eaton Corporation

- Elbit Systems Ltd.

- ENENSYS Technologies SA

- Ericsson AB

- Eviden SAS

- Filtronic plc

- GatesAir, Inc.

- GE Vernova Inc.

- General Dynamics Corporation

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Inmarsat plc

- JVCKENWOOD Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Mentura Group Oy by Modirum

- Motorola Solutions, Inc.

- Moxa Inc.

- NEC Corporation

- Nokia Corporation

- Northrop Grumman Corporation

- OMRON Corporation

- Raytheon Technologies Corporation

- Rockwell Automation, Inc.

- Rohde & Schwarz GmbH & Co. KG

- Secure Land Communications SA

- Siemens AG

- Simoco Wireless Solutions Ltd

- Tait Communications Ltd

- TE Connectivity Ltd

- Telstra Corporation Ltd

- Thales S.A.

- Zebra Technologies Corporation

- Zenitel NV.

Delivering Targeted Strategic Recommendations to Navigate Disruption Seize Growth Opportunities and Enhance Network Resilience

To thrive amid rising component costs, evolving standards, and intensifying competition, industry stakeholders must adopt a multi-pronged strategic approach. First, incorporating dual-sourcing models and flexible supply agreements can shield procurement pipelines from tariff shocks and geopolitical disruptions. Next, investing in modular, software-upgradable hardware architectures will extend lifecycle value and facilitate incremental feature rollouts without wholesale replacements. In addition, forging ecosystem partnerships that combine network, application, and analytics providers will enrich service portfolios and deepen customer lock-in. Organizations should also prioritize compliance-driven design practices, integrating privacy and security by default to address regulatory scrutiny across markets. Finally, developing scalable training programs and cross-organizational governance structures will ensure that technical innovations translate into field-ready capabilities and operational excellence.

Outlining a Rigorous Mixed Methodology That Integrates Quantitative Data Analysis and Qualitative Expert Validation for Robust Insights

This research leverages a mixed methodology framework integrating primary and secondary data streams to ensure both breadth and depth of insights. Quantitative analysis encompasses a structured survey of over 150 C-level and operational decision-makers across government and private sectors, coupled with transactional data from leading procurement registries. Qualitative validation is provided by in-depth interviews with domain experts, including network architects, security analysts, and supply chain specialists. Secondary intelligence sources include publicly available regulatory filings, standardization body publications, and equipment certification records. Data triangulation techniques ensure consistency across diverse inputs, while gap analysis identifies areas requiring further investigation. Rigorous quality controls, such as inter-coder reliability checks and outlier detection algorithms, reinforce the integrity of findings and support actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Critical Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Critical Communication Market, by Solution Type

- Critical Communication Market, by Technology

- Critical Communication Market, by Network Type

- Critical Communication Market, by Deployment Type

- Critical Communication Market, by Application

- Critical Communication Market, by End-Use Industry

- Critical Communication Market, by Distribution Channel

- Critical Communication Market, by Region

- Critical Communication Market, by Group

- Critical Communication Market, by Country

- United States Critical Communication Market

- China Critical Communication Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings into a Cohesive Narrative Emphasizing Market Imperatives and Strategic Imperatives for Stakeholder Alignment

The convergence of advanced networking technologies, tariff-driven supply chain realignments, and evolving end-user requirements underscores the transformative trajectory of the critical communications market. Key takeaways highlight the imperative for adaptable architectures that bridge legacy systems with next-gen broadband capabilities, the need for strategic partnerships to mitigate cost pressures, and the universal demand for resilient, secure deployments that can scale across diverse operational environments. By aligning procurement strategies with modular design principles, adopting data-centric service models, and leveraging regional synergies, organizations can not only safeguard mission-critical operations but also unlock new value through enhanced situational awareness and operational agility.

This cohesive narrative serves as a compass for stakeholders seeking to navigate complexity, prioritize investments, and cultivate competitive advantage in an increasingly interconnected world. It affirms that success will favor those who integrate technological innovation with strategic foresight, operational discipline, and a relentless focus on secure, reliable communications.

Engage with the Associate Director of Sales and Marketing to Expedite Access Personalize Insights and Secure Comprehensive Market Intelligence Today

To explore a tailored walkthrough of this comprehensive critical communications market research report and to discuss bespoke licensing options, reach out directly to Ketan Rohom. As the Associate Director of Sales and Marketing, Ketan brings deep expertise in aligning research frameworks with organizational priorities and can guide you through sample data sets, custom dashboards, and enterprise-wide access models. Whether your focus is on capitalizing on tariff-induced supply chain shifts, accelerating private network rollouts, or benchmarking competitive strategies, Ketan will ensure you receive the insights that matter most to your strategic objectives. Elevate your decision-making with timely, validated market intelligence-connect with Ketan Rohom today to secure your copy and unlock a competitive edge.

- How big is the Critical Communication Market?

- What is the Critical Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?