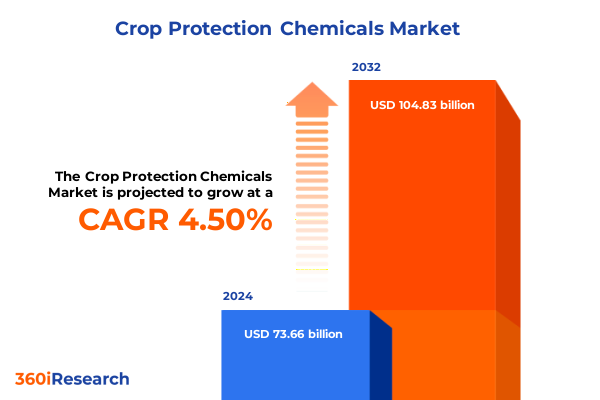

The Crop Protection Chemicals Market size was estimated at USD 77.06 billion in 2025 and expected to reach USD 80.21 billion in 2026, at a CAGR of 4.49% to reach USD 104.83 billion by 2032.

Setting a Forward-Looking Foundation for Sustainable and Innovative Crop Protection Strategies Amidst Evolving Agricultural Challenges

In an era marked by evolving agronomic challenges and ever-increasing demands for sustainable food production, understanding the complex terrain of crop protection chemicals has never been more critical. As global populations continue to grow and climate variability exerts pressure on yield stability, farmers and agribusinesses alike are seeking innovative solutions that balance efficacy with environmental stewardship. This introduction establishes the foundation for a comprehensive exploration of the market dynamics, highlighting the interplay between technological advances, regulatory landscapes, and emerging threats that collectively shape strategic decision-making processes.

By situating chemical crop protection within the broader context of integrated pest management and sustainable agriculture, this analysis underscores the necessity of adaptive strategies. The historic reliance on conventional synthetic actives is being reexamined in favor of hybrid approaches that incorporate biological formulations and precision application techniques. With supply chain resilience and cost volatility climbing the list of concerns, stakeholders from multinational corporations to regional cooperatives require deep insights to calibrate investment priorities and R&D initiatives. The subsequent sections will delve into transformative shifts, tariff impacts, segmentation layers, and regional nuances, equipping industry leaders with the guidance needed to navigate an increasingly complex marketplace.

Uncovering Pivotal Technological Regulatory and Sustainability Shifts Redefining Strategic Crop Protection Chemical Landscape

Across the crop protection chemicals landscape, a wave of transformative shifts is redefining how products are developed, regulated, and deployed. Breakthroughs in microbial and biochemical research are yielding natural oil and pheromone-based pest deterrents that reduce environmental footprints while maintaining robust efficacy. Concurrently, advances in formulation science-ranging from water dispersible granules to suspension concentrates-enable more precise delivery of active ingredients, minimizing off-target exposure and boosting cost-effectiveness. These technological strides are complemented by the rise of digital agriculture platforms, where data analytics and remote sensing unlock real-time insights into pest dynamics and application optimization.

Regulatory frameworks are also undergoing substantive recalibration. In response to public demand for safer and more sustainable agronomic inputs, agencies are tightening approval pathways for synthetic chemistries while streamlining evaluation processes for biological alternatives. This shift encourages the harmonization of standards across major markets, yet creates compliance challenges for products reliant on multi-jurisdictional registrations. Meanwhile, the integration of predictive modeling and artificial intelligence is revealing new opportunities to anticipate pest resistance and adapt application protocols accordingly. As a result, companies that embrace these converging trends-sustainability, digitalization, and regulatory agility-are poised to capture disproportionate value and drive the next wave of portfolio innovation.

Evaluating the Comprehensive Effects of 2025 United States Tariff Measures on Crop Protection Chemical Trade and Innovation Channels

The United States’ announcement of adjusted tariff measures on key agricultural chemical imports in 2025 has had a cascading effect across the crop protection sector. By imposing additional duties on selected raw materials and active ingredient precursors, domestic manufacturers face elevated input costs that have put pressure on profit margins. These changes have spurred a strategic pivot toward reshoring critical supply chains, as well as intensified collaboration with local specialty chemical producers to mitigate exposure to import levies. At the same time, end-users in farming cooperatives and custom applicator firms are reassessing procurement strategies to balance cost control with the necessity of maintaining high-performance protection products.

In response, research and development efforts have accelerated around alternative bio-based chemistries that circumvent tariff-affected channels. Producers are investing in the scale-up of microbial pesticides and plant extract formulations that leverage domestic feedstocks and benefit from streamlined regulatory pathways. Moreover, the tariff environment has awakened interest in modular on-site synthesis technologies, enabling agile production of key actives in proximity to demand centers. While short-term adjustments have centered on cost pass-through and supply reconfiguration, the longer-term implication is a redefined innovation agenda that prizes local sourcing resilience and encourages continual reevaluation of global trade dependencies.

Deciphering Market Nuances Through Product Crop and Application Segmentation Insights to Guide Strategic Portfolio Development

A nuanced understanding of market segmentation is essential for refining product development and commercial strategies in the crop protection chemicals domain. When viewed through a product lens, traditional synthetic classes such as fungicides, herbicides, and insecticides coexist alongside biologicals, which themselves bifurcate into biochemical and microbial subclasses. Natural oils, pheromones, and plant extracts serve as the biochemical frontier, while bacteria-, fungi-, and virus-based microbial solutions demonstrate growing efficacy across diverse pest challenges. The fungicide portfolio has also matured beyond dithiocarbamates to include strobilurins and triazoles, each offering distinct modes of action against fungal threats. Meanwhile, herbicide development has diversified from long-standing actives like 2,4-D and glyphosate to newer modes targeting resistant weed populations, and insecticide research spans carbamates, neonicotinoids, organophosphates, and pyrethroids, reflecting a commitment to robust integrated pest management.

Crop-specific considerations further complicate the landscape, as cereals and grains such as barley, maize, rice, and wheat present pest spectra that differ markedly from those encountered in fruits and vegetables like citrus, potato, and tomato. Oilseeds and pulses, encompassing canola, chickpea, lentil, and soybean, have spurred tailored herbicidal and fungicidal innovations to protect high-value rotational crops. In more niche applications, turf and ornamental segments spanning golf courses, public gardens, and residential lawns require specialized chemistries that balance turf health with environmental stewardship. Across all crop types, modes of application from foliar sprays to seed coatings and soil treatments-whether post-planting or pre-planting-determine the efficacy and economic viability of a given active. Formulation choices, whether dry dusts, granules, wettable powders, emulsifiable concentrates, or suspension concentrates, further influence handling, drift potential, and field performance. Lastly, while traditional offline distribution channels retain significant share in rural markets, an emerging e-commerce ecosystem on company websites and multi-vendor platforms is reshaping how growers source crop protection solutions.

This comprehensive research report categorizes the Crop Protection Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Crop Type

- Mode Of Application

- Formulation

- Application Channel

Analyzing Regional Agricultural Dynamics and Regulatory Frameworks Driving Differential Demand for Crop Protection Chemicals Across Key Global Markets

Regional dynamics play a pivotal role in shaping demand patterns and regulatory priorities for crop protection chemicals. In the Americas, large-scale cereal and oilseed production drives significant volumes of synthetic herbicides and fungicides, with stringent environmental benchmarks in the United States and Canada fostering early adoption of biological alternatives and precision application tools. Latin American markets, notably Brazil and Argentina, are characterized by robust trait-stacked seed adoption and evolving registration protocols that encourage diversified protection portfolios. This landscape compels manufacturers to maintain agile registration pipelines and localized market support infrastructures.

Meanwhile, Europe, the Middle East, and Africa represent a mosaic of regulatory intensities and agronomic contexts. The European Union’s Farm to Fork strategy exerts downward pressure on high-risk chemistries, stimulating a broader shift toward lower-residue products and integrated pest management frameworks. In contrast, many Middle Eastern and African markets continue to rely on a combination of conventional actives and emerging biopesticides, with climatic extremes demanding formulations that can withstand variable environmental stresses. Across these regions, establishing sustainable supply chains and extensions services is instrumental to driving adoption and ensuring regulatory compliance.

Asia-Pacific encompasses some of the world’s highest utilization rates of herbicides and insecticides, particularly in rice-dominant economies. Farmers in Southeast Asia and South Asia are increasingly exploring microbial and biochemical alternatives to counter pesticide resistance and meet tightening food safety standards. Meanwhile, Australia’s mature regulatory system and Oceania’s unique pest pressures have catalyzed the development of novel modes of action and digital application technologies. The convergence of rising disposable incomes, farm consolidation, and government incentives for sustainable agriculture ensures that Asia-Pacific will remain a frontier for both conventional and next-generation crop protection solutions.

This comprehensive research report examines key regions that drive the evolution of the Crop Protection Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Advancing Innovation Partnerships Sustainability-Driven Solutions and Portfolio Diversification in Crop Protection Chemistry

Several leading industry stakeholders have distinguished themselves through strategic investments in innovation platforms, targeted acquisitions, and cross-sector partnerships. Major multinational companies have diversified their pipelines by integrating biological solutions with legacy synthetic portfolios, thereby offering comprehensive crop protection toolkits. Simultaneously, mid-sized specialty players have carved out niches in microbial actives and formulation technologies, leveraging agility to respond swiftly to regional regulatory updates and evolving grower preferences. Collaborative ventures between established agrochemical firms and biotechnology startups are accelerating the translation of genomic insights into scalable microbial products.

In parallel, organizations across the value chain are strengthening digital agriculture capabilities to enhance customer engagement and product efficacy. Several prominent firms have launched proprietary decision support systems that synthesize satellite imagery, weather forecasts, and pest modeling to deliver prescriptive recommendations. Investments in advanced delivery systems-such as controlled-release granules and drone-compatible formulations-further underscore a commitment to adding value beyond traditional chemical actives. These developments illustrate a competitive milieu in which differentiated offerings and service-based models are increasingly essential for market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crop Protection Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adama Agricultural Solutions

- Albaugh, LLC

- American Vanguard Corporation

- BASF SE

- Bayer AG

- BioTEPP Inc.

- CORTEVA, INC.

- DOW AGROSCIENCES S.R.O.

- DuPont de Nemours, Inc.

- FMC Corporation

- Jiangsu Yangnong Chemical

- Kumiai Chemical Industry Co., Ltd.

- Nissan Chemical Corporation

- Nufarm Limited

- PI Industries Ltd.

- Rainbow Agrosciences Private Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta Crop Protection, LLC

- UPL Limited

- Zhejiang Xinan Chemical Industrial Group

Actionable Strategic Recommendations for Industry Leaders to Navigate Complex Regulations and Capitalize on Sustainable Crop Protection Opportunities

To thrive in this evolving environment, industry leaders must adopt a multifaceted strategy that balances innovation with operational resilience. First, expanding research pipelines to encompass microbial and biochemical actives will not only align with regulatory trends but also open new market segments seeking low-residue solutions. Prioritizing scalable fermentation and plant extract platforms can mitigate reliance on tariff-exposed raw materials while bolstering sustainability credentials. Second, forging strategic alliances with digital agriculture providers and academic institutions will accelerate the deployment of data-driven advisory services, enhancing value propositions for end-users and fostering customer loyalty.

Operationally, reinforcing local manufacturing and modular synthesis capabilities is paramount to countervailing the impacts of global trade uncertainties. Establishing regional production hubs for critical intermediates ensures both supply security and responsiveness to shifting demand patterns. Concurrently, implementing robust stewardship programs and resistance management plans will prolong active lifecycles and safeguard efficacy. Finally, investing in transparent supply chain traceability and eco-certification initiatives can differentiate offerings in premium markets and support brand reputation. By integrating these recommendations, industry participants can navigate regulatory complexities, unlock new growth avenues, and deliver sustainable crop protection solutions.

Detailed Mixed Methodology Explaining the Structured Framework and Expert Validation Process Underpinning the Crop Protection Market Research

This analysis is grounded in a mixed-methods research approach designed to capture both quantitative market parameters and qualitative expert insights. Initial desk research encompassed an exhaustive review of regulatory filings, patent databases, and peer-reviewed scientific publications to map the evolution of active ingredients, formulation technologies, and registration frameworks. These findings were supplemented by monitoring industry conferences and trade association newsletters to track emergent trends and competitive developments.

To validate secondary data, more than thirty in-depth interviews were conducted with agronomists, R&D specialists, regulatory consultants, and commercial leaders across major markets. Structured surveys provided additional context on grower adoption drivers and distribution channel transformations. The segmentation framework was refined iteratively through data triangulation, ensuring alignment between market realities and analytical constructs. Finally, regional case studies and proprietary field evaluations enriched the report’s insights, offering real-world perspectives on application performance, ROI metrics, and stakeholder collaboration models.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crop Protection Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crop Protection Chemicals Market, by Product Type

- Crop Protection Chemicals Market, by Crop Type

- Crop Protection Chemicals Market, by Mode Of Application

- Crop Protection Chemicals Market, by Formulation

- Crop Protection Chemicals Market, by Application Channel

- Crop Protection Chemicals Market, by Region

- Crop Protection Chemicals Market, by Group

- Crop Protection Chemicals Market, by Country

- United States Crop Protection Chemicals Market

- China Crop Protection Chemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Consolidating Key Findings to Illuminate the Future Trajectory of Crop Protection Chemicals in a Transforming Agricultural Ecosystem

The synthesis of these multi-dimensional findings reveals a crop protection chemicals market at the nexus of sustainability imperatives, technological innovation, and regulatory evolution. The integration of biological platforms with advanced formulation science is unlocking new efficacy frontiers while attenuating environmental risks. Tariff-driven supply chain realignment is catalyzing investments in localized production and alternative chemistries, reshaping global trade dynamics. At the same time, granular segmentation by product type, crop focus, application mode, formulation class, and distribution channel is empowering stakeholders to tailor value propositions with increasing precision.

Regional nuances underscore the importance of adaptive strategies, as diverse regulatory regimes and agronomic contexts dictate differentiated adoption pathways. Leading companies are responding with cross-sector partnerships, digital agriculture solutions, and service-based models that transcend traditional chemical offerings. By embracing these insights and following the actionable recommendations outlined herein, decision-makers will be well positioned to harness emerging opportunities, mitigate risks, and chart a sustainable growth trajectory in the evolving crop protection chemicals landscape.

Engage with Ketan Rohom to Unlock Actionable Insights and Secure In-Depth Crop Protection Chemicals Research for Strategic Growth

To access the full breadth of insights presented in this executive summary and equip your organization with the strategic intelligence required to thrive in the dynamic crop protection chemicals market, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating in-depth research into actionable growth plans ensures that decision-makers receive tailored guidance to address their unique challenges and opportunities.

Engaging with Ketan Rohom offers direct insight into advanced segmentation strategies, regional demand analyses, and competitive intelligence distilled from leading industry players. By securing this comprehensive market research report, you will gain the clarity needed to optimize product portfolios, strengthen supply chains, and accelerate innovation pathways. Reach out today to schedule a personalized consultation and take the first step toward driving sustainable growth in the crop protection chemicals sector.

- How big is the Crop Protection Chemicals Market?

- What is the Crop Protection Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?