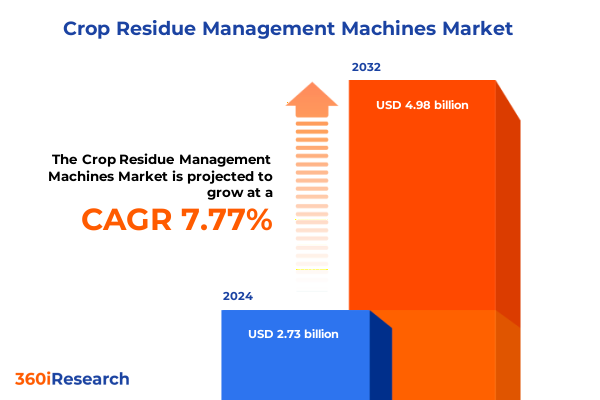

The Crop Residue Management Machines Market size was estimated at USD 5.00 billion in 2025 and expected to reach USD 5.65 billion in 2026, at a CAGR of 13.25% to reach USD 11.95 billion by 2032.

Revolutionizing Agricultural Sustainability through Next-Generation Crop Residue Management Machines Boosting Soil Health and Operational Excellence

Effective management of crop residue has become a cornerstone of sustainable modern agriculture. As pressures mount to improve soil health, reduce greenhouse gas emissions, and close nutrient cycles, the deployment of specialized machines is emerging as a critical enabler. Seamless integration of balers, shredders, rotavators, mulchers, and incorporators is empowering farmers and land managers to monetize what was once discarded biomass. By converting residue into compost, fodder, or bioenergy feedstocks, stakeholders are not only reducing waste but also cultivating added revenue streams and reinforcing circularity within agroecosystems.

Against a backdrop of tightening environmental regulations and escalating input costs, operators are increasingly drawn to solutions that deliver both operational efficiency and ecological benefits. Next-generation equipment offers precision residue processing capabilities across diverse growing systems-from expansive grain fields to specialized orchards and vineyards. These machines are designed to handle variable moisture content, heterogeneous waste streams, and residue densities while maintaining high throughput and minimizing field passes. Consequently, adoption of advanced platforms is accelerating as operators seek to optimize fuel usage, reduce labor requirements, and align with carbon reduction targets mandated by policymakers.

Moreover, recent innovations in mechanization tiers-spanning manual, semi-automatic, and fully automated units-have democratized access to residue management best practices. Diesel-engine variants remain prevalent for their robustness and wide service networks, while hybrid electric and battery-electric options are gaining traction among sustainability-minded operators. These powertrain diversifications reflect a broader industry shift toward electrification, digital telematics, and smart connectivity. This introduction sets the stage for a detailed exploration of the technological breakthroughs, policy catalysts, segmentation dynamics, regional nuances, competitive strategies, and actionable recommendations that define the evolving market for crop residue management machines.

Unleashing Disruptive Forces Reshaping the Crop Residue Management Landscape with Digital Integration, Precision Engineering, and Sustainable Policy Incentives

The crop residue management sector is undergoing seismic transformations driven by converging technological and policy forces. Digitization is at the forefront, with integrated sensor arrays and IoT-enabled telemetry delivering real-time insights on residue moisture, distribution, and incorporation depth. Machine learning algorithms are evolving to optimize operating parameters on the fly, reducing downtime and ensuring uniform residue comminution. At the same time, remote monitoring platforms are facilitating predictive maintenance, minimizing unplanned repairs and extending equipment lifecycles-a crucial benefit as capital expenditures come under closer scrutiny.

Policy incentives aimed at curbing greenhouse gas emissions and soil erosion are reshaping the competitive landscape. Subsidies for low-emission machinery, carbon credit frameworks, and nutrient stewardship mandates are encouraging farm operators to adopt residue processing solutions that align with broader environmental targets. Circular economy initiatives are further accelerating demand by emphasizing the reuse of agricultural waste for bioenergy generation, soil amendment, and livestock feed. These regulatory tailwinds are complemented by growing consumer and investor scrutiny on sustainable sourcing practices, amplifying the business case for operators that can demonstrate measurable environmental impact.

Innovation cycles are also being compressed by collaborative R&D partnerships between OEMs, agricultural institutes, and startup incubators. Breakthroughs in biomaterial processing, high-efficiency shredding technologies, and modular equipment architectures are entering the market at a rapid pace. This dynamic backdrop underscores a pivotal shift: residue management is no longer an ancillary activity but a strategic priority, with emerging players and incumbents alike vying to deliver platforms that integrate seamlessly into the farm of the future. The following analysis will delve into how these transformative shifts are redefining market structures and stakeholder expectations.

Analyzing the Comprehensive Effects of New 2025 United States Tariff Measures on Crop Residue Equipment Supply Chains and Cost Structures

The implementation of new U.S. tariff measures in early 2025 has introduced notable complexities for import-dependent segments of the crop residue management equipment market. By designating additional duties on key components and finished assemblies, policymakers have sought to bolster domestic manufacturing and mitigate trade imbalances. While these actions are aligned with broader industrial revitalization goals, they have also led to immediate cost escalations for OEMs and distributors that rely on competitively priced imports for critical machine parts ranging from rotor assemblies to hydraulic systems.

In response, equipment manufacturers and aftermarket providers have pursued diversified sourcing strategies. Some have shifted portions of supply chains to alternative international partners with lower tariff exposure, while others have accelerated local supplier development programs to safeguard margins. This strategic reallocation has required accelerated supplier qualification processes, enhanced quality assurance protocols, and revised inventory planning to buffer against lead-time volatility. Although these adjustments have helped stabilize production lines, operators have faced temporary price hikes that have compressed near-term adoption rates, especially among smaller farms operating on tighter budgets.

Looking beyond immediate cost impacts, the tariff landscape has also stimulated investment in domestic R&D and assembly capacity. Grant programs and public–private partnerships aimed at fostering onshore manufacturing of precision components have gained traction. Over time this realignment holds the promise of shorter supply chains, improved service responsiveness, and strengthened resilience against future trade disruptions. Nevertheless, market participants must remain vigilant, as evolving tariff schedules and reciprocal trade actions by foreign governments could inject further uncertainty into the equipment procurement cycle. The ensuing sections will explore how companies are navigating these headwinds through strategic supply network design and collaborative innovation.

Unlocking Market Dynamics through Comprehensive Segmentation of Crop Residue Machines by Type, Application, Mechanization, End Use, Power Source, and Distribution

A nuanced understanding of the crop residue equipment market emerges when one considers its core segment dimensions. In the realm of product type, balers, shredders, rotavators, mulchers, and incorporators each address distinct residue processing needs-from compaction and collection to soil integration and surface mulching. Application environments further delineate usage patterns, with field-scale machines optimized for row crops, while specialized attachments are tailored to turf management, vineyard prunings, or orchard debris. These varying use cases demand design versatility, influencing machine size, cutting width, and residue discharge configurations.

Mechanization level represents another critical segmentation axis. Manual and semi-automatic machines deliver cost-effective solutions for low-volume operations, whereas fully automatic, self-propelled platforms are engineered for high-throughput, large-scale adoption. Such differentiation extends to end-use orientation: equipment targeting bioenergy producers emphasizes particle size consistency and moisture control, while systems geared toward composting and soil enrichment focus on thorough mixing and organic breakdown acceleration. Additionally, fodder producers require residue processors capable of generating uniform, palatable bales.

Power source preferences illustrate evolving sustainability priorities. Diesel-powered units remain prevalent due to mature service ecosystems, yet battery-electric and hybrid electric drive trains are gaining share amid decarbonization mandates and fuel cost pressures. Finally, distribution channel mix shapes market access and aftermarket support. Traditional OEM networks coexist with decentralized dealer ecosystems, and online sales platforms are expanding reach to niche operators. In many regions, dealer-based service offerings coexist with direct-to-farmer e-commerce portals, creating a hybrid distribution landscape that caters to both high-touch customer relationships and digital convenience.

This comprehensive research report categorizes the Crop Residue Management Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mechanization Level

- Power Source

- Application

- End Use

- Distribution Channel

Unveiling Regional Nuances Shaping Crop Residue Equipment Adoption Patterns and Performance across the Americas, EMEA, and the Asia-Pacific Domains

Regional dynamics exert a profound influence on the evolution of the crop residue equipment market. In the Americas, expansive arable land holdings and well-developed dealer networks have accelerated the adoption of high-capacity baling and shredding platforms. Government programs emphasizing soil carbon sequestration and renewable energy feedstock generation have further solidified the business case for mechanized residue processing. Producers in Brazil, Canada, and the United States are investing in modular attachments to retrofit existing tractors and reduce capital intensity, while larger OEMs partner with local distributors to expand service footprints in emerging states.

The Europe, Middle East, and Africa region exhibits diverse regulatory and agronomic contexts. European Union emissions standards and incentive schemes for low-carbon agriculture have catalyzed demand for electric-hybrid and fully electric implements. At the same time, smallholder-dominated markets in parts of Eastern Europe and North Africa are driving interest in low-cost, semi-automatic shredders and manual mulchers. In Sub-Saharan Africa, residue management solutions are increasingly linked to integrated bioenergy projects, where small-scale mills and compact balers supply feedstock for village-level power generation.

In Asia-Pacific, high-density farming systems and fragmented land parcels have fostered innovative compact designs. Japan and South Korea lead in precision incorporation machines that integrate seamlessly with digital farm management platforms, while India, China, and Southeast Asia are witnessing rapid uptake of diesel-powered rotavators and mulchers adapted for rice straw and sugarcane trash. Collaborative pilot programs between governments and equipment suppliers are promoting residue collection schemes, aiming to curb open-field burning and urban air pollution. Overall, regional heterogeneity underscores the importance of calibrated product portfolios and go-to-market strategies that reflect local agronomic realities and policy frameworks.

This comprehensive research report examines key regions that drive the evolution of the Crop Residue Management Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Pioneering Industry Leaders Steering Innovation and Competitive Strategies in the Crop Residue Management Equipment Market Landscape

Leading equipment manufacturers are deploying a blend of incremental innovation and bold strategic moves to secure competitive advantage. Major OEMs with global footprints are expanding their service networks, leveraging field service teams and digital diagnostics to minimize machine downtime. They are also investing heavily in R&D labs focused on next-generation shredding mechanisms, rotor design enhancements, and energy-efficient drive systems. At the same time, mid-tier companies are differentiating through modular platforms that facilitate rapid attachment swaps, catering to operators seeking versatility across multiple residue management tasks.

Alliances between OEMs and technology startups are also reshaping the competitive arena. Startups specializing in machine learning, robotics, and advanced materials are collaborating with established equipment brands to co-develop residue sensing solutions and lightweight chassis designs. This blending of entrepreneurial agility with manufacturing scale is accelerating the commercialization of automated residue removal units capable of autonomous operation and integration with precision planting systems.

Moreover, strategic distribution partnerships are emerging as a key battleground. Exclusive agreements with regional dealers, joint venture service centers, and e-commerce ventures are providing differentiated aftermarket support and spare parts availability. These partnerships are further bolstered by financing solutions such as equipment leasing and pay-per-use models, enabling broader access to high-end machines. Collectively, these initiatives illustrate how leading companies are synchronizing product innovation, service excellence, and channel optimization to capture value in a rapidly evolving residue management market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crop Residue Management Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alamo Group Inc.

- Avtar Kalsi Agro Works

- Balkar Combines

- Clanton Tractor & Equipment

- Deere & Company

- Gagan Harvester

- Gessner Pty Ltd.

- Gomselmash India Private Limited

- Heber Equipment

- Hiniker Company

- Kisan Agro Industries Pvt. Ltd.

- KS AGROTECH PVT.LTD.

- KUHN GROUP

- Maax Engineering

- Malkit Agrotech Private Limited

- McFarlane Ag Manufacturing

- NEW VISHAVKARMA AGRO INDUSTRIES PRIVATE LIMITED

- PREET GROUP

- Richmond Brothers Equipment

- Shankdhar Agro Technology

- Shred-Tech

- Shree Jayamurugan Agro Links

- TEHNOS, d.o.o.

- Vaderstad Inc.

- Van Wamel B.V.

- Weterings Machinery B.V.

Strategic Roadmap for Industry Leaders to Elevate Crop Residue Management Profitability, Sustainability, and Technological Excellence in a Dynamic Market

Industry leaders should prioritize the development of next-generation powertrain options to align with stringent emissions regulations and rising energy costs. Investing in hybrid and fully electric residue processors will not only reduce operational carbon footprints but also open doors to novel financing incentives and government rebates. Concurrently, OEMs and aftermarket providers must enhance supply chain resilience by diversifying component sourcing, establishing localized manufacturing hubs, and forging strategic partnerships with regional suppliers.

A robust step forward involves deepening collaboration with digital agriculture platforms. By embedding sensor networks and data analytics capabilities into residue management machines, equipment vendors can deliver prescriptive insights on optimal field pass timing, residue moisture levels, and incorporation depth. This value-added service offering can be monetized through subscription models, strengthening client relationships and creating recurring revenue streams.

To capture untapped segments, organizations should consider introducing modular equipment architectures and flexible rental programs targeting smallholders and specialty crop producers. Tailored training programs and field demonstrations can accelerate technology adoption by illustrating tangible cost savings and environmental benefits. Finally, engaging with policymakers and industry associations to shape incentive frameworks and technical standards will help ensure that residue management solutions remain at the forefront of sustainable agriculture agendas.

Robust Research Framework Employing Integrated Primary and Secondary Data Collection with Rigorous Validation Methods to Ensure Analytical Integrity

This analysis is built upon a multifaceted research framework combining primary interviews, secondary data collection, and rigorous validation techniques. Over 40 in-depth discussions were conducted with OEM executives, equipment distributors, agricultural extension specialists, and farm operators across different geographies. These conversations provided qualitative insights into adoption drivers, customization requirements, and service expectations.

Secondary research encompassed a thorough review of industry publications, government policy documents, patent filings, and academic studies on residue processing technologies. Market intelligence databases and trade journals were consulted to track equipment launches, partnerships, and tariff developments. Statistical data on cropping patterns, farm size distributions, and sustainability program enrollments were incorporated to contextualize demand trends.

Data triangulation was achieved by cross-referencing primary feedback with secondary sources, ensuring that insights reflect both practitioner experiences and documented evidence. Methodological rigor was further reinforced through peer review by independent agricultural technology experts, who assessed the credibility of findings and validated key assumptions. The result is a robust analytical foundation that underpins the strategic narratives and recommendations presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crop Residue Management Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crop Residue Management Machines Market, by Type

- Crop Residue Management Machines Market, by Mechanization Level

- Crop Residue Management Machines Market, by Power Source

- Crop Residue Management Machines Market, by Application

- Crop Residue Management Machines Market, by End Use

- Crop Residue Management Machines Market, by Distribution Channel

- Crop Residue Management Machines Market, by Region

- Crop Residue Management Machines Market, by Group

- Crop Residue Management Machines Market, by Country

- United States Crop Residue Management Machines Market

- China Crop Residue Management Machines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Emphasize the Pivotal Role of Advanced Crop Residue Management Solutions in Driving Agricultural Resilience and Sustainability

The convergence of technological advancements, evolving policy landscapes, and shifting end-user requirements underscores the critical importance of sophisticated crop residue management machines. Organizations that embrace digital integration, decarbonized powertrains, and modular equipment architectures stand to capture significant operational and environmental value. Meanwhile, segmented approaches tailored to specific residue types, application scenarios, and regional conditions will prove essential in addressing the heterogeneous needs of global agriculture.

Tariff-driven supply chain realignments present both challenges and opportunities, compelling stakeholders to reassess sourcing strategies and invest in localized capabilities. Regional insights further highlight the need for agile go-to-market models that balance the scale benefits of large OEMs with the customization agility of niche innovators. Across the value chain, partnerships between manufacturers, technology startups, distributors, and policy bodies will drive the next wave of innovation and adoption.

Ultimately, the future of sustainable agriculture will be shaped by equipment solutions that transform crop residue from a management burden into a strategic resource. By synthesizing the segmentation dynamics, regional nuances, competitive strategies, and actionable recommendations outlined in this executive summary, industry leaders can position themselves to thrive in a rapidly evolving market, delivering both economic returns and environmental impact.

Secure Exclusive Access to the Comprehensive Executive Summary on Crop Residue Management Innovation and Enhance Your Strategic Decisions Today

To secure an in-depth understanding of how cutting-edge crop residue management machines can transform your operations, reach out to Ketan Rohom, Associate Director, Sales & Marketing, and explore the tailored insights contained within the full executive summary. Engage directly to discover how this comprehensive analysis can inform your capital investments, technology roadmaps, and strategic partnerships. Don’t miss the opportunity to gain a competitive edge by leveraging data-driven recommendations and rich market intelligence designed to support your growth objectives. Contact Ketan today to obtain your copy of the complete research report and unlock actionable guidance that will help you navigate the rapidly evolving landscape of residue management equipment

- How big is the Crop Residue Management Machines Market?

- What is the Crop Residue Management Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?