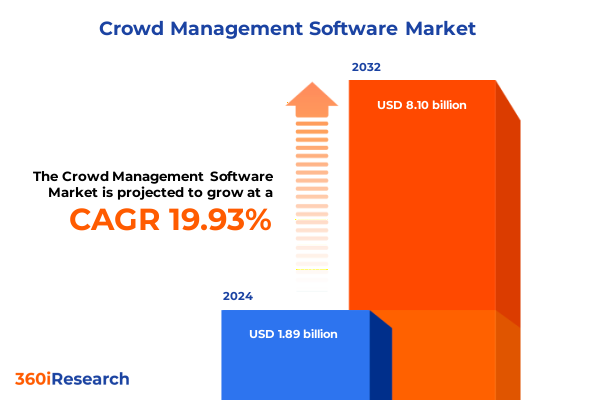

The Crowd Management Software Market size was estimated at USD 2.26 billion in 2025 and expected to reach USD 2.70 billion in 2026, at a CAGR of 20.00% to reach USD 8.10 billion by 2032.

Setting the Stage for Next-Generation Crowd Management Solutions Designed to Ensure Safety, Efficiency, and Seamless Experience Across Diverse Environments

The contemporary landscape for crowd management software is defined by a convergence of emerging technologies, evolving safety regulations, and heightened expectations for operational efficiency. As organizations grapple with increasingly complex public gatherings, from cultural events to large‐scale conferences, the imperative to adopt intelligent solutions has never been more pronounced. This report introduces the core dynamics driving demand for sophisticated crowd management platforms that integrate advanced analytics, access control, incident management, and video surveillance to deliver end‐to‐end visibility and control.

A modern crowd management strategy transcends traditional security postures, weaving together predictive and real‐time analytics to anticipate potential challenges before they escalate. Organizations are no longer satisfied with reactive measures alone; they seek proactive capabilities that harness data patterns to forecast crowd flows, detect anomalies, and streamline resource allocation. In doing so, they create safer environments while optimizing cost structures and elevating user experiences.

With stakeholder expectations transforming at a rapid pace, the need for comprehensive software suites has escalated. This introduction sets the stage by outlining the technological pillars and institutional drivers that underpin current market developments. As we navigate through subsequent sections, the foundational context provided here will anchor a deeper exploration of market shifts, tariff influences, segmentation insights, and strategic imperatives.

Uncovering the Critical Technological and Societal Shifts Driving the Evolution of Intelligent Crowd Management Systems in an Interconnected World

Over the past few years, the crowd management ecosystem has experienced a seismic shift driven by advances in artificial intelligence and Internet of Things architectures. Organizations are rapidly integrating edge computing capabilities into video surveillance infrastructures to reduce latency, improve resilience in bandwidth‐constrained environments, and guarantee continuous monitoring even when connectivity fluctuates. Simultaneously, the proliferation of AI‐powered computer vision algorithms has transformed raw video data into actionable insights, enabling security teams to classify behaviors, assess density metrics, and trigger alerts with unprecedented accuracy.

In parallel, the public’s post‐pandemic expectations have reshaped safety protocols and compliance mandates. Health screening integrations, contactless access control, and occupancy tracking have become embedded features within comprehensive crowd management platforms. This transition has not only accelerated innovation cycles but also prompted solution providers to prioritize modular architectures that accommodate rapidly changing regulatory landscapes and evolving user preferences.

Furthermore, collaborative platforms linking multiple stakeholders-from venue operators to public safety officials-are redefining traditional command centers. Data sharing across municipal agencies and private enterprises under secure frameworks has unlocked new use cases for incident management, ranging from large‐scale sporting events to emergency response drills. As the industry moves forward, these transformative shifts will continue to catalyze product roadmaps and investment strategies, forging a more resilient and intelligent foundation for crowd safety.

Assessing the Far-reaching Consequences of 2025 Tariff Policies on the Crowd Management Solutions Industry’s Supply Chains and Technology Ecosystems

In 2025, tariff adjustments enacted by the United States have exerted significant pressure on hardware-centric components of crowd management solutions. As duties on cameras, sensors, and related electronic modules rose, original equipment manufacturers and system integrators faced escalated procurement costs that rippled through supply chains. This environment forced software vendors to accelerate their pivot toward value-added services and subscription-driven models, offsetting the impact of hardware price inflation by offering cloud-based analytics and managed services.

At the same time, end users recalibrated budgeting priorities to accommodate higher capital expenditures for on-location deployments. Organizations with legacy on-premise systems increasingly evaluated hybrid solutions that blend local compute with remote processing, seeking to balance cost control with performance demands. These hybrid configurations also reinforced business continuity by ensuring mission‐critical analytics remain functional even amid tariff‐driven component shortages or shipping delays.

Moreover, the tariff environment stimulated strategic partnerships between North American integrators and regional hardware manufacturers, fostering an ecosystem designed to mitigate reliance on cross-border supply. By localizing certain segments of production and assembly, stakeholders have bolstered supply resilience while maintaining compliance with domestic content thresholds. As a result, the market is witnessing a gradual recalibration of sourcing strategies, aligning procurement, software licensing, and service offerings to withstand evolving trade policy dynamics.

Revealing Critical Segmentation Dynamics That Shape Demand Across Components, Deployments, Verticals, and Organization Sizes in Crowd Management Market

A nuanced understanding of market segmentation reveals the diverse drivers behind component adoption, deployment preferences, vertical use cases, and organizational readiness. Within the component framework, crowd analytics emerges as a transformative pillar, enabled by the integration of both predictive analytics modules and real-time analytics engines that process streaming data at the edge. Access control systems continue to mature through interoperability with mobile credentials and biometric readers, while incident management solutions are being reimagined with embedded workflows and collaboration tools. Video surveillance remains essential, but its value proposition now hinges on intelligent video search and automated incident tagging.

When considering deployment models, cloud architectures are increasingly favored for their scalability, continuous update cycles, and remote access capabilities, though on-premise installations persist in environments demanding deterministic performance and data sovereignty. Vertically, entertainment venues such as theaters and theme parks are pushing the boundaries of spectator engagement through location-based services and crowd heat mapping, while public venues-encompassing city squares and tourist attractions-require streamlined visitor flows and anomaly detection to safeguard iconic sites. In retail settings, shopping malls and supermarkets leverage analytics to optimize checkout queues and promotional displays, and in stadiums and arenas, concert venues and sports stadiums depend on seamless ticket validation and proactive incident response. Transportation hubs-including airports, metro systems, and railway stations-represent high-traffic environments where density monitoring and queuing solutions protect passenger safety and operational continuity.

Across all segments, large enterprises often spearhead deployments with comprehensive, multi-module platforms, while small and medium organizations look to managed offerings and tiered licensing that align with leaner IT budgets. These segmentation dynamics underscore the importance of customization, interoperability, and cost structure alignment in the ongoing evolution of crowd management software.

This comprehensive research report categorizes the Crowd Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User Vertical

Exploring Regional Variations and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Crowd Management Ecosystems

Diverse regional landscapes present unique challenges and opportunities for crowd management software adoption. In the Americas, mature security infrastructures and significant investments in public safety initiatives have created fertile ground for advanced analytics and incident management platforms. Regulatory frameworks at the federal and state levels increasingly mandate stringent reporting and oversight, driving organizations to integrate comprehensive monitoring solutions that deliver both operational insights and compliance assurances.

Across Europe, Middle East, and Africa, regulatory complexity and geopolitical considerations collide with rapid urbanization trends. European data privacy directives, including stringent data localization requirements, have influenced the design of both cloud and on-premise deployments, leading vendors to offer regionally segmented architectures. In the Middle East, the buildup of smart city projects and high-profile events has accelerated demand for modular crowd management suites, while in parts of Africa, emerging urban centers seek cost-effective, scalable solutions to modernize public safety workflows.

Asia-Pacific stands out for its accelerated digital transformation agenda, with national initiatives in China, India, and Southeast Asian nations placing crowd safety at the forefront of smart city architectures. Large-scale infrastructure projects, paired with rapidly expanding transportation networks, underscore a pressing need for integrated access control and analytics platforms. In parallel, wide-area surveillance strategies are being bolstered by next-generation mobile insights and cross-platform data orchestration. These regional contours highlight the imperative for solution providers to adopt flexible architectures, local partnerships, and culturally attuned user experiences to unlock sustained growth.

This comprehensive research report examines key regions that drive the evolution of the Crowd Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Strategies and Competitive Differentiation of Leading Technology Providers in the Global Crowd Management Software Domain

Leading providers in the crowd management software domain are differentiating through strategic investments in artificial intelligence, platform interoperability, and expanded service portfolios. Market frontrunners have broadened their ecosystems by acquiring niche analytics startups, thereby infusing core platforms with advanced capabilities such as crowd sentiment analysis and anomaly detection based on behavioral biometrics. These strategic acquisitions enable rapid time‐to‐market for new features while reinforcing competitive moats.

In addition to M&A, top companies are forging deep alliances with hardware specialists, ensuring seamless integration of access control readers, IP cameras, and edge compute nodes. This collaborative approach not only streamlines deployment cycles but also enhances overall system reliability. Furthermore, companies with global footprints are tailoring go-to-market strategies to support multilingual interfaces, region-specific compliance modules, and localized support services, recognizing that software alone cannot secure broad adoption without contextual alignment.

Another axis of differentiation lies in service innovation: providers offering managed analytics subscriptions and continuous monitoring as a service are growing their recurring revenue streams, while those focused on open API frameworks empower third parties and channel partners to develop bespoke extensions. These diverse strategic pathways illustrate how established and emerging software vendors alike are adapting to shifting customer expectations and competitive pressures in the crowd management landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crowd Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4id Solutions

- AGT Fortgeschrittene Deutsche Technologie GmbH

- BriefCam Ltd.

- Contemporary Services Corporation

- Crowd Vision Limited

- CrowdSec

- e2open, LLC

- Event Security Management Ltd.

- Gainsight, Inc.

- IdeaConnection Ltd.

- Ipsotek Ltd.

- Milesight Technology

- NEC Corporation

- Nokia Corporation

- Omnivex Corporation

- ProtaTECH, Inc.

- PwC Solutions GmbH

- SAP SE

- Savannah Simulations AG

- SES Group Limited

- SmartinfoLogiks LLP

- Vision Technology Systems

- Wavestore Global Ltd.

- XpressGuards, LLC

- Crowd Dynamics International Ltd.

Strategic Roadmap for Industry Leaders to Leverage Innovation, Strengthen Partnerships, and Enhance Operational Resilience in Crowd Management

To thrive in an environment characterized by rapid technological change and complex regulatory demands, industry leaders must prioritize an innovation‐centric culture, underpinned by agile development practices and continuous customer feedback loops. By fostering cross-functional teams that align product roadmaps with end‐user operational challenges, organizations can accelerate feature delivery while ensuring high adoption rates.

Forging strategic partnerships with academic institutions, research labs, and technology incubators can unlock access to cutting-edge algorithms and prototype platforms. Such collaborations not only advance capabilities in predictive analytics, but also build credibility through joint validation studies. Equally important is the need to strengthen relationships with hardware vendors and systems integrators to reduce time-to-deployment and enhance end‐to‐end service offerings.

Moreover, investing in robust data governance and privacy frameworks will be critical for building trust among stakeholders and mitigating legal risks. Leaders should institute transparent policies around data collection, retention, and consent, while leveraging encryption and access controls to safeguard sensitive information. Finally, cultivating a disciplined approach to talent development-through specialized training programs and certification pathways-will ensure that security, operations, and IT teams possess the skills required to maximize the value of advanced crowd management solutions.

Unpacking Rigorous Research Methodology Employed to Deliver In-depth, Data-driven Insights Backed by Comprehensive Qualitative and Quantitative Analysis

This report synthesizes insights derived from a two‐pronged approach that blends secondary research with extensive primary validation. The initial phase involved an exhaustive review of publicly available white papers, regulatory filings, industry journals, and trade association publications to map current technology capabilities, regulatory landscapes, and end‐user requirements. Key performance indicators, security standards, and compliance mandates were cataloged to inform the baseline context.

Following this, the secondary benchmarks were tested and refined through primary interviews with senior executives, systems integrators, and end‐user organizations across multiple verticals. These interviews provided qualitative depth, uncovering nuanced challenges related to scalability, interoperability, and user adoption. In addition, quantitative surveys capturing satisfaction metrics, deployment timelines, and technology preferences were conducted to validate overarching trends.

Finally, all findings underwent rigorous validation via an expert panel comprising security consultants, academic researchers, and technology advisory specialists. This multi-layered methodology ensures that the analysis is both comprehensive and precise, offering stakeholders a high‐fidelity understanding of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crowd Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crowd Management Software Market, by Component

- Crowd Management Software Market, by Deployment Mode

- Crowd Management Software Market, by End User Vertical

- Crowd Management Software Market, by Region

- Crowd Management Software Market, by Group

- Crowd Management Software Market, by Country

- United States Crowd Management Software Market

- China Crowd Management Software Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Imperatives to Navigate the Future of Crowd Management Solutions with Confidence and Agility

The convergence of artificial intelligence, edge computing, and cloud architectures has redefined the paradigms of crowd management solutions. Organizations that embrace predictive analytics alongside real‐time monitoring stand to transform operational efficiency and elevate safety standards. At the same time, evolving tariff structures and regional regulatory considerations underscore the need for agile sourcing strategies and adaptable deployment frameworks.

Segmentation analysis highlights the importance of tailoring software suites to specific component modules, deployment modes, vertical requirements, and organizational scales. The nuanced demands of entertainment venues, transportation hubs, and enterprise campuses call for configurable platforms that can balance performance, compliance, and cost management. Meanwhile, leading vendors are differentiating through strategic acquisitions, partnerships, and service innovations that expand their competitive footprint.

Ultimately, industry stakeholders that align forward-looking product strategies with robust data governance practices and collaborative ecosystems will be best positioned to navigate the rapidly evolving crowd management landscape. The insights presented in this report offer a strategic compass for decision makers seeking to harness the full potential of advanced software solutions while remaining resilient in the face of shifting external forces.

Connect with Ketan Rohom to Secure the Comprehensive Market Research Report Delivering Actionable Insights on Crowd Management Software Trends

To explore tailored insights, interactive demos, and comprehensive analyses that drive informed decision making in crowd management technology, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engage with an expert who understands the evolving demands of safety, security, and operational excellence across diverse industries. Elevate your strategic planning and gain access to an in‐depth market research report packed with actionable recommendations, cutting‐edge trends, and nuanced segmentation breakdowns crafted specifically for decision makers. Start your journey toward optimized crowd management today by collaborating with Ketan Rohom to secure the definitive resource your organization needs to stay ahead of emerging challenges and capitalize on new opportunities in the rapidly advancing landscape of crowd management software

- How big is the Crowd Management Software Market?

- What is the Crowd Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?