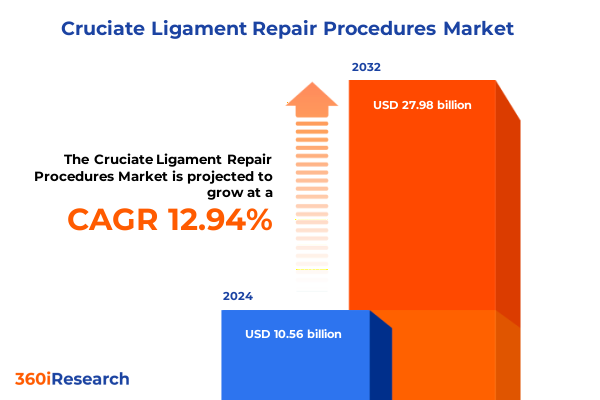

The Cruciate Ligament Repair Procedures Market size was estimated at USD 11.93 billion in 2025 and expected to reach USD 13.49 billion in 2026, at a CAGR of 12.93% to reach USD 27.98 billion by 2032.

Understanding the Critical Role of Cruciate Ligament Repair in Modern Orthopedics and the Evolving Market Dynamics Impacting Patient Outcomes

Anterior cruciate ligament and posterior cruciate ligament injuries represent some of the most prevalent orthopedic conditions affecting athletes, active adults, and an aging population worldwide. In the United States alone, recent data indicate that approximately 200,000 ACL reconstructions are performed annually, highlighting the significant demand for advanced repair solutions. Such procedures are critical for restoring knee stability, preventing joint degeneration, and enabling patients to return to high levels of physical activity.

Over the past decade, the field of ligament repair has witnessed remarkable advancements driven by regenerative medicine, imaging technology, and digital health. Biologic therapies such as platelet-rich plasma and stem cell augmentation have been integrated into surgical protocols to enhance graft healing and vascularization, thereby improving long-term outcomes. Simultaneously, innovations in three-dimensional imaging, virtual reality planning, and robotic-assisted navigation are enabling surgeons to achieve greater precision in tunnel placement and graft tensioning.

Against this backdrop of technological progress, the market faces multifaceted forces including shifting tariff policies, evolving product and service segmentation, and dynamic regional variations in healthcare infrastructure. This executive summary provides a concise yet comprehensive analysis of the transformative shifts reshaping cruciate ligament repair procedures, examines the cumulative impact of U.S. tariffs in 2025, distills key segmentation and regional insights, evaluates competitive strategies of leading firms, and offers actionable recommendations. It concludes by detailing the research methodology and inviting stakeholders to engage directly with our Associate Director of Sales & Marketing to access the full market research report.

Exploring Groundbreaking Technological and Biological Innovations Reshaping Cruciate Ligament Repair Procedures Across the Healthcare Ecosystem

Advancements in biologic augmentation and regenerative medicine are revolutionizing ligament repair by leveraging the body’s natural healing mechanisms. Surgeons increasingly employ platelet-rich plasma (PRP) and stem cell therapies to enhance graft integration, reduce inflammation, and accelerate revascularization of implanted tissue. Scaffold technologies crafted from natural or synthetic polymers provide structural support to transplanted grafts, promoting organized tissue regeneration and improving biomechanical strength during the critical early phase of healing.

In parallel, there is a growing shift toward primary ACL repair in select proximal tear cases, where the original ligament is reattached rather than entirely reconstructed with a graft. This approach preserves native mechanoreceptors within the ligament, potentially offering quicker recovery and reduced long-term morbidity compared to traditional reconstruction. Internal brace augmentation, which involves reinforcing repaired tissue with high-strength suture tape, provides supplemental stability during the early healing period before the native ligament regains functional integrity.

Rehabilitation protocols have also evolved, emphasizing accelerated weight-bearing and neuromuscular training to mitigate muscle atrophy and optimize joint proprioception. Such enhanced recovery programs integrate balance and coordination exercises early in the postoperative timeline to address biomechanical deficits and lower the risk of reinjury. Moreover, the integration of wearable sensors and telemedicine platforms permits continuous remote monitoring of patient progress, enabling clinicians to adapt rehabilitation regimens in real time based on objective movement and strength data.

Emerging arthroscopic navigation systems further exemplify the technological frontier in cruciate ligament reconstruction. A recently developed dynamic video-based navigation system applies a multi-level memory architecture to track anatomic landmarks in real time, achieving unparalleled stability and accuracy without additional hardware. This innovation delivers real-time feedback at over 25 frames per second with latencies under 40 milliseconds, representing a 3.5-fold improvement in tracking precision compared to prior static methods.

Analyzing the Broad Effects of 2025 United States Tariffs on Cruciate Ligament Medical Devices Supply Chains and Cost Structures

In April 2025, the U.S. Trade Representative introduced a comprehensive tariff package encompassing a universal 10% import duty on all medical device imports, alongside punitive reciprocal tariffs ranging from 20% for European exports to a combined 54% duty on devices sourced from China. Critically, while pharmaceuticals secured limited exemptions, medical devices-including surgical instruments and repair implants-face no such relief, triggering widespread concern across the medtech sector.

Prominent industry organizations, led by the American Hospital Association and the Advanced Medical Technology Association, have actively lobbied for exemptions or phased tariff implementations. AHA research indicates that 82% of healthcare supply-chain professionals anticipate cost increases of at least 15% on devices and supplies within the next six months, while AdvaMed warns that broad tariffs could act as an excise tax on medtech innovation and strain hospital budgets already challenged by inflationary pressures.

Consequently, manufacturers and providers are accelerating initiatives to diversify and localize supply chains. GlobalData forecasts that reinstated Section 301 tariffs on Class I and II devices will prompt significant shifts toward regional manufacturing and nearshoring strategies, as companies seek to mitigate exposure to unpredictable trade policies. Major device makers such as Zimmer Biomet estimate that the tariff regime could reduce 2025 profits by up to $80 million, underscoring the urgency of supply chain reconfiguration and cost-containment measures.

Uncovering Crucial Segmentation Insights Revealing Variations in Graft Types, Surgical Techniques, Products, Procedure Approaches, and User Profiles

The cruciate ligament repair market encompasses a diverse range of graft options tailored to patient needs and surgical objectives. Allografts, derived from donor Achilles, peroneus, or tibialis tendons, are favored for their avoidance of donor-site morbidity and mechanical consistency. Conversely, autografts harvested from the patient’s own hamstring, patellar, or quadriceps tendons offer exceptional biocompatibility and integration potential, albeit at the expense of additional harvest-site recovery. Synthetic grafts, constructed from carbon fiber or advanced polymers, present an emerging alternative that eliminates biological constraints, while xenografts sourced from bovine or porcine tissues invite novel reconstruction strategies despite immunogenic considerations.

Surgeons choose between single-bundle and double-bundle techniques based on patient anatomy and activity demands. Single-bundle procedures remain predominant due to their streamlined workflow and proven efficacy, whereas double-bundle approaches have gained traction for delivering enhanced rotational stability that may benefit athletes in pivot-intensive sports.

Product segmentation further differentiates the landscape. Biological agents-including growth factor cocktails and cell-seeded scaffolds-focus on expediting healing and reducing complications. Fixation devices, from bioabsorbable interference screws to advanced cortical buttons, ensure mechanical stability and precise graft positioning. Knee braces, deployed in pre- and postoperative phases, support joint alignment and controlled motion to facilitate safe rehabilitation.

Procedure modalities span minimally invasive arthroscopic reconstructions that reduce tissue trauma and accelerate discharge, to open techniques reserved for complex revisions or multiligament injuries. Meanwhile, the choice of treatment venue-whether cost-efficient ambulatory surgery centers, high-volume hospital operating suites, or specialized orthopedic clinics-reflects a balance of patient acuity, reimbursement structures, and operational priorities.

This comprehensive research report categorizes the Cruciate Ligament Repair Procedures market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Graft Type

- Technique

- Product

- Procedure Type

- End User

Examining Regional Market Dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific Highlighting Cruciate Ligament Repair Trends

North America continues to lead global adoption of cruciate ligament repair solutions, driven by a high incidence of sports-related injuries, robust reimbursement frameworks, and advanced surgical infrastructure. Approximately 40% of global procedure volumes occur in the Americas, with the United States performing an estimated 200,000 ACL reconstructions annually. This region’s market maturity is bolstered by widespread adoption of minimally invasive arthroscopic techniques and comprehensive rehabilitation services that optimize return-to-play outcomes.

In Europe, Middle East & Africa, the market exhibits considerable diversity. Western European countries such as Germany and the United Kingdom emphasize standardized post-surgical protocols integrating physiotherapy and injury prevention initiatives, which support sustained procedure volumes. Meanwhile, Gulf Cooperation Council nations are investing in orthopedic infrastructure to serve a growing expatriate and sports population, and select African markets are benefiting from nonprofit outreach programs introducing cost-effective repair options to underserved regions.

Asia-Pacific is the fastest-growing region, fueled by expanding middle-class demographics, rising participation in recreational sports, and significant investments in healthcare capacity. Countries including Japan, Australia, India, and China are scaling up capabilities in both metropolitan centers and emerging secondary cities, driven by government incentives and private-sector partnerships. Telemedicine integration and digital health platforms are enhancing postoperative monitoring and widening access to specialized orthopedic expertise across vast geographic areas.

This comprehensive research report examines key regions that drive the evolution of the Cruciate Ligament Repair Procedures market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves and Competitive Strengths of Leading Firms Driving Innovation in Cruciate Ligament Repair Solutions

The competitive landscape in cruciate ligament repair is dominated by global orthopedics and medtech leaders that combine extensive product portfolios with strategic partnerships and targeted acquisitions. Industry stalwarts such as Arthrex, Smith & Nephew, Stryker, Zimmer Biomet, CONMED, and DJO Global leverage deep R&D pipelines and broad distribution networks to maintain market leadership and drive incremental innovation in graft materials and fixation devices.

In response to growing demand for biologic and digital therapies, leading firms are forging alliances with biotechnology start-ups and software developers to incorporate cell-based scaffolds, growth factor technologies, and smart sensor integration into their core offerings. This convergence seeks to create data-driven postoperative monitoring systems that enhance clinical decision-making and foster personalized rehabilitation pathways.

At the same time, emerging companies and academic spin-outs are contributing disruptive solutions in niche areas such as 3D-printed patient-specific grafts and dynamic arthroscopic navigation systems. These entrants often collaborate with established device manufacturers to accelerate commercialization, underlining a robust ecosystem of open innovation that promises continued advancements in surgical precision and patient outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cruciate Ligament Repair Procedures market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- B. Braun Melsungen AG

- Bauerfeind AG

- CONMED Corporation

- Corin Group PLC

- DeRoyal Industries, Inc.

- DJO, LLC by Enovis

- Exactech, Inc.

- GROUP FH ORTHO communication

- HCA International Limited

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Mayo Clinic

- Medtronic PLC

- Miach Orthopaedics, Inc.

- MicroPort Scientific Corporation

- Olympus Corporation

- RTI Surgical

- Smith & Nephew PLC

- Stryker Corporation

- Tissue Regenix Ltd

- TRUSTEES OF THE LONDON CLINIC LIMITED.

- Waldemer Link GmbH & Co. K.G.

- Zimmer Biomet Holdings, Inc.

- Össur

Implementing Practical and Forward-Looking Recommendations to Enhance Market Position and Operational Excellence in Cruciate Ligament Repair

To capitalize on evolving treatment paradigms, industry leaders should prioritize investment in regenerative medicine platforms and establish strategic research partnerships that integrate advanced biologics with synthetic scaffold technologies. By co-developing cell-based and growth factor-enhanced grafts, manufacturers can differentiate their portfolios and address unmet clinical needs in challenging patient cohorts.

Simultaneously, companies must diversify their supply chains through regional manufacturing hubs and nearshoring strategies. Establishing localized production facilities will mitigate tariff exposure, reduce lead times, and strengthen relationships with key healthcare providers in high-growth markets.

Adoption of minimally invasive and navigated surgical platforms should be accelerated through targeted education and surgeon training programs. Leveraging digital simulation, virtual reality modules, and dynamic tracking systems will support faster procedure adoption and enhance surgeon proficiency, ultimately improving patient satisfaction and reducing complication rates.

Finally, integrating telemedicine and wearable sensor technologies into postoperative care pathways will enable real-time monitoring of rehabilitation progress. Creating bundled service models that combine devices, digital health platforms, and value-based outcomes reporting can improve patient engagement and support favorable reimbursement discussions with payers.

Detailing the Rigorous Research Methodology and Analytical Framework Underpinning Insights into Cruciate Ligament Repair Trends and Developments

Our research methodology blends rigorous primary and secondary research to ensure robust, actionable insights. Primary research included in-depth interviews with orthopedic surgeons, hospital procurement leaders, and rehabilitation specialists, complemented by surveys of industry stakeholders to validate emerging trends and product preferences.

Secondary research encompassed comprehensive literature reviews, analysis of peer-reviewed journals, device manufacturer publications, government healthcare reports, and trade association data. These sources provided foundational context on clinical practices, regulatory developments, and technology adoption rates.

We applied a structured data triangulation approach to cross-verify quantitative and qualitative inputs, ensuring reconciliation of divergent viewpoints and mitigation of bias. Advanced analytical tools were employed to identify key drivers, challenges, and competitive dynamics across each segment and region.

Quality assurance was integral throughout the process, with iterative reviews conducted by subject-matter experts in orthopedic surgery and medical device strategy. This validation framework underpins the credibility of our findings and supports confident strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cruciate Ligament Repair Procedures market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cruciate Ligament Repair Procedures Market, by Graft Type

- Cruciate Ligament Repair Procedures Market, by Technique

- Cruciate Ligament Repair Procedures Market, by Product

- Cruciate Ligament Repair Procedures Market, by Procedure Type

- Cruciate Ligament Repair Procedures Market, by End User

- Cruciate Ligament Repair Procedures Market, by Region

- Cruciate Ligament Repair Procedures Market, by Group

- Cruciate Ligament Repair Procedures Market, by Country

- United States Cruciate Ligament Repair Procedures Market

- China Cruciate Ligament Repair Procedures Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Conclusions from Comprehensive Analysis to Illuminate the Future Landscape of Cruciate Ligament Repair and Orthopedic Care

This comprehensive analysis underscores a pivotal moment in cruciate ligament repair, marked by groundbreaking biologic and technological advances, evolving tariff landscapes, and nuanced segmentation and regional dynamics. The integration of regenerative therapies, precision navigation systems, and smart devices is reshaping surgical protocols and enhancing patient outcomes.

At the same time, 2025 U.S. tariff measures introduce significant supply chain challenges, prompting manufacturers to reconfigure sourcing strategies and accelerate domestic production capabilities. Stakeholders adept at navigating these shifts will gain a competitive advantage in cost management and operational resilience.

Segmentation insights reveal that tailored graft choices, surgical techniques, and product portfolios enable providers to address diverse patient needs, while regional variations in infrastructure and healthcare policy inform targeted market entry and expansion plans.

Leading companies that leverage strategic collaborations, invest in clinical education, and adopt integrated digital health solutions will be well positioned to capture growth and drive innovation in ligament repair. As the market evolves, continuous monitoring of technology trends, policy developments, and end-user preferences will be essential to sustain momentum and deliver value across the healthcare continuum.

Partner with Ketan Rohom to Secure Comprehensive Cruciate Ligament Repair Market Intelligence for Strategic Advantage and Informed Decision-Making

To explore the full breadth of insights into cruciate ligament repair procedures, and to equip your team with actionable intelligence for strategic decision-making, contact Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to purchase the comprehensive market research report.

Partnering with Ketan Rohom will enable your organization to leverage in-depth analysis, robust data, and expert perspectives designed to drive innovation and growth in the evolving landscape of ligament repair.

- How big is the Cruciate Ligament Repair Procedures Market?

- What is the Cruciate Ligament Repair Procedures Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?