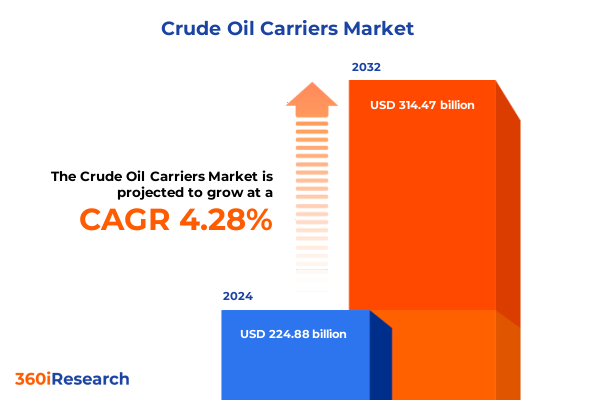

The Crude Oil Carriers Market size was estimated at USD 234.03 billion in 2025 and expected to reach USD 243.56 billion in 2026, at a CAGR of 4.31% to reach USD 314.47 billion by 2032.

Navigating the Evolving Dynamics of Global Crude Oil Carrier Operations Amidst Intensifying Geopolitical Tensions Technological Advancements and Regulatory Shifts

Crude oil carriers stand at the intersection of global energy supply and maritime logistics, serving as the backbone of seamless hydrocarbon transportation across continents. Against a backdrop of volatile oil prices, evolving regulatory regimes, and shifting trade patterns, these specialized vessels play a critical role in balancing regional supply and demand imbalances. As strategic assets, they are subject not only to economic cycles but also to technological, environmental, and geopolitical pressures that shape their deployment and utilization.

In recent years, increasing emphasis on environmental stewardship alongside decarbonization targets has prompted stakeholders to reconsider the design and operation of tanker fleets. Simultaneously, digitalization initiatives-from advanced voyage optimization tools to real-time performance monitoring-are transforming traditional operating models and driving efficiency gains. Meanwhile, intensifying geopolitical tensions and trade policy shifts continue to influence route selection, port calls, and charter negotiations, compelling owners and operators to remain agile.

Against this multifaceted backdrop, this executive summary offers a concise yet comprehensive introduction to the crude oil carrier landscape. It sets the stage for an in-depth exploration of transformative industry shifts, the 2025 United States tariff regime, segmentation dynamics, regional variations, leading companies, actionable strategies, and the rigorous research methodology underpinning our findings.

Examining Transformative Shifts Reshaping Crude Oil Carrier Industry from Demand Realignment to Environmental and Digital Innovations

The crude oil carrier sector is undergoing a period of profound transformation driven by a convergence of demand-side realignments and supply-side innovations. On the demand front, the gradual energy transition in advanced economies is reshaping global consumption patterns, while industrial expansion in emerging markets continues to support robust seaborne oil trade. This duality underscores the need for carriers that can adapt to both traditional long-haul crude flows and shorter haul trade lanes catering to regional refining hubs.

From a supply-side perspective, the adoption of digital solutions such as machine learning-enabled voyage planning and predictive maintenance platforms has delivered tangible reductions in fuel burn and operational downtime. Concurrently, initiatives to lower greenhouse gas emissions have spurred interest in LNG dual-fuel conversions and the exploration of carbon capture integration aboard tankers. These technological strides, coupled with evolving safety and environmental regulations, are redefining vessel specifications and refit strategies across the fleet spectrum.

Moreover, risk management practices have advanced in response to geopolitical uncertainties and trade policy flux. Shipowners and charterers are increasingly pursuing flexible charter structures and diversifying route portfolios to hedge against potential market disruptions. In tandem, collaborative frameworks among industry participants-such as data-sharing consortia and joint sustainability ventures-are fostering a more resilient and future-ready crude oil carrier ecosystem.

Analyzing the Cumulative Consequences of the 2025 United States Tariff Regime on Crude Oil Carrier Trade Patterns and Operational Economics

In early 2025, the United States implemented a new tariff framework aimed at energy imports, imposing a 10 percent levy on Canadian crude oil and a 25 percent tariff on Mexican crude oil effective March 4 with a subsequent delay until April 2. These measures have prompted significant rerouting of seaborne crude flows as U.S. refiners seek more cost-effective supply alternatives. As a result, a portion of North American oil shipments has shifted to markets in Latin America, Europe, and Asia, thereby altering traditional trade corridors and compressing voyage durations for certain vessel segments.

The tariff impact extends beyond route optimization. Freight rates on key routes have experienced upward pressure, particularly for medium-range vessels such as Aframax and Suezmax, which are now being redeployed to serve shifting trade flows. Charterers facing increased voyage fees are negotiating more flexible, spot-market arrangements, while owners of longer-haul VLCC tonnage are capitalizing on the opportunity to reposition their fleets toward deep-sea trades that bypass U.S. import points. Furthermore, the tariff-induced volatility has intensified demand for shorter-term contracts, boosting utilisation of time and voyage charters at the expense of longer bareboat fixtures.

Looking ahead, the cumulative effect of these trade restrictions is driving industry participants to reassess risk exposure and optimize fleet deployment strategies. Some operators are accelerating newbuild deliveries to secure modern, fuel-efficient tonnage capable of mitigating increased voyage costs, whereas others are exploring strategic alliances to share trade and commercial risk. Amid this dynamic environment, adaptability and proactive scenario planning have emerged as critical success factors for any stakeholder in the crude oil carrier domain.

Unveiling Core Segmentation Insights Driving Vessel Dimensions, Hull Designs, Charter Models, Use Cases and Fleet Renewal Pathways

The crude oil carrier market encompasses a diverse array of vessel types, each tailored to specific cargo volumes and trade routes. Medium-size Aframax tankers, prized for their versatility on regional trades, sit alongside Panamax vessels whose dimensions are optimized for canal transits. In contrast, Suezmax carriers dominate Suez Canal passages with maximum allowable draft, while the ultra-large VLCC class underpins major long-haul crude transports. These distinctions in vessel type inform charter strategies, fuel consumption profiles, and port access capabilities.

Hull configuration is another pivotal segmentation, with double-hulled vessels now constituting the industry standard in light of stringent environmental regulations. Although single-hull ships still operate in limited secondary markets, they face higher insurance premiums and constrained trading regions. Charter arrangements further diversify market participation, spanning bareboat charters where operators assume full vessel control, time charters tied to fixed hire rates, and voyage charters that link earnings directly to freight performance and commodity price dynamics.

Application-based segmentation reveals dual roles for crude carriers: traditional transportation of oil from load ports to refineries and floating storage during periods of contango or logistical delay. Lastly, build type distinguishes newbuild orders designed for cutting-edge efficiency from secondhand acquisitions that offer shorter delivery lead times. Each build decision reflects tradeoffs among capital expenditure, environmental compliance, and immediate market access, shaping fleet compositions and strategic investment plans.

This comprehensive research report categorizes the Crude Oil Carriers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vessel Type

- Hull Type

- Charter Type

- Application

- Build Type

Decoding Regional Variations in Crude Oil Carrier Dynamics across the Americas, Europe Middle East & Africa and Asia-Pacific Markets

Regional dynamics exert a significant influence on crude oil carrier operations, with the Americas, Europe Middle East & Africa, and Asia-Pacific each presenting unique market drivers. In the Americas, proximity to major shale oil production centers and expanding coastal refinery capacity has elevated intra-regional trade, highlighting the strategic importance of smaller tanker classes capable of trans-Gulf and Caribbean voyages. Infrastructure bottlenecks such as Panama Canal constraints further amplify the value of vessels optimized for canal dimensions.

In Europe Middle East & Africa, the interplay between North Sea, West African, and Middle Eastern crude flows underpins a complex network of export corridors. Here, geopolitical developments and OPEC+ production decisions directly affect tanker demand, while stringent EU emissions directives accelerate the phase-out of non-compliant tonnage. The region’s refiners rely heavily on Suezmax and VLCC vessels to maintain supply continuity, creating stable demand for larger classes despite periodic oversupply challenges.

Asia-Pacific constitutes the world’s largest net importer of crude, driven by robust energy demand in China, India, Japan, and South Korea. Extended voyage distances from Middle Eastern load ports underscore the value of VLCC scale efficiencies, while burgeoning refining capacity in Southeast Asia has spurred increased intra-regional short sea trades. Moreover, developing hubs in Malaysia and Singapore have emerged as critical floating storage nodes, reinforcing the dual transport and storage role of modern tanker fleets.

This comprehensive research report examines key regions that drive the evolution of the Crude Oil Carriers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Crude Oil Carrier Organizations Driving Innovation Operational Excellence and Strategic Collaborations in a Competitive 2025 Landscape

The competitive landscape of crude oil carriers is shaped by a mix of publicly listed shipping firms, state-owned enterprises, and private family-owned operators. Leading publicly traded players leverage scale advantages to invest in fleet renewal, securing LNG dual-fuel newbuilds and retrofits that meet the latest environmental standards. These organizations also explore joint ventures to gain exposure to specialized trades and emerging markets, bolstering resilience through portfolio diversification.

State-backed carriers in the Middle East and Asia continue to channel national investment toward expanding export capacity and infrastructure, often integrating shipping arms with upstream and downstream assets. Meanwhile, private operators focus on niche segments such as floating storage operations or regional medium-range trades, competing on flexibility and service customization. Across the board, top performers distinguish themselves through disciplined cost management, digital transformation roadmaps, and strategic partnerships with charterers and commodity traders.

Strategic alliances and pooling arrangements have gained traction as a means to optimize vessel utilisation and share commercial risk. By combining resources, carriers can allocate tonnage more efficiently across fluctuating demand cycles and capitalize on emerging trade lanes. Collectively, these leading companies demonstrate a clear strategic emphasis on operational excellence, fleet modernization, and collaborative growth models in response to evolving market imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crude Oil Carriers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angelicoussis Shipping Group Ltd.

- China COSCO Shipping Energy Transportation Co., Ltd.

- China Merchants Group Ltd.

- DHT Holdings Inc.

- Euronav NV

- Frontline Ltd.

- Minerva Marine Inc.

- Mitsui O.S.K. Lines, Ltd.

- National Iranian Tanker Company

- SFL Corporation Ltd.

- Teekay Corporation

- The National Shipping Company of Saudi Arabia

- Tsakos Energy Navigation Ltd.

Proposing Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience Efficiency and Sustainability in Crude Oil Carrier Fleets

Industry leaders are advised to adopt a multifaceted approach focused on fleet flexibility and decarbonization readiness. Prioritizing dual-fuel and alternative fuel conversions can serve as a hedge against tightening emissions regulations, while strategic newbuild orders should target highly efficient designs capable of delivering lower lifecycle costs. Embracing digital platforms for voyage optimization and predictive maintenance will further reduce fuel consumption and downtime, enhancing overall profitability.

Risk management practices must evolve to encompass geopolitical and trade policy volatility. Securing a balanced charter portfolio that spans spot, time, and bareboat arrangements mitigates exposure to sudden market swings. Furthermore, forging strategic partnerships with oil majors and trading houses can unlock integrated commercial opportunities, streamlining cargo placement and ensuring consistent employment for owned tonnage.

Finally, cultivating transparent environmental, social, and governance (ESG) frameworks is critical for attracting capital and long-term stakeholder support. Clear emissions reporting, credible decarbonization roadmaps, and proactive engagement with regulatory bodies will position carriers as industry leaders in a sustainability-driven era. By combining these actionable levers, operators can safeguard competitive advantage and foster enduring resilience in an uncertain marketplace.

Detailing Robust Research Methodology Combining Primary Interviews Secondary Data Vessel Tracking and Expert Validation for Unparalleled Market Insights

Our research methodology integrates a blend of primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary insights were obtained through structured interviews with vessel owners, ship managers, chartering executives, and regulatory authorities. These dialogues provided nuanced perspectives on operational challenges, vessel deployment strategies, and emerging regulatory expectations.

Secondary research involved extensive review of maritime registries, international shipping databases, and publications from the International Maritime Organization, energy agencies, and port authorities. Vessel movement and utilization metrics were analyzed via AIS data feeds, enabling a granular understanding of trade flows and seasonal pattern shifts. Where quantitative gaps existed, expert panels and peer-review checkpoints were employed to validate key assumptions and ensure consistency across findings.

The combination of qualitative stakeholder insights and quantitative vessel tracking underpinned a bottom-up analysis framework that enhances confidence in observed trends and strategic imperatives. All findings were subjected to multi-tier validation to ensure accuracy and relevance for decision-makers in the crude oil carrier domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crude Oil Carriers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crude Oil Carriers Market, by Vessel Type

- Crude Oil Carriers Market, by Hull Type

- Crude Oil Carriers Market, by Charter Type

- Crude Oil Carriers Market, by Application

- Crude Oil Carriers Market, by Build Type

- Crude Oil Carriers Market, by Region

- Crude Oil Carriers Market, by Group

- Crude Oil Carriers Market, by Country

- United States Crude Oil Carriers Market

- China Crude Oil Carriers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on the Future Trajectory of Crude Oil Carriers within an Era of Regulatory Technological and Trade Transformation

As the crude oil carrier sector navigates an era defined by regulatory transformation, technological innovation, and shifting trade dynamics, stakeholders must remain agile and forward-looking. The interplay between energy transition imperatives, digitalization opportunities, and evolving policy frameworks will continue to reshape fleet composition and operational models.

In this landscape, strategic differentiation will hinge on the speed of fleet modernization, the depth of digital integration, and the clarity of sustainability commitments. Carriers that effectively balance commercial agility with rigorous risk management and ESG leadership will secure preferential access to charters, capital markets, and strategic partnerships.

Ultimately, the future trajectory of crude oil carriers will be determined by the industry’s collective capacity to anticipate change, embrace collaboration, and invest in enduring operational resilience. This executive summary lays the groundwork for informed decision-making, equipping leaders with the essential insights needed to thrive in an increasingly complex maritime environment.

Engaging with Ketan Rohom to Secure the Definitive Market Research Report Enabling Strategic Advantage in Crude Oil Carrier Sector

Elevate your strategic decision-making by securing the full market research report on crude oil carriers. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through tailored insights and bespoke solutions that align with your organizational priorities. Connect today to gain access to in-depth analysis, proprietary data, and expert recommendations that will empower your team to stay ahead of evolving market dynamics. Reach out to Ketan Rohom to discuss customization options and unlock your competitive advantage now

- How big is the Crude Oil Carriers Market?

- What is the Crude Oil Carriers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?