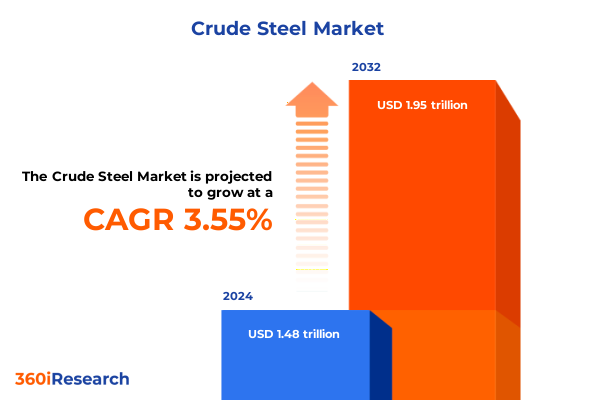

The Crude Steel Market size was estimated at USD 1.53 trillion in 2025 and expected to reach USD 1.57 trillion in 2026, at a CAGR of 3.56% to reach USD 1.95 trillion by 2032.

Unveiling Crude Steel’s Strategic Pillars and Current Market Dynamics Shaping the Future of Global Production and Consumption Patterns Today

In the evolving landscape of global industrial production, crude steel remains foundational to infrastructure, energy, and transportation sectors. According to data from the World Steel Association, total global crude steel output reached 1,882.6 million tonnes in 2024, a slight decrease of 0.8% compared to 2023. China accounted for over half of this volume with output of 1,005.1 million tonnes, while India, Japan, the United States, and Russia collectively contributed the majority of remaining production. Despite modest growth in regions such as Asia and Europe, North America experienced a 4.2% decline in 2024, reflecting broader economic headwinds. This production profile underscores ongoing shifts in regional competitiveness, raw material supply chains, and capacity utilization, setting the stage for dynamic market interactions in 2025.

In the United States, domestic steel production measures serve as barometers for industrial health, with the American Iron and Steel Institute reporting raw steel production of 88 million net tons in 2024, down 2% from the prior year. Shipments from U.S. mills totaled 87 million net tons, while finished steel imports captured a 22% share of apparent consumption, indicating a delicate balance between domestic output and import reliance. The construction and automotive sectors continued to drive end-use demand, even as margins and supply chain constraints challenged producers. These dynamics highlight the critical interplay between policy, technology, and market forces shaping the U.S. steel landscape, and they frame the themes explored in this report.

Navigating Transformative Shifts: Decarbonization, Electrification, and Digital Innovation Reshaping the Crude Steel Industry’s Competitive Landscape

Decarbonization is redefining competition in the crude steel sector, as producers adopt electric arc furnaces and hydrogen-based iron reduction to mitigate carbon intensity. A recent report by the Centre for Research on Energy and Clean Air notes that transitioning from traditional blast furnaces to electric arc furnaces powered by scrap and direct reduced iron could reduce emissions by over 160 million tonnes in China alone, offering a blueprint for global decarbonization. Meanwhile, the United States led global EAF utilization at 71.8% in 2024, leveraging scrap-based production to improve environmental performance. These shifts are catalyzed by tightening climate policies and rising stakeholder expectations, prompting integrated steelmakers to explore innovations such as blue hydrogen and carbon capture, utilization, and storage to balance cost and sustainability imperatives.

Alongside decarbonization, digital transformation initiatives are accelerating operational performance across steel value chains. Industry surveys indicate that more than 85% of steel firms consider data analytics critical to their digital strategies, leveraging AI-driven predictive maintenance to boost equipment uptime by up to 25% and reduce unscheduled downtime significantly. The adoption of machine learning algorithms for quality control has enhanced defect detection rates, while digital twin and IoT sensor platforms enable real-time monitoring of production processes. This convergence of digital and physical systems is forging smarter, more resilient steel operations capable of adapting to market fluctuations and regulatory demands.

Assessing the Cumulative Impact of United States Steel Tariffs in 2025 on Domestic Prices, Supply Chains, and Global Trade Relationships

In February 2025, President Trump restored full 25% tariffs on steel imports and ended country exemptions and exclusion processes, reinforcing Section 232 measures originally imposed in 2018. This action applied to imports from all previous exemption recipients, subjecting them to a uniform ad valorem duty, and removed General Approved Exclusions effective March 12, 2025. Subsequently, on June 4, 2025, the administration increased steel and aluminum tariffs to 50%, while maintaining a 25% rate for the United Kingdom pending bilateral economic talks. These successive policy moves mark one of the most significant escalations in U.S. trade barriers against metals in recent decades and have redefined the framework for import competition.

The immediate impact on domestic steel prices has been pronounced, with benchmark hot rolled coil prices climbing by approximately 15% to 20% since the initial tariff restoration. Domestic producers ramped up utilization by an estimated 8% year-to-date, yet fabrication bottlenecks emerged as mills reached capacity limits. In the construction sector, rebar costs surged by over 26%, adding significant overhead to infrastructure projects, while lead times for architectural metals extended from typical eight to ten weeks to fourteen to eighteen weeks, forcing developers to adjust project timelines and budgets.

Supply chain realignment has become a strategic imperative for steel-consuming industries. Automotive OEMs, which rely on approximately 15% imported steel and 60% imported aluminum, have faced per-vehicle cost increases of around $240, driven by tariffs and domestic price inflation. Companies like Ford and General Motors have accelerated their supplier localization programs and sought alternative materials, but these adjustments require lengthy qualification cycles and capital investment. Similarly, aerospace and machinery manufacturers report multi-million-dollar hits to earnings, as exemplified by RTX’s 2025 forecast revision attributing a $125 million tariff-related charge in the first half of the year and projecting up to $500 million in total headwinds.

International trade relationships have also been reshaped, as key partners respond with reciprocal measures and negotiate new frameworks. European Commission officials have indicated readiness to impose counter-tariffs if U.S. steel duties reach 50%, while high-level talks between EU and U.S. leaders aim to establish a baseline 15% tariff and special terms for major industries by a looming August deadline. These discussions have lifted market sentiment even as European auto giants brace for increased costs. Meanwhile, supply chain diversification deals with Southeast Asian producers have been forged to alleviate immediate pressures, though the long-term efficacy of such arrangements remains contingent on tariff stability.

Key Insights into Crude Steel Market Segmentation Revealing Product Types, Grades, Technologies, Applications, Forms, and Coating Trends

The crude steel market exhibits a complex array of product type distinctions, spanning cold rolled coil and hot rolled coil to galvanized steel, plate and sheet, and the more elongated long products that include bars, sections, and wire rods. Each category presents unique cost structures and performance attributes, driving producers to tailor production mixes in line with customer specifications and downstream processing requirements. Concurrently, the steel grade spectrum-from carbon and alloy steels to specialized tool steels-further diversifies the market. Within the stainless steel segment, the industry navigates nuances between austenitic, ferritic, and martensitic grades, ensuring that each metallurgical variant meets stringent corrosion resistance and mechanical strength standards demanded by sectors such as energy and automotive.

Manufacturing technology segmentation underscores divergent pathways to steelmaking, with traditional blast furnace–basic oxygen furnace integration coexisting alongside the rapid expansion of electric arc furnace operations. Within the EAF realm, operators distinguish between direct reduced iron–based facilities and scrap-based installations, each offering different decarbonization and cost profiles. On the application front, the market spans critical infrastructure domains: automotive production-spanning both commercial and passenger vehicles-construction activities in commercial, residential, and infrastructure projects, energy sector applications in oil and gas and power generation, heavy machinery and equipment fabrication, as well as home appliances and packaging solutions, each requiring tailored grades, surface treatments, and production scales.

Form and coating considerations further segment the landscape. Flat products bifurcate into coils and sheets and plates, with sheets and plates divided into plate and sheet subtypes, while long products echo the segmentation of bars, sections, and wire rods. Tubular products, indispensable to piping and conduit systems, consist of seamless and welded offerings. Coating distinctions-between galvanized and uncoated steels-affect corrosion performance and cost, with galvanized steel subdivided into electrogalvanized and hot dip processes, each selected based on end-use exposure conditions and fabrication compatibility.

This comprehensive research report categorizes the Crude Steel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Steel Grade

- Manufacturing Technology

- Application

- Form

- Coating

Unearthing Regional Dynamics: Comparative Analysis of Crude Steel Demand, Production, and Infrastructure Developments across Key Global Regions

In the Americas, crude steel production dynamics reflect both mature industrial capacity and evolving trade patterns. North American output, led by the United States and Canada, faced a 4.3% decline in December 2024, with U.S. production dipping to 6.7 million tonnes that month. Domestic production of 79.5 million tonnes for the full year 2024 was down 2.4%, even as shipments remained robust at 87 million net tons. Import penetration increased to capture approximately 22% of apparent consumption, underscoring the region’s reliance on foreign steel amidst domestic capacity constraints and policy-driven cost adjustments.

Europe, the Middle East, and Africa present a diverse production landscape, with the EU27 recording a 7.2% increase to 9.6 million tonnes in December 2024 and year-to-date output rising by 2.6%. Other European producers outside the EU saw more pronounced volatility, and Middle Eastern mills experienced a 4.5% decrease that month. This heterogeneity is influenced by varying regulatory regimes, decarbonization incentives, and regional demand drivers, from infrastructure modernization in the Gulf to automotive supply chains in Central Europe.

Asia-Pacific remains the largest crude steel hub, producing 106.3 million tonnes in December 2024, up 9.0% year-on-year, with annual output of 1,357.8 million tonnes. China alone accounted for over 1,005.1 million tonnes in 2024, driven by stimulus measures and export resilience, while India’s production grew by 6.3%. Japan and South Korea, despite marginal declines, maintained significant export volumes. These dynamics underscore Asia-Pacific’s centrality to global supply chains, even as policy shifts and environmental mandates begin to reshape regional production strategies.

This comprehensive research report examines key regions that drive the evolution of the Crude Steel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players: Strategic Moves, Innovations, and Collaborations Driving Competitive Advantage in the Crude Steel Industry

Domestic champions such as Nucor and United States Steel have responded to market shifts by expanding electric arc furnace capacity, investing in scrap-based production, and exploring partnerships for hydrogen-ready facilities. These initiatives aim to leverage the flexibility of EAF technology while meeting emerging environmental standards, positioning them to serve both traditional heavy industries and new green steel demand channels.

Global integrated leaders are also recalibrating their footprints. ArcelorMittal, the world’s second-largest producer, has advanced plans for a greenfield facility in Alabama to supply the automotive sector, reflecting a broader trend of onshore capacity additions to circumvent tariff and logistical headwinds. Meanwhile, South Korea’s Hyundai Steel has announced U.S. expansions, signaling intensified competition in key end-use markets.

Mid-tier players are similarly adapting. Cleveland-Cliffs reversed its hydrogen fuel transition at its Middletown, Ohio, plant, citing feasibility challenges, and instead maintained coal-fired operations under the security of heightened tariff protections. This decision underscores the balancing act between decarbonization ambitions and immediate economic realities, as companies navigate policy incentives, capital constraints, and technology readiness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crude Steel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansteel Group Corporation Limited

- ArcelorMittal S.A.

- China Baowu Steel Group Corp., Ltd.

- China Steel Corporation

- Cleveland-Cliffs Inc.

- Evraz plc

- Gerdau S.A.

- HBIS Group Co., Ltd.

- Hyundai Steel Company

- JFE Holdings, Inc.

- Jiangsu Shagang Group Co., Ltd.

- Jianlong Heavy Industry Group Co., Ltd.

- Jingye Group Co., Ltd.

- Liuzhou Iron & Steel Co., Ltd.

- Nippon Steel Corporation

- Nucor Corporation

- POSCO Holdings Inc.

- Severstal PJSC

- Shandong Iron and Steel Group Co., Ltd.

- Shougang Group Co., Ltd.

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine AG

Actionable Recommendations for Industry Leaders to Enhance Resilience, Drive Sustainable Growth, and Capitalize on Emerging Opportunities in the Steel Sector

Industry leaders should prioritize strategic decarbonization investments by accelerating the deployment of electric arc furnace technologies and hydrogen-ready facilities. Securing access to high-quality scrap and exploring partnerships for direct reduced iron projects will mitigate exposure to tariff volatility while aligning with environmental regulations. Capital allocation should emphasize modular, scalable solutions that can adapt to shifting policy frameworks and raw material markets.

Simultaneously, embracing advanced digital tools is critical to optimizing operational efficiency. Implementing predictive maintenance platforms, digital twin simulations, and data analytics for quality control will reduce downtime and enhance throughput. A cohesive digital roadmap can also improve supply chain visibility, enabling proactive responses to procurement disruptions and market fluctuations.

Finally, companies must engage constructively with policymakers and industry associations to shape pragmatic trade and environmental regulations. Active participation in dialogue around tariff exclusions, decarbonization incentives, and infrastructure funding will ensure balanced outcomes that support both national security objectives and industry competitiveness. Cultivating strategic relationships with customers and suppliers will further strengthen market resilience.

Research Methodology Highlighting Data Sources, Analytical Approaches, and Validation Protocols Underpinning the Crude Steel Market Assessment

This analysis draws on a triangulated research methodology combining primary and secondary data sources, rigorous validation techniques, and expert consultations. Primary inputs include proprietary shipment and production data from industry bodies, supplemented by company disclosures, government proclamations, and tariff documentation. Secondary sources encompass peer-reviewed reports, reputable news outlets, and specialized industry databases. A systematic exclusion criterion was applied to avoid content from non-permitted market research firms.

Quantitative data underwent cross-verification through multiple channels, including World Steel Association statistics, American Iron and Steel Institute releases, and governmental fact sheets. Qualitative insights were validated via expert interviews with steelmakers, policy analysts, and end-use sector leaders. Analytical approaches involved segmentation analysis, scenario evaluation, and impact modeling to assess tariff effects and decarbonization trajectories.

To ensure accuracy and reliability, the research team employed consistency checks, source credibility assessments, and peer review. All findings were subjected to triangulation against external benchmarks and refined iteratively to reflect emerging market developments and policy shifts, guaranteeing a robust and actionable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crude Steel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crude Steel Market, by Product Type

- Crude Steel Market, by Steel Grade

- Crude Steel Market, by Manufacturing Technology

- Crude Steel Market, by Application

- Crude Steel Market, by Form

- Crude Steel Market, by Coating

- Crude Steel Market, by Region

- Crude Steel Market, by Group

- Crude Steel Market, by Country

- United States Crude Steel Market

- China Crude Steel Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Synthesizing Key Findings and Industry Implications to Provide a Clear Conclusion on the Crude Steel Market’s Current State and Future Trajectory

The crude steel landscape in 2025 is defined by intricate interplays between policy, technology, and global market forces. Decarbonization initiatives and tariff policies have emerged as twin drivers, challenging legacy production models while opening pathways for innovation. Market segmentation reveals distinct competitive dynamics across product types, grades, and manufacturing technologies, underlining the importance of strategic alignment with end-use requirements.

Regionally, shifts in production and consumption patterns reflect the evolving roles of established and emerging players, from North American capacity adjustments to Asia-Pacific’s production dominance. Leading companies are navigating this terrain through capacity investments, technology pivots, and supply chain realignments, all while balancing short-term economic imperatives against long-term sustainability goals.

Looking ahead, the industry’s ability to integrate digital transformation with green steel technologies, engage constructively on trade policy, and anticipate shifting demand will determine competitive success. By synthesizing these insights, stakeholders can chart informed strategies that harness market opportunities, manage risks, and drive value creation in a rapidly transforming sector.

Act Now to Secure Detailed Insights and Drive Strategic Advantage in the Crude Steel Industry with Expert Guidance from Associate Director Ketan Rohom

Ready to gain unparalleled depth on crude steel market dynamics and strategic imperatives? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the full market research report today and empower your organization with the insights needed to stay ahead in this rapidly evolving industry

- How big is the Crude Steel Market?

- What is the Crude Steel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?