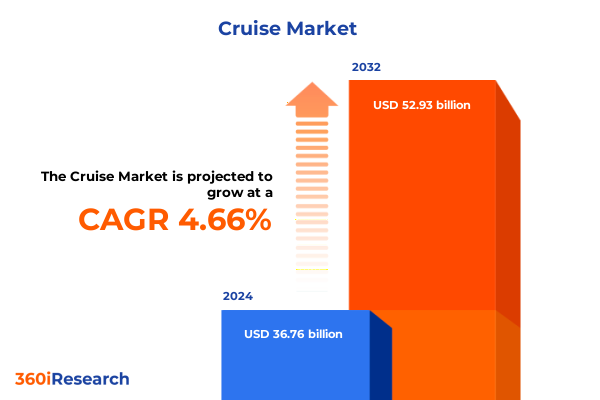

The Cruise Market size was estimated at USD 38.39 billion in 2025 and expected to reach USD 40.12 billion in 2026, at a CAGR of 4.69% to reach USD 52.93 billion by 2032.

Navigating the Dynamic Resurgence of the Global Cruise Industry Driven by Passenger Demand Innovation and Sustainable Technology Integration

The cruise industry has demonstrated remarkable resilience and vitality in the post-pandemic era, evolving beyond traditional vacation paradigms to meet rising consumer expectations and sustainability imperatives. In 2024, the sector generated a record global economic impact exceeding $168 billion, underpinning 1.6 million jobs across myriad communities and value chains. This robust performance was driven by surging passenger volumes, with 34.6 million travelers embarking on ocean voyages in 2024, and an anticipated rise to 37.7 million in 2025. The industry’s ability to attract new audiences is equally notable, as first-time cruisers accounted for 31 percent of all sailings over the past two years, reflecting the sector’s enduring appeal and capacity to innovate beyond conventional boundaries.

Witnessing a Paradigm Shift in Cruising Through Sustainable Propulsion Digital Innovation and Experiential Personalization in 2025

The cruise landscape is undergoing transformative shifts as operators adopt sustainable propulsion technologies and prioritize eco-efficient vessel design to align with rigorous environmental targets. By 2028, half of all new cruise ship capacity will feature engines adaptable to liquefied natural gas or methanol, positioning the industry for a low-to-zero emissions future; currently, 61 percent of the global fleet is equipped for shore power connection, with that figure projected to rise to 72 percent by 2028. Concurrently, a growing preference for intimately scaled voyages is reshaping fleet composition: more than 70 percent of ships scheduled for operation through 2036 are classified as small- to medium-sized, catering to travelers seeking personalized service and exclusive itineraries in niche ports where mega-ships cannot dock.

Assessing the Cumulative Economic and Operational Impact of United States Tariffs on the Cruise Industry Supply Chains and Consumer Confidence in 2025

In early 2025, the United States instituted a 25 percent tariff on all steel and aluminum imports, intensifying the cost structure for shipbuilding, repair, and maintenance across the maritime sector; derivative products crafted from these base metals also fall within the new tariff schedule, and no new product exclusions will be granted beyond existing exemptions effective February 10, 2025. Moreover, proposed measures include fees of up to $1.5 million on Chinese-built commercial vessels entering U.S. ports, highlighting geopolitical frictions in global ship procurement and underscoring the urgency for cruise lines to reassess sourcing strategies and supply chain resiliency.

Unlocking Key Market Segmentation Insights Spanning Cruise Types Propulsion Innovations Vessel Sizes and End User Travel Preferences Shaping Demand

The cruise market’s heterogeneity is underscored by the diversity of offerings spanning Expedition Cruises, Luxury Cruises, Ocean Cruises, River Cruises, and Theme Cruises, each segment responding to distinct traveler motivations and thematic interests. Expedition voyages have surged in popularity, reflecting a 22 percent increase in passenger demand from 2023 to 2024 as adventurers seek remote and culturally immersive experiences. At the same time, the luxury segment continues to expand, with ultra-premium vessels boasting opulent amenities that cater to high-net-worth individuals desiring curated experiences in exclusive destinations. Parallel to these thematic variations, propulsion modalities are evolving; diesel-powered vessels remain prevalent, yet electric, hybrid, and LNG-powered ships are gaining traction as operators pursue reduced emissions and enhanced operational efficiency.

This comprehensive research report categorizes the Cruise market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cruise Type

- Propulsion

- Ship Size

- End-User

Mapping Regional Dynamics Revealing Distinct Growth Patterns and Demand Drivers Across the Americas EMEA and Asia Pacific Cruise Markets

Regional dynamics reveal differentiated growth trajectories across the Americas, EMEA (Europe, Middle East & Africa), and Asia-Pacific markets. The Americas, led by the Caribbean’s enduring appeal-accounting for 43 percent of worldwide itineraries-continue to command significant market share, while Alaska and the Pacific Northwest terminal in Seattle drive nearly $900 million in local economic impact as the city prepares for almost 300 cruise calls in 2025. Meanwhile, Europe’s Mediterranean cruises remain highly sought after, leveraging rich cultural heritage and well-developed port infrastructure, and cruise throughput in Northern Europe is buoyed by Scandinavia and the Baltic.

This comprehensive research report examines key regions that drive the evolution of the Cruise market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Leading Cruise Industry Players and Their Strategic Initiatives in Fleet Modernization Sustainability and Digital Engagement

Leading cruise operators have deployed strategic initiatives to fortify competitive positioning and address evolving passenger expectations. Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings have collectively invested over $56 billion in new ship orders through 2036, signaling a commitment to fleet renewal and capacity expansion aligned with sustainability targets. Royal Caribbean’s enhanced digital capabilities, including AI-driven guest engagement tools, have reduced booking times by half and improved onboard service efficiency, demonstrated by a 35 percent increase in in-app chat adoption and a 20 percent decline in queue times for customer support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cruise market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIDA Cruises GmbH

- Ambassador Cruise Holidays Limited

- BLS Lake Cruise Ltd.

- Carnival Corporation & plc

- Costa Crociere S.p.A.

- Cruise Saudi

- Cruiseaway Pty Ltd.

- Disney Cruise Line

- Fred. Olsen Cruise Lines Ltd.

- Island Queen Cafe, Cruises & Tours, Inc.

- Lake Lucerne Navigation Company

- Luxury Cruise Connections

- MSC Cruises S.A.

- Norwegian Cruise Line Holdings Ltd.

- Paul Gauguin Cruises

- Princess Cruise Lines, Ltd.

- Pursuit Attractions and Hospitality Inc.

- Royal Caribbean Cruises Ltd.

- SILVERSEA CRUISES LTD.

- SP Cruises OpCo Limited

- TUI Cruises GmbH

- Uniworld Boutique River Cruises

- Viking River Cruises Inc.

- Waterways Leisure Tourism Pvt. Ltd.

- Windermere Lake Cruises Ltd.

Implementing Actionable Strategies for Cruise Industry Leaders to Navigate Regulatory Challenges Embrace Innovation and Enhance Guest Experiences

Industry leaders should prioritize investment in green propulsion and alternative fuels, accelerating the retrofit of existing vessels with LNG or hybrid systems while ensuring all future newbuilds are designed for seamless transition to next-generation low-emission fuels. Embracing shore power capabilities at key homeports and major itineraries will further mitigate environmental impact and align operations with tightening regulatory requirements in sensitive regions such as the Mediterranean and Alaska’s Inside Passage. Concurrently, expanding private destination footprints-through the development of branded island resorts-can enhance revenue diversification and reduce exposure to port fee volatility, while deepening control over guest experiences and ancillary spend.

Detailed Research Methodology Underpinning the Cruise Industry Analysis Incorporating Data Collection Primary Interviews and Rigorous Triangulation

This research integrates a multi-stage methodology combining comprehensive secondary analysis, extensive primary interviews, and rigorous data triangulation. Secondary sources included industry association publications, financial disclosures, regulatory filings, and reputable trade news outlets to map macro-level trends and competitive landscapes. Primary qualitative research involved 35 in-depth interviews with senior executives across cruise lines, port authorities, sustainability experts, and maritime technology providers to capture strategic priorities and innovation roadmaps. Quantitative data were validated through cross-referencing with operational metrics provided by CLIA, public port statistics, and proprietary ship order registers. The insights were synthesized using segmentation analysis and scenario planning to ensure robust, actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cruise market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cruise Market, by Cruise Type

- Cruise Market, by Propulsion

- Cruise Market, by Ship Size

- Cruise Market, by End-User

- Cruise Market, by Region

- Cruise Market, by Group

- Cruise Market, by Country

- United States Cruise Market

- China Cruise Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Insights Emphasizing Industry Resilience Adaptive Innovations and Strategic Collaboration for a Sustainable Cruise Future

The cruise industry’s trajectory demonstrates a balance between robust passenger demand and the imperative to reduce environmental footprints through innovative technologies and sustainable practices. While United States tariffs present immediate cost pressures and supply chain complexities, the long-term outlook remains positive for operators that proactively diversify sourcing, optimize fleet composition, and invest in alternative fuels. By leveraging digital engagement, experiential product differentiation, and strategic port partnerships, cruise lines can sustain growth across diverse market segments and regions. The collective resilience and adaptability displayed throughout recent challenges set a solid foundation for continued expansion and value creation.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Cruise Market Research Report Today

To delve deeper into these comprehensive insights and secure the full market research report that will empower your strategic planning and operational decisions, reach out to Ketan Rohom, Associate Director, Sales & Marketing, today. Ketan is ready to guide you through the report’s extensive data, in-depth analysis, and actionable recommendations tailored to your organization’s objectives. Engage with an expert who understands the cruise sector’s evolving landscape and can help you leverage these findings to navigate challenges, identify growth opportunities, and drive sustainable success. Don’t miss the chance to transform this critical market intelligence into a competitive advantage-contact Ketan Rohom now to purchase your copy of the definitive Cruise Market Research Report.

- How big is the Cruise Market?

- What is the Cruise Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?