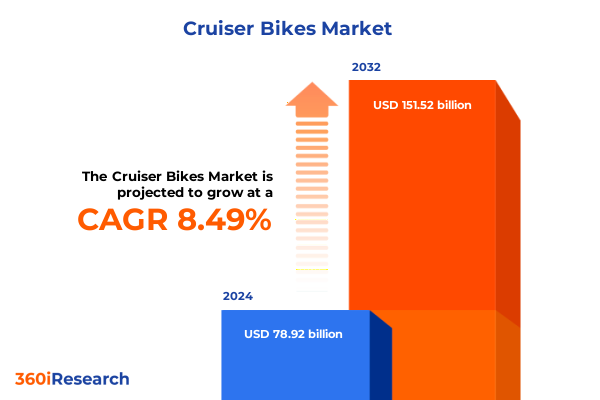

The Cruiser Bikes Market size was estimated at USD 85.64 billion in 2025 and expected to reach USD 91.86 billion in 2026, at a CAGR of 8.49% to reach USD 151.52 billion by 2032.

Setting the Scene for Cruiser Bike Market Evolution through Electrification, Innovative Designs, Shifting Consumer Preferences and Emerging Technologies

The cruiser bike market has long captivated enthusiasts with its blend of distinctive styling, low-slung ergonomics, and a heritage rooted in freedom and self-expression. In recent years, technological advancements and shifting consumer expectations have propelled the segment into an era of rapid transformation. Riders now seek vehicles that harmonize the classic cruiser aesthetic with modern performance, sustainability, and connectivity features. This convergence of nostalgia and innovation is redefining what a cruiser can be, attracting a broader demographic that values personalization, fuel efficiency, and digital integration.

While traditional internal combustion engine (ICE) cruisers continue to command a loyal following, the emergence of electric powertrains is fostering new opportunities for brand differentiation and market expansion. Manufacturers are experimenting with battery chemistries, lightweight materials, and modular design platforms to deliver next-generation cruiser experiences. As the regulatory environment tightens on emissions and consumer interest in alternative fuels intensifies, the industry stands at a pivotal juncture. Navigating this landscape requires a nuanced understanding of evolving rider profiles, technological trajectories, and the interplay between heritage and innovation.

Unveiling Transformative Shifts Redefining Cruiser Bike Landscape from Sustainable Powertrains to Digital Connectivity and Urban Mobility Trends

Over the past several years, the cruiser bike landscape has undergone transformative shifts driven by electrification, connectivity, and sustainable materials. Electric cruisers powered by advanced lithium-ion systems are elevating performance benchmarks once dominated by traditional ICE platforms, while intelligent rider interfaces and smartphone integration are delivering personalized experiences on and off the road. Meanwhile, manufacturers are leveraging composite frames, recycled metals, and bio-based composites to align with consumer demand for environmentally responsible products. These movements are reshaping value propositions and forging new paths for brand engagement.

Concurrently, the retail paradigm is evolving as direct-to-consumer digital channels gain prominence. OEM websites and third-party ecommerce platforms are offering virtual showrooms, online financing, and customizable ordering processes that blur the lines between physical dealerships and the digital ecosystem. At the same time, subscription-based access models and micro-mobility solutions are introducing alternative ownership frameworks, broadening the appeal of cruisers to urban commuters and casual riders. As these trends converge, they are redefining the competitive landscape and compelling traditional players to rethink distribution, service, and customer loyalty strategies.

Analyzing the Cumulative Impact of Recent United States Tariffs on Cruiser Bike Manufacturing Supply Chains and Pricing Dynamics in 2025

In 2025, the cumulative impact of United States tariffs has created significant headwinds for both domestic and international cruiser bike manufacturers. The extension of Section 301 tariffs on imports from key manufacturing hubs added a 25 percent levy on many motorcycle components, affecting engines, chassis parts, and subassemblies sourced from affected regions. At the same time, Section 232 tariffs on steel and aluminum raised input costs for domestic producers that rely on these materials for frames, exhaust systems, and structural reinforcements. The combined effect has been a notable increase in manufacturing expenditures, prompting companies to reassess production footprints and supply chain configurations.

As a result, many OEMs have accelerated plans to relocate or expand facilities in North America, seeking tariff exemption through local content thresholds and leveraging free trade agreements. Others have negotiated cost reductions with suppliers or absorbed a portion of the tariffs to maintain competitive retail pricing. The tariff landscape has also elevated the importance of efficiency gains in logistics and procurement, as companies optimize inventory management, consolidate shipments, and explore alternative material sources. These adjustments are critical for preserving margins and sustaining product affordability in a market now defined by higher regulatory-induced costs.

Revealing Key Segmentation Insights by Powertrain, Engine Capacity, Application Scenarios and Distribution Channels Driving Strategic Market Decisions

Understanding the diverging demands of cruiser bike customers requires a multifaceted segmentation approach that considers propulsion, engine displacement, usage scenario, and distribution preferences. In the propulsion dimension, the market spans both electric and internal combustion engine variants, with electric cruisers further delineated by battery technology such as traditional lead-acid and advanced lithium-ion systems. Each powertrain presents distinct trade-offs in terms of performance, weight, and total cost of ownership, guiding product positioning and consumer communications.

Examining engine capacity reveals appetites ranging from entry-level sub-150cc models suitable for urban explorers up to high-displacement machines exceeding 500cc that cater to highway touring enthusiasts. Mid-range segments between 150-250cc and 250-500cc continue to capture volume by balancing agility and long-distance capability. Application-based segmentation further refines market dynamics: commuter cruisers are divided into daily riders seeking fuel economy and occasional users valuing comfort for weekend outings, while leisure enthusiasts choose between city cruising and touring models, and sports aficionados differentiate performance-oriented build quality from racing-focused specifications. Finally, distribution channels shape purchase experiences, with physical franchised or independent dealerships offering hands-on service and direct-to-consumer ecommerce channels through OEM websites or third-party platforms providing convenience and customization. Integrating these segmentation layers enables stakeholders to tailor offerings, communications, and channel strategies for maximum resonance.

This comprehensive research report categorizes the Cruiser Bikes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Engine Capacity

- Application

- Distribution Channel

Exploring Regional Dynamics and Market Nuances across Americas, Europe Middle East Africa and Asia Pacific Cruiser Bike Ecosystems

Regional dynamics in the cruiser bike market underscore the heterogeneity of consumer preferences, regulatory frameworks, and competitive intensity across the Americas, Europe Middle East & Africa, and the Asia-Pacific region. In the Americas, a deeply rooted cruiser culture, especially in the United States, fuels robust demand for both heritage ICE models and nascent electric variants. Regulatory incentives for zero-emission vehicles are further sweetening adoption rates in urban and suburban centers, while robust aftersales networks ensure strong brand loyalty. Mexico and Canada also exhibit growing interest in mid-displacement and commuter-style cruisers as share-of-wallet shifts toward lifestyle mobility solutions.

Across Europe, the Middle East, and Africa, escalating emissions standards and congestion regulations in major cities are prompting riders toward smaller capacity and electric-powered cruisers. Western European markets are witnessing double-digit growth in urban electric cruiser registrations, while premium segments maintain traction with high-performance ICE offerings. Emerging economies in Eastern Europe, the Gulf Cooperation Council, and South Africa present opportunities for affordable, mid-capacity bikes designed for both commuting and leisure. In the Asia-Pacific region, rapid urbanization and rising disposable incomes are driving mass adoption of sub-250cc cruisers in countries such as India and China, complemented by government subsidies for electric two-wheelers. Southeast Asian markets likewise display growing appetite for modular, multi-use cruiser platforms capable of meeting both daily transportation and weekend adventure use cases.

This comprehensive research report examines key regions that drive the evolution of the Cruiser Bikes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Collaborations Shaping the Competitive Cruiser Bike Market Environment Worldwide

The competitive landscape in the cruiser bike segment is anchored by legacy OEMs that have shaped rider preferences through decades of brand heritage, alongside nimble challengers that are accelerating innovation cycles. Iconic names like one North American heavyweight continue to leverage their established dealer networks and lifestyle branding to defend market share, even as they broaden electric model portfolios. Japanese manufacturers with diversified global footprints are deploying modular platforms that span multiple engine sizes and powertrains to optimize cost efficiency and streamline production.

Emerging players in the electric cruiser space are forging strategic partnerships with battery and software specialists to deliver advanced ride control systems and rapid charging ecosystems. Collaborations with component suppliers on lightweight composites and advanced suspension technologies are further enabling new performance benchmarks. Meanwhile, service providers offering connected diagnostics and subscription-based usage models are partnering with OEMs to extend revenue streams beyond initial sales. This evolving ecosystem of alliances, joint ventures, and co-development initiatives is intensifying competition and accelerating time to market for next-generation cruiser innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cruiser Bikes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American IronHorse

- Arch Motorcycle Company

- Big Dog Motorcycles

- BMW AG

- Bourget's Bike Works

- Cleveland CycleWerks Inc.

- Confederate Motors Inc.

- Curtiss Motorcycles Co.

- Ducati Motor Holding S.p.A.

- Falcon Motorcycles

- Harley-Davidson, Inc.

- Honda Motor Co., Ltd.

- Husqvarna Motorcycles GmbH

- Indian Motorcycle Company

- Janus Motorcycles

- Kawasaki Heavy Industries, Ltd.

- Moto Guzzi S.p.A.

- MV Agusta Motor S.p.A.

- Roehr Motorcycles

- Royal Enfield (A division of Eicher Motors Limited)

- Suzuki Motor Corporation

- Triumph Motorcycles Ltd.

- Yamaha Motor Co., Ltd.

- Zero Motorcycles, Inc.

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends Operational Efficiencies and Consumer Demands

Leaders in the cruiser bike space should prioritize electric powertrain development, investing in proprietary battery management systems and scalable production processes to meet escalating regulatory and consumer requirements. Aligning research and development budgets with modular platform architectures will streamline product launches across multiple capacity tiers and geographic markets. Strengthening relationships with tier-1 suppliers through strategic sourcing contracts can mitigate tariff exposure and enhance supply chain resilience.

On the commercial front, industry stakeholders must embrace omnichannel retailing that integrates offline dealer experiences with digital showrooms, virtual test rides, and personalized financing solutions. Establishing clear carbon neutrality pathways and transparent sustainability reporting will resonate with eco-conscious riders and differentiate brands in a crowded marketplace. Finally, forging alliances with technology firms and mobility service providers can unlock new revenue streams through data monetization, connected services, and subscription models, ensuring long-term relevance in an increasingly software-centric mobility ecosystem.

Demystifying Research Methodology Integrating Primary Intelligence Secondary Data Triangulation and Advanced Analytics Approaches

Our research methodology synthesizes primary insights and comprehensive secondary data to deliver a robust understanding of the cruiser bike market. Primary inputs include in-depth interviews with senior executives at leading OEMs, structured conversations with dealership networks, and focus group sessions with riders representing diverse demographics. This qualitative intelligence is complemented by surveys conducted across key global regions to quantify consumer sentiment, purchase drivers, and brand awareness metrics.

Secondary research integrates governmental import-export records, industry association statistics, and publicly available corporate filings to map production volumes, tariff schedules, and patent activity. Advanced analytical techniques, including regression analysis and scenario modeling, are employed to validate trends and stress-test potential market disruptions. Data triangulation across multiple sources ensures that findings are cross-verified and credible, providing stakeholders with a high-confidence foundation for strategic decision-making and resource allocation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cruiser Bikes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cruiser Bikes Market, by Propulsion Type

- Cruiser Bikes Market, by Engine Capacity

- Cruiser Bikes Market, by Application

- Cruiser Bikes Market, by Distribution Channel

- Cruiser Bikes Market, by Region

- Cruiser Bikes Market, by Group

- Cruiser Bikes Market, by Country

- United States Cruiser Bikes Market

- China Cruiser Bikes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways Demonstrating How Market Trends Regulatory Forces and Technological Innovations Converge in Cruiser Bike Sector

In conclusion, the cruiser bike market stands at an inflection point where legacy design ethos meets modern performance requirements and sustainability imperatives. Electrification and digital connectivity are not merely supplemental features but foundational elements shaping the next wave of consumer engagement. Tariff-induced cost pressures and shifting regulatory landscapes demand agile supply chain strategies and localized manufacturing contingencies to maintain profitability and price competitiveness.

Segmentation and regional nuances underscore the importance of targeted product offerings and channel strategies to address diverse rider expectations across propulsion types, engine capacities, usage scenarios, and distribution platforms. Leading companies are those that skillfully navigate this complexity, forging partnerships and deploying modular architectures to minimize time to market. By leveraging rigorous research insights and embracing forward-looking recommendations, stakeholders can secure a sustainable growth trajectory and strengthen their position in an increasingly dynamic cruiser bike ecosystem.

Engage with Ketan Rohom to Unlock Comprehensive Cruiser Bike Market Intelligence and Propel Your Strategic Decisions with Expert Insight

To gain a definitive competitive edge and refine your strategic roadmap for the dynamic cruiser bike market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore the comprehensive market research report available for purchase. Engaging directly with Ketan Rohom allows you to receive tailored insights, clarify specific data points, and design a bespoke research package aligned with your business objectives. His deep expertise and consultative approach will ensure that you obtain the precise intelligence needed to inform product development, market entry strategies, distribution optimization, and investment decisions.

By initiating a conversation with Ketan Rohom today, you will unlock immediate access to actionable data on sector trends, regulatory implications, segmentation nuances, and regional growth trajectories. His guidance will streamline your decision-making process and empower your organization to adapt swiftly to tariff changes, technological disruptions, and evolving consumer preferences. Take the first step toward securing your position at the forefront of the cruiser bike market by contacting Ketan Rohom for a personalized consultation and report quotation.

- How big is the Cruiser Bikes Market?

- What is the Cruiser Bikes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?