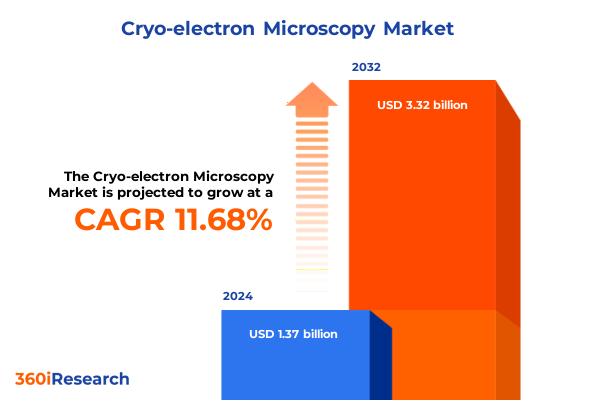

The Cryo-electron Microscopy Market size was estimated at USD 1.52 billion in 2025 and expected to reach USD 1.69 billion in 2026, at a CAGR of 11.77% to reach USD 3.32 billion by 2032.

Comprehensive overview of cryo-electron microscopy’s evolution and its pivotal role in advancing high-resolution structural analysis techniques

Cryo-electron microscopy (cryo-EM) has emerged as a cornerstone technology for structural biology, enabling scientists to visualize macromolecular complexes at near-atomic resolution in their native states. By flash-freezing samples and imaging them under cryogenic conditions, cryo-EM preserves biological structures without the need for crystallization, offering unparalleled insights into dynamic cellular processes. Over the last decade, this technique has driven breakthroughs across virology, membrane protein studies, and macromolecular assemblies, reshaping our understanding of molecular mechanisms.

The evolution of cryo-EM traces back to the early days of electron microscopy, where limited resolution and radiation damage constrained its utility for biological specimens. The transformative introduction of direct electron detectors and advanced image-processing algorithms catalyzed a dramatic leap in resolution, earning recognition from the Nobel Committee and ushering in the so-called "resolution revolution." These technological milestones have democratized access to subnanometer structural information, empowering both academic and industrial researchers to unravel previously intractable biomolecules.

Beyond its technical achievements, cryo-EM has become pivotal for drug discovery and vaccine design, where high-resolution structures inform target validation and lead optimization. Partnerships between instrument developers and software innovators have accelerated throughput and reliability, while advancements in in situ tomography are expanding the horizons of cellular and tissue-level visualization. As the field matures, cryo-EM stands poised to redefine our approach to complex biological challenges, underpinning the next wave of scientific discovery and therapeutic innovation.

Revelatory shifts driving cryo-electron microscopy’s integration across disciplines and accelerating multidisciplinary collaboration in structural biology

Recent years have witnessed revelatory shifts that are redefining the landscape of cryo-electron microscopy and its integration across scientific disciplines. The advent of state-of-the-art direct electron detectors has not only enhanced signal-to-noise ratios but also accelerated data acquisition, enabling researchers to capture transient conformational states with unprecedented clarity. Coupled with artificial intelligence–driven image processing pipelines, these breakthroughs are streamlining workflows and reducing the barriers to entry for non-specialist laboratories.

In parallel, the convergence of cryo-EM with complementary modalities such as cryo-electron tomography and cryo-focused ion beam milling is facilitating holistic, multi-scale imaging. Researchers are now mapping molecular architectures within intact cells, bridging the gap between high-resolution structural data and functional cellular contexts. Cloud-based data management platforms and remote operation capabilities are further democratizing access, allowing geographically dispersed teams to collaborate seamlessly and share datasets securely.

These transformative shifts are catalyzing cross-disciplinary collaborations, where structural biologists, materials scientists, and pharmaceutical researchers converge around shared data platforms and standardized protocols. The integration of real-time analytics and in situ experimentation is fostering a dynamic feedback loop between hypothesis generation and empirical validation, driving the pace of discovery. As these trends mature, cryo-EM is set to become an even more indispensable tool for unraveling complex biological systems and accelerating translational research.

Comprehensive analysis of how the 2025 United States tariffs reshape procurement, supply chain dynamics, and cost structures in cryo-electron microscopy

The imposition of new United States tariffs in 2025 has introduced a recalibration of procurement strategies and supply chain dynamics within the cryo-electron microscopy ecosystem. Components such as direct electron detectors, cryo stages, and specialized plungers are now subject to increased import duties, prompting instrument manufacturers and service providers to reassess supplier portfolios and consider alternative sourcing avenues. Consequently, organizations are exploring regional supply agreements and inventory buffering to mitigate the potential for cost escalations and delivery delays.

These tariff-driven headwinds are also influencing reagent and consumable procurement, where grid substrates and cryogens may experience extended lead times and price adjustments. Response strategies have included forging strategic partnerships with domestic suppliers and investing in vertical integration models to secure critical inputs. At the same time, end users in academic and industrial settings are reevaluating maintenance contracts and service-level agreements to factor in potential downtime risks arising from disrupted logistics.

In this environment, resilient supply chain architectures are gaining prominence, emphasizing diversified supplier networks and real-time tracking systems. Leveraging predictive analytics, organizations are enhancing demand forecasting accuracy and optimizing inventory levels to offset tariff-induced uncertainties. These adaptive measures are essential for sustaining operational continuity and preserving the momentum of research programs reliant on cryo-EM capabilities.

Insights into technique, product, end user, application, and component segmentation revealing dimensions of the cryo-electron microscopy market

Segmenting the cryo-electron microscopy landscape reveals multiple layers of specialization that inform strategic decision-making. Based on technique, the market encompasses Cryo-Electron Tomography for three-dimensional cellular mapping, Electron Crystallography for ordered filament analysis, and Single Particle Analysis for high-resolution reconstructions of isolated macromolecules. From a product standpoint, the ecosystem comprises Instruments-including Accessories, Cryo Sample Preparation Systems, Scanning Transmission Electron Microscopes, and Transmission Electron Microscopes-alongside Services spanning Data Processing, Maintenance & Support, Sample Preparation, and Training & Consultation, as well as Software such as Data Processing, Simulation & Modeling, and Visualization suites. Examining end users highlights a spectrum from Academic & Research Institutes to Contract Research Organizations, Industrial applications, and Pharmaceutical & Biotechnology firms, each with distinct operational requirements and investment horizons. In terms of application focus, the technology underpins Drug Discovery & Development pipelines, Materials Science inquiries, Structural Biology explorations, and Vaccine Development initiatives, reflecting its versatile utility across life sciences and beyond. Finally, component analysis underscores the critical roles of Cryo Plungers-including both Automated and Manual variants-Cryo Stages differentiated by Temperature and Vibration Isolation features, and Electron Detectors comprising CMOS, Direct Electron, and Hybrid Pixel technologies. Together, these segmentation dimensions provide a nuanced understanding of where value is created, performance can be optimized, and future growth trajectories are likely to emerge.

This comprehensive research report categorizes the Cryo-electron Microscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Sample Type

- Product Type

- Automation Level

- Application

- End User

In-depth regional analysis highlighting unique drivers and challenges shaping cryo-electron microscopy adoption across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the adoption and maturation of cryo-electron microscopy technologies. In the Americas, robust funding from public institutions and private foundations has fueled the establishment of core facilities and service centers, driving high demand for advanced instruments and specialized training programs. The presence of leading universities and pharmaceutical hubs in North America creates a competitive environment that incentivizes rapid technological upgrades and collaborative research initiatives. Transitioning to Europe, Middle East & Africa, the landscape is characterized by diverse regulatory frameworks and research priorities. While European Union directives promote cross-border data sharing and standardized quality controls, emerging markets in the Middle East and Africa are investing strategically to build foundational infrastructure, often through public–private partnerships. These efforts are enabling universities and national labs to integrate cryo-EM into their research portfolios. In the Asia-Pacific region, aggressive government investment programs and a growing base of biotechnology enterprises are accelerating capacity expansion. Countries across East Asia are prioritizing domestic manufacturing of key components to reduce dependency on imports, while Australasia focuses on fostering collaborative networks between academic centers and sovereign research agencies. Together, these regional insights illuminate the geographic contours of technological diffusion, funding landscapes, and policy environments that collectively influence the trajectory of cryo-electron microscopy adoption worldwide.

This comprehensive research report examines key regions that drive the evolution of the Cryo-electron Microscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive overview of leading technology providers and emerging disruptors driving innovation, partnerships, and dynamics in cryo-electron microscopy

The competitive landscape of cryo-electron microscopy is defined by a mix of established technology providers and agile innovators. Traditional microscope manufacturers continue to invest heavily in next-generation electron optics, automation modules, and service infrastructures, leveraging decades of expertise in electron beam physics and precision engineering. At the same time, pioneering startups specializing in direct electron detection and proprietary software algorithms are disrupting conventional workflows, offering modular upgrades and cloud-enabled analytics that cater to both high-throughput facilities and niche research groups. Strategic collaborations between instrument vendors and software developers have resulted in integrated solutions that simplify data pipelines, reduce hands-on time, and enhance reproducibility.

In addition, several organizations are forging partnerships with academic consortia to co-develop tailored applications, from in situ cellular tomography to high-throughput ligand screening for drug discovery. These alliances not only expand the technological frontier but also create marketplaces for specialized services, training modules, and custom assay development. The result is a dynamic competitive terrain where customer-centric platforms, subscription-based software models, and comprehensive service offerings are becoming key differentiators. As incumbent players refine their product roadmaps and emerging entrants secure venture funding, the convergence of innovation, collaboration, and strategic investment continues to shape the future of the cryo-EM market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryo-electron Microscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca PLC

- Atem Structural Discovery

- Carl Zeiss AG

- Charles River Laboratories International, Inc.

- Creative Biostructure

- Delmic B.V.

- EMphasis

- Gandeeva Therapeutics, Inc.

- Gatan, Inc. by Ametek, Inc.

- Hitachi, Ltd.

- Intertek Group PLC

- Jena Bioscience GmbH

- Jeol Ltd.

- LeadXpro AG

- Leica Microsystems by Danaher Corporation

- Linkam Scientific Instruments Ltd.

- NanoImaging Services, Inc.

- Nanoscience Instruments

- NovAliX

- Oxford Instruments by Spectris PLC

- Proteros biostructures GmbH

- Quorum Technologies by Judges Scientific PLC

- Shuimu BioSciences Ltd.

- SPT Labtech Ltd.

- Structura Biotechnology Inc.

- Thermo Fisher Scientific Inc.

- Wuxi Biortus Biosciences Co. Ltd.

Strategic recommendations to optimize investment, foster collaboration, and accelerate technological adoption in cryo-electron microscopy for market leadership

To capitalize on the evolving cryo-electron microscopy landscape, industry leaders should adopt a multifaceted strategy that balances technological investment, collaborative networks, and operational excellence. Prioritizing the integration of next-generation direct electron detectors and automated sample preparation systems can significantly reduce time-to-data and improve throughput, while establishing in-house or consortium-based service facilities can mitigate external dependency and enhance quality control. Cultivating partnerships with software innovators will ensure access to advanced image-processing pipelines, enabling real-time data interpretation and streamlined workflows.

Moreover, organizations should invest in workforce development through targeted training programs that cover both experimental techniques and data analytics, thereby building internal expertise that can translate into faster project turnaround. Incorporating predictive analytics into procurement and maintenance planning will bolster resilience against supply chain disruptions, such as those arising from tariff changes or component shortages. Finally, fostering open innovation platforms and standardized protocols across academic, industrial, and governmental stakeholders will accelerate cross-sector collaboration, drive reproducibility, and unlock new application areas, including in situ structural studies and multimodal imaging. By combining these targeted measures, industry leaders can strengthen their competitive positioning, drive cost efficiencies, and pioneer the next wave of scientific breakthroughs.

Rigorous research framework combining primary interviews, secondary analysis, and methodological rigor ensuring comprehensive cryo-electron microscopy insights

The findings presented in this report are underpinned by a robust research methodology designed to capture both breadth and depth of the cryo-electron microscopy ecosystem. Primary data were gathered through structured interviews with key opinion leaders, including instrument developers, facility managers, and end users across academic, industrial, and clinical settings. These conversations provided qualitative insights into technology adoption drivers, pain points, and innovation roadmaps. Secondary research involved exhaustive reviews of peer-reviewed journals, patent filings, industry white papers, and publicly disclosed vendor specifications, ensuring a comprehensive landscape analysis.

Quantitative triangulation was achieved by cross-referencing supplier catalogs, regulatory filings, and procurement databases to validate product portfolios and service offerings. A multi-layered data validation process, including peer review by external subject-matter experts, was employed to uphold methodological rigor and minimize bias. The report’s segmentation framework was iteratively refined through stakeholder workshops, aligning classification criteria with real-world use cases. Together, these methodological pillars provide a transparent foundation for the report’s insights, enabling decision-makers to trust the accuracy, relevance, and applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryo-electron Microscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryo-electron Microscopy Market, by Technique

- Cryo-electron Microscopy Market, by Sample Type

- Cryo-electron Microscopy Market, by Product Type

- Cryo-electron Microscopy Market, by Automation Level

- Cryo-electron Microscopy Market, by Application

- Cryo-electron Microscopy Market, by End User

- Cryo-electron Microscopy Market, by Region

- Cryo-electron Microscopy Market, by Group

- Cryo-electron Microscopy Market, by Country

- United States Cryo-electron Microscopy Market

- China Cryo-electron Microscopy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of key findings highlighting the enduring significance of cryo-electron microscopy in driving scientific breakthroughs and future innovations

In synthesizing the report’s key findings, it becomes evident that cryo-electron microscopy occupies a transformative position at the intersection of structural biology, material science, and pharmaceutical innovation. Technological advancements-ranging from direct electron detection to AI-augmented image processing-are driving enhanced resolution, throughput, and accessibility, while strategic investments and regional funding initiatives are expanding global adoption. Despite challenges posed by supply chain disruptions and regulatory complexities, the momentum of collaboration, open data sharing, and methodological standardization underscores a resilient and rapidly evolving market.

Looking ahead, the convergence of cryo-EM with complementary modalities and the integration of predictive analytics are poised to unlock new frontiers in in situ imaging and high-throughput structural screening. For stakeholders across academia, industry, and government, the imperative is clear: embrace these innovations, cultivate strategic partnerships, and invest in workforce capabilities to harness the full potential of cryo-EM. By doing so, organizations will be well-positioned to translate high-resolution insights into tangible scientific breakthroughs and therapeutic advancements, reinforcing the technology’s enduring impact on future research landscapes.

Engaging call to action encouraging industry professionals to connect with Ketan Rohom for access to the cryo-electron microscopy market research report

We appreciate your interest in gaining in-depth insights into the cryo-electron microscopy market. For immediate access to the comprehensive research report and personalized guidance on how these findings can inform your strategic decisions, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan is well-positioned to help you navigate the detailed analyses, uncover bespoke opportunities, and arrange tailored consultations that align with your organizational objectives. Connect with him today to secure your copy of the report, explore collaborative engagements, and drive your cryo-electron microscopy initiatives forward with confidence

- How big is the Cryo-electron Microscopy Market?

- What is the Cryo-electron Microscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?