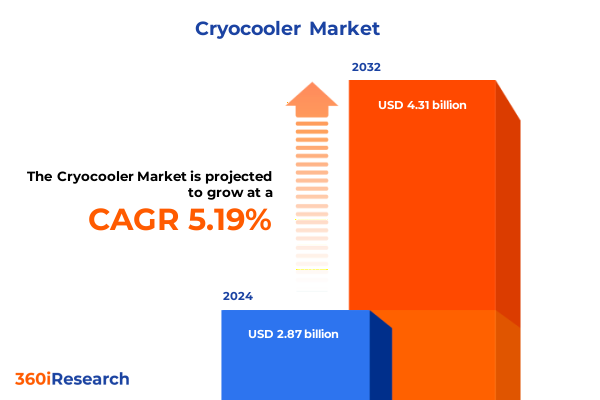

The Cryocooler Market size was estimated at USD 2.98 billion in 2025 and expected to reach USD 3.10 billion in 2026, at a CAGR of 5.39% to reach USD 4.31 billion by 2032.

Setting the Stage for Cryogenic Innovation as Cryocoolers Propel Technological Frontiers in Defense, Medical Imaging, LNG, and Semiconductor Applications

Over the past decade, cryocoolers have become the enabling technology behind advances in defense sensors, medical imaging, liquefied natural gas processing, and semiconductor manufacturing. These refrigeration systems, capable of achieving temperatures below 120 K with compact footprints and high reliability, underpin critical applications from satellite-based infrared detectors to helium-free MRI machines. Progress in materials science, system architecture, and compressor design has further broadened cryocooler applications, empowering portable platforms and demanding infrastructure alike. Transitioning beyond traditional open-cycle models, the industry has embraced closed-cycle configurations that eliminate consumable cryogens and enhance lifecycle economics. Consequently, end users are redefining performance expectations around efficiency, uptime, and total cost of ownership as quantum computing gains traction where sub-Kelvin precision is non-negotiable.

As the market evolves, converging pressures-from stricter environmental regulations to intensifying digitalization-are accelerating both technical innovation and strategic realignment. Manufacturers are extending service contracts with built-in remote diagnostics to minimize unplanned downtime, while research institutions invest in hybrid cycles combining Stirling and Joule-Thomson elements for scalable heat lift. Moreover, the emergence of pulse-tube variants with inertance or orifice designs has created a new class of vibration-free cryocoolers that meet the low-vibration thresholds demanded by quantum processors and precision instrumentation.

Unleashing Paradigm Shifts as Digital Diagnostics, Hybrid Architectures, and Sustainable Refrigerants Drive Cryocooler Industry Evolution

Digital diagnostics and predictive maintenance platforms are redefining performance standards by embedding sensors that monitor temperature, pressure, and operational health in real time. These capabilities enable service providers to anticipate seal degradation and micro-leaks before they escalate into costly failures, while reducing maintenance downtime and extending service intervals. Hybrid systems that fuse Gifford-McMahon cycles with Joule-Thomson elements are also gaining traction, offering scalable cooling capacities from sub-100 watts to beyond 500 watts in a single architecture.

In parallel, advances in miniaturization are unlocking applications that were once constrained by size, weight, and power considerations. Free-piston and reciprocating Stirling coolers now achieve power-to-volume ratios suitable for portable medical imaging and unmanned aerial sensor payloads. Pulse-tube variants, benefiting from regenerative heat exchangers and advanced damping techniques, deliver sub-4 K performance with negligible vibration, meeting the exacting requirements of quantum processors and space-borne instruments. These transformative shifts are underpinned by innovations in additive manufacturing and eco-friendly refrigerants, driving system-level efficiency and compliance with sustainability mandates.

Navigating the Ripple Effects of 2025 U.S. Trade Actions as Elevated Tariffs Reshape Cryocooler Supply Chains, Costs, and Strategic Sourcing Decisions

The 2025 U.S. trade actions have precipitated one of the most aggressive tariff environments in over a century, with combined measures pushing the effective tariff rate to 22.5 percent. These measures, including universal levies on steel, aluminum, and targeted equipment imports, have intensified input cost pressures and disrupted established supply chains, particularly for specialized cryogenic components.

Cryocooler manufacturers reliant on imported cold heads, compressors, and precision sub-assemblies have faced extended lead times and higher unit costs as steel tariffs climbed to 25 percent and Chinese exports attracted levies up to 145 percent on select product codes. In response, several OEMs are accelerating supplier diversification strategies, onshoring critical manufacturing steps, and reengineering designs to accommodate domestic material sources. While these actions bolster supply chain resilience, they also necessitate significant capital investment and programmatic realignments, reshaping the competitive landscape through 2025 and beyond.

Deciphering Market Segmentation to Illuminate Distribution, Cooling Capacity, Technology Types, Applications, and End User Industry Dynamics

Analysis of distribution channels reveals that direct sales relationships enable deeper technical partnerships and custom-engineered solutions, while distributor networks excel at rapid fulfillment and regional market coverage. Cooling capacity segmentation highlights distinct procurement drivers: sub-100 watt systems prioritize form factor and energy efficiency for portable and research applications; 100 to 500 watt coolers balance modular scalability and lifecycle serviceability; and above-500 watt units target industrial and LNG regasification projects demanding high heat lift. Type-based analysis underscores how pulse-tube variants with inertance and orifice designs are attuned to vibration-sensitive platforms, whereas Stirling cycles-free-piston and reciprocating-serve weight-critical aerospace and defense programs. Applications such as aerospace and defense demand ruggedized, long-life performance; liquefied natural gas projects focus on thermal recovery and boil-off mitigation; medical imaging requires precision control and low acoustic noise; and semiconductor fabs emphasize ultra-stable temperature regulation. End user industries from defense procurement and electronics manufacturing to energy utilities, healthcare providers, and research institutions each impose unique reliability and compliance expectations, driving differentiated product roadmaps and aftermarket service models.

This comprehensive research report categorizes the Cryocooler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- Cooling Capacity

- Type

- Application

- End User Industry

Mapping Regional Trajectories as Americas, EMEA, and Asia-Pacific Regions Carve Distinct Paths in Cryocooler Adoption and Innovation

In the Americas, cryocooler adoption is anchored by substantial defense budgets and a mature semiconductor ecosystem. U.S. space programs and military sensor initiatives demand high-performance, compact refrigeration solutions, while LNG regasification terminals leverage closed-cycle coolers to reclaim cold energy and reduce boil-off losses. Suppliers in this region benefit from well-established R&D infrastructure and proximity to leading system integrators, supporting rapid innovation cycles and collaborative product development.

Across Europe, the Middle East, and Africa, a diversified user base propels growth. European research consortia and public-funded quantum computing roadmaps drive demand for vibration-free pulse-tube systems. LNG projects in the Gulf region utilize cryocoolers for efficiency optimization, and healthcare providers in major EMEA markets prioritize compact, energy-efficient machines for MRI and PET scanners. Regulatory frameworks around energy efficiency and emissions further incentivize advanced refrigerant management and system-level optimization in these markets.

Asia-Pacific exhibits the fastest growth trajectory, fueled by booming electronics manufacturing, semiconductor fabs, and renewable energy initiatives. East Asian clean energy projects harness cryogenic cooling for hydrogen storage and superconducting grid technologies, while South Asian healthcare expansions drive investment in closed-cycle medical refrigeration. Partnerships between regional OEMs and global technology leaders accelerate technology transfer and local assembly, establishing Asia-Pacific as a pivotal innovation and production hub for next-generation cryocoolers.

This comprehensive research report examines key regions that drive the evolution of the Cryocooler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Cryocooler Suppliers to Expose Competitive Strengths, Strategic Alliances, and Innovation Leadership Across the Value Chain

Leading cryocooler suppliers leverage differentiated portfolios to capture strategic programs across defense, aerospace, energy, and healthcare. Established names such as Sumitomo Heavy Industries, Cryomech, and Thales Cryogenics dominate high-capacity and space-rated coolers, while Northrop Grumman emphasizes integrated thermal management for military sensor suites. Stirling Cryogenics and Sunpower drive compact, high-efficiency solutions tailored to portable medical and electronics cooling applications. These players reinforce market positions through M&A, JV agreements, and multi-year service contracts that embed remote monitoring and predictive maintenance into their value propositions.

Mid-tier and emerging vendors are carving niches by innovating around digital twin diagnostics, advanced regenerator materials, and modular architectures. Strategic alliances between cryocooler OEMs and semiconductor equipment manufacturers enable co-development of ultra-low temperature solutions for sub-10-nanometer lithography. Meanwhile, collaborations with energy utilities accelerate the deployment of cryogenic storage and hydrogen refueling stations, illustrating how end-user partnerships can accelerate adoption and de-risk technology rollouts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryocooler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Chart Industries, Inc.

- Cryogenic Limited

- Cryomech, Inc.

- IHI Corporation

- II-VI Incorporated

- QMC Instruments Ltd.

- Ricor Cryogenic & Vacuum Systems Ltd.

- Sumitomo Heavy Industries, Ltd.

- Sunpower, Inc.

- Thales S.A.

Advancing Strategic Roadmaps with Tactical Recommendations to Capitalize on Emerging Cryocooler Trends and Fortify Market Position

Industry leaders should prioritize integrated digital monitoring platforms that aggregate performance data across distributed field assets, enabling condition-based maintenance and informed aftermarket service offerings. Rigorous supplier qualification programs and dual-sourcing strategies will mitigate tariff-induced risks, while investment in domestic component fabrication can accelerate time to market and ensure compliance with evolving trade policies. Collaboration with research institutions on next-generation regenerator alloys and eco-friendly refrigerants will unlock higher COPs and lower environmental footprints, aligning product roadmaps with sustainability mandates.

Furthermore, modular design philosophies that allow interchangeable cores-Stirling or pulse-tube-within common compressor housings can reduce development costs and accelerate customization for diverse applications. Finally, establishing regional service hubs and localized engineering centers in high-growth markets will enhance customer responsiveness and strengthen global presence.

Outlining Rigorous Research Methodology Combining Primary Engagements and Thorough Secondary Analysis to Ensure Comprehensive and Unbiased Insights

This research integrates a multi-stage methodology combining in-depth secondary research and targeted primary engagements. The secondary phase reviewed trade publications, patent databases, government reports, and peer-reviewed journals to map technological advancements and policy drivers. Leading indices and customs data informed tariff impact analyses. The primary phase comprised interviews with key stakeholders-including OEM executives, system integrators, end users in defense, LNG, medical imaging, and semiconductor segments-and surveys of supply chain partners to validate supply route dynamics and procurement priorities.

Analytical rigor was upheld through triangulation of data sources, ensuring consistency across qualitative insights and quantitative observations. Segmentation frameworks were constructed based on distribution channel, cooling capacity, cycle type, application, and end user industry, facilitating granular analysis of market drivers and adoption barriers. Geographic assessments leveraged regional market reports and local expert consultations to capture nuanced growth trajectories and regulatory landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryocooler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryocooler Market, by Distribution Channel

- Cryocooler Market, by Cooling Capacity

- Cryocooler Market, by Type

- Cryocooler Market, by Application

- Cryocooler Market, by End User Industry

- Cryocooler Market, by Region

- Cryocooler Market, by Group

- Cryocooler Market, by Country

- United States Cryocooler Market

- China Cryocooler Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Driving Future Momentum by Synthesizing Cryocooler Market Insights to Inform Strategic Decision-Making and Foster Sustainable Growth

The cryocooler market stands at an inflection point where technological prowess, policy dynamics, and strategic partnerships converge to redefine the future of cryogenic cooling. Transformative shifts in system architectures and refrigerant management pave the way for sustainable, high-performance solutions. Elevated trade barriers underscore the importance of supply chain agility and domestic manufacturing resilience. Segmentation and regional analyses highlight differentiated growth pockets, while competitive profiling reveals the critical role of digitalization and service excellence.

As industry stakeholders chart their paths forward, embracing modular designs, predictive analytics, and collaborative innovation will be paramount. By synthesizing insights across technology, policy, and market landscapes, decision-makers can align investments with emerging demands, balancing risk mitigation with growth opportunism to ensure enduring leadership in the evolving cryocooler ecosystem.

Engage with Associate Director Ketan Rohom Today to Unlock the Full Cryocooler Market Research Report and Elevate Your Strategic Framework

Contact Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the comprehensive cryocooler market research report detailing industry dynamics, segmentation insights, tariff analyses, and strategic recommendations. Secure your copy today and empower your organization with the intelligence needed to navigate evolving cryogenic cooling landscapes with confidence.

- How big is the Cryocooler Market?

- What is the Cryocooler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?