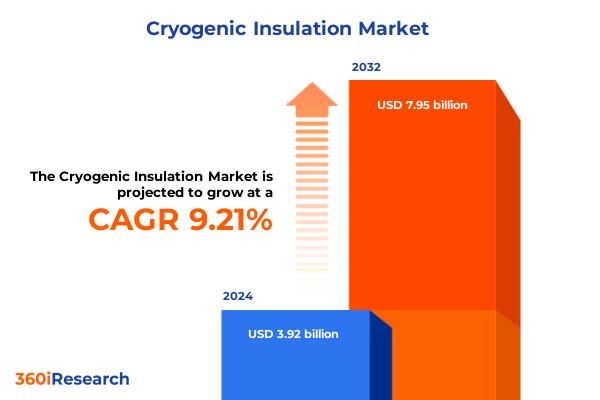

The Cryogenic Insulation Market size was estimated at USD 4.25 billion in 2025 and expected to reach USD 4.61 billion in 2026, at a CAGR of 9.34% to reach USD 7.95 billion by 2032.

Unveiling the Strategic Significance of Cryogenic Insulation in Modern Industrial Applications and Emerging Technological Frontiers

Cryogenic insulation stands at the forefront of enabling ultra-low temperature applications across a variety of industries, from liquefied natural gas (LNG) storage to superconducting technologies. By minimizing thermal losses, advanced cryogenic materials protect critical infrastructure and processes operating at extremes below ‑150 °C, ensuring safety, efficiency, and longevity. Today’s market demands not only superior performance in retaining sub-ambient temperatures but also mechanical resilience under fluctuating operational pressures. As end users pursue stringent energy-efficiency goals and tighter environmental regulations, the role of cryogenic insulation has evolved from a supporting component into a strategic enabler of next-generation industrial processes and renewable energy initiatives.

Against this backdrop, stakeholders across the value chain are aligning their investments and R&D efforts to deliver higher performance at lower life-cycle costs. Emerging applications in hydrogen transport and storage, space exploration, and biomedical preservation are expanding the addressable market beyond traditional LNG and petrochemical domains. Meanwhile, cross-industry collaborations have accelerated material innovation cycles, integrating nanotechnology, aerogel composites, and multi-layer systems into mainstream supply portfolios. This introduction frames the critical drivers that underscore the growing importance of cryogenic insulation and sets the stage for an in-depth examination of transformative shifts, evolving regulatory landscapes, and strategic approaches that define the market today.

Exploring Revolutionary Innovations and Sustainable Practices Shaping the Future Trajectory of the Cryogenic Insulation Industry

Recent breakthroughs in material science and engineering have propelled cryogenic insulation into a new era of performance and sustainability. Nanostructured aerogels, for instance, deliver remarkably low thermal conductivity while boasting improved mechanical strength, ushering in lightweight solutions for mobile LNG transport and aerospace applications. At the same time, advances in multi-layer insulation (MLI) systems have optimized layer configurations and reflective coatings, reducing radiant heat transfer in applications ranging from superconducting magnets to deep-space probes.

In parallel, the industry has embraced sustainable practices and digital innovations that redefine lifecycle management. Manufacturers now integrate automated quality inspections, real-time temperature monitoring via embedded sensors, and predictive analytics to anticipate maintenance needs and prevent thermal failures. Meanwhile, eco-friendly binders and recyclable encapsulation materials have emerged in response to growing environmental scrutiny, ensuring that insulation systems align with corporate net-zero commitments. These converging trends underscore a transformative shift toward integrated solutions that combine high-performance materials, smart diagnostics, and circular-economy principles, positioning cryogenic insulation as a linchpin of tomorrow’s energy and advanced-technology landscapes.

Assessing the Far-Reaching Cumulative Impact of Newly Imposed United States Tariffs on Cryogenic Insulation Supply Chains and Cost Structures

In early 2025, the United States government enacted new tariffs on a range of imported cryogenic insulation products, including microporous panels and specialized multilayer assemblies, citing national security and domestic-industry protection. These measures have had a cascading effect on global supply chains, driving up landed costs for critical thermal barriers and prompting end users to reassess procurement strategies. As import duties rose, companies reliant on low-cost offshore manufacturing faced immediate margin compression, leading to project delays and renegotiations of long-term contracts.

However, the cumulative impact has extended beyond cost pressures. Faced with sustained tariff regimes, major OEMs and EPC contractors accelerated the reshoring of production lines and forged joint ventures with domestic material suppliers. This shift not only mitigated the impact of duties but also bolstered local capacity and shortened lead times. Meanwhile, downstream sectors such as petrochemicals and pharmaceutical cold-chain logistics began exploring blended supply models to hedge tariff exposure, combining domestic inventory buffers with opportunistic imports. Ultimately, the 2025 tariffs have catalyzed a realignment of procurement networks and investment flows, reinforcing the strategic imperative for manufacturers to diversify sourcing options and enhance supply-chain transparency.

Uncovering Critical Market Segmentation Dynamics Across End Use Industries Materials Types and Application Scenarios Driving Targeted Growth

A granular view of market segmentation reveals critical nuances that drive tailored strategies across application, industry, and material dimensions. Within the end-use industry landscape, cryogenic insulation demand is anchored by oil and gas, where downstream facilities require robust thermal barriers for LNG peak shaving terminals, midstream pipelines rely on field-insulated flowlines, and upstream operations deploy insulated manifolds and separators in offshore platforms. Food and beverage processors similarly leverage low-temperature storage for specialty ingredients, while pharmaceutical manufacturers depend on cryogenic tanks to preserve biologics at precise temperatures. In petrochemicals, the interplay of reaction heat management and storage stability underscores insulation’s role in enhancing process efficiency.

Material type segmentation further nuances performance requirements. Microporous insulation, prized for its ultralow conductivity, addresses tight space constraints in compact transport containers, while multilayer insulation systems, including reflective foil and spacer-based configurations, deliver customizable thickness for both industrial and research cryogenics. Perlite remains a cost-effective granulate choice for large-volume storage tanks, and polyurethane foams continue to serve as reliable general-purpose insulators. Cutting-edge vacuum-insulated panels, encompassing both evacuated core and sandwich constructions, push the envelope in mobile applications by combining minimal thickness with high R-values.

Application segmentation ties these material and industry insights into the field. Offshore and onshore pipelines demand corrosion-resistant jackets and field-built insulation wraps, whereas horizontal and vertical storage tanks call for specialized support systems and cold-tolerant facesheets. ISO tanks and road tankers must balance weight and insulation efficiency for long-distance chemical and LNG transport, and valves and fittings-whether ball or gate configurations-require precision-molded cryogenic inserts to ensure leak-free performance. Together, these segmentation layers illuminate where innovation, cost optimization, and regulatory compliance intersect to shape product development and go-to-market tactics.

This comprehensive research report categorizes the Cryogenic Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- End Use Industry

- Application

Analyzing Key Regional Markets and Emerging Opportunities in the Americas EMEA and Asia-Pacific for Cryogenic Insulation Solutions

Regional markets for cryogenic insulation display unique growth drivers and adoption patterns. In the Americas, a surge in natural gas exports, coupled with government incentives for renewable hydrogen infrastructure, has heightened investments in LNG storage terminals and cryogenic pipelines across North America. Canada’s focus on cold-climate energy projects adds further momentum, supporting innovations in perlite-based systems and advanced vacuum-insulated modules. This regional emphasis on large-scale energy applications has encouraged collaboration between local material suppliers and engineering firms to develop solutions that meet North American regulatory standards and performance expectations.

Europe, Middle East, and Africa (EMEA) present a diverse landscape where energy diversification and sustainability mandates drive demand for cryogenic storage and transport. The Middle East’s expansion of petrochemical complexes and LNG export facilities has accelerated procurement of high-performance microporous panels, while European governments’ commitments to green hydrogen roadmaps have spurred pilot projects requiring ultra-efficient multilayer systems. In parallel, African initiatives to stabilize remote power grids via LNG-to-power plants have introduced off-grid storage challenges, spotlighting modular insulation technologies capable of rapid installation and low maintenance.

Across Asia-Pacific, governments in China, India, and Southeast Asia prioritize energy security and cold-chain expansion, fueling strong uptake of insulated ISO tanks and tankers for both petrochemicals and pharmaceutical logistics. China’s growing fleet of floating LNG terminals and India’s push for cryogenic hydrogen fueling stations underscore regional ambitions to integrate low-carbon fuels. These dynamics have prompted regional manufacturers to invest in localized production lines and strategic partnerships, ensuring alignment with complex import regulations and accelerating delivery timelines in this rapidly evolving market.

This comprehensive research report examines key regions that drive the evolution of the Cryogenic Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positioning and Competitive Strengths of Leading Players Shaping the Cryogenic Insulation Market Landscape

Leading players in the cryogenic insulation arena are leveraging their core competencies to capture emerging opportunities and strengthen market presence. Several global material specialists have prioritized research into next-generation microporous and aerogel composites, collaborating with universities and research institutes to commercialize high-performance formulations. At the same time, major engineering and construction firms have integrated insulation services into turnkey project offerings, streamlining procurement and installation under single-source contracts.

Strategic alliances and joint ventures have reshaped competitive dynamics, enabling companies to pool technology portfolios and expand geographic reach. In particular, partnerships between Western material innovators and regional fabricators in Asia-Pacific have accelerated technology transfer and cost rationalization, allowing for competitive pricing without compromising performance. Mergers and acquisitions among midsized insulation specialists have also consolidated niche capabilities, from reflective foil lamination to automated spray-applied systems, strengthening end-to-end service models.

These developments underscore a broader trend: market leaders are moving beyond product sales toward integrated lifecycle solutions. By embedding digital monitoring tools, offering performance guarantees, and providing training for maintenance personnel, companies are enhancing customer value and reinforcing long-term relationships. As a result, differentiation now hinges on the ability to deliver holistic solutions that address technical requirements, regulatory compliance, and sustainability goals in one cohesive package.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryogenic Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- Callenberg Technology Company AB

- Dow Inc.

- DUNMORE Corporation

- Evonik Industries AG

- GEA Group Aktiengesellschaft

- Herose GmbH

- Imerys Minerals S.A.

- KAEFER SE & Co. KG

- Lydall, Inc.

- Nichias Corporation

- Norplex-Micarta Corporation

- Owens Corning

- Parker-Hannifin Corporation

- Pittsburgh Corning Corporation

- Thermaxx Jackets, LLC

- Unifrax I LLC

- Zotefoams plc

Actionable Strategic Recommendations to Enhance Operational Excellence Innovation and Sustainability in Cryogenic Insulation Deployment

Industry leaders can capitalize on the evolving cryogenic insulation market by adopting a multifaceted strategy that spans innovation, sustainability, and operational excellence. First, investing in material R&D with a focus on next-generation aerogel composites and advanced multilayer systems will unlock performance gains while meeting emerging low-carbon mandates. By forming consortia with academic and national laboratories, companies can accelerate product development cycles and establish first-mover advantages in high-growth applications such as hydrogen fueling and space technology.

Second, operational resilience demands a diversified manufacturing footprint. Establishing localized production hubs near key demand centers not only mitigates tariff exposure but also shortens lead times and enhances service responsiveness. Coupling this with digital supply-chain platforms enables real-time visibility into inventory levels, supplier performance, and logistics bottlenecks, empowering leaders to make data-driven sourcing decisions.

Finally, embedding sustainability throughout the value chain-from eco-friendly binder selection to recycling end-of-life panels-will satisfy stakeholder expectations and preempt regulatory requirements. Developing take-back programs for spent insulation materials can convert waste into value-added feedstock streams and strengthen circular-economy credentials. By executing these integrated recommendations, businesses can secure their position at the vanguard of cryogenic insulation innovation and deliver compelling value propositions to the markets they serve.

Detailing Robust Research Methodology and Rigorous Analytical Approaches Employed to Ensure Accuracy and Insight in Cryogenic Insulation Market Analysis

Our research methodology combined primary and secondary approaches to ensure comprehensive coverage and rigorous analysis of the cryogenic insulation market. On the primary side, we conducted in-depth interviews with industry veterans, including materials scientists, project engineers, and procurement heads from major energy and pharmaceutical companies. These discussions provided first-hand insights into application challenges, performance criteria, and emerging customer preferences.

For secondary research, we reviewed technical papers, patent filings, regulatory frameworks, and trade association publications to map technology trends, material specifications, and safety standards. We also analyzed public filings and investor presentations from leading market participants to understand strategic priorities and capacity expansions.

To validate findings, we triangulated data points across sources, cross-referencing interview inputs with documented case studies and field performance reports. Statistical modeling and scenario analysis helped us identify correlations between tariff changes, supply-chain configurations, and end-market demand. A dedicated advisory panel of external experts reviewed the draft report, ensuring that methodologies adhered to best practices in market intelligence and that conclusions remained objective and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryogenic Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryogenic Insulation Market, by Material Type

- Cryogenic Insulation Market, by End Use Industry

- Cryogenic Insulation Market, by Application

- Cryogenic Insulation Market, by Region

- Cryogenic Insulation Market, by Group

- Cryogenic Insulation Market, by Country

- United States Cryogenic Insulation Market

- China Cryogenic Insulation Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Implications to Empower Stakeholders in Navigating Future Opportunities within the Cryogenic Insulation Ecosystem

This executive summary has distilled the pivotal trends, structural shifts, and strategic imperatives defining the cryogenic insulation market today. Key findings highlight the accelerating role of advanced materials-from aerogel composites to vacuum-insulated panels-in enhancing performance while addressing space and weight constraints. The recent imposition of U.S. tariffs has realigned supply-chain strategies, driving reshoring initiatives and mixed sourcing models that balance cost efficiency with risk mitigation. Segmentation analysis underscores the varied demands across end-use industries, material types, and applications, while regional insights reveal how energy security, sustainability goals, and infrastructure expansion are fueling growth in the Americas, EMEA, and Asia-Pacific.

Looking ahead, stakeholders must navigate complex regulatory frameworks, shifting trade policies, and rising sustainability expectations. The competitive landscape is intensifying as market leaders integrate digital monitoring, lifecycle services, and circular-economy practices into their offerings. To stay ahead, companies should align R&D investments with emerging application needs, fortify supply-chain resilience, and cultivate partnerships that accelerate innovation.

By synthesizing these strategic implications, decision-makers can better anticipate market opportunities, minimize operational risks, and chart a path toward sustainable, high-performance cryogenic systems that meet the energy and technology demands of tomorrow.

Engage Directly with Ketan Rohom to Unlock Exclusive Access and Tailored Insights from the Comprehensive Cryogenic Insulation Market Research Report

To secure your organization’s competitive advantage and gain in-depth understanding of the complex dynamics shaping the global cryogenic insulation market, take the next step today by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. By connecting with Ketan, you’ll benefit from his tailored guidance on how this comprehensive research can be customized to address your specific operational challenges and strategic objectives. Whether you seek deeper insight into tariff implications, material innovations, or regional expansion strategies, Ketan will walk you through the detailed findings and answer any questions you have about data interpretation or bespoke analytical services. Don’t miss this opportunity to transform raw market intelligence into actionable strategies that power your decision-making process and drive sustainable growth for your projects and investments. Reach out now to unlock exclusive access to the full report and the expert support needed to turn research insights into real-world success.

- How big is the Cryogenic Insulation Market?

- What is the Cryogenic Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?