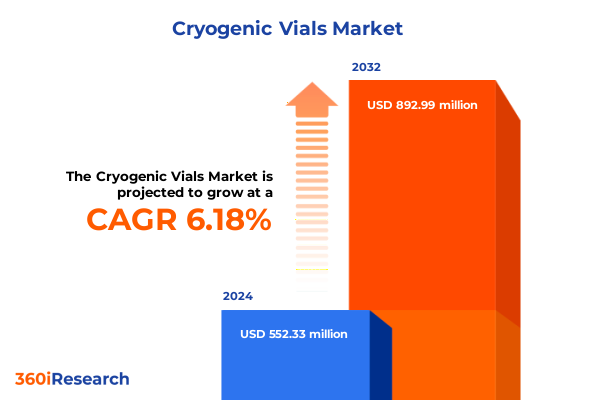

The Cryogenic Vials Market size was estimated at USD 582.67 million in 2025 and expected to reach USD 618.15 million in 2026, at a CAGR of 6.28% to reach USD 892.98 million by 2032.

Establishing the Critical Role of Cryogenic Vials Amidst Accelerated Scientific Innovation and Global Supply Chain Dynamics Unfolding in 2025

The cryogenic vial sector has emerged as a cornerstone of modern life sciences, enabling the preservation and transport of critical biological specimens under ultra-low temperature conditions. As laboratories, biobanks, and pharmaceutical entities intensify their focus on innovation and efficiency, the demand for high-performance vials capable of ensuring sample integrity over extended periods has never been greater. This trend is underscored by accelerating advancements in medical research, including gene therapy, cell-based diagnostics, and personalized medicine, all of which rely on fail-safe cryopreservation techniques. Consequently, the ability of vials to withstand cryogenic stress while maintaining contaminant-free environments has become paramount for researchers and clinicians alike.

Concurrently, global supply chain complexities have introduced new considerations into procurement strategies. Fluctuating raw material availability, evolving regulatory landscapes, and shifting trade policies are compelling stakeholders to adopt more agile sourcing models. Within this context, manufacturers are challenged to balance stringent quality standards with cost optimization and sustainable practices. The intersection of these pressures highlights the strategic importance of crafting a nuanced understanding of material properties, production processes, and end-user requirements.

Against this backdrop, the following executive summary distills the latest industry developments, assesses economic and regulatory catalysts, and identifies key levers for competitive differentiation. By establishing this foundational perspective, stakeholders can navigate the evolving cryogenic vial landscape with clarity and strategic foresight.

Unraveling the Pivotal Transformative Forces Reshaping the Cryogenic Vials Market Through Automation Digitalization and Sustainability Imperatives

The cryogenic vial ecosystem is undergoing transformative shifts driven by a convergence of technological, environmental, and operational imperatives. One of the most pronounced changes arises from the integration of automated processing systems. Laboratories are increasingly deploying robotics and high-throughput platforms to enhance consistency, accelerate sample throughput, and minimize human error. As a result, vial manufacturers are recalibrating product designs to ensure compatibility with automated decappers, barcode readers, and liquid handling modules. This compatibility not only streamlines workflows but also fortifies data integrity across the sample lifecycle.

Simultaneously, digital traceability solutions are redefining quality assurance protocols. The adoption of 2D barcoded vial labels and connected inventory management platforms allows real-time monitoring of storage conditions and chain-of-custody documentation. Such innovations mitigate risks associated with sample misplacement and temperature excursions, directly contributing to improved research reproducibility and regulatory compliance.

Environmental sustainability has also emerged as a key driver of market differentiation. Manufacturers are increasingly exploring bio-based plastics and low-carbon glass formulations to reduce their carbon footprint. Lifecycle assessments and eco-design principles are no longer optional considerations but critical factors in securing procurement contracts with institutions that prioritize green credentials.

These developments, in concert with evolving sterility requirements and advanced closure mechanisms, underscore a pivotal shift in which cryogenic vials are not mere passive containers but integral components of sophisticated, digitized research and diagnostic workflows.

Assessing the Comprehensive Ramifications of 2025 United States Tariff Measures on Raw Material Costs and Global Supply Chains in Cryogenic Vials

The implementation of new United States tariff measures in 2025 has injected fresh complexities into the cryogenic vial supply chain, affecting both raw material procurement and finished goods. Tariffs applied to specific classes of glass feedstock and polymer resins have elevated input costs, prompting manufacturers to reassess their sourcing strategies. Many suppliers have accelerated contracts with domestic glass producers to mitigate exposure to punitive duties on borosilicate and soda lime imports. At the same time, some stakeholders are evaluating alternative polymer blends, such as high-performance polyethylene and polypropylene, as a circumvention tactic to preserve cost efficiency without compromising material integrity.

These tariff-induced cost pressures have rippled through distribution channels, compelling end users to revisit pricing negotiations and budget allocations. Academic laboratories and diagnostic facilities are recalibrating procurement cycles, often opting for longer-term agreements that secure favorable pricing structures in anticipation of further policy shifts. Simultaneously, leading manufacturers are leveraging nearshoring strategies, expanding capacity in North American facilities to reduce transit times and tariff burdens.

On a broader scale, these trade policies have also catalyzed innovation. With cost volatility driving a renewed focus on material efficiency, research and development teams are exploring advanced vial geometries that minimize polymer usage while enhancing thermal performance. Collectively, these responses highlight the market’s adaptive capacity in navigating shifting regulatory frameworks and underscore the strategic importance of agility in both procurement and design.

Deriving Actionable Segmentation Insights Across Material Volume Sterility Closure Automation Compatibility End User and Application Dimensions

A multidimensional segmentation analysis reveals critical drivers of demand across materials, volumes, sterility levels, closure mechanisms, automation compatibility, end-user profiles, and application domains. Material selection underscores a dichotomy between traditional glass offerings and polymeric alternatives, with borosilicate retaining preference for ultra-low temperature resilience, while soda lime glass finds traction in cost-sensitive scenarios. Polyethylene and polypropylene variants have gained prominence for their lightweight nature and resistance to cryogenic fracturing, particularly in settings where high-volume sample throughput is paramount.

Volume distinctions further influence purchasing patterns, as laboratories optimizing space efficiency gravitate toward compact designs like 1.5 mL and 2 mL vials, whereas biobanks and pharmaceutical entities handling large specimen libraries often standardize on 5 mL and 10 mL formats. The delineation between non-sterile and sterile offerings is likewise crucial, with sterile vials commanding a premium in clinical diagnostic workflows and regulated research environments, while non-sterile formats suffice for general laboratory storage and transport functions.

Closure system diversity-from magnetic closures and O rings to screw caps and snap caps-caters to specific requirements around leak-proofing and ease of handling. This variety becomes even more salient when viewed through the lens of automation compatibility: fully automated platforms demand uniform torque profiles and precise dimensional tolerances, whereas manual and semi-automated operations permit a broader range of closure technologies.

End-user segmentation highlights the distinct purchasing priorities across academic and research institutes, biobanks, biotechnology firms, diagnostic laboratories, hospitals, and pharmaceutical companies. Finally, application areas such as cryopreservation, sample storage, and transport each place unique performance criteria on the vial, influencing preferences for thermal retention, structural robustness, and handling ergonomics. By synthesizing these dimensions, stakeholders can tailor product development and marketing strategies to the precise needs of their target segments.

This comprehensive research report categorizes the Cryogenic Vials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Volume

- Sterility

- Closure

- Automation Compatibility

- End User

- Application

Highlighting the Distinctive Regional Dynamics Influencing Cryogenic Vial Demand in Americas EMEA and Asia Pacific Markets and Cross Border Regulatory Factors

Regional dynamics exert a pronounced influence on cryogenic vial adoption patterns and procurement strategies. In the Americas, robust investment in biotechnology research and expansion of biopharmaceutical manufacturing facilities drive steady demand growth, particularly in regions with extensive academic networks and contract research organizations. Supply chain resilience has become a priority, prompting stakeholders to secure regional warehousing and ink long-term partnerships with domestic glass and polymer producers to minimize trade uncertainties.

In Europe, the Middle East, and Africa (EMEA), diverse regulatory environments and variable infrastructure maturity levels present both opportunities and challenges. Western European markets, characterized by stringent regulatory frameworks and sustainability mandates, favor premium vials with enhanced traceability and eco-friendly materials. Conversely, emerging markets in the Middle East and Africa prioritize cost-effective solutions that balance performance with budget constraints. Cross-border logistics considerations, including customs clearances and cold chain reliability, further shape product specifications and packaging formats.

The Asia Pacific region exhibits heterogeneous growth trajectories, driven by rapid expansion of contract research and biobanking capabilities in countries such as China, India, and South Korea. Local manufacturers are increasingly competitive, offering cost-optimized polymer vials that cater to high-volume applications, while multinationals maintain a strong presence through partnerships and localized production centers. Regulatory evolutions in the region are progressively aligning with international standards, signaling an imminent shift toward more stringent sterility and quality assurance requirements.

Across all regions, the interplay between infrastructure readiness, regulatory landscapes, and local manufacturing capacities underscores the necessity of a nuanced, region-specific approach to product development and market entry.

This comprehensive research report examines key regions that drive the evolution of the Cryogenic Vials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Initiatives and Competitive Positioning of Leading Cryogenic Vial Manufacturers Driving Innovation and Market Differentiation

Leading cryogenic vial manufacturers have adopted diverse strategies to maintain competitive positioning and drive innovation. Established industry giants have intensified investments in research and development, focusing on next-generation materials and sustainability initiatives. These incumbents leverage expansive global distribution networks to deliver consistent quality standards and regulatory-compliant products across multiple geographies, securing long-term contracts with large-scale biobanks and pharmaceutical companies.

Simultaneously, agile challengers are carving out niche segments by introducing differentiated closure technologies and specialized vial coatings that enhance thermal uniformity and chemical resistance. These market entrants benefit from streamlined decision-making processes, enabling rapid prototyping and expedited validation cycles. As a result, they can respond swiftly to emerging customer requirements and pivot their offerings to address novel applications such as high-concentration sample storage and advanced cellular therapies.

Collaborations and strategic alliances are another hallmark of competitive dynamics, with manufacturers partnering with automation platform providers to co-develop vial formats optimized for specific liquid handling systems. This integration enhances overall workflow efficiency and fosters a more seamless user experience. Furthermore, some companies are pursuing vertical integration strategies, acquiring or partnering with polymer resin producers to exercise greater control over raw material quality and cost structures.

Collectively, these strategic initiatives reflect an industry characterized by both scale-driven consolidation and targeted innovation, underscoring the multifaceted paths through which companies seek to differentiate themselves in a rapidly evolving marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryogenic Vials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abdos Labtech Private Limited

- Argos Technologies, Inc.

- BioCision, LLC

- Capp ApS

- CELLTREAT Scientific Products

- Corning Incorporated

- DWK Life Sciences GmbH

- Eppendorf AG

- EZ BioResearch LLC

- Greiner Bio‑One International GmbH

- Heathrow Scientific LLC

- Micronic Holding B.V.

- Sigma‑Aldrich Corporation

- Simport Scientific, Inc.

- Starlab International GmbH

- Sumitomo Bakelite Co., Ltd.

- Thermo Fisher Scientific, Inc.

- VWR International, LLC

Providing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Evolving Cryogenic Vial Landscape

To capitalize on emerging opportunities and navigate prevailing challenges, industry leaders should prioritize an integrated approach to innovation and supply chain resilience. First, investing in product lines that are inherently compatible with fully automated workflows will enable rapid adoption by laboratories seeking to enhance throughput and reduce manual intervention. Concurrently, pursuing modular closure designs that accommodate a spectrum of cap technologies will ensure broader applicability across automation platforms.

Diversification of sourcing strategies is equally critical. By establishing dual-sourcing agreements for high-purity glass feedstocks and partnering with regional polymer resin suppliers, manufacturers can mitigate the impact of trade policy fluctuations and logistical bottlenecks. Nearshoring initiatives, including the expansion of regional manufacturing hubs and the adoption of flexible production modules, will further enhance supply chain agility.

On the sustainability front, embedding eco-design principles into product development-such as reducing polymer usage through optimized vial geometries and selecting recyclable or bio-based materials-will resonate with procurement teams operating under corporate responsibility mandates. Engaging in transparent life cycle assessments and obtaining recognized sustainability certifications can serve as powerful differentiators in competitive tender processes.

Finally, fostering deep collaborations with end users-including regular feedback loops with academic researchers and clinical laboratory managers-can inform iterative improvements in product performance and usability. These partnerships will not only strengthen customer loyalty but also enable early identification of emerging application requirements, ensuring that product portfolios remain aligned with evolving market needs.

Detailing Robust Research Methodology Leveraging Primary Data Secondary Sources and Rigorous Validation Techniques to Ensure Comprehensive Market Insights

This research employs a rigorous, multi-tiered methodology designed to deliver comprehensive insights into the cryogenic vial market. Primary research components included in-depth interviews with procurement leaders, laboratory directors, and technical experts across key end-user segments. These conversations provided qualitative perspectives on purchasing criteria, performance expectations, and emerging application trends. Concurrently, a structured online survey captured quantitative data from a broader respondent base, enabling cross-validation of qualitative findings and trend quantification.

Secondary research activities encompassed a systematic review of regulatory documents, industry publications, and patent filings to map the competitive landscape and identify technological advancements. Company annual reports and financial disclosures were analyzed to assess strategic initiatives, capacity expansions, and merger and acquisition activities. Trade data and tariff schedules were examined to understand the implications of the 2025 United States trade measures on raw material sourcing and pricing dynamics.

To ensure data integrity, all proprietary findings were triangulated through multiple sources, and a dedicated validation protocol was implemented. This protocol included peer reviews by industry consultants and technical audits by subject matter experts, guaranteeing that conclusions are both robust and actionable. Finally, the assembled insights were synthesized into thematic frameworks that align with the critical segmentation dimensions, regional dynamics, and competitive strategies most relevant to market stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryogenic Vials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryogenic Vials Market, by Material

- Cryogenic Vials Market, by Volume

- Cryogenic Vials Market, by Sterility

- Cryogenic Vials Market, by Closure

- Cryogenic Vials Market, by Automation Compatibility

- Cryogenic Vials Market, by End User

- Cryogenic Vials Market, by Application

- Cryogenic Vials Market, by Region

- Cryogenic Vials Market, by Group

- Cryogenic Vials Market, by Country

- United States Cryogenic Vials Market

- China Cryogenic Vials Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesis of Imperative Findings Highlighting Market Trajectories and Strategic Imperatives Guiding Stakeholders Through the Future of Cryogenic Vial Applications

This executive summary has illuminated the key forces shaping the cryogenic vial landscape, from automation-led workflow enhancements to the strategic recalibrations induced by 2025 tariff implementations. By dissecting material preferences, volume requirements, and closure system innovations, stakeholders can align product development with the distinct performance imperatives of diverse end-user segments. Moreover, a nuanced understanding of regional market dynamics-from established Americas supply chains to emerging Asia-Pacific production centers-facilitates targeted market entry and expansion strategies.

Competitive analysis underscores that industry leaders are employing a dual-pronged approach, investing in sustainable materials and forging strategic alliances to co-create automation-compatible solutions. At the same time, agile challengers continue to drive incremental innovation through specialized coatings, advanced geometries, and nimble prototyping capabilities. These varying trajectories highlight the multifaceted nature of competition and the opportunities that arise from both scale and specialization.

Looking ahead, organizations that embrace holistic strategies-integrating supply chain diversification, sustainability-driven product design, and end-user collaboration-will be best positioned to navigate evolving regulatory frameworks and capture growth in high-value application areas such as cellular therapies and precision diagnostics. The synthesis of these insights provides a clear blueprint for stakeholders seeking to secure leadership positions in this dynamic market environment.

Engage with Ketan Rohom to Secure Comprehensive Cryogenic Vial Market Intelligence and Drive Strategic Decision Making with Tailored Research Insights

Engaging with Ketan Rohom empowers decision-makers to access an authoritative market research report meticulously curated to address the nuanced challenges and growth opportunities within the cryogenic vial industry. By partnering with an experienced Associate Director of Sales & Marketing, organizations gain tailored insights that align with their strategic objectives and operational realities. This collaboration ensures that procurement teams, R&D departments, and executive leadership receive personalized guidance on product selection, pricing strategies, and regulatory navigation, ultimately optimizing investment decisions.

Moreover, this direct engagement facilitates a deeper understanding of cutting-edge material innovations, advanced automation compatibility, and region-specific regulatory considerations. Stakeholders benefit from customized briefings, in-depth technical consultations, and priority access to proprietary data sets, elevating their competitive advantage. Through this targeted approach, industry players can accelerate time-to-market for new applications, enhance supply chain resilience, and capitalize on emerging segments such as fully automated workflows and advanced closure systems.

To secure your copy of the comprehensive cryogenic vial market intelligence report and explore bespoke partnership opportunities, contact Ketan Rohom, Associate Director of Sales & Marketing. His expertise and consultative approach will guide you through the intricacies of the report, ensuring seamless integration of insights into your strategic roadmap. Take the next step toward informed decision-making and sustained growth in this dynamic market.

- How big is the Cryogenic Vials Market?

- What is the Cryogenic Vials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?