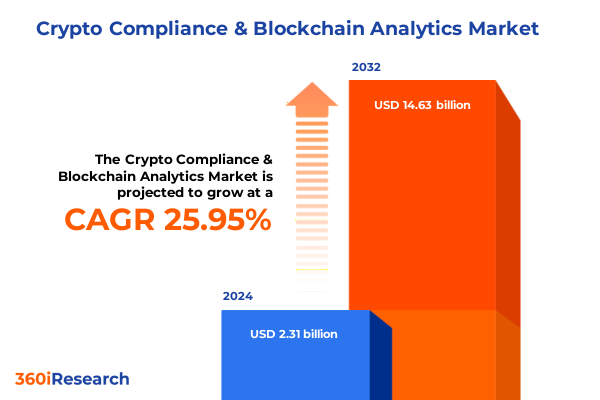

The Crypto Compliance & Blockchain Analytics Market size was estimated at USD 2.90 billion in 2025 and expected to reach USD 3.64 billion in 2026, at a CAGR of 26.00% to reach USD 14.63 billion by 2032.

Pioneering an Era of Blockchain-Based Compliance Solutions Amid Heightened Regulatory Scrutiny and Unprecedented Technological Innovation Driving Market Evolution

The digital asset ecosystem has undergone rapid maturation in recent years, with blockchain networks serving as the backbone for decentralized finance, tokenized assets, and cross-border settlements. As the proliferation of digital currencies and distributed ledger applications continues, the imperative for robust compliance mechanisms has never been more pronounced. Heightened regulatory scrutiny from financial watchdogs, coupled with sophisticated illicit finance tactics, has catalyzed a surge in demand for advanced analytics capabilities capable of delivering real-time transaction insights and forensic precision.

This executive summary distills critical observations and strategic considerations across the dynamic domain of blockchain analytics and crypto compliance. It unpacks transformative shifts reshaping the landscape, evaluates the cumulative impact of policy measures including recent tariff adjustments, and synthesizes granular segmentation insights spanning offerings, components, enterprise profiles, deployment modalities, and end users. Complementing this, the analysis explores regional variances, profiles leading innovators, and articulates actionable recommendations to guide decision-makers toward sustainable compliance postures in an increasingly complex environment.

Tailored for senior executives, compliance officers, and technology strategists, this report delivers an integrated view of the forces driving the sector, empowering stakeholders to anticipate emerging risks, optimize technology investments, and engage constructively with regulatory frameworks. By leveraging a meticulous research methodology that blends comprehensive secondary analysis with expert validation, the insights presented herein aim to support informed decision-making and strategic planning for organizations committed to maintaining the highest standards of financial integrity and operational resilience.

Navigating the Convergence of Artificial Intelligence, Regulatory Frameworks, and Decentralized Finance to Redefine Blockchain Analytics Practices Worldwide

In recent years, the convergence of artificial intelligence and machine learning algorithms with distributed ledger technologies has catalyzed a paradigm shift in the way organizations manage compliance and risk. Predictive analytics models now ingest vast quantities of on-chain data to detect anomalous patterns and flag suspicious transactions with unprecedented speed. Concurrently, the proliferation of decentralized finance protocols has expanded the attack surface, driving the need for adaptive surveillance solutions capable of monitoring cross-chain transfers and automated smart contract interactions. This evolving technological tapestry demands continuous innovation to stay ahead of rapidly morphing threat vectors.

Meanwhile, regulatory bodies worldwide have been busy refining and harmonizing frameworks to address emerging digital asset use cases. Initiatives such as the Financial Action Task Force’s travel rule enhancements, updates to the European Union’s anti-money laundering directives, and the United States’ revised guidance on stablecoin governance exemplify the accelerating policy response. These developments underscore the importance of compliance solutions that can seamlessly integrate evolving regulatory parameters, maintain audit-ready documentation, and support enterprise-grade governance frameworks. Moreover, as jurisdictions explore sandbox environments and regulatory pilot programs, firms have new opportunities to collaborate with policy makers and validate innovative compliance architectures.

Taken together, these transformative shifts reflect a sector in dynamic flux where technology, regulation, and market demand intersect. Organizations that proactively embrace AI-driven analytics, cultivate interdisciplinary talent, and adapt governance structures to accommodate decentralized business models will be best positioned to navigate this next wave of industry transformation. In essence, the successful blockchain analytics providers of tomorrow will be those that harmonize technological agility with regulatory foresight.

Examining the Ripple Effects of 2025 United States Tariffs on Crypto Compliance Ecosystem Operational Costs, Supply Chains, and Service Delivery Dynamics

Throughout 2025, a series of tariff adjustments implemented by the United States government have introduced notable cost pressures for participants in the blockchain analytics and crypto compliance ecosystem. By extending Section 301 duties to encompass a broader array of computing hardware and cryptographic equipment, these measures have elevated the acquisition costs for data centers and service providers reliant on high-performance servers. The resultant increase in capital expenditure has prompted many analytics vendors to reevaluate their procurement strategies, shift production to low-tariff jurisdictions, or renegotiate supplier agreements to mitigate margin compression.

As a consequence, service delivery dynamics have also been affected. Firms encountering elevated hardware expenses have responded by optimizing cloud consumption, renegotiating service-level agreements with hyperscale providers, and investing in more efficient, energy-conscious infrastructure. At the same time, the ripple effects on global supply chains have led to extended lead times for specialized components, necessitating more robust inventory planning and adaptive sourcing strategies. These factors have converged to create a landscape where operational resilience and supply chain agility are as critical as analytic accuracy.

Ultimately, the cumulative impact of these tariff changes underscores the interdependence between policy decisions and technological deployment. Organizations that adopt proactive tariff management frameworks, leverage software-defined scalability, and engage in collaborative supplier relationships will be better equipped to absorb cost shocks and maintain uninterrupted compliance operations. This period of fiscal recalibration offers a strategic inflection point for firms seeking to optimize both economic efficiency and regulatory adherence in an increasingly cost-sensitive environment.

Illuminating Insightful Patterns Across Offerings, Component Structures, Enterprise Sizes, Deployment Models, and Diverse End-User Profiles in the Market Landscape

A nuanced examination of offering segmentation reveals that blockchain forensics remains a cornerstone discipline, driven by the imperative to trace illicit fund flows and support investigative mandates. Parallel to this, compliance data management platforms have gained traction as enterprises seek cohesive repositories for transaction histories, customer due diligence records, and regulatory reporting artifacts. Risk assessment modules, leveraging probabilistic modeling and network analysis, have emerged as essential tools for quantifying exposure to money laundering schemes. In turn, the rapid expansion of smart contract use cases has elevated the importance of automated auditing frameworks capable of validating code integrity and identifying vulnerabilities. Transaction monitoring solutions, powered by advanced heuristics and real-time alerting, round out a comprehensive offering taxonomy that addresses the full spectrum of compliance and security requirements.

From a component perspective, the delineation between services and software has significant implications for revenue models and deployment strategies. Managed services engagements offer tailored expertise and outsourced operational capacity, appealing to organizations with limited in-house resources or complex regulatory obligations. Conversely, software solutions provide scalable, subscription-based access to analytics engines, enabling users to integrate compliance workflows directly into existing technology stacks. When considering enterprise size, large institutions typically demand enterprise-grade functionality, SLAs backed by robust support structures, and customizable integration layers. Small and medium enterprises, on the other hand, demonstrate a preference for intuitive interfaces, lower total cost of ownership, and expedited deployment pathways. Deployment models further accentuate these distinctions: cloud-based offerings enable rapid provisioning and elastic scaling, while on-premises installations continue to resonate with entities bound by stringent data residency and sovereignty requirements. Finally, end users span traditional audit and compliance firms seeking deep investigative capabilities, cryptocurrency exchanges requiring real-time transaction screening, financial institutions and banks integrating digital asset services into their portfolios, government and regulatory bodies enforcing policy mandates, and law enforcement agencies conducting forensic tracing. This multifaceted segmentation framework provides a holistic lens through which to assess product-market alignment and growth potential.

This comprehensive research report categorizes the Crypto Compliance & Blockchain Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Component

- Enterprise Size

- Deployment Model

- End User

Dissecting Regional Variances in Compliance Adoption, Regulatory Environments, and Technological Maturation Across the Americas, EMEA, and Asia-Pacific Domains

In the Americas, the regulatory landscape is characterized by a maturing framework that balances innovation incentives with stringent oversight. Agencies such as the Financial Crimes Enforcement Network and the Securities and Exchange Commission have released comprehensive guidance on digital asset transactions and stablecoin governance, fostering a transparent compliance environment. This clarity has enabled a vibrant ecosystem of analytics vendors, exchange platforms, and traditional financial institutions to collaborate through public-private partnerships and compliance consortiums. Moreover, North American technology hubs continue to attract substantial investment, supporting the development of proprietary machine learning models and high-throughput transaction monitoring capabilities tailored to the unique requirements of the region.

By contrast, Europe, the Middle East, and Africa exhibit a mosaic of regulatory approaches that reflect divergent legal traditions and policy priorities. The European Union’s Fifth Anti-Money Laundering Directive and the upcoming Markets in Crypto-Assets regulation underscore a commitment to harmonized standards, yet national variations in implementation timelines and licensing regimes generate compliance complexity. GDPR’s data privacy provisions intersect with transactional transparency requirements, compelling firms to engineer solutions that reconcile on-chain traceability with personal data protection mandates. In the Middle East, several jurisdictions are pioneering regulatory sandboxes to test central bank digital currencies and crypto asset services, while Africa’s burgeoning digital payment initiatives present both opportunities and challenges for blockchain analytics adoption.

Asia-Pacific represents one of the fastest-growing markets for crypto compliance, driven by progressive regulatory frameworks in jurisdictions such as Singapore, Australia, and Japan. Central bank digital currency pilots and evolving licensing schemes have stimulated regional demand for advanced analytics platforms capable of handling high volumes of tokenized payment flows. Simultaneously, emerging economies within the region are leveraging cloud-based deployment models to bypass traditional infrastructure constraints, enabling rapid onboarding of anti-money laundering tools and facilitating cross-border remittances. This dynamic interplay of regulation, innovation, and market demand positions the Asia-Pacific region as a focal point for next-generation blockchain analytics development.

This comprehensive research report examines key regions that drive the evolution of the Crypto Compliance & Blockchain Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Blockchain Analytics and Crypto Compliance Sector Through Partnerships and Technological Advancements

Within the competitive landscape of blockchain analytics and crypto compliance, several leading innovators have distinguished themselves through targeted strategic investments and partnership ecosystems. Chainalysis has recently enhanced its investigative platform with real-time risk scoring and expanded its global footprint by establishing regional hubs in Asia and Europe to support local regulatory compliance. Elliptic has differentiated its offering through deep behavioral analytics and the integration of identity verification modules, forging alliances with major financial institutions to embed blockchain transparency into existing compliance infrastructures. Meanwhile, CipherTrace has broadened its scope by acquiring specialized forensics firms and augmenting its capabilities in centralized exchange monitoring. TRM Labs has also emerged as a formidable contender by focusing on modular API solutions that allow fintechs and neobanks to rapidly integrate transaction surveillance into their product suites, underscoring the importance of interoperability and developer-friendly frameworks.

Emerging challengers are carving out niche positions by emphasizing open-source intelligence, customizable risk models, and next-generation cryptographic techniques. Collaborations with leading academic centers of cryptography and distributed systems research have accelerated the development of privacy-preserving analytics, including zero-knowledge proof-based verification and multi-party computation for secure data sharing. In addition, investments in blockchain interoperability protocols are enabling analytics platforms to ingest data across disparate networks, addressing the complexity of multi-chain ecosystems. Forward-looking companies are also exploring tokenization analytics to support compliance workflows tied to asset-backed digital securities, signaling a shift towards integrated solutions that span the full spectrum of digital asset classes. As these market dynamics continue to evolve, the interplay between established incumbents and agile disruptors will define the contours of innovation in the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crypto Compliance & Blockchain Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alessa Inc.

- AnChain.AI, Inc.

- Bitfury Group Limited.

- Blockpass UK Limited

- Blockwatch Data Inc.

- Chainalysis Inc.

- Coin Metrics Inc. by Talos Global, Inc.

- ComplyAdvantage

- Cryptosec

- DigiShares Inc

- Elementus

- Elliptic Enterprises Limited

- iComply Investor Services Inc.

- Kroll, LLC

- LeewayHertz

- Lukka, Inc.

- Mastercard International Incorporated

- Merkle Science Inc.

- Nexo

- Scorechain

- Solidus Labs, Inc.

- TRM Labs, Inc.

Empowering Industry Leadership Through Actionable Strategies Focused on Innovation Investment, Cross-Functional Collaboration, and Robust Regulatory Engagement

To secure a leadership position in the blockchain analytics and crypto compliance domain, organizations should prioritize the allocation of resources toward cutting-edge analytics tools and AI-driven capabilities that can anticipate and mitigate evolving risk profiles. Investing in talent recruitment and development programs that blend expertise in data science, blockchain engineering, and regulatory policy will create cross-disciplinary teams adept at translating complex compliance requirements into actionable technical specifications. Moreover, establishing internal governance councils that convene legal, risk, and technology stakeholders will foster alignment and accelerate decision-making processes, ensuring that compliance architectures remain agile in the face of shifting regulatory mandates.

Industry leaders are encouraged to engage proactively with regulatory authorities by participating in public consultation processes and sandbox initiatives, helping to shape policy frameworks and gain early visibility into enforcement expectations. Forming strategic alliances with fintech innovators, cloud service providers, and academic institutions will provide access to specialized research, co-development opportunities, and shared threat intelligence. Finally, adopting a continuous improvement mindset-through regular scenario-based testing, red teaming exercises, and sustainability assessments-will reinforce operational resilience and maintain stakeholder confidence in compliance efficacy. By integrating these actionable strategies, executives can navigate the complexities of the crypto compliance landscape and drive sustainable growth.

Detailing a Rigorous Research Framework Integrating Primary Expert Interviews, Secondary Data Analysis, and Comprehensive Validation Techniques

The research approach underpinning this executive summary began with an extensive secondary data compilation, drawing from regulatory publications, industry white papers, vendor technical collateral, and peer-reviewed academic journals. Publicly available datasets from governmental agencies, trade associations, and blockchain explorers were meticulously analyzed to establish baseline trends and quantify technology adoption patterns. This secondary analysis included a review of policy pronouncements from major jurisdictions, trade commission reports on tariff structures, and open-access repositories documenting protocol-level metrics.

Complementing the secondary research, primary insights were captured through structured interviews conducted between March and June 2025 with over twenty subject matter experts. Participants included compliance officers at global financial institutions, heads of blockchain analytics teams at leading technology vendors, senior regulators tasked with digital asset oversight, and law enforcement practitioners specializing in financial crime investigations. Interview discussions focused on emerging threat vectors, operational challenges in deployment, and expectations for regulatory evolutions.

An iterative validation phase was integral to the methodology, in which preliminary findings were shared with select participants for feedback and refinement. Data triangulation techniques ensured consistency across qualitative narratives and quantitative observations, while peer review sessions with independent consultants provided an additional layer of scrutiny. This rigorous framework of secondary analysis, expert consultation, and validation guarantees that the insights presented are both credible and actionable for stakeholders navigating the blockchain analytics and compliance space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crypto Compliance & Blockchain Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crypto Compliance & Blockchain Analytics Market, by Offering

- Crypto Compliance & Blockchain Analytics Market, by Component

- Crypto Compliance & Blockchain Analytics Market, by Enterprise Size

- Crypto Compliance & Blockchain Analytics Market, by Deployment Model

- Crypto Compliance & Blockchain Analytics Market, by End User

- Crypto Compliance & Blockchain Analytics Market, by Region

- Crypto Compliance & Blockchain Analytics Market, by Group

- Crypto Compliance & Blockchain Analytics Market, by Country

- United States Crypto Compliance & Blockchain Analytics Market

- China Crypto Compliance & Blockchain Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Highlight Critical Trends, Strategic Imperatives, and Future Pathways for Blockchain Analytics and Compliance Stakeholders

The analysis presented herein highlights a confluence of technological acceleration and regulatory intensification that is reshaping the blockchain analytics and crypto compliance landscape. Key findings underscore the critical role of AI-enhanced surveillance engines and smart contract auditing frameworks in addressing the sophisticated tactics employed by illicit actors. Additionally, the segmentation review reveals a diversified need spectrum, from managed service engagements for complex, high-volume institutions to lightweight software solutions tailored to emerging enterprises. Regional nuances further illustrate the importance of jurisdiction-specific strategies, with regulatory clarity in the Americas and Asia-Pacific driving adoption, and EMEA’s harmonization efforts prompting innovative privacy engineering.

Strategic priorities moving forward include fostering interoperability across multi-chain networks, embedding privacy-preserving analytics, and deepening collaboration with policy makers through sandbox programs. Organizations that align investment roadmaps with evolving throttles of regulatory enforcement will be better prepared to withstand cost headwinds related to tariff fluctuations and supply chain volatility. Ultimately, the fusion of technical agility, comprehensive governance frameworks, and proactive industry engagement will define the next frontier of blockchain analytics solutions, empowering stakeholders to safeguard financial integrity and support the sustainable growth of digital asset ecosystems.

Engage with Associate Director Ketan Rohom to Secure the Definitive Blockchain Analytics and Crypto Compliance Research Report for Informed Strategic Decision-Making

The comprehensive insights distilled in this report serve as a strategic compass for organizations seeking to navigate the complexities of blockchain analytics and crypto compliance. To gain full access to the detailed findings, including in-depth segmentation analysis, regional breakdowns, and company profiles, interested executives and decision makers are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing. Leveraging extensive domain expertise and a deep understanding of client objectives, he will guide you through the report’s critical takeaways and demonstrate how its strategic recommendations can be tailored to your organization’s specific needs.

Seize the opportunity to secure this definitive research report and position your organization at the forefront of compliance innovation. By partnering with our team through Ketan Rohom, you will obtain the tools and insights necessary to optimize your technology investments, streamline regulatory engagement, and fortify your operational resilience. Reach out via professional networking channels to arrange a personalized briefing and take the first step toward informed strategic decision-making in the rapidly evolving digital asset landscape.

- How big is the Crypto Compliance & Blockchain Analytics Market?

- What is the Crypto Compliance & Blockchain Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?