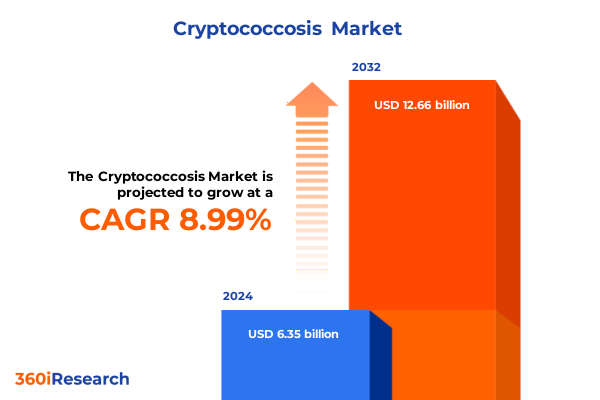

The Cryptococcosis Market size was estimated at USD 6.87 billion in 2025 and expected to reach USD 7.43 billion in 2026, at a CAGR of 9.12% to reach USD 12.66 billion by 2032.

Exploring the Critical Evolution of Cryptococcosis Therapeutics and Unveiling Core Market Dynamics Amidst Emerging Treatment Paradigms and Regulatory Shifts

Cryptococcosis represents a life-threatening fungal disease predominantly caused by Cryptococcus neoformans and, less frequently, Cryptococcus gattii. The infection primarily affects individuals with compromised immunity, notably those living with HIV/AIDS, but can also impact transplant recipients and patients undergoing immunosuppressive therapy. Globally, an estimated 152,000 cases of cryptococcal meningitis are diagnosed annually among people living with HIV, leading to approximately 112,000 fatalities, underscoring a continued high mortality risk in regions with limited healthcare access. Broader analyses indicate that cryptococcal meningitis contributes to an annual incidence of around 194,000 cases with approximately 147,000 deaths across all populations, reflecting the critical public health burden of invasive fungal pathogens.

Management of cryptococcosis follows a multi-phase antifungal regimen, beginning with induction therapy-often liposomal amphotericin B in combination with flucytosine-transitioning to consolidation and maintenance phases mediated by oral azoles such as fluconazole. These strategies aim to rapidly reduce fungal burden in the central nervous system and prevent relapse, yet significant morbidity and mortality persist, particularly in settings where timely diagnosis and treatment access are limited.

As therapeutic options evolve, the cryptococcosis treatment landscape has witnessed the introduction of novel azole compounds and emerging echinocandin formulations, alongside progress in diagnostic assays that enable earlier intervention. To dissect these complex dynamics, this executive summary employs a segmentation framework across drug classes, indications, routes of administration, end-user settings, and distribution channels, delivering actionable insights for decision-makers navigating the evolving market environment.

Charting the Transformative Shifts Reshaping the Therapeutic Landscape for Cryptococcosis Treatments in a Rapidly Evolving Healthcare Ecosystem

Recent regulatory approvals have redefined the cryptic therapeutic terrain, with isavuconazole, marketed as Cresemba, attaining orphan drug designation and approval for both intravenous and oral administration in cryptococcal meningitis and mucormycosis. Having achieved global in-market sales of USD 562 million in the 12 months ending December 2024, isavuconazole has swiftly become the largest branded antifungal for invasive fungal infections, reflecting strong clinician uptake and favorable safety profiles.

Parallel to azole innovations, the echinocandin class has expanded with the approval of rezafungin (Rezzayo) in March 2023 in the United States and December 2023 in the European Union, offering once-weekly intravenous dosing and an improved safety and pharmacokinetic profile. Ongoing global Phase 3 trials, such as the ReSTORE study in China, may further broaden the echinocandin footprint in invasive fungal disease management, presenting an alternative to daily-dosed agents and potential applicability in cryptococcal infections.

Diagnostic innovation has accelerated disease detection and patient triage through point-of-care tools. The cryptococcal antigen lateral flow assay (CrAg LFA) delivers results within 10 minutes at a cost of $3–4 per test, with sensitivity and specificity exceeding 99% in clinical evaluations. Endorsed by the World Health Organization for screening people with advanced HIV, these assays enable early intervention and preemptive therapy, especially in resource-limited environments, thereby reducing progression to meningitis and associated mortality.

Assessing the Comprehensive Impact of 2025 U.S. Tariff Measures on the Supply Chain and Cost Structure of Cryptococcosis Treatment Protocols

In 2025, U.S. trade policies introduced sweeping tariff measures that reverberate across pharmaceutical supply chains. A blanket 10% tariff on all imported goods took effect in April, coupled with targeted duties of 25% on active pharmaceutical ingredients sourced from China and 20% from India, and 15% on imported medical packaging and lab equipment. These levies are designed to incentivize domestic manufacturing but pose immediate cost pressures for drugmakers reliant on global ingredient suppliers.

For cryptococcosis therapeutics, which depend heavily on imported APIs such as flucytosine and amphotericin derivatives, the elevated duties translate into higher production expenses. Generic fluconazole manufacturers, in particular, face margin compression as raw material costs escalate. Intermediate inputs imported for compounding liposomal formulations are similarly affected, threatening to raise treatment acquisition costs and potentially delay patient access in price-sensitive markets.

Beyond the current tariffs, political discourse has contemplated phased increases up to 200% on drug imports after a grace period of one year or longer. Though skepticism persists regarding enforcement, leading companies have begun reshoring API production and seeking exemptions for critical medical products. This uncertainty compels stakeholders to reconfigure supply chains, diversify sourcing, and engage with U.S. policymakers to safeguard continuity of antifungal drug availability.

Uncovering Critical Segmentation Insights Across Drug Classes, Indications, Administration Routes, End Users, and Distribution Channels for Cryptococcosis Therapies

Analysis by drug class reveals that azoles remain the cornerstone of cryptococcosis therapy, with fluconazole sustaining its role in maintenance phases, while newer agents such as voriconazole and isavuconazole address refractory and severe cases. Echinocandins, segmented into anidulafungin, caspofungin, and micafungin, are increasingly positioned for off-label use and clinical trials, reflecting strategic pipeline diversification by manufacturers.

Across indications, treatment of cryptococcal meningitis dominates clinical demand, driven by its high fatality rate and prevalence in immunocompromised populations. Disseminated cryptococcosis treatments are garnering interest through broader-spectrum antifungals, and pulmonary cryptococcosis management is poised for expansion as noninvasive diagnostic capabilities improve.

Route of administration segmentation underscores the critical balance between intravenous induction therapies, which require hospital resources and specialist oversight, and oral maintenance regimens that support outpatient care and long-term adherence. This dynamic informs formulary decisions and patient support program design.

End-user insights indicate that hospitals remain the primary setting for initial diagnosis and induction therapy, whereas clinics and ambulatory care centers are vital for consolidation and maintenance phases. This transition necessitates coordinated referral pathways and training across care settings to optimize outcomes.

Distribution channel analysis highlights hospital pharmacies as pivotal for acute therapies, with retail pharmacies delivering oral azole refills. Simultaneously, online pharmacies are emerging as flexible access points for maintenance medications, presenting opportunities for digital patient engagement and adherence solutions.

This comprehensive research report categorizes the Cryptococcosis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Indication

- Route Of Administration

- End User

- Distribution Channel

Exploring Pivotal Regional Dynamics and Stakeholder Engagement Across the Americas, EMEA, and Asia-Pacific Markets in Cryptococcosis Care

In the Americas, advanced healthcare infrastructure and established HIV care networks have driven declines in cryptococcal meningitis incidence. Early antiretroviral therapy adoption and widespread access to induction regimens have reshaped regional treatment paradigms, although pockets of underserved populations still encounter barriers to screening and follow-up care.

Within Europe, the Middle East, and Africa, disparities in diagnostic capacity and antifungal availability persist. Sub-Saharan Africa continues to bear the highest burden of disease, where limited access to liposomal formulations and rapid diagnostics constrains timely intervention. Contrastingly, Europe and the Middle East have seen modest increases in non–HIV-associated cryptococcosis, underscoring the need for vigilant surveillance and diversified treatment protocols.

The Asia-Pacific region exhibits a steady state of cases, supported by emerging point-of-care programs in high-prevalence countries such as China and India. Progressive adoption of lateral flow assays, coupled with expanding hospital networks, promises to enhance early detection. However, optimizing the supply chain for imported APIs and aligning reimbursement frameworks remain essential to broaden access to novel antifungal agents.

This comprehensive research report examines key regions that drive the evolution of the Cryptococcosis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Collaborations, and Competitive Positioning in the Cryptococcosis Treatment Arena

Astellas’ Cresemba franchise has rapidly scaled through strategic licensing and distribution across 115 countries, leveraging orphan drug pathways and flexible dosing formulations to capture key market segments. Its strong sales performance reflects effective collaboration with regional stakeholders and robust clinical evidence supporting isavuconazole’s safety and efficacy in invasive fungal diseases.

Rezafungin, commercialized as Rezzayo by Melinta Therapeutics, has disrupted the echinocandin category with its once-weekly dosing schedule and favorable safety profile. Its March 2023 FDA approval and concurrent EU authorization position it as a viable alternative to existing daily-dosed echinocandins, while data from the ReSTORE Phase 3 trial in China signal potential expansion into broader patient populations.

Legacy players such as Merck maintain a formidable echinocandin presence through caspofungin (Cancidas) and micafungin (Mycamine), complemented by a diversified antifungal pipeline. Generic entrants like Mylan’s caspofungin acetate broaden access and apply pricing pressure, prompting originators to optimize value-based contracts and innovate lifecycle management strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryptococcosis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Astellas Pharma Inc.

- B.M. Pharmaceuticals

- Bausch Health Companies Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- Citron Pharma

- Eisai Co., Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Glenmark Pharmaceuticals Limited

- Johnson & Johnson Services, Inc.

- Jolly Limited

- Lunan Pharmaceutical Group

- Matinas Biopharma Holdings, Inc.

- Merck & Co., Inc.

- Novartis AG

- NuCare Pharmaceuticals, Inc.

- Pfizer Inc.

- Sanofi S.A.

- Sigmapharm Laboratories, LLC

- Skyepharma Production SAS

- Sumitomo Pharma Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Strategic Recommendations Empowering Industry Leaders to Navigate Market Complexities and Capitalize on Growth Opportunities in Cryptococcosis Care

Leaders should prioritize diversification of API supply chains by investing in domestic or near-shore manufacturing partnerships to mitigate tariff risks and ensure consistent drug availability. Flexible sourcing agreements and dual-supplier models can reduce vulnerability to policy shifts and geopolitical disruptions.

Expanding point-of-care diagnostic programs through partnerships with public health agencies and non-governmental organizations can drive earlier disease detection and preemptive therapy, reducing hospital burden and improving patient outcomes. Integrating CrAg LFA screening into routine HIV care protocols and transplant evaluations will be critical to capturing asymptomatic cases.

Portfolio optimization should align with regional epidemiology, emphasizing broad-spectrum azoles for high-burden settings and long-acting echinocandin options in hospital-inpatient scenarios. Tailoring medical education and patient support initiatives to diverse end-user environments will enhance adherence and streamline transition across care settings.

Elucidating the Rigorous Research Methodology and Data Collection Approaches Underpinning the Cryptococcosis Therapeutics Market Analysis

This analysis synthesizes data from peer-reviewed literature, regulatory databases, clinical trial registries, and published tariffs to ensure a comprehensive perspective. Epidemiological metrics were sourced from global health agencies and large-scale meta-analyses, while therapeutic insights derive from product approval documents and real-world sales disclosures.

Segmentation and regional assessments incorporated primary interviews with infectious disease specialists, hospital pharmacists, and policy experts, complemented by secondary research from public-sector and nonprofit organizations. Supply chain evaluations leveraged trade publications and tariff databases to quantify cost implications and barrier scenarios.

Qualitative insights were validated through cross-verification with key opinion leaders and triangulation against multiple data points, ensuring robust, actionable conclusions. Strategic recommendations reflect a holistic integration of clinical, commercial, and regulatory considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryptococcosis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryptococcosis Market, by Drug Class

- Cryptococcosis Market, by Indication

- Cryptococcosis Market, by Route Of Administration

- Cryptococcosis Market, by End User

- Cryptococcosis Market, by Distribution Channel

- Cryptococcosis Market, by Region

- Cryptococcosis Market, by Group

- Cryptococcosis Market, by Country

- United States Cryptococcosis Market

- China Cryptococcosis Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Foundational Insights and Future Imperatives for Stakeholders in the Evolving Cryptococcosis Therapeutics Landscape

This executive summary has distilled the evolving cryptococcosis treatment landscape, highlighting transformative product approvals, segmentation-driven market dynamics, and the regulatory challenges posed by U.S. tariff policies. Regional insights underscore the heterogeneity of patient needs and infrastructure capacities, while competitive analyses reveal the strategic imperatives of leading innovators.

Actionable recommendations offer a roadmap for stakeholders to fortify supply chains, enhance diagnostic reach, and optimize product portfolios. By aligning therapeutic advancements with regional epidemiology and evolving policy environments, industry leaders can drive sustained progress in cryptococcosis care.

Continued collaboration among biopharmaceutical companies, healthcare providers, and public health authorities will be essential to mitigate disease burden, expand patient access, and foster innovative solutions. The collective insights presented herein aim to inform strategic decision-making and catalyze impactful interventions in the cryptococcosis treatment arena.

Connect with the Associate Director of Sales & Marketing to unlock tailored cryptococcosis market research and strategic intelligence

To secure comprehensive, data-driven insights into the cryptococcosis therapeutics landscape and empower your strategic planning, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a tailored discussion to explore how this market research report can inform your portfolio optimization, regulatory positioning, and patient access strategies. Connect directly with Ketan to schedule a briefing, request customized analysis, and gain the competitive intelligence needed to drive growth in the evolving cryptococcosis treatment arena.

- How big is the Cryptococcosis Market?

- What is the Cryptococcosis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?