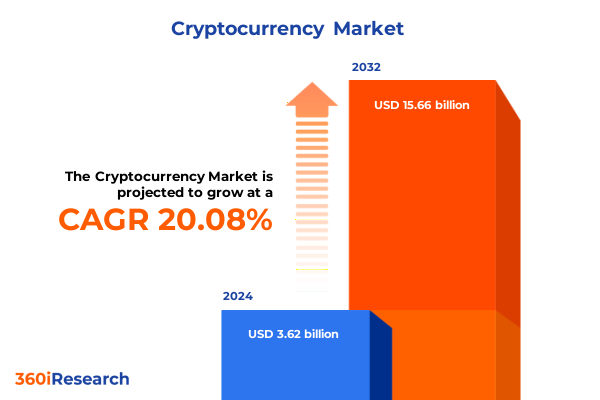

The Cryptocurrency Market size was estimated at USD 4.77 billion in 2025 and expected to reach USD 5.36 billion in 2026, at a CAGR of 13.04% to reach USD 11.26 billion by 2032.

Exploring the rapidly evolving cryptocurrency landscape through innovative technologies, regulatory developments, and emerging market opportunities

The global cryptocurrency environment has reached a pivotal juncture, driven by accelerated adoption, technological innovation, and evolving regulatory frameworks. Institutional entry into digital assets has surged, as leading financial institutions and corporate treasuries integrate cryptocurrencies into their balance sheets for portfolio diversification and yield enhancement. At the same time, retail investor engagement remains robust, fueled by user-friendly mobile platforms, educational initiatives, and the promise of decentralized finance solutions.

Blockchain networks continue to innovate, addressing scalability, interoperability, and sustainability challenges. Layer-two solutions and cross-chain bridges are gaining traction as transaction throughput becomes critical for enterprise-grade applications. Moreover, environmental considerations have prompted miners and protocol developers to explore renewable energy integration, carbon offsetting initiatives, and consensus mechanism evolution towards less resource-intensive models.

Against this backdrop, policy makers worldwide are crafting clearer digital asset regulations, seeking to balance consumer protection, anti–money laundering controls, and taxation guidelines without stifling innovation. As national central banks accelerate research into central bank digital currencies (CBDCs), the interplay between public and private digital money models is reshaping the fundamental architecture of payments and settlements.

This introduction lays the groundwork for an in-depth exploration of transformative market shifts, the implications of recent United States tariffs on hardware supply chains, segmentation dynamics, regional growth patterns, competitive landscapes, and strategic recommendations to help organizations navigate the cryptocurrency ecosystem with confidence.

Uncovering pivotal shifts reshaping the cryptocurrency ecosystem driven by decentralized finance growth, scalability breakthroughs, and environmental focus

The cryptocurrency landscape has undergone profound transformation over the past year, catalyzed by breakthroughs in decentralized finance protocols, advances in blockchain scalability, and heightened scrutiny on environmental impact. Decentralized finance platforms now handle trillions of dollars in total value locked, driving innovations in cross-border lending, algorithmic stablecoins, and tokenized derivatives. These developments have positioned DeFi as a core pillar of the broader financial infrastructure, challenging incumbent institutions to adapt or collaborate.

Scalability solutions have emerged as another key driver of change. Layer-two networks employing rollup technologies and sidechains are enabling transaction speeds and cost efficiencies that rival centralized processors. These architectures facilitate high-frequency trading, microtransactions, and real-time settlement, opening pathways for gaming, supply chain traceability, and Internet of Things integrations.

Sustainability concerns have prompted a wave of protocol upgrades and mining reforms. Major networks have shifted towards proof-of-stake and hybrid consensus models to reduce energy consumption, while mining operations accelerate the adoption of solar, wind, and hydroelectric power sources. This alignment between ecological stewardship and financial innovation is reshaping public sentiment and institutional mandates.

Meanwhile, regulatory clarity has become a focal point for market participants. Jurisdictions are refining digital asset classifications, licensing frameworks, and consumer safeguards. This patchwork of regulations has spurred industry collaboration on global standards and compliance tooling, ensuring that growth in token offerings and secondary markets proceeds within well-defined legal boundaries.

Analyzing cumulative effects of newly imposed United States tariffs in 2025 on hardware supply chains, cost structures, and global cryptocurrency investment flows

In 2025, the United States enacted a suite of tariffs targeting imported cryptocurrency mining rigs, storage devices, and related hardware components, aiming to bolster domestic manufacturing and address national security concerns. By imposing duties on key equipment categories, policy makers sought to reduce reliance on foreign supply chains, particularly in regions with geopolitical tensions surrounding critical semiconductor and assembly capabilities.

These tariffs immediately affected the cost structure for mining operations, with small and mid-sized miners facing heightened capital expenditures and compressed profit margins. In response, several global equipment manufacturers pivoted manufacturing lines to North American facilities, leveraging local incentives and tax credits to offset additional duties. Concurrently, mining operations diversified procurement strategies, sourcing older-generation rigs and exploring second-hand markets to manage budget constraints.

The ripple effects extended to cryptocurrency exchanges and custodial services, which saw slower onboarding of institutional clients focused on staking and lending products. With hardware costs elevated, entity financing windows broadened, creating temporary friction in the capital-intensive staking-as-a-service ecosystem. Yet, this also spurred innovation in software-centric infrastructure, as protocol developers and exchange operators prioritized solutions that minimized hardware dependencies.

Looking ahead, the cumulative impact of these tariffs is fostering a burgeoning onshore manufacturing cluster. States with renewable energy advantages and existing semiconductor industries are competing to attract new facilities, while equipment makers plan collaborative ventures with U.S. universities and research labs to advance next-generation chip designs. These developments are reshaping the hardware landscape and have significant implications for market entry strategies across the cryptocurrency value chain.

Insightful segmentation perspectives reveal how diverse currency types, technological architectures, token classifications, and user profiles drive market dynamics

A nuanced understanding of the cryptocurrency market emerges when examined through multiple segmentation lenses, each offering distinct perspectives on stakeholder needs and technological requirements. Currency type variations illustrate how flagship assets such as Bitcoin, Ethereum, Cardano, and Tether (USDT) cater to divergent use cases ranging from value storage to programmable finance. Meanwhile, component distinctions underscore the dual reliance on hardware innovations like cold wallets and mining rigs, and software platforms spanning exchange infrastructures to network marketing tools that engage grassroots communities.

Technology-oriented segmentation further highlights the interplay between foundational architectures and operational efficiencies. Consortium, private, and public blockchains present differing governance and permissioning models, while proof-of-stake and proof-of-work consensus mechanisms impact throughput, security, and energy consumption profiles. Cryptographic underpinnings, whether elliptic curve techniques or hash functions, drive the integrity and resilience critical to decentralized systems.

Token classifications provide additional granularity, as payment tokens facilitate peer-to-peer transactions, security tokens unlock regulated digital assets, stablecoins offer value stability, and utility tokens grant protocol-specific privileges. Application verticals stretch across finance and gaming, healthcare data exchange, legal contract management and intellectual property rights, as well as supply chain inventory management and logistics tracking, reflecting blockchain’s versatility.

Finally, end user segmentation reveals diverse adoption patterns among developers building decentralized applications, financial institutions integrating custody and settlement services, governments exploring digital currency issuance, institutional investors structuring tokenized portfolios, and retail participants seeking exposure to emerging asset classes. This layered segmentation framework enables precise targeting and product alignment across the rapidly evolving cryptocurrency ecosystem.

This comprehensive research report categorizes the Cryptocurrency market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Currency Type

- Token Type

- Component

- Technology

- Application

- End User

Examining key regional cryptocurrency market trajectories across the Americas, Europe Middle East Africa, and Asia-Pacific to identify growth corridors and challenges

Regional differentiation has emerged as a defining factor in the trajectory of cryptocurrency adoption and infrastructure development. In the Americas, North America continues to lead adoption with robust regulatory dialogues in the United States and Canada, bolstered by strong institutional involvement and growing consumer interest in digital asset payment options. Meanwhile, Latin American nations are leveraging cryptocurrencies as a hedge against currency devaluation, driving grassroots adoption through peer-to-peer remittances and community-driven exchange platforms.

Shifting focus to Europe, Middle East, and Africa, regulatory frameworks in the European Union are pioneering digital asset licensing and market integrity standards, while the United Kingdom refines its fintech sandbox to nurture innovative token offerings. In the Middle East, select jurisdictions compete to position themselves as regional crypto hubs, constructing favorable tax regimes and regulatory certainty. Across Africa, entrepreneurs in Nigeria and South Africa are propelling mobile wallet solutions and localized micropayment services, addressing both unbanked populations and cross-border trade challenges.

Asia-Pacific markets present a tapestry of innovation and caution. Japan and South Korea maintain mature institutional ecosystems with stringent consumer protections, whereas China’s regulatory posture drives mining operations to relocate while its digital yuan pilot advances central bank digital currency dialogue. Southeast Asian economies, including Singapore and Malaysia, are championing blockchain use cases in trade finance and supply chain traceability, leveraging government-backed consortiums to pilot cross-border transactions.

These regional insights underscore the importance of tailoring strategies to jurisdictional nuances and identifying collaborative opportunities that align with local market drivers and policy objectives.

This comprehensive research report examines key regions that drive the evolution of the Cryptocurrency market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading cryptocurrency industry players to illuminate strategic partnerships, innovation roadmaps, and competitive positioning in a dynamic market

Industry leaders across the cryptocurrency spectrum are defining their competitive positions through strategic partnerships, technology investments, and market expansions. Coinbase, for instance, has deepened its institutional custody services while advancing its layer-two scaling initiatives to alleviate network congestion and lower transaction fees, reinforcing its position among professional investors. In parallel, Binance continues to diversify its product suite, launching cross-chain bridges and localized staking pools that target emerging markets with high growth potential.

Hardware specialist Bitmain has responded to shifting global tariffs by accelerating research and development in high-efficiency mining rigs, while forging alliances with domestic foundries in North America to circumvent duty impositions. At the same time, Ripple Labs has pursued collaborations with central banks on cross-border payment pilots, leveraging its on-chain settlement protocols to streamline liquidity management across corridors.

On the analytics front, Chainalysis has expanded its compliance tooling to support anti–money laundering requirements for decentralized finance platforms and regional regulators, reflecting the industry’s drive towards transparent on-chain monitoring. Likewise, Fireblocks has enhanced its multi-party computation wallet solutions, catering to institutional investors seeking secure custody and settlement of tokenized asset portfolios.

Together, these insights illustrate how leading organizations are balancing regulatory compliance, technological innovation, and market diversification to solidify their roles at the forefront of the cryptocurrency ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cryptocurrency market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Alchemy Insights, Inc.

- Aptos Labs

- Binance Holdings Ltd.

- bitfly gmbh

- BitGo Holdings, Inc.

- BITMAIN Technologies Holding Company.

- Bitstamp Ltd.

- Bybit Fintech Limited

- Canaan Inc.

- Coinbase, Inc.

- Coinstash by TWMT Pty Ltd.

- Cointree Pty. Ltd.

- Dunamu Inc.

- eToro (Europe) Ltd.

- Galaxy Digital Holdings Ltd

- Gemini Trust Company, LLC.

- iFinex Inc.

- Intel Corporation

- KuCoin

- Ledger SAS

- LocalBitcoins Oy.

- Marathon Digital Holdings Inc.

- NVIDIA Corporation

- Pandaminer

- Riot Blockchain Inc.

- Securitize Markets, LLC

- Silvergate Capital Corp.

- Swyftx Pty Ltd

- Xapo Holdings Limited

Actionable strategies for industry leaders to navigate regulatory complexities, optimize supply chains, and foster sustainable growth in the cryptocurrency sector

Industry leaders must adopt a multifaceted strategic approach to thrive amid ongoing regulatory developments and supply chain complexities. First, prioritizing sustainable mining solutions that integrate renewable energy sources and invest in next-generation consensus mechanisms will enhance operational resilience and align corporate strategies with environmental commitments. Concurrently, diversifying procurement networks will mitigate the impact of geopolitical tensions and tariff fluctuations, ensuring continuity of critical hardware supplies.

Moreover, proactive engagement with policy makers and participation in industry working groups can shape balanced regulatory frameworks that preserve innovation while safeguarding stakeholders. Developing interoperable protocols and open standards will facilitate cross-chain collaboration, enabling seamless asset transfers and broadening addressable markets. Organizations should also enhance user experience through intuitive interfaces, embedded compliance tooling, and robust security measures to foster consumer trust and institutional confidence.

Expanding into underpenetrated application sectors such as healthcare data exchange, legal contract management, and supply chain logistics can unlock new revenue streams and reinforce blockchain’s value proposition beyond financial services. Finally, cultivating partnerships with academic institutions and research centers will accelerate cryptographic advancements and provide a talent pipeline, equipping industry players to lead future technological breakthroughs.

By implementing these actionable recommendations, business leaders can position their organizations to navigate uncertainty, capitalize on growth opportunities, and maintain a competitive edge in the evolving cryptocurrency landscape.

Robust research methodology combining primary interviews, quantitative analysis, and extensive secondary data to ensure comprehensive cryptocurrency market insights

This analysis draws on a rigorous research methodology that blends qualitative and quantitative techniques to deliver a holistic view of the cryptocurrency market. Primary research included in-depth interviews with executives at mining operations, exchange platforms, regulatory bodies, and blockchain protocol developers. These discussions provided nuanced perspectives on emerging trends, operational challenges, and strategic priorities across the value chain.

Complementing these insights, a structured survey of institutional investors, wallet providers, and software integrators captured sentiment indicators, adoption drivers, and technology preferences. Data triangulation incorporated on-chain analytics, hardware shipment reports, and regulatory filings to ensure accuracy and contextual relevance. Secondary sources encompassed white papers, industry journals, academic publications, and publicly available datasets, carefully vetted to maintain objectivity.

An expert panel comprising cryptographers, financial market analysts, supply chain strategists, and legal scholars reviewed preliminary findings, offering iterative feedback that refined segmentation frameworks and thematic emphases. Throughout the process, quality assurance measures included consistency checks, outlier analysis, and cross-validation against independent data repositories.

This robust methodological foundation underpins the credibility of the insights presented, enabling decision-makers to rely on a comprehensive, data-driven understanding of the cryptocurrency ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cryptocurrency market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cryptocurrency Market, by Currency Type

- Cryptocurrency Market, by Token Type

- Cryptocurrency Market, by Component

- Cryptocurrency Market, by Technology

- Cryptocurrency Market, by Application

- Cryptocurrency Market, by End User

- Cryptocurrency Market, by Region

- Cryptocurrency Market, by Group

- Cryptocurrency Market, by Country

- United States Cryptocurrency Market

- China Cryptocurrency Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing critical findings and strategic imperatives to guide stakeholders through the complex and evolving cryptocurrency environment

The cryptocurrency ecosystem stands at the intersection of technological innovation, evolving regulatory landscapes, and shifting economic imperatives. Breakthroughs in decentralized finance and blockchain scalability are redefining transactional efficiency and asset tokenization, while network consensus reforms and sustainability initiatives address critical environmental and security considerations. At the same time, newly imposed United States tariffs have reshaped hardware supply chains, prompting strategic shifts among miners, manufacturers, and software providers.

Layered segmentation analyses reveal that currency types, technological architectures, token classifications, and user profiles each play a pivotal role in tailoring solutions to stakeholder requirements. Regional variations in regulatory frameworks and adoption patterns underscore the importance of localized strategies, while leading companies demonstrate the value of partnerships, innovation roadmaps, and adaptive business models.

Actionable recommendations focus on sustainable mining practices, supply chain diversification, regulatory engagement, interoperability protocols, and expansion into untapped application verticals. These strategies provide a clear blueprint for organizations seeking to harness the full potential of digital assets and distributed ledger technologies.

As the market continues to evolve, strategic decision-makers who combine data-driven insights with proactive collaboration will be best positioned to navigate complexity, capitalize on emerging opportunities, and drive the next wave of growth in the cryptocurrency realm.

Connect with Ketan Rohom to unlock exclusive cryptocurrency market insights that drive strategic advantage and informed decision making

If you’re ready to translate deep market insights into actionable strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for exclusive access to the comprehensive cryptocurrency market research report. He can guide you through tailored data on emerging trends, regional growth corridors, and strategic moves by leading industry players, empowering your organization to stay ahead in this rapidly evolving ecosystem.

By partnering with Ketan Rohom, you gain the opportunity to leverage high-quality intelligence that informs investment decisions, product development roadmaps, regulatory engagement tactics, and supply chain management strategies. His expertise ensures you receive personalized support that aligns research findings with your strategic priorities, whether it’s optimizing mining operations, enhancing exchange platforms, or tapping into new application verticals.

Engage today to secure access to proprietary analysis, detailed segmentation breakdowns, and forward-looking recommendations that will sharpen your competitive edge. Connect with Ketan to schedule a one-on-one consultation, explore premium customization options, and discover how this research can become the foundation for your next wave of innovation.

Don’t miss out on the chance to capitalize on critical insights ahead of your peers. Contact Ketan Rohom now and transform raw data into decisive market actions that accelerate growth and resilience in the cryptocurrency landscape.

- How big is the Cryptocurrency Market?

- What is the Cryptocurrency Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?