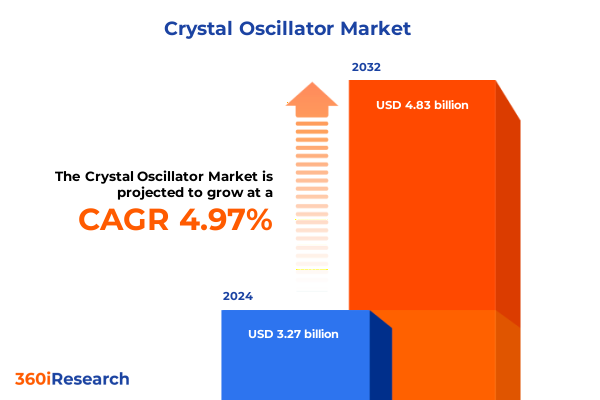

The Crystal Oscillator Market size was estimated at USD 3.20 billion in 2025 and expected to reach USD 3.37 billion in 2026, at a CAGR of 5.37% to reach USD 4.62 billion by 2032.

Understanding the Vital Role of Crystal Oscillators in Modern Electronics and the Evolution of Precision Timing Across Industries

Crystal oscillators are electronic circuits that leverage the piezoelectric properties of quartz crystals to generate highly stable and precise frequency signals. By applying a voltage to the crystal, it vibrates at a resonant frequency determined by its cut and dimensions, producing a clock signal with frequency accuracy measured in parts per million. These oscillators serve as the timing backbone for a wide range of applications, from quartz wristwatches and communication systems to digital integrated circuits and radio frequency transmitters and receivers.

Since their inception in the early 20th century, crystal oscillators have undergone significant evolution to meet the demands of modern electronics. Advances in resonator design, temperature compensation techniques, and packaging have enhanced frequency stability, reduced phase noise, and minimized jitter. As a result, crystal oscillators remain indispensable in telecommunications, computing, aerospace, and consumer devices, underpinning the synchronized operation of complex systems and enabling innovations in high-speed data transfer and precision instrumentation.

Exploring the Transformative Technological Shifts and MEMS Innovations That Are Redefining Oscillator Performance for 5G, IoT, Automotive, and Emerging Applications

The oscillator landscape is experiencing a transformative shift driven by the emergence of MEMS-based alternatives and the growing complexity of electronic systems. While traditional quartz crystal oscillators continue to capture the majority of the market, MEMS oscillators have gained traction in applications requiring ruggedness, compact form factors, and integration into CMOS processes. In 2024, crystal oscillators held nearly 79% of the global market, with MEMS devices accounting for over 21%; projections indicate that MEMS market share will expand significantly through the end of the decade, spurred by their robustness and environmental resilience.

Simultaneously, the proliferation of 5G networks and IoT ecosystems is driving demand for high-frequency, low-jitter timing solutions. Industry leaders like TXC Corporation have introduced temperature-compensated crystal oscillator series optimized for 5G base stations and networking equipment, delivering improved phase noise performance and reduced power consumption. This surge in ultra-high-frequency requirements has also accelerated the adoption of overtone mode resonators, enabling crystal oscillators to operate reliably above 100 MHz while maintaining the precision needed for next-generation communication infrastructure.

Assessing the Cumulative Impact of the 2025 United States Section 301 Tariff Increases on Semiconductor Components Affecting Crystal Oscillator Supply Chains

Under its Section 301 authority, the United States Trade Representative finalized tariff increases on semiconductor products imported from China, raising rates from 25% to 50% effective January 1, 2025. This adjustment encompasses a broad range of components, including crystal oscillators classified under semiconductor categories, and reflects a strategic move to address concerns over technology transfer and supply chain security.

For crystal oscillator manufacturers and distributors, the 50% tariff increase introduces material cost pressures and supply chain complexities. Many companies are evaluating their sourcing strategies, increasing inventories to hedge against future duty assessments, and exploring partial tariff exclusions or alternative manufacturing locations. These efforts aim to mitigate cost increases, maintain competitive pricing, and ensure continuity of supply in the face of evolving trade policy landscapes.

Uncovering Critical Segmentation Insights Across Applications, Frequency Bands, Packaging Types, Technologies, and Distribution Channels

Crystal oscillator demand is shaped by diverse applications that require tailored frequency and performance characteristics. In aerospace and defense, oscillators are integrated into avionics and military communication systems that prioritize reliability under extreme conditions, while automotive electronics leverage timing devices for advanced driver assistance systems and in-vehicle networks. Consumer electronics segments, such as smartphones, televisions, and wearable devices, demand ultra-miniature and low-power oscillators to extend battery life without compromising signal integrity. Industrial automation and sensor networks rely on crystal units to synchronize processes, and telecommunications infrastructure utilizes oscillators in 5G backhaul and networking equipment, each application imposing unique stability, tolerance, and packaging requirements.

Frequency segmentation further refines product selection, distinguishing between low-frequency devices below 50 MHz, including very low frequency under 1 MHz for timekeeping and simple clocks, and medium-frequency oscillators from 50 MHz to 100 MHz for niche communication applications. High-frequency products above 100 MHz, especially those operating in ultra-high frequencies beyond 1 GHz, cater to critical telecommunications and radar systems. Packaging type also plays a pivotal role: ceramic packages and metal cans offer traditional robustness, while surface mount devices and through-hole configurations support automated assembly and mechanical resilience. In surface mount implementations, advanced silicon interposer and system-in-package approaches enable denser integration. Technology modes-fundamental and overtone-address different frequency and stability requirements, and overtone variants incorporating microelectromechanical systems or surface acoustic wave resonators provide enhanced performance for specialized use cases. Finally, distribution channels including direct sales, distributors, and online platforms such as e-commerce portals and value-added resellers ensure that oscillators can be procured efficiently across global markets.

This comprehensive research report categorizes the Crystal Oscillator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Oscillator Type

- Package Format

- Frequency Band

- Application

- Distribution Channel

Delivering Key Regional Insights: In-Depth Analysis of Americas, Europe Middle East & Africa, and Asia-Pacific Dynamics in Crystal Oscillator Markets

The Americas region continues to drive a significant share of global crystal oscillator demand, underpinned by robust telecommunications infrastructure upgrades, aerospace and defense contracts, and the automotive industry’s shift toward electric vehicles and ADAS integration. The United States, in particular, commands over 80% of regional consumption for active quartz oscillator chips, supported by key manufacturers such as Microchip Technology, Abracon, and SiTime, which have expanded production capacities to meet the needs of 5G, IoT, and high-reliability applications.

Europe, Middle East & Africa exhibits steady growth fueled by demand for SMD quartz oscillators in automotive electronics, industrial automation, and medical devices. The SMD quartz oscillator segment in Europe was valued at approximately USD 1.2 billion in 2022, reflecting the region’s focus on high-performance, energy-efficient timing solutions for smart factories, 5G rollouts, and precision instrumentation in sectors ranging from healthcare to aerospace.

Asia-Pacific remains the powerhouse of oscillator manufacturing and consumption, accounting for nearly 66% of global oscillator revenue in 2024. Japan leads in crystal production with advanced autoclave facilities for synthetic quartz, while China’s electronics assembly scale and South Korea’s midstream wafer processing support a vertically integrated ecosystem. The region’s dominance is further bolstered by extensive investment in 5G infrastructure, consumer electronics manufacturing, and automotive electronics, ensuring sustained growth in both volume and value.

This comprehensive research report examines key regions that drive the evolution of the Crystal Oscillator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players and Innovations Shaping the Competitive Crystal Oscillator Landscape Through Product Launches, Patents, and Strategic Partnerships

Industry incumbents continue to set performance benchmarks through ongoing innovation and strategic investments. Murata Manufacturing unveiled its high-accuracy HCR crystal series in November 2024, achieving ±40 ppm frequency tolerance across −40 °C to +125 °C, a milestone for automotive IVN and ADAS applications. Seiko Epson introduced ultra–low-power quartz oscillators in April 2024 optimized for wearable and IoT devices, extending battery life while maintaining timing precision. Nihon Dempa Kogyo (NDK) has advanced radiation-hardened OCXOs tailored for satellite communications, and Rakon Limited offers high-stability master reference oscillators for GEO telecom satellites, underscoring the critical role of reliable timing in space missions.

Meanwhile, disruptor companies leverage MEMS and mixed-signal integration to capture emerging opportunities. SiTime expanded its MEMS oscillator portfolio to rival traditional quartz devices in automotive and aerospace markets, emphasizing robustness under high shock and vibration conditions. TXC Corporation rolled out overtone mode oscillators for 5G base stations with superior phase noise performance, and Abracon ventured into highly integrated silicon interposer solutions to support miniaturization. These strategic product launches and technology shifts are reshaping competitive dynamics by offering differentiated performance, smaller footprints, and enhanced manufacturability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crystal Oscillator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Seiko Epson Corporation

- TXC Corporation

- KYOCERA AVX Components Corporation

- SiTime Corp.

- Nihon Dempa Kogyo Co., Ltd.

- Murata Manufacturing Co., Ltd

- Daishinku Corporation

- Microchip Technology Inc.

- SIWARD Crystal Technology Co., Ltd.

- Rakon Limited

- Diodes Incorporated

- Oscilloquartz by Adtran Networks SE

- Abracon, LLC

- HOSONIC TECHNOLOGY (GROUP) CO., LTD.

- JenJaan Quartek Corporation

- River Eletec Corporation

- TKD Science and Technology Co., Ltd.

- Bliley Technologies Inc.

- Greenray Industries, Inc.

- Mercury Electronic Ind. Co., Ltd.

- MTI-Milliren Technologies Inc.

- Pletronics, Inc.

- QVS Tech, Inc.

- Tai-Saw Technology Co., Ltd.

- TAITIEN Electronics Co., LTD

- Transko Electronics Inc.

- ZHEJIANG A-CRYSTAL ELECTRONIC TECHNOLOGY CO.,LTD.

Recommendations for Industry Leaders to Navigate Supply Chain Challenges, Leverage Technological Advancements, and Drive Growth in the Crystal Oscillator Sector

To mitigate escalating duty costs and supply chain risks, industry leaders should diversify sourcing by qualifying multiple contract manufacturers across geographies and pursuing partial tariff relief through exclusion petitions. Maintaining buffer inventories and leveraging bonded warehousing can also help cushion the impact of Section 301 rate increases effective January 1, 2025, and ensure continuity of supply for critical applications.

Investing in next-generation timing technologies, such as MEMS-based resonators, surface acoustic wave overtone devices, and silicon interposer packages, will enable companies to meet evolving performance requirements while reducing overall system costs. Strategic partnerships with semiconductor foundries and semiconductor-grade packaging specialists can accelerate time-to-market for innovative oscillator products and capture growth in automotive, telecom, and industrial sectors.

Establishing regional manufacturing and assembly hubs within key markets-particularly in Asia-Pacific and Europe-can lower logistical expenses and shorten lead times. Collaborations with local distributors and value-added resellers will enhance market coverage and responsiveness, positioning companies to capitalize on rising demand for precision timing in 5G infrastructure, smart mobility, and IoT ecosystems.

Comprehensive Research Methodology Incorporating Primary Interviews, Secondary Data Sources, and Rigorous Validation for Crystal Oscillator Market Analysis

Our analysis combines quantitative and qualitative research methodologies to ensure a comprehensive understanding of the crystal oscillator market. Primary research included in-depth interviews with senior executives, technical experts, and procurement specialists from leading oscillator manufacturers, system integrators, and distribution partners across key regions. Secondary research encompassed a review of industry publications, patent databases, regulatory filings, and trade association reports.

Data validation and triangulation were conducted through cross-referencing of primary insights with secondary data sources and historical trends. Market segmentation was defined along application, frequency, packaging, technology, and distribution channel dimensions, reflecting the nuances of end-user requirements and supply chain structures. The research process adhered to rigorous standards for accuracy, consistency, and transparency, providing a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crystal Oscillator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crystal Oscillator Market, by Oscillator Type

- Crystal Oscillator Market, by Package Format

- Crystal Oscillator Market, by Frequency Band

- Crystal Oscillator Market, by Application

- Crystal Oscillator Market, by Distribution Channel

- Crystal Oscillator Market, by Region

- Crystal Oscillator Market, by Group

- Crystal Oscillator Market, by Country

- United States Crystal Oscillator Market

- China Crystal Oscillator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusive Insights Summarizing Market Trends, Technological Drivers, and Strategic Implications for the Future of Crystal Oscillator Solutions

The crystal oscillator market stands at an inflection point where legacy quartz technologies and innovative MEMS solutions coexist to address diverse application demands. As 5G deployment accelerates and IoT ecosystems expand, demand for high-frequency, low-jitter timing devices will intensify, driving investments in overtone and surface acoustic wave resonators. At the same time, geopolitical shifts and trade policy changes underscore the importance of resilient supply chains and agile sourcing strategies.

Looking ahead, companies that successfully integrate advanced materials, cutting-edge packaging, and software-defined timing control will differentiate themselves in performance-sensitive sectors such as telecommunications, automotive, aerospace, and industrial automation. Strategic collaborations, regional manufacturing footprints, and proactive tariff management will be critical enablers for maintaining competitive advantage and capturing growth opportunities in a rapidly evolving market landscape.

Don’t Miss Out: Contact Ketan Rohom to Secure Your Comprehensive Crystal Oscillator Market Research Report and Gain Strategic Insights

If you’re seeking to stay ahead in the dynamic crystal oscillator market, now is the time to act. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report. This in-depth analysis will equip you with strategic insights and actionable intelligence tailored to your business objectives. Don’t let this opportunity pass-reach out today and gain the competitive edge you need to thrive in the precision timing industry.

- How big is the Crystal Oscillator Market?

- What is the Crystal Oscillator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?