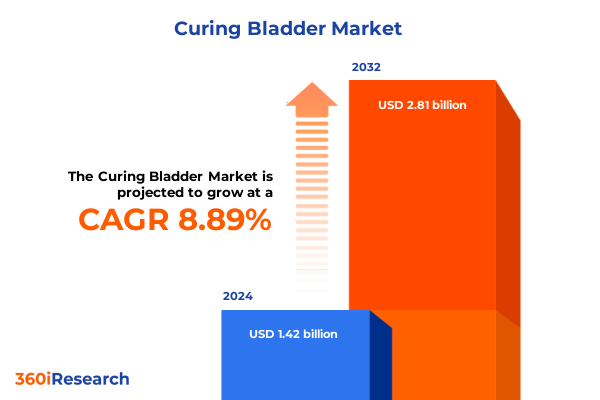

The Curing Bladder Market size was estimated at USD 1.52 billion in 2025 and expected to reach USD 1.62 billion in 2026, at a CAGR of 9.21% to reach USD 2.81 billion by 2032.

Unveiling the Urgency and Opportunities in Bladder Cancer Treatment Innovation That Will Redefine Patient Outcomes and Market Dynamics

Bladder cancer remains one of the most pressing oncology challenges, demanding innovative solutions to improve patient survival and quality of life. The evolving landscape of therapeutic modalities, from traditional chemotherapy to next-generation immunotherapies, underscores a critical inflection point in research and clinical practice. Against this backdrop, stakeholders across the value chain-including biopharmaceutical developers, medical device manufacturers, clinicians, and payers-seek a holistic understanding of treatment pathways, patient segmentation, and regulatory influences.

Moreover, the convergence of technological advancements and shifting reimbursement paradigms has catalyzed fresh opportunities to address unmet needs in both early-stage and advanced disease. Integrating insights into molecular diagnostics, precision medicine, and minimally invasive device platforms has never been more essential to unlocking superior outcomes and driving value. As cost containment pressures mount and healthcare systems prioritize value-based care, a comprehensive assessment of both therapeutic and non-therapeutic interventions will empower decision-makers to align R&D investments with market demands.

This executive summary distills multi-source intelligence into a coherent narrative that traces transformative shifts, tariff implications, segmentation insights, regional dynamics, and competitive positioning. It culminates in strategic recommendations and a robust methodology overview, offering a clear roadmap for organizations poised to redefine bladder cancer treatment in the years ahead.

Charting the Transformative Technological Advancements and Clinical Paradigm Shifts Reshaping Bladder Cancer Care Across Global Healthcare Ecosystems

Over the past decade, bladder cancer has transitioned from a historically stagnant field into one characterized by rapid technological and clinical breakthroughs. Advances in molecular profiling have enabled the identification of novel targets beyond the traditional focus on cytotoxic agents, while breakthroughs in immunomodulation have ushered in treatment paradigms that engage the patient’s own immune system to combat tumor progression. These innovations have not only reshaped clinical protocols but also redefined the expectations of efficacy, safety, and patient convenience.

In parallel, the integration of digital pathology and artificial intelligence-driven imaging analysis is transforming diagnostic accuracy and workflow efficiency. Such tools facilitate early detection and enable dynamic monitoring of treatment response, thereby influencing therapeutic sequencing decisions. The convergence of robotics and laser-based endoscopic systems has further refined minimally invasive interventions, reducing procedural morbidity and accelerating patient recovery.

Furthermore, the shift toward personalized medicine has reoriented development strategies to focus on biomarker-driven cohorts, fostering the emergence of targeted therapies that address specific molecular aberrations. As a result, clinical trial design has evolved to incorporate adaptive protocols and real-world evidence frameworks that expedite regulatory review and market access. Collectively, these transformative shifts illustrate a dynamic ecosystem in which technological prowess and clinical acumen coalesce to elevate standards of care.

Assessing the 2025 United States Tariff Implications on Bladder Cancer Therapeutics and Medical Device Supply Chains and Strategic Responses Required

In early 2025, the United States implemented enhanced tariffs on a selection of imported oncology therapeutics and diagnostic components, generating significant reverberations across the bladder cancer treatment supply chain. Manufacturers reliant on international sourcing of critical agents and precision instrumentation have confronted higher input costs, compelling a reassessment of pricing models and procurement strategies. This development has particularly influenced companies that import checkpoint inhibitors and advanced endoscopic imaging systems from overseas producers.

Consequently, several organizations have accelerated efforts to localize manufacturing or secure alternative domestic partnerships to mitigate tariff-driven cost pressures. Procurement teams within hospital networks and cancer centers are increasingly negotiating volume-based agreements and exploring consortia purchasing to preserve budgetary flexibility. Simultaneously, payers have signaled heightened scrutiny of treatment regimens, emphasizing the need for robust health economic data to justify premium pricing amidst a tariff-impacted environment.

Looking ahead, strategic responses to these tariff changes include diversifying supplier portfolios, fostering greater vertical integration, and leveraging regulatory incentives that support domestic production. By proactively adapting to this evolving trade policy, stakeholders can stabilize supply continuity, maintain competitive pricing, and safeguard patient access to both established and novel bladder cancer therapies.

Revealing Critical Patient Population and Treatment Modality Segmentation to Illuminate Bladder Cancer Market Opportunities and Precision Therapeutic Pathways

The drug segment reveals a tripartite structure in which chemotherapy agents continue to anchor standard-of-care protocols, even as immunotherapy agents garner growing clinical and commercial momentum. Within immunotherapy, BCG therapy maintains a pivotal role in managing non-muscle invasive disease, while checkpoint inhibitors have emerged as the cornerstone for advanced and metastatic settings. Targeted therapy, meanwhile, exploits a spectrum of molecular drivers-ranging from FGFR alterations to angiogenic pathways-offering precision options for genetically defined patient cohorts.

Simultaneously, the device segment underscores an ecosystem of both reusable and single-use catheters that facilitate localized intravesical treatments, complemented by laser systems that enhance tumor ablation precision. Urodynamic equipment has evolved to provide comprehensive functional assessments, driving personalized procedural planning. These developments coalesce to optimize both therapeutic efficacy and patient safety within surgical and outpatient environments.

In the diagnostic sphere, biomarkers now guide risk stratification and real-time monitoring, while endoscopy platforms integrate high-definition imaging to improve lesion detection rates. Imaging modalities have advanced to deliver enhanced resolution and contrast sensitivity, supporting non-invasive evaluations and longitudinal surveillance. Beyond treatment and diagnostics, support services such as patient counseling and specialized physical therapy have become integral to holistic care pathways, improving adherence and quality-of-life outcomes by addressing the psychosocial and functional dimensions of bladder cancer management.

This comprehensive research report categorizes the Curing Bladder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drugs

- Devices

- Diagnostics

- Support Services

Exploring Regional Patient Access Dynamics and Healthcare Infrastructure Variations Across Geographies Impacting Bladder Cancer Treatment Adoption and Outcomes

Within the Americas, bladder cancer stakeholders benefit from established healthcare infrastructure and reimbursement frameworks that support rapid adoption of advanced therapies. Several leading academic centers have adopted next-generation sequencing and immunotherapy protocols as part of routine care, driving accelerated uptake of novel agents. Commercial dynamics in this region reflect robust partnerships between pharmaceutical innovators and regional health systems, underpinned by well-developed distribution channels and value appraisal mechanisms.

Across Europe, the Middle East and Africa, diversity in regulatory timelines and pricing environments presents both challenges and opportunities. In Western Europe, centralized regulatory pathways and cost-containment policies have fostered the development of systematic health technology assessments, influencing market entry strategies for premium therapeutics. Conversely, emerging markets in the Middle East and Africa exhibit an increasing willingness to invest in cutting-edge treatments, supported by government initiatives aimed at strengthening oncology infrastructure and training specialized clinical staff.

The Asia-Pacific region stands out for its rapidly expanding patient base and government-backed precision medicine initiatives. National immunization programs and diagnostic screening subsidies have enhanced early detection rates, while strategic collaborations between local biotechs and multinational companies accelerate technology transfer. As a result, regional market participants are actively tailoring go-to-market approaches to address diverse payer models, regulatory frameworks, and cultural considerations, driving nuanced adoption patterns across this dynamic geography.

This comprehensive research report examines key regions that drive the evolution of the Curing Bladder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical and Device Innovators Driving Breakthroughs in Bladder Cancer Treatment Through Strategic Collaborations and Pipeline Expansions

Pfizer has leveraged its deep immuno-oncology portfolio to launch combination regimens that integrate checkpoint inhibitors with targeted agents, fostering synergy in refractory patient populations. Merck is advancing its PD-1 inhibitor into earlier lines of therapy and has established collaborative agreements with diagnostic firms to co-develop companion tests. Roche maintains a stronghold in molecular diagnostics, utilizing its comprehensive biomarker platforms to inform both clinical trials and real-world evidence studies in bladder oncology.

Johnson & Johnson’s surgical device division has refined laser-based resection systems, emphasizing user ergonomics and real-time feedback to improve procedural precision. Boston Scientific continues to invest in single-use catheter technologies that reduce infection risk and streamline intravesical administration, while Olympus expands its endoscopic imaging suites with integrated AI modules for lesion characterization. Smaller innovators are also making inroads: biotech start-ups focused on FGFR inhibitors are entering clinical stages, and niche diagnostics companies are validating novel urinary biomarkers to enable non-invasive monitoring.

These leading companies share a common commitment to strategic alliances-whether through co-development partnerships, licensing agreements, or joint ventures-that amplify R&D capabilities and accelerate market entry. By cultivating a balanced portfolio of proprietary assets, external collaborations and platform technologies, these organizations chart a clear path toward sustained differentiation in the bladder cancer market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Curing Bladder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Astellas Pharma Inc.

- Continental AG

- DER-GOM S.R.L.

- Dragon Wave Industry CO., LTD.

- Ferring Pharmaceuticals SA

- GlaxoSmithKline plc

- HBT Rubber Industrial Co., Ltd.

- Johnson & Johnson

- Lanxess AG

- LY-Holding GmbH

- McGee Industries, Inc.

- Merck & Co., Inc.

- Münch Chemie International GmbH

- Novartis AG

- Pfizer Inc.

- Polymer Industrial Products Company, LLC

- Qualiform, LLC

- Roche Holding AG

- Rubber King Tyre Pvt. Ltd.

- Rubber Resources

- Salvadori S.R.L.

- Super Polymers

- Teva Pharmaceutical Industries Ltd.

- Tianjin Dajin Tire & Capsule Co., Ltd.

- Tyre Bladder Company Limited

- VM Rubber S.R.L.

- Xingyuan Tyre Group Co. Ltd.

Driving Market Leadership Through Targeted Actions and Innovative Strategies to Accelerate Bladder Cancer Treatment Accessibility and Clinical Adoption Rates

To secure market leadership in bladder cancer, industry stakeholders should prioritize investments in next-generation immunotherapeutic combinations that address both efficacy and safety in earlier disease stages. Simultaneously, fostering partnerships with diagnostic vendors will unlock synergies in companion test development, facilitating seamless integration of precision medicine into clinical pathways. Companies are advised to engage proactively with regulatory bodies to establish adaptive trial designs and real-world data frameworks that support accelerated approval and reimbursement.

Moreover, mitigating trade policy impacts through strategic supply chain diversification and localized manufacturing partnerships can safeguard against future tariff fluctuations. Payers and providers should collaborate to develop value-based contracting models that align outcomes with reimbursement, ensuring sustainable patient access to high-cost therapies. In parallel, expanding digital health initiatives-such as remote patient monitoring and tele-medicine platforms-can enhance post-treatment surveillance and patient support, further distinguishing market offerings.

Ultimately, aligning R&D portfolios with high-unmet-need segments, deploying agile regulatory engagement strategies, and leveraging data-driven market insights will enable organizations to capture emerging opportunities and deliver superior patient outcomes. By operationalizing these recommendations, leaders can transform strategic intent into measurable commercial success.

Implementing Robust Mixed Methodologies to Ensure Comprehensive Validity and Reliability in Bladder Cancer Market Intelligence and Stakeholder Insights

Our research methodology combines a balanced mix of primary and secondary approaches to ensure robust validity and reliability. Initially, comprehensive secondary research aggregated insights from peer-reviewed literature, regulatory databases, and clinical trial registries to map the existing treatment landscape. We supplemented these findings with in-depth interviews and surveys conducted across key stakeholder groups, including oncologists, interventional urologists, payers, and procurement managers, to capture real-world perspectives on emerging trends and unmet needs.

To further refine our analysis, we employed a series of expert panel discussions that facilitated critical review of preliminary conclusions and challenged assumptions around therapeutic efficacy, patient segmentation, and pricing dynamics. This iterative feedback loop enhanced the depth and accuracy of our insights. Quantitative modeling techniques were applied to evaluate competitive dynamics and tariff implications, drawing on publicly available financial disclosures and supply chain cost structures. Qualitative scenario planning allowed us to stress-test strategic recommendations under varying regulatory and market conditions.

By integrating these mixed methodologies, our approach delivers a nuanced understanding of both macro-level drivers and granular operational considerations. This comprehensive framework ensures that the conclusions and recommendations presented are grounded in empirical evidence and aligned with the strategic priorities of stakeholders across the bladder cancer ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Curing Bladder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Curing Bladder Market, by Drugs

- Curing Bladder Market, by Devices

- Curing Bladder Market, by Diagnostics

- Curing Bladder Market, by Support Services

- Curing Bladder Market, by Region

- Curing Bladder Market, by Group

- Curing Bladder Market, by Country

- United States Curing Bladder Market

- China Curing Bladder Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Critical Findings and Strategic Conclusions to Inform Next Generation Decisions in Bladder Cancer Treatment and Research Prioritization

In summary, the bladder cancer landscape is undergoing a period of unprecedented transformation driven by immunotherapy breakthroughs, advanced diagnostic platforms, and evolving device technologies. Tariff changes in the United States have underscored the importance of supply chain resilience and strategic sourcing, while regional disparities continue to shape access and adoption patterns. Segmentation analysis highlights distinct opportunities within drug, device, diagnostic, and support service categories that warrant targeted investment.

Leading companies are differentiating through strategic collaborations, platform expansions, and adaptive regulatory engagement, reflecting a shift toward value-based, patient-centric models. To maintain competitive advantage, stakeholders must holistically integrate novel therapeutic modalities with precision diagnostics and digital health solutions. Investing in agile R&D portfolios, coupled with proactive payer partnerships and data-driven market strategies, will be critical to driving sustainable growth and improved patient outcomes.

These findings form a cohesive blueprint for next-generation decision-making, guiding stakeholders through a complex ecosystem toward actions that deliver clinical innovation and commercial success. As the bladder cancer field continues to evolve, the insights and recommendations presented in this report will serve as a strategic compass for organizations seeking to shape the future of care.

Inviting Actionable Engagement to Secure the Comprehensive Bladder Cancer Market Report With Expert Support From Ketan Rohom to Drive Your Strategic Growth

We invite you to take a decisive step toward securing comprehensive insights into the bladder cancer treatment landscape and arm your organization with the strategic intelligence it needs to achieve sustainable market leadership. Engaging directly with our Associate Director of Sales & Marketing, Ketan Rohom, will enable you to receive personalized guidance tailored to your unique objectives and challenge areas. By securing this report, you will gain access to our rigorously synthesized qualitative and quantitative analyses, complemented by actionable recommendations that can be implemented immediately across research, development, and commercialization pathways.

Connecting with Ketan Rohom ensures that you will have a dedicated expert to navigate any questions regarding report scope, methodology, or specific sections of interest, facilitating faster decision-making and investment prioritization. This direct liaison provides a streamlined channel to discuss bespoke insights, licensing options, and supplemental data packages that align with your strategic growth plans. Act now to transform these insights into tangible competitive advantages and catalyze the next wave of bladder cancer treatment innovation within your organization.

- How big is the Curing Bladder Market?

- What is the Curing Bladder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?