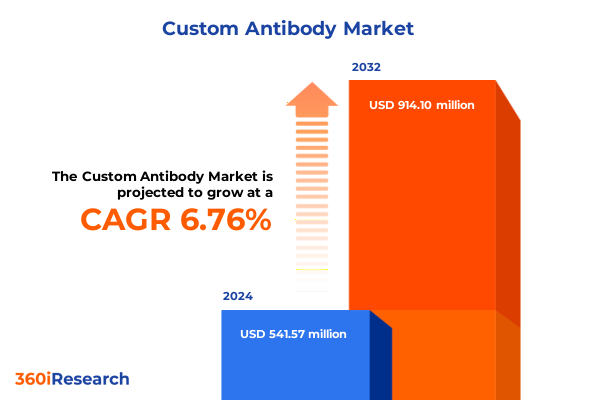

The Custom Antibody Market size was estimated at USD 572.59 million in 2025 and expected to reach USD 607.24 million in 2026, at a CAGR of 6.91% to reach USD 914.10 million by 2032.

Unveiling the Critical Dynamics Shaping the Custom Antibody Market Landscape Amidst Advancing Research and Therapeutic Innovations Globally

The custom antibody sector has emerged as a cornerstone of modern life sciences, undergirding breakthroughs in diagnostics, therapeutics, and research applications. As precision medicine continues to gain traction, the demand for bespoke antibody solutions tailored to unique protein targets has accelerated markedly. This shift stems from the recognition that off-the-shelf reagents often fall short in specificity or functionality when compared to custom-engineered counterparts. Consequently, research institutes, clinical laboratories, and biopharmaceutical companies are prioritizing partnerships with specialized providers capable of delivering end-to-end antibody services-from design and development to labeling and quality validation.

Against this backdrop, recent advances in molecular engineering and high-throughput screening have transformed the timeline and cost structure of bespoke antibody production. Enhanced discovery platforms, leveraging machine learning and synthetic biology, enable rapid in silico epitope mapping and affinity maturation. Parallel improvements in fragment labeling techniques and purification protocols ensure that custom antibodies not only meet but exceed stringent performance benchmarks. As a result, stakeholders navigating the evolving landscape can harness these technological improvements to drive innovation, expedite project timelines, and secure competitive advantage.

Examining the Pivotal Technological and Scientific Shifts Revolutionizing Custom Antibody Development and Driving Competitive Differentiation Across the Industry

Over the past several years, a wave of transformative shifts has reshaped the custom antibody industry, driven by both technological breakthroughs and evolving end-user requirements. Foremost among these is the integration of artificial intelligence into antibody discovery workflows. Computational platforms now predict epitope–paratope interactions with unprecedented accuracy, significantly reducing the experimental cycles required for lead candidate selection. By harnessing these digital tools, companies can allocate resources more efficiently, shortening development timelines from months to mere weeks.

Simultaneously, innovations in antibody fragmentation and labeling have expanded the functional versatility of custom reagents. Novel site-specific conjugation chemistries facilitate consistent labeling yields, enabling high-sensitivity assays in immuno-oncology and cell therapy research. Furthermore, advances in cell-free expression systems and continuous biomanufacturing have disrupted traditional production paradigms, offering scalable, cost-effective alternatives to conventional cell-culture methods. These dual forces-digital design and streamlined bioprocessing-have collectively elevated the competitive bar, compelling service providers to expand their technical portfolios and forge strategic collaborations that amplify their scientific prowess and market reach.

Assessing the Multifaceted Implications of United States Tariffs in 2025 on Custom Antibody Supply Chains, Cost Structures, and Competitive Positioning

The imposition and continuation of United States tariffs in 2025 have imparted significant reverberations across custom antibody supply chains and cost structures. Tariffs levied on imported raw materials-ranging from specialized resins to labeling reagents-have incrementally raised the cost base for production and quality control. In particular, providers reliant on components sourced from countries subject to Section 301 or Section 232 duties have grappled with margin compression, prompting a recalibration of pricing strategies and supplier networks.

In response to these headwinds, many stakeholders have sought to diversify procurement by forging alliances with domestic vendors or nearshoring critical inputs. While this approach has mitigated some of the direct tariff burden, it has also introduced new variables related to capacity constraints and lead times. Moreover, the cumulative impact of higher import levies has accelerated investments in in-house manufacturing capabilities, driving capital allocation toward facility upgrades and process intensification. Ultimately, the tariff landscape of 2025 has underscored the importance of supply chain agility and strategic sourcing as foundational elements of resilience in the custom antibody market.

Deciphering the Core Segmentation Paradigms in the Custom Antibody Market to Illuminate Service Types, Antibody Classes, Sources, Research Applications, and End Users

When examining the custom antibody market through the lens of service-based segmentation, it becomes evident that end-to-end development offerings hold a pronounced appeal for biopharma sponsors seeking seamless integration from antigen design to final QC release. Antibody fragmentation and labeling services are gaining traction among diagnostic developers keen on enhancing assay sensitivity, while production and purification remain indispensable pillars for organizations prioritizing bespoke biomanufacturing solutions. Pivoting to antibody type, monoclonal antibodies continue to dominate therapeutic research pipelines due to their high specificity, but polyclonal variants retain relevance in multiplexed assay formats, and recombinant formats are increasingly valued for their lot-to-lot consistency and reduced immunogenic risk.

Considering source-derived segmentation, each host system presents unique benefits; goat-derived antibodies are prized for high-affinity polyclonal preparations, mouse systems offer robust hybridoma platforms for monoclonal generation, rabbit hosts excel in eliciting diverse epitope coverage, and sheep-derived products are recognized for scalable serum yields. Research area segmentation further reveals that oncology applications drive the greatest demand for custom reagents, closely followed by investigations in autoimmune and infectious disease contexts, while cardiovascular, neurological, metabolic, and rare genetic disorder studies contribute to a steadily growing share of commissioned projects. Finally, insights from end-user segmentation demonstrate that academic and research institutes rely heavily on rapid-turnaround custom services to support exploratory studies, hospitals and clinics leverage tailored antibodies for diagnostic assay development, and pharmaceutical and biotechnology companies allocate substantial budgets toward strategic partnerships to de-risk clinical candidate selection.

This comprehensive research report categorizes the Custom Antibody market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Antibody Type

- Services

- Host Species

- Application

- End-User

Comparative Analysis of Regional Dynamics Influencing Custom Antibody Research and Commercialization Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

In the Americas, the confluence of robust biotech infrastructure and supportive funding mechanisms has fostered a vibrant custom antibody ecosystem, characterized by leading-edge CROs offering vertically integrated services and numerous academic spinouts driving niche innovation. Regulatory clarity from agencies has further incentivized the adoption of custom reagents in both discovery and companion diagnostic development. Moving eastward, the Europe Middle East and Africa region presents a heterogeneous tapestry of market maturity. Western Europe hosts a network of specialized providers benefitting from cross-border research collaborations and pan–EU funding frameworks, whereas emerging markets in the Middle East and Africa are progressively enhancing local production capabilities to reduce reliance on imports. Through targeted grants and academic consortia, these regions are increasingly contributing to global antibody research.

In Asia-Pacific, dynamic growth is propelled by major investments in biopharma R&D across China, Japan, and South Korea, alongside government initiatives aimed at bolstering domestic biologics manufacturing. Local players have rapidly expanded their technical portfolios, leveraging cost-competitive production to capture global outsourcing mandates. Across these regions, the interplay between regulatory environments, R&D funding, and infrastructure development delineates a diverse yet interconnected panorama of opportunity and competition in the custom antibody market.

This comprehensive research report examines key regions that drive the evolution of the Custom Antibody market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Participants Steering the Competitive Trajectory of the Custom Antibody Industry Through Strategic Partnerships and R&D Excellence

Leading the charge in custom antibody innovation, key market participants are leveraging integrated platforms and strategic alliances to deliver differentiated offerings. Prominent service providers have invested in proprietary high-throughput screening technologies that seamlessly integrate computational design with experimental validation, enabling rapid candidate identification. Several firms have forged partnerships with academic institutions to access novel epitope discovery tools, while others have diversified their portfolios through acquisitions that bolster capabilities in advanced conjugation and glycosylation profiling.

These competitive maneuvers are complemented by differentiated go-to-market strategies: some companies emphasize full-service contracts that bundle development, labeling, and quality management, positioning themselves as one-stop shops for biopharmaceutical clients. Others specialize in niche segments, targeting diagnostic developers with customized fragment labeling and assay optimization services. Across the board, sustained investment in R&D, coupled with an unwavering focus on regulatory compliance and quality assurance, has solidified the reputations of market leaders and emerging innovators alike. The result is a dynamic competitive landscape in which collaboration, specialization, and technological leadership define pathways to success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Custom Antibody market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbiotec, Inc.

- ABclonal, Inc.

- ABGENEX Pvt. Ltd.

- Abnova Corporation

- ACROBiosystems Inc.

- Agilent Technologies, Inc.

- Alta Bioscience Limited

- Antibodies Incorporated

- Bio Basic Inc.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- BioChain Incorporated

- Bionovation Inc.

- Biosynth Ltd.

- Boster Biological Technology

- BTL Biotechno Labs Pvt. Ltd.

- Capralogics, Inc.

- Cell Signaling Technology, Inc.

- Charles River Laboratories International, Inc.

- Creative Biolabs

- CSBio (Shanghai) Ltd.

- Cusabio Technology LLC

- Danaher Corporation

- Davids Biotechnologie GmbH

- evitria AG by Atlas Antibiodies

- GenScript Biotech Corporation

- Hybrigenics Services SAS

- IMGENEX India Pvt. Ltd.

- Innovagen AB

- Inotiv, Inc.

- Kaneka Eurogentec S.A.

- Laboratory Corporation of America Holdings

- Merck KGaA

- MyBiosource, Inc.

- OriGene Technologies, Inc.

- Pacific Immunology

- ProMab Biotechnologies, Inc.

- ProteoGenix SAS

- RayBiotech, Inc.

- Rockland Immunochemicals, Inc.

- Sino Biological, Inc.

- The Antibody Company

- Thermo Fisher Scientific Inc.

- WuXi Biologics (Cayman) Inc.

- YenZym Antibodies, LLC

Strategic Imperatives and Forward-Looking Recommendations Empowering Industry Leaders to Enhance Custom Antibody Capabilities, Mitigate Risks, and Capitalize on Emerging Opportunities

To navigate the rapidly evolving custom antibody arena, industry leaders must prioritize strategies that enhance agility, foster innovation, and mitigate emerging risks. Companies should invest in expanding digital discovery platforms and machine learning tools to accelerate epitope prediction and streamline candidate selection. Simultaneously, establishing multi-tiered supply networks-incorporating both domestic and nearshore vendors-will safeguard against tariff volatility and material shortages. Partnerships with academic research centers and technology incubators can further unlock access to cutting-edge methodologies and bolster internal R&D pipelines.

Moreover, developing modular service offerings that allow clients to customize development packages can drive differentiation and customer loyalty. Emphasizing robust data management and regulatory support services will also improve the client experience and ensure compliance across multiple jurisdictions. Finally, continuous upskilling of technical teams in novel conjugation chemistries and process intensification techniques will sustain service excellence and reinforce market positioning. By adopting these imperatives, organizations can maintain competitiveness while capitalizing on the expanding role of custom antibodies in diagnostics, therapeutics, and research.

Elucidating an Integrated Research Methodology Combining Primary Engagements and Secondary Data to Ensure Rigorous and Transparent Market Insights for Custom Antibodies

This research study employed a mixed-methods approach to ensure a comprehensive and unbiased analysis of the custom antibody market. Initially, extensive secondary research was conducted, encompassing peer-reviewed literature, patent filings, regulatory agency releases, and company disclosures to map the technological and competitive landscape. These insights provided a foundational framework for identifying key market drivers, challenges, and emerging trends.

Subsequently, primary research was undertaken through in-depth interviews with senior executives, R&D scientists, and supply chain managers across leading service providers, academic institutions, and end-user organizations. These discussions elucidated practical considerations related to development workflows, cost structures, and strategic priorities. Data triangulation methods were then applied to validate findings, comparing qualitative perspectives with quantitative indicators such as patent trends and funding allocations. Finally, iterative peer review by subject-matter experts ensured methodological rigor and clarity, resulting in actionable insights and strategic recommendations for stakeholders operating across the custom antibody value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Custom Antibody market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Custom Antibody Market, by Antibody Type

- Custom Antibody Market, by Services

- Custom Antibody Market, by Host Species

- Custom Antibody Market, by Application

- Custom Antibody Market, by End-User

- Custom Antibody Market, by Region

- Custom Antibody Market, by Group

- Custom Antibody Market, by Country

- United States Custom Antibody Market

- China Custom Antibody Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Considerations to Provide a Cohesive Conclusion on the Future Outlook and Value Proposition of Custom Antibodies

In synthesizing the key insights from this analysis, it is evident that the custom antibody market stands at a pivotal inflection point defined by rapid technological advancement and shifting commercial dynamics. Organizations that harness the power of AI-enabled discovery, flexible manufacturing approaches, and resilient supply chain architectures will be best positioned to meet the growing demand for tailored antibody solutions. Furthermore, a nuanced understanding of regional regulatory landscapes and tariff implications will be critical for optimizing operational efficiency and market access.

As the industry continues to mature, the delineation between service providers and strategic partners will blur, giving rise to collaborative ecosystems that coalesce around specialized capabilities. Stakeholders who proactively adapt their offerings to encompass end-to-end value propositions-from epitope mapping to clinical-grade production-will secure a competitive edge. Ultimately, the sustained growth of the custom antibody domain will be driven by a confluence of scientific innovation, regulatory foresight, and market-oriented agility.

Engage with Ketan Rohom to Access Comprehensive Custom Antibody Market Insights, Drive Informed Decision Making, and Accelerate Strategic Growth Trajectories Today

For decision-makers seeking to deepen their understanding of the custom antibody landscape and to equip their organizations with actionable insights, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, represents an invaluable opportunity. By partnering with Ketan, stakeholders gain privileged access to a robust compendium of qualitative analyses and data-driven perspectives that underpin strategic choices in antibody development. Whether refining prioritization criteria for novel therapeutic targets or optimizing supply chain resilience against tariff-induced cost pressures, Ketan’s consultative approach ensures alignment of market intelligence with corporate objectives.

Through a personalized briefing session, Ketan will guide clients through the comprehensive market research report, elucidating nuances in service offerings, antibody modalities, and regional dynamics. This collaboration extends beyond mere data delivery; it is a tailored advisory experience designed to reveal emergent trends and competitive differentiators. Prospective partners can thus fortify pipeline strategies, accelerate time-to-market, and enhance profitability in a marketplace defined by rapid innovation and regulatory complexity.

To initiate a strategic conversation and explore licensing options for the full custom antibody market research report, don’t hesitate to reach out to Ketan Rohom today. Empower your team with foresight, convert insights into impactful actions, and stay ahead of the curve in the evolving world of custom antibodies.

- How big is the Custom Antibody Market?

- What is the Custom Antibody Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?