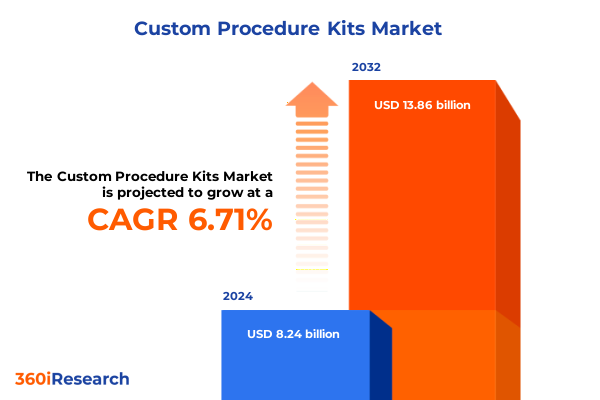

The Custom Procedure Kits Market size was estimated at USD 8.78 billion in 2025 and expected to reach USD 9.36 billion in 2026, at a CAGR of 6.72% to reach USD 13.86 billion by 2032.

Unveiling the Critical Role of Custom Procedure Kits in Streamlining Healthcare Workflows and Elevating Surgical Efficiency

Custom procedure kits have emerged as indispensable solutions in modern healthcare settings, offering a single-point assembly of instruments and consumables tailored to specific surgical workflows. By consolidating pre-sterilized components into cohesive trays, these kits drastically reduce preparation time and minimize the risk of missing or incorrect items during procedures. As hospitals and outpatient facilities strive to optimize operational efficiency, custom trays play a pivotal role in promoting lean inventory practices and enhancing overall patient safety.

In tandem with efficiency gains, health systems are increasingly prioritizing infection control and regulatory compliance. The shift toward single-use disposables within custom kits underscores a broader emphasis on eliminating cross-contamination risks, particularly in an era where quality metrics and reimbursement models increasingly tie performance to patient outcomes. Consequently, stakeholders across the supply chain-from suppliers to procurement teams-are collaborating more closely to design kits that align with stringent clinical protocols while reducing waste and driving sustainability initiatives.

Examining How Digital Integration, Sustainability Initiatives, and Outpatient Trends Are Redefining the Custom Procedure Kits Landscape

Over the past two years, digitalization has catalyzed profound shifts in how healthcare organizations manage surgical supplies. Advanced tracking technologies, such as radio-frequency identification (RFID) and integrated barcode systems, now enable real-time visibility into kit utilization, expiration management, and automated replenishment cycles. This connectivity not only mitigates stockouts and overstock scenarios, but also supports data-driven decision making around inventory optimization and cost containment.

Simultaneously, the proliferation of outpatient and minimally invasive procedures has reshaped kit demand profiles. Ambulatory surgical centers, driven by cost pressures and patient preference for same-day interventions, are customizing kits for high-volume specialties such as orthopedics and general surgery. At the same time, sustainability imperatives are pushing manufacturers toward eco-friendly materials and modular designs that cater to both disposable and reusable components-reflecting a balance between infection control and environmental stewardship.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Supply Chain Dynamics and Cost Structures Within Custom Procedure Kits

In 2025, the United States implemented expanded Section 301 tariffs on a range of medical supplies imported from China, including rubber gloves, disposable facemasks, and surgical accessories. Rates of up to 50% on medical gloves and 25% on textile facemasks have imposed new cost pressures on manufacturers relying on global sourcing, challenging long-established procurement models and squeezing margins across the value chain.

These measures have accelerated supply chain diversification as leading medtech organizations explore near-shoring, alternate suppliers, and strategic inventory buffers to mitigate tariff impacts. Companies such as Zimmer Biomet estimate profit reductions in the tens of millions due to the tariffs, underscoring the financial significance of trade policy on device manufacturing. Industry analysts project that, while tariffs aim to bolster domestic production, the immediate effect is heightened cost volatility and logistical complexity for surgical kit providers and end users alike.

Gaining Strategic Insights from Diversified Segmentation Across Product Types, Specialty Procedures, End Users, and Distribution Channels

The custom procedure kits landscape is bifurcated by product type into disposable and reusable formats, each serving distinct clinical and operational imperatives. Disposable kits appeal to infection control priorities and procedural convenience, enabling streamlined disposal workflows, whereas reusable instrument trays support cost-efficiency mandates-albeit requiring stringent sterilization protocols and capital investments in decontamination infrastructure.

Clinical demand for tailored trays spans a diverse array of specialties, from cardiovascular surgery, where precision instruments and hemostatic agents are critical, to colorectal and general surgery, which demand high-volume consumables. Neurological procedures necessitate ultra-fine tools and contamination-resistant packaging, while orthopedic and urology interventions leverage robust implant-compatible sets. Ophthalmology and gynecology kits, in contrast, feature specialized microsurgical items that underscore the degree of customization required for niche procedural requirements.

End-user segmentation further refines adoption strategies across academic research institutions, ambulatory surgical centers, hospitals, and specialty clinics. Academic centers prioritize pilot testing and validation, often requiring experimental or prototype components. Ambulatory surgical centers focus on turnover efficiency and cost containment, while hospitals balance comprehensive clinical offerings with compliance mandates. Specialty clinics, by virtue of concentrated procedural volumes, seek highly tailored kits that reflect the nuances of their service lines.

Distribution channels have evolved from traditional, offline supply relationships to omnichannel strategies that incorporate online ordering platforms, direct-to-facility logistics, and vendor-managed inventory models. Digital procurement portals enhance transparency and responsiveness, whereas legacy wholesale partnerships continue to play a strategic role in regions with complex regulatory or infrastructural constraints.

This comprehensive research report categorizes the Custom Procedure Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Procedure Specialty

- Component Type

- End User

- Distribution Channel

Exploring Regional Differentiators Shaping Demand and Adoption Patterns for Custom Procedure Kits in the Americas, EMEA, and Asia-Pacific

In the Americas, advanced healthcare infrastructure and robust reimbursement systems underpin strong demand for custom procedure kits. High procedural volumes and stringent regulatory oversight in markets such as the United States and Canada have fostered early adoption of disposable-heavy kits integrated with digital inventory controls. Meanwhile, Latin American healthcare systems, despite budgetary constraints, are gradually embracing customization to enhance procedural quality and infection control.

Europe, Middle East & Africa (EMEA) present a diverse landscape characterized by mature markets in Western Europe and emerging dynamics in the Middle East and Africa. Sustainability regulations and environmental mandates in the European Union have accelerated interest in reusable kit frameworks and recyclable packaging. Conversely, the Gulf region is witnessing rapid adoption of turnkey surgical solutions in newly established facilities, while sub-Saharan markets prioritize cost-effective disposables amid infrastructure development.

Asia-Pacific is the fastest-growing region for custom procedure kits, driven by expanding private healthcare networks, government-led surgical capacity initiatives, and rising patient volumes in China, India, and Southeast Asia. Localized manufacturing hubs are emerging to service cost-sensitive markets, and partnerships between global kit suppliers and regional distributors are facilitating faster go-to-market cycles. Digital procurement and mobile-friendly ordering interfaces are particularly impactful in markets with high smartphone penetration but varying hospital IT infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Custom Procedure Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Competitive Strategies and Innovations Driving Leadership Among Key Custom Procedure Kits Manufacturers and Providers

Leading companies in the custom procedure kits space are differentiating through strategic alliances, technology investments, and expanded service offerings. Sterile solutions providers have forged partnerships with supply chain software vendors to offer turnkey inventory management as part of their kit packages. Large medical distributors are integrating digital procurement marketplaces, enabling clinical teams to configure kits online and track deliveries in real time.

On the manufacturing front, established medical device firms are acquiring or partnering with niche custom kit assemblers to broaden their procedural coverage and regional reach. Product innovation remains a competitive differentiator, with several players introducing modular tray designs that allow on-demand swapping of components. Furthermore, investments in regional assembly and sterilization centers have been pivotal for reducing lead times in fast-growing markets, reflecting a shift toward localized supply strategies in response to trade and logistical volatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Custom Procedure Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alcon Vision LLC

- Alcon Vision LLC

- B. Braun Melsungen AG

- Bausch Health Companies Inc.

- Becton, Dickinson, and Company

- Cardinal Health, Inc.

- Hakuzo Medical Asia Co., Ltd

- ICU Medical, Inc.

- Kimal PLC

- Lohmann & Rauscher GmbH & Co. KG

- McKesson Corporation

- Med-Italia Biomedica S.r.l.

- Medline Industries, LP

- Medtronic PLC

- Merit Medical Systems, Inc.

- Mölnlycke Health Care AB

- NewGen Surgical, Inc.

- OneMed Sverige AB

- Owens & Minor, Inc.

- Paul Hartmann AG

- Pennine Healthcare

- Priontex (Pty) Ltd.

- Ruhof Corporation

- SDP Inc.

- STERIS plc

- STS Medical Group

- Teleflex Incorporated

- Terumo Cardiovascular Systems Corporation

- Thermo Fisher Scientific Inc.

- Unisurge International Limited

Actionable Strategies for Industry Stakeholders to Enhance Custom Procedure Kit Adoption, Efficiency, and Supply Chain Resilience

To thrive amidst evolving clinical demands and trade uncertainties, industry stakeholders should prioritize investments in digital supply chain visibility tools that integrate RFID tagging and predictive analytics. Such capabilities enable proactive replenishment and minimize disruptions driven by tariff-induced sourcing shifts. Concurrently, cultivating supply partnerships across multiple geographies will provide a buffer against regional trade policy fluctuations.

Sustainability must also be embedded within kit design and materials selection. Embracing biodegradable and recycled components not only addresses environmental mandates but also resonates with healthcare systems that increasingly track sustainability metrics. Additionally, expanding modular kit platforms allows providers to offer customizable configurations without overhauling manufacturing lines, thereby balancing variety with operational efficiency.

Finally, aligning kit development closely with high-growth specialty areas-such as minimally invasive cardiovascular procedures and orthopedic robotics-will position manufacturers at the forefront of procedural innovation. Collaborating with clinical thought leaders through co-development programs ensures that kit configurations reflect evolving surgical techniques and procedural workflows, deepening market relevance and competitive advantage.

Detailing a Rigorous and Transparent Mixed-Methods Research Approach to Deliver Robust Insights into Custom Procedure Kits Trends

Our research methodology combined primary stakeholder engagement with rigorous secondary data analysis to deliver a comprehensive perspective on custom procedure kit dynamics. We conducted in-depth interviews and surveys with surgeons, procurement directors, and supply chain managers across a representative sample of healthcare facilities. This primary outreach illuminated real-world challenges and prioritized areas for kit optimization.

Secondary research included a systematic review of peer-reviewed clinical journals, regulatory publications, and open-source financial filings. We also analyzed government trade and tariff documentation to quantify policy impacts on procurement cost structures. Data triangulation techniques were employed to validate insights from multiple sources, ensuring robust and reliable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Custom Procedure Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Custom Procedure Kits Market, by Type

- Custom Procedure Kits Market, by Procedure Specialty

- Custom Procedure Kits Market, by Component Type

- Custom Procedure Kits Market, by End User

- Custom Procedure Kits Market, by Distribution Channel

- Custom Procedure Kits Market, by Region

- Custom Procedure Kits Market, by Group

- Custom Procedure Kits Market, by Country

- United States Custom Procedure Kits Market

- China Custom Procedure Kits Market

- United Kingdom Custom Procedure Kits Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1760 ]

Synthesizing Core Findings to Highlight the Unprecedented Importance of Custom Procedure Kits in Modern Healthcare Ecosystems

The convergence of digital integration, regulatory shifts, and evolving clinical preferences underscores the strategic importance of custom procedure kits in modern healthcare delivery. Enhanced tracking technologies have transformed kit management from a reactive to a proactive function, while sustainability pressures are redefining material choices and design principles.

Trade policy developments, particularly the 2025 tariff increases, have injected new complexity into global supply chains, making diversification and localization critical for long-term resilience. By aligning segmentation strategies with end-user needs and regional market characteristics, providers can tailor offerings that optimize clinical outcomes and operational performance. Ultimately, the future of custom procedure kits lies in the seamless fusion of innovation, efficiency, and environmental stewardship.

Engaging Decision-Makers with a Clear Path to Access Premium Market Intelligence from Ketan Rohom for Custom Procedure Kits Insights

To gain a competitive edge and unlock the full potential of custom procedure kits, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, whose in-depth expertise will guide you to the precise market intelligence your organization needs. Engage with Ketan to discuss your unique challenges and receive tailored insights drawn from our comprehensive analysis. By partnering with our team, you will access actionable data, best-in-class strategies, and a roadmap for resilient growth in an evolving healthcare environment. Reach out today to secure your copy of the full report and embark on a transformative journey toward operational excellence and innovation.

- How big is the Custom Procedure Kits Market?

- What is the Custom Procedure Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?