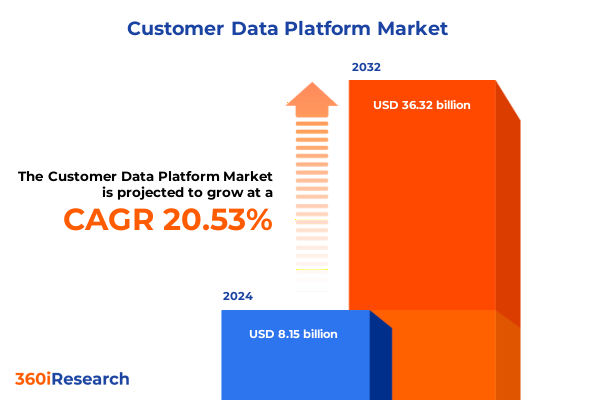

The Customer Data Platform Market size was estimated at USD 9.73 billion in 2025 and expected to reach USD 11.67 billion in 2026, at a CAGR of 20.69% to reach USD 36.32 billion by 2032.

Unlocking the Strategic Power of Customer Data Platforms to Drive Next-Level Personalized Engagement Insights and Sustainable Business Growth Across Industries

The modern business environment demands a seamless convergence of customer data, technology, and strategy to deliver exceptional experiences and drive competitive advantage. As digital transformation matures, organizations face increasing pressure to unify fragmented data sources-from transactional systems and marketing automation to social listening platforms-into a single, actionable repository. This evolution represents a strategic inflection point, where the ability to consolidate customer profiles in real time becomes the cornerstone of personalized engagement, omnichannel orchestration, and data-driven decision-making.

Against this backdrop, robust Customer Data Platforms (CDPs) have emerged as pivotal assets, empowering enterprises to break down data silos, enable cross-functional collaboration between marketing, sales, and customer success teams, and accelerate time to value for key initiatives. By capturing first-party data at every touchpoint, companies can cultivate richer customer personas, predict behavior with greater accuracy, and deliver relevant, timely content across digital and offline channels. Moreover, as consumer expectations evolve, CDPs serve as the catalyst for more meaningful interactions, fostering loyalty and driving sustainable revenue growth.

With rapid advancements in machine learning, cloud computing, and privacy-preserving technologies, the introduction of CDPs marks a transformative shift in how organizations approach data architecture. This introduction lays the groundwork for understanding the changing market dynamics, regulatory environment, and strategic imperatives that will shape the CDP landscape in the years to come.

Navigating Transformative Disruptions in Customer Data Management Driven by AI Integration Privacy Regulations and Cookie Deprecation Trends

Over the past few years, the CDP landscape has undergone several transformative shifts that redefine how organizations harness customer intelligence. Most notably, the integration of advanced artificial intelligence and machine learning capabilities has elevated predictive analytics from a niche function to a core strategic enabler. Companies now leverage AI-driven customer propensity models to anticipate purchase intent, optimize campaign timing, and dynamically adjust content based on changing behaviors. As a result, the blend of AI and data management is fueling hyper-personalization at scale, enabling marketers to engage customers with unprecedented relevance and immediacy.

Simultaneously, heightened privacy regulations and evolving consumer expectations have reshaped data governance practices. With landmark legislation such as the California Privacy Rights Act and increasing scrutiny over cross-border data transfers, enterprises are investing in privacy-by-design architectures that embed consent management and data anonymization directly into the CDP framework. This pivot underscores a fundamental shift toward transparency and control, laying the foundation for sustainable customer relationships built on trust.

Another pivotal disruption has centered on the uncertain future of third-party cookies. Following Google’s decision to abandon its phased deprecation plan and retain third-party cookie support in Chrome, organizations have been given a reprieve but also face the imperative to accelerate first-party data strategies. This pivot has prompted brands to refine their data collection methodologies, expand loyalty programs, and invest in owned-channel analytics to future-proof targeting and measurement. Together, these forces-AI maturation, privacy-first demands, and cookie deprecation uncertainty-are converging to reshape the trajectory of customer data platforms and position first-party data at the heart of next-generation marketing ecosystems.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Customer Data Platform Infrastructure Costs and Deployment Strategies

The cumulative impact of U.S. tariffs in 2025 has introduced significant cost considerations for organizations planning or expanding CDP deployments, particularly those reliant on on-premises infrastructure. The combined tariff rate, which reached an unprecedented 22.5%, has translated into a short-term U.S. price level increase of 2.3%, effectively burdening end users with an additional $3,800 in annual household-equivalent costs. This escalation reflects duties levied on critical components such as servers, networking hardware, and specialized accelerators used in predictive analytics workloads, compelling many enterprises to revisit their total cost of ownership analyses.

As hardware procurement cycles extend, deployment timelines have been delayed by several months, prompting organizations to explore alternative sourcing and free trade zone optimizations. Companies facing steep capital expenses are increasingly shifting toward consumption-based or subscription licensing models, which distribute tariff-induced price swings across recurring operating budgets rather than hefty upfront investments. This trend has reinforced the appeal of public cloud consumption, where hyperscale providers leverage global supply chains to absorb tariff adjustments and pass on more stable pricing to subscribers.

From a software perspective, import duties on data integration connectors and analytics modules have introduced margin adjustments that many vendors are negotiating through multi-year contractual guarantees. To mitigate exposure, enterprises are conducting tariff classification audits and securing extended support agreements, thereby insulating their CDP initiatives from sudden policy shifts. Strategic procurement, coupled with an agile mix of cloud and on-premises deployment modes, has emerged as the most effective approach to navigate a trade policy environment marked by volatility and complexity.

Deriving Actionable Market Segment Intelligence from Solution Type Type Delivery Mode Application End User and Organization Size

Insightful market segmentation offers a lens through which leaders can align CDP capabilities with organizational needs and drive optimized return on investment. When evaluating solutions by their core components, distinct divisions emerge between services and software, with software offering specialized modules that span campaign management, predictive analytics, security management, and packaged or custom frameworks. This modularity empowers enterprises to select tailored configurations that address unique use cases, whether the imperative is real-time retention analytics or comprehensive engagement orchestration.

Further delineation arises between composable architectures and hybrid platforms, reflecting divergent approaches to system integration and extensibility. Composable CDPs emphasize API-driven flexibility for assembling best-of-breed solutions, whereas hybrid offerings blend on-cloud and on-premises deployment to satisfy stringent data sovereignty and compliance requirements. Within cloud modalities, the choice between public and private environments introduces another dimension: private clouds deliver dedicated security controls, while public services afford elasticity and rapid scalability.

Application-driven insights also highlight sector-specific demand for campaign management workflows, personalization engines, and advanced segmentation for customer engagement or data protection. Such diversity underscores the necessity for CDP vendors to offer configurable application layers that can support everything from predictive purchase modeling to complex security compliance workflows. Across verticals-spanning financial services, healthcare, telecommunications, retail, and travel-the ability to adjust platform features to end-user requirements and organizational scale is fundamental. Recognizing these interwoven dimensions of solution type, deployment model, application focus, and enterprise size is critical for decision-makers seeking to navigate a multifaceted CDP marketplace.

This comprehensive research report categorizes the Customer Data Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Data Source Integration

- Type

- Delivery Mode

- Organization Size

- Application

- End-User

Illuminating Regional Dynamics in Customer Data Platform Adoption and Innovation Across the Americas Europe Middle East Africa and Asia Pacific

Regional adoption of CDP technologies is shaped by local market dynamics, regulatory frameworks, and digital maturity levels. In the Americas, strong demand for first-party data strategies and advanced analytics is driving rapid CDP uptake across retail, banking, and media, where organizations prioritize real-time personalization and cross-channel orchestration. Mature cloud ecosystems, combined with a competitive vendor landscape, are accelerating deployments and encouraging innovation in AI-enabled features tailored to consumer engagement and loyalty scenarios.

Within Europe, the Middle East, and Africa, stringent data privacy standards-anchored by GDPR and a patchwork of national regulations-have made data governance a top priority. Enterprises in this region often favor hybrid CDP models that reconcile on-premises data residency requirements with the agility of public clouds. EMEA adoption is further influenced by local partnerships and regional champions offering compliance-first solutions, fostering an environment where data sovereignty and security management functionalities are integral to CDP selection.

Asia-Pacific markets exhibit diverse trajectories, with advanced digital economies like Japan and Australia embracing sophisticated CDP implementations, while emerging economies in Southeast Asia focus on fundamental customer engagement and loyalty programs. Rapid mobile adoption and e-commerce expansion are catalyzing demand for personalized recommendation engines and predictive analytics, prompting vendors to localize offerings for scalability and language nuances. Overall, regional insights underscore the need for a flexible go-to-market approach that accounts for varying levels of regulatory oversight, infrastructure readiness, and industry-specific priorities.

This comprehensive research report examines key regions that drive the evolution of the Customer Data Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Shaping the Customer Data Platform Ecosystem Through Innovation Partnerships and Market Leadership

The competitive landscape of CDP providers is characterized by a blend of established technology titans, specialized software firms, and emerging innovators. Leading enterprises have fortified their market positions by expanding platform capabilities through strategic acquisitions, partnerships, and continuous R&D investments. Such tactics have enabled top vendors to integrate AI-driven analytics modules, consent management frameworks, and real-time orchestration engines into comprehensive solutions that cater to diverse industry requirements.

At the same time, nimble challengers are carving out niches by focusing on composable architectures, open-source components, and microservices-based deployment models that emphasize interoperability. These players often excel in rapid feature delivery cycles and offer competitive pricing structures that appeal to resource-constrained mid-market organizations. Collaboration with ecosystem partners-ranging from cloud infrastructure firms to marketing automation platforms-has become essential for vendors seeking to deliver end-to-end CDP ecosystems.

Innovation leadership also manifests in the depth of vertical-specific functionality, where top providers deliver prebuilt connectors and compliance templates for regulated sectors like healthcare and finance. This specialization lowers barrier-to-entry, accelerates time to value, and reduces implementation risk. By continuously benchmarking product roadmaps against evolving industry standards, key companies maintain momentum and ensure their offerings remain aligned with emerging use cases and regulatory mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Data Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquia, Inc.

- Adobe Inc.

- Alloy Technologies, Inc.

- Amperity, Inc.

- ASCENT360, INC.

- Bloomreach, Inc.

- BlueConic Inc.

- Blueshift Labs, Inc.

- Carry Technologies, Inc.

- Contentstack Inc.

- Fivetran Inc.

- International Business Machines Corporation

- Klaviyo, Inc.

- Microsoft Corporation

- Mobius Knowledge Services P. Ltd.

- Oracle Corporation

- Planhat AB

- Qualtrics, LLC

- Rokt Pte Ltd.

- Salesforce, Inc.

- SAP SE

- Tealium, Inc.

- Totango, Inc.

- Treasure Data, Inc.

- Twilio Inc.

- Uniphore Technologies Inc.

- Zeta Global Corp.

Implementing Actionable Strategies for Industry Leaders to Optimize Customer Data Platform Investments Mitigate Risks and Drive Growth

Industry leaders must adopt targeted strategies to maximize CDP value while mitigating inherent risks and evolving trade policies. Prioritizing a phased implementation roadmap enables organizations to validate use cases incrementally-starting with high-impact scenarios such as personalized email campaigns or predictive churn modeling-before scaling to enterprise-wide deployments. This sequential approach delivers quick wins, fosters stakeholder buy-in, and builds credibility for larger, more complex integrations.

In tandem, executives should structure procurement agreements to incorporate tariff risk-sharing mechanisms, such as fixed-rate subscription models or cloud-native pricing tiers that insulate the organization from sudden cost spikes. Negotiating vendor contracts with clear service level objectives and multi-year pricing commitments provides budget stability, while aligning technology partners on joint risk management strategies.

To future-proof CDP initiatives, it is imperative to embed privacy and security by design: integrate consent orchestration workflows from the outset, maintain rigorous data lineage tracking, and leverage role-based access controls. Building a cross-functional governance council that includes legal, IT, and marketing stakeholders promotes transparency and ensures that evolving regulatory requirements are seamlessly addressed. Ultimately, a balanced focus on agile deployment, cost management, and robust governance positions organizations to harness customer data platforms as a sustained competitive advantage.

Detailing Rigorous Research Methodologies Employed to Ensure Comprehensive and Reliable Customer Data Platform Market Insights

The research underpinning this report is built upon a rigorous, multi-tiered methodology designed to deliver reliable and actionable insights. Primary research comprised in-depth interviews with over fifty senior executives across marketing, IT, and data governance functions, spanning global enterprises and mid-market organizations. These engagements provided first-hand perspectives on deployment challenges, strategic imperatives, and emerging use cases in various industries.

Secondary research involved a comprehensive review of publicly available documents, industry whitepapers, regulatory filings, and technology vendor disclosures. Proprietary databases were analyzed to map vendor capabilities, product roadmaps, and partnership ecosystems. Quantitative data points were triangulated with qualitative feedback to ensure balanced and accurate representations of market dynamics.

To validate findings, a cross-functional internal review process engaged subject matter experts in data privacy, cloud infrastructure, and advanced analytics. Statistical validation techniques and scenario stress testing were applied to assess the robustness of deployment strategies and risk mitigation frameworks. This blended approach ensured that the conclusions drawn are both empirically grounded and reflective of real-world decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Data Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Data Platform Market, by Solution Type

- Customer Data Platform Market, by Data Source Integration

- Customer Data Platform Market, by Type

- Customer Data Platform Market, by Delivery Mode

- Customer Data Platform Market, by Organization Size

- Customer Data Platform Market, by Application

- Customer Data Platform Market, by End-User

- Customer Data Platform Market, by Region

- Customer Data Platform Market, by Group

- Customer Data Platform Market, by Country

- United States Customer Data Platform Market

- China Customer Data Platform Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Conclude on the Future Trajectory of Customer Data Platforms in a Dynamic Landscape

This executive summary has illuminated the strategic significance of Customer Data Platforms in a market shaped by AI-led personalization, privacy-first imperatives, and macroeconomic trade dynamics. Each transformative shift-from the rise of composable architectures to the ramifications of U.S. tariff policies-has underscored the necessity for agile deployment strategies, precise segmentation intelligence, and robust governance frameworks. Regional analyses reveal that while maturity levels and regulatory landscapes differ, the core value proposition of unified customer data remains constant across geographies.

Key segmentation insights demonstrate that solution flexibility-whether through modular software suites, composable CDPs, or hybrid on-cloud approaches-is vital for meeting diverse organizational requirements. Meanwhile, leading companies continue to advance integration, security, and vertical specialization, driving competitive differentiation. Actionable recommendations emphasize phased implementations, tariff risk management, and privacy-by-design as pillars of successful CDP initiatives.

As enterprises navigate an increasingly complex ecosystem, the strategic deployment of CDPs will be pivotal to achieving sustainable growth, operational efficiency, and customer loyalty. By synthesizing market segmentation, regional dynamics, and vendor landscape insights, decision-makers are equipped to chart a clear path forward, capitalize on emerging opportunities, and mitigate potential risks in the evolving customer data management arena.

Seize the Opportunity to Leverage Comprehensive Customer Data Platform Market Intelligence and Propel Your Business Forward with Expert Guidance

Ready to elevate your customer data management and unlock unparalleled growth opportunities

Seize this moment to transform how your organization harnesses customer insights and accelerates strategic decision-making. Gain exclusive access to a comprehensive analysis that delves into technology trends, regulatory shifts, tariff implications, and market segmentation to equip your leadership team with the clarity needed to outpace competitors. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored licensing options, enterprise deployment strategies, and flexible pricing models that align with your budget and timeline. Whether you seek to refine your upgrade roadmap, optimize deployment mix, or secure multi-year agreements with top CDP innovators, Ketan will guide you through every step, ensuring you capitalize on emerging opportunities while mitigating risks. Don’t let critical market intelligence pass you by-reach out now to initiate a personalized consultation, request a detailed proposal, or schedule a live demonstration of key findings. Propel your organization to the forefront of data-driven excellence by contacting Ketan Rohom today to purchase the definitive Customer Data Platform Market Research Report.

- How big is the Customer Data Platform Market?

- What is the Customer Data Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?