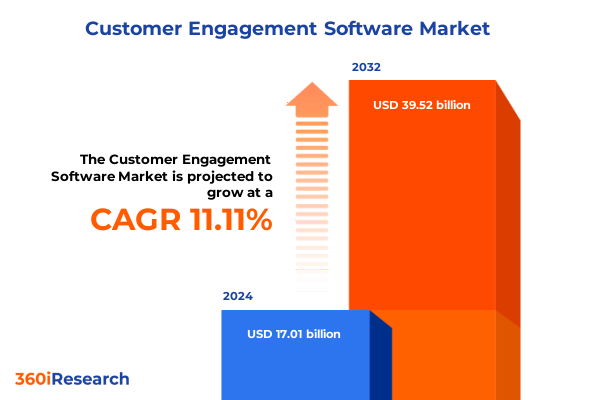

The Customer Engagement Software Market size was estimated at USD 18.82 billion in 2025 and expected to reach USD 20.83 billion in 2026, at a CAGR of 11.17% to reach USD 39.52 billion by 2032.

Introduction That Establishes the Vital Importance of Advanced Customer Engagement Software in Modern Digital Ecosystems for Driving Business Growth

In an era where digital transformation dictates the pace of competitive advantage, customer engagement software has emerged as a cornerstone for organizations aiming to foster meaningful interactions and lasting relationships with their audiences. As enterprises navigate an increasingly complex landscape of touchpoints-from web and mobile channels to social media platforms and emerging voice interfaces-the imperative to adopt sophisticated engagement solutions has never been greater. Contemporary buyers expect personalized experiences, real-time responsiveness, and seamless transitions across channels, placing pressure on businesses to implement platforms capable of unifying data, automating intricate workflows, and delivering actionable insights.

Consequently, the introduction of advanced engagement technologies represents not just a tactical enhancement but a strategic imperative for growth and retention. Leaders across industries are investing in integrated suites that combine analytics, journey orchestration, and AI-driven personalization to anticipate customer needs and foster loyalty. This study provides a holistic overview of the fundamental drivers, adoption patterns, and technological innovations shaping the market, offering decision-makers a clear understanding of how to harness these capabilities effectively. By unpacking key trends and contextual factors, the research sets the stage for an in-depth analysis of the market dynamics and actionable recommendations.

Exploring the Game-Changing Transformational Shifts Reshaping the Customer Engagement Software Landscape in Response to Technological and Behavioral Trends

The customer engagement software landscape is undergoing seismic shifts driven by rapid advancements in AI, automation, and cloud computing. Organizations are increasingly moving from isolated point solutions to comprehensive platforms that can orchestrate multichannel interactions and leverage machine learning to personalize at scale. Consequently, the traditional linear communication models are being replaced by dynamic, contextually aware experiences that adapt in real time to behavioral cues and environmental factors.

Moreover, the proliferation of data sources-from CRM systems and e-commerce platforms to social listening tools-has necessitated the adoption of unified engagement hubs capable of integrating disparate datasets. This convergence enables a more granular understanding of customer journeys and empowers marketing and customer success teams to deliver highly relevant content. Additionally, as privacy regulations evolve and consumer expectations around data sovereignty intensify, software providers are embedding advanced compliance frameworks directly within their solutions to ensure data is handled securely and ethically. These transformative shifts underscore the need for a strategic approach to technology selection, implementation, and ongoing optimization.

Analyzing the Cumulative Effects of United States Tariffs Implemented in 2025 on the Ecosystem of Customer Engagement Software and Supporting Infrastructure

Since the imposition of new United States tariffs in early 2025 on imported hardware components and cloud infrastructure services, vendors and end users of customer engagement software have experienced a range of cumulative impacts. The increased duty rates on servers, networking equipment, and storage devices have elevated operational expenses for on-premises deployments, prompting several enterprises to accelerate migrations to cloud-based models. Consequently, this shift has reinforced the appeal of public and hybrid cloud configurations that can offer scalable resources without the upfront capital expenditure tied to physical assets.

Furthermore, the tariffs have catalyzed strategic realignments within global supply chains, as software providers seek to mitigate cost pressures by partnering with domestic data center operators or diversifying their vendor portfolios. This realignment has introduced a layer of complexity to component procurement and has necessitated adaptive pricing strategies. Meanwhile, cloud service providers have responded with revised service agreements and flexible consumption plans designed to absorb some of the tariff-related increases. Overall, the cumulative effects of these policy measures highlight the importance of agility and cost management in sustaining software adoption and supporting seamless customer experiences.

Unveiling Key Insights Derived from Comprehensive Segmentation That Illuminate Diverse Deployment, Component, Enterprise, Vertical, and Channel Preferences

The market’s evolution can be traced through distinct deployment preferences that reveal a nuanced balance between cloud and on-premises adoption. Based on deployment model, organizations demonstrate a clear gravitation toward hybrid solutions that blend the control and security of private cloud with the scalability of public environments. Meanwhile, some sectors continue to leverage on-premises systems for sensitive workloads, reflecting enduring concerns around data sovereignty and compliance.

Component type segmentation underscores the multifaceted nature of engagement platforms, where analytics and reporting modules-ranging from descriptive dashboards to predictive forecasts and prescriptive recommendations-provide the backbone for informed decision making. Campaign management capabilities span both cross-channel orchestration and targeted email initiatives, ensuring consistent messaging across diverse touchpoints. Journey orchestration technologies, whether batch-driven or enabled for real-time interactions, empower organizations to automate complex processes at scale. Personalization engines, differentiated by AI-based learning algorithms and rule-based frameworks, deliver tailored content that resonates with individual user profiles. Social media engagement tools, encompassing both listening to audience sentiment and publishing targeted campaigns, complete the comprehensive suite of offerings.

Enterprise size further delineates distinct adoption trajectories, as tier-one and tier-two large organizations invest heavily in end-to-end platforms for global rollouts, while medium, micro, and small enterprises increasingly seek modular solutions that can grow with their evolving requirements. Industry vertical segmentation highlights the critical role of sector-specific functionality, with banking, insurance, and securities firms prioritizing robust compliance features, healthcare providers demanding seamless integration with clinical systems, retailers focusing on omnichannel conversion, and telecommunications operators emphasizing high-volume interaction management. Finally, engagement channel preferences reveal a strategic blend of promotional and transactional email campaigns alongside mobile in-app messages, push notifications, and SMS alerts. Social channels such as Facebook, LinkedIn, and Twitter facilitate brand awareness and community building, while web-based chat and push notifications offer direct, real-time customer touchpoints.

This comprehensive research report categorizes the Customer Engagement Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Enterprise Size

- Engagement Channel

- Deployment Model

- Industry Vertical

Distilling Regional Dynamics Influencing Customer Engagement Technology Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping customer engagement software adoption, driven by varying regulatory landscapes, infrastructure maturity, and cultural considerations. In the Americas, organizations benefit from advanced digital infrastructure and progressive data privacy frameworks, which foster rapid uptake of cloud-native platforms. Consequently, North American enterprises often serve as bellwethers for innovative engagement strategies and early adopters of cutting-edge features such as conversational AI and predictive analytics.

Europe, the Middle East, and Africa present a more heterogeneous environment, where stringent data protection regulations coexist with emerging tech hubs seeking agile solutions. As a result, businesses in this region demonstrate cautious yet steady migration to hybrid and private cloud deployments, prioritizing compliance and localization. Meanwhile, the rise of digital transformation initiatives in the Gulf Cooperation Council and Sub-Saharan Africa is driving investments in scalable engagement platforms that can support both urban and rural connectivity scenarios.

Asia-Pacific markets, characterized by diverse levels of digital maturity, exhibit robust demand for mobile-first engagement tools and social media integration. In mature economies such as Japan and Australia, enterprises focus on advanced analytics and orchestration capabilities, whereas high-growth markets like India and Southeast Asia prioritize cost-effective, scalable solutions that can address high-volume consumer bases. This regional overview underscores the importance of tailoring deployment strategies and feature sets to the unique needs and maturity levels of each market.

This comprehensive research report examines key regions that drive the evolution of the Customer Engagement Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Innovations from Leading Customer Engagement Vendors Driving Competitive Advantage in the Global Market

Leading vendors in the customer engagement software arena continue to expand their portfolios through strategic acquisitions, organic innovation, and partnership ecosystems. One prominent provider has integrated AI-driven analytics into its core platform, enabling predictive behavior modeling and automated campaign optimization. Another key player has focused on enhancing journey orchestration with advanced workflow builders and customizable triggers that support both batch and real-time executions. Meanwhile, a third vendor has distinguished itself through a modular architecture that allows customers to select discrete components-such as analytics and reporting or social media engagement-while maintaining unified data governance.

In addition to product differentiation, these companies are competing on the basis of ecosystem partnerships, offering prebuilt connectors to leading CRM and e-commerce systems, as well as developer-friendly APIs for custom integrations. Strategic alliances with cloud infrastructure providers have also become integral to delivering scalable solutions, particularly in regions affected by tariff-induced cost fluctuations. Furthermore, the competitive landscape is witnessing the emergence of niche specialists that offer highly tailored personalization engines or vertical-specific compliance modules, challenging the broader suites to continuously innovate. Ultimately, these movements reflect a dynamic vendor ecosystem committed to addressing evolving enterprise requirements and maintaining a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Engagement Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe, Inc.

- Alvaria, Inc.

- Avaya Inc.

- Braze, Inc.

- Calabrio, Inc.

- Capillary Technologies

- Freshworks Inc.

- Genesys Telecommunications Laboratories, Inc.

- IBM Corporation

- Microsoft Corporation

- MoEngage, Inc.

- NICE Ltd.

- Nuance Communications, Inc.

- OpenText Corporation

- Oracle Corporation

- Pegasystems Inc.

- Salesforce, Inc.

- SAP SE

- Twilio, Inc.

- Verint Systems Inc.

- Zendesk, Inc.

Providing Actionable Strategic Recommendations for Industry Leaders to Enhance Customer Engagement Platform Adoption and Achieve Sustainable Competitive Growth

Industry leaders seeking to stay ahead of the curve must adopt a multistep approach that begins with a clear alignment between engagement objectives and technology selection. First, organizations should conduct a comprehensive audit of existing workflows and data sources to identify integration gaps and automation opportunities. This foundational step ensures that any new platform will complement-and not duplicate-current investments, thereby maximizing return on technology spend.

Subsequently, decision makers should prioritize solutions that offer flexible deployment options, enabling them to pivot quickly between cloud models or on-premises configurations as business needs and regulatory landscapes evolve. By choosing platforms with both AI-based personalization capabilities and rule-based frameworks, enterprises can strike a balance between agility and governance. It is also advisable to leverage vendor ecosystems and prebuilt integrations to accelerate time to value, rather than relying solely on custom development.

Finally, organizations must invest in ongoing governance and skills development to sustain engagement initiatives. Establishing cross-functional teams that include marketing, IT, and data analytics experts can foster a culture of continuous optimization. Regular performance reviews, informed by descriptive, predictive, and prescriptive analytics, will help to refine messaging strategies and streamline customer journeys. Through this holistic approach, industry leaders can secure sustainable competitive advantages and drive meaningful returns from their engagement software investments.

Describing a Rigorous Research Methodology Combining Qualitative and Quantitative Approaches to Ensure Analytical Robustness and Data Integrity

The research methodology underpinning this study employs a blend of qualitative and quantitative techniques to ensure comprehensive coverage and analytical rigor. Initially, secondary research involved the systematic review of industry publications, regulatory filings, technology white papers, and credible independent reports. This background work established a knowledge base of market drivers, challenges, and emerging technologies.

Building upon this foundation, primary research was conducted through in-depth interviews with key stakeholders, including enterprise decision makers, technology vendors, and system integrators. These interviews provided firsthand insights into real-world deployment experiences, strategic priorities, and technology roadmaps. To add empirical precision, quantitative surveys were distributed to a broader sample of end users across multiple regions and industry verticals, capturing metrics related to adoption rates, budgetary allocations, and satisfaction levels.

Data synthesis involved triangulating findings from both primary and secondary sources, followed by validation sessions with subject matter experts. Advanced analytical models, including regression analysis and scenario planning, were employed to identify correlations between deployment strategies and performance outcomes. This rigorous process ensures that the conclusions and recommendations reflect validated industry perspectives and reliable data.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Engagement Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Engagement Software Market, by Component Type

- Customer Engagement Software Market, by Enterprise Size

- Customer Engagement Software Market, by Engagement Channel

- Customer Engagement Software Market, by Deployment Model

- Customer Engagement Software Market, by Industry Vertical

- Customer Engagement Software Market, by Region

- Customer Engagement Software Market, by Group

- Customer Engagement Software Market, by Country

- United States Customer Engagement Software Market

- China Customer Engagement Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Drawing Comprehensive Conclusions on the Evolution and Future Trajectory of Customer Engagement Software and Its Impact on Enterprise Success

The evolution of customer engagement software is characterized by a shift toward integrated, intelligence-driven platforms that can adapt to the dynamic needs of both enterprises and consumers. Over the past few years, advancements in AI and real-time data processing have accelerated the transition from reactive, campaign-based models to proactive, journey-focused architectures. This transformation has empowered organizations to anticipate customer needs, deliver hyper-personalized experiences, and foster long-term loyalty.

Looking ahead, the confluence of regulatory pressures, tariff-induced cost considerations, and emerging technologies such as conversational AI and augmented reality will continue to shape the market’s trajectory. Enterprises that cultivate a culture of continuous innovation-leveraging descriptive, predictive, and prescriptive analytics to drive decision making-will be best positioned to navigate these complexities. Moreover, as engagement channels proliferate, the ability to maintain cohesive, omni-channel experiences will be a critical differentiator.

Ultimately, customer engagement software is no longer a nice-to-have tool but a strategic imperative that underpins competitive resilience. Organizations that embrace the insights and recommendations outlined in this report will gain a clear advantage in crafting future-proof engagement strategies and unlocking sustainable growth.

Driving Immediate Acquisition with Personalized Engagement Through a Direct Call to Action to Contact Ketan Rohom for Exclusive Market Research Access

For a deeper exploration of the comprehensive market intelligence presented in this research and to secure privileged access to proprietary insights, please reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engaging with Ketan will provide you with tailored guidance on how to leverage these findings to drive strategic initiatives within your organization and to obtain the complete market research report. Take this opportunity to transform your customer engagement strategies with an authoritative resource that delivers clarity, depth, and actionable intelligence for optimal decision-making.

- How big is the Customer Engagement Software Market?

- What is the Customer Engagement Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?