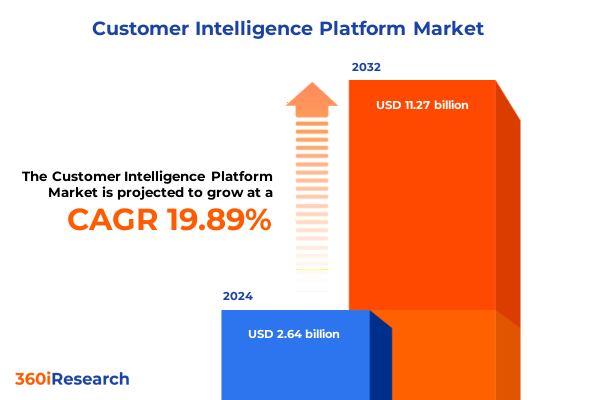

The Customer Intelligence Platform Market size was estimated at USD 3.15 billion in 2025 and expected to reach USD 3.72 billion in 2026, at a CAGR of 19.94% to reach USD 11.27 billion by 2032.

Unveiling the Power of Customer Intelligence Platforms to Elevate Engagement Profitability and Foster Agile Decision Making in Dynamic Markets

The customer intelligence platform (CIP) landscape has reached a critical juncture where data-driven engagement strategies are no longer optional for organizations seeking competitive differentiation. As enterprises amass exponentially growing volumes of customer data across digital and physical channels, the ability to translate complex datasets into personalized experiences has become paramount.

In this context, customer intelligence platforms serve as the nerve center for capturing, unifying, and analyzing customer behaviors to support real-time decision making. These platforms integrate advanced analytics, machine learning, and data management tools to deliver cohesive customer profiles that inform marketing, sales, and service functions.

Rapidly evolving customer expectations demand that businesses move beyond traditional segmentation approaches toward hyper-personalization, predictive engagement, and proactive service models. Against this backdrop, this executive summary outlines the transformative dynamics reshaping the CIP market, examines external factors influencing adoption, and highlights actionable insights derived from a rigorous combination of primary interviews and secondary research. Transitioning through segmentation strategies, regional nuances, and competitive benchmarks, this overview equips decision-makers with the essential context to navigate the complexities of modern customer intelligence.

How AI-Driven Personalization Real-Time Analytics and Data Privacy Regulations Are Reshaping Customer Intelligence Platforms for Unprecedented Impact

Customer intelligence platforms are undergoing profound transformation driven by the convergence of artificial intelligence, omnichannel integration, and heightened data privacy regulations. Advanced machine learning algorithms now ingest vast quantities of structured and unstructured data to detect patterns and predict behaviors, enabling marketers to craft hyper-personalized experiences at scale. Organizations that harness explainable AI ensure transparency in recommendation engines, building trust while delivering tailored interactions.

Simultaneously, the relentless demand for seamless omnichannel experiences has pushed platforms to weave together digital touchpoints, in-store interactions, and emerging channels such as voice-activated assistants and conversational AI agents. This integration allows data and insights to flow uninterrupted across channels, creating a unified customer journey. Companies leveraging real-time analytics can preemptively address customer needs, deploying AI-driven chatbots before frustration escalates.

Parallel to technological advances, regulatory landscapes such as GDPR, CCPA, and new AI governance frameworks are compelling businesses to prioritize data privacy and compliance. As privacy expectations intensify, platforms are embedding robust governance modules and consent management functions to uphold ethical data practices. This balance of personalization and privacy is redefining the value proposition of modern customer intelligence solutions.

Assessing the Broad Ripple Effects of the 2025 United States Tariff Measures on Customer Intelligence Platform Infrastructure and Operational Costs

The United States’ tariff measures enacted in early 2025 have introduced a new layer of complexity for businesses investing in customer intelligence infrastructures. A universal 10% reciprocal tariff on all imported goods was implemented on April 5, 2025, briefly vacated and then reinstated at the end of May, creating uncertainty for hardware procurement cycles.

Concurrently, Section 232 tariffs on steel and aluminum imports were increased to 50% on June 4, 2025, extending the impact to derivative goods used in server racks and networking equipment essential for on-premise deployments. Effective March 12, 2025, the 25% tariff on steel and aluminum applies across previously exempt markets, constraining supply chain flexibility and driving up capital expenditures for infrastructure-intensive solutions.

Additional levies include a 25% tariff on automobiles introduced on April 3, 2025, and a 30% tariff on Chinese imports in effect since May 14, 2025, which affects specialty components sourced from overseas manufacturers. Altogether, these measures have cumulatively increased total landed costs of CIP hardware and related services, prompting many organizations to revisit deployment models, accelerate cloud migrations, or renegotiate vendor agreements. The resulting shifts in procurement strategies and operating budgets underscore the importance of adaptable architecture and total cost of ownership assessments.

Unpacking Critical Segmentation Dimensions That Drive Personalized Customer Intelligence Solutions Across Components Applications Deployments and Industry Verticals

Segmenting the customer intelligence platform market by component reveals two primary pillars: services and solution platforms. Within services, managed offerings address ongoing optimization and support needs, while professional services deliver custom integrations, strategy development, and advanced analytics deployments. On the solution platform side, campaign management modules orchestrate multi-channel outreach, analytics engines surface deep customer insights, loyalty management drives retention programs, and personalization tools leverage real-time data to fine-tune experiences.

Application-based segmentation highlights the diverse functional roles of customer intelligence tools. Campaign management spans email marketing workflows and multi-channel program delivery, while customer analytics encompasses predictive modeling, recency-frequency-monetary analysis, and sentiment evaluation. Loyalty management solutions range from simple point-based schemes to tiered reward structures, and personalization engines operate through AI-driven dynamic content or rule-based frameworks.

Considering deployment, organizations may opt for cloud-native offerings hosted on shared public infrastructure, private cloud configurations for enhanced control, or hybrid environments that balance both. Community cloud models serve industry-specific consortia, private clouds cater to security-sensitive enterprises, and public variants enable swift scalability.

Enterprise size further defines market dynamics, with large corporations driving complex, global implementations; micro enterprises favoring lightweight, turnkey solutions; and small and medium businesses seeking flexible, cost-effective platforms. Lastly, vertical-specific needs shape the competitive landscape, as BFSI aligns banking and insurance use cases, healthcare tailors solutions for hospitals and pharmacies, IT and telecommunications address service provider demands, manufacturing supports automotive and electronics production cycles, and retail caters to both e-commerce and grocery channels.

This comprehensive research report categorizes the Customer Intelligence Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Application

- Organization Size

- Industry Vertical

Illuminating Regional Variations in Customer Intelligence Platform Adoption Spanning the Americas EMEA and Asia-Pacific Markets

The Americas region has emerged as an early adopter of customer intelligence solutions, driven by robust digital infrastructure, mature cloud ecosystems, and a high concentration of technology vendors. North American enterprises benefit from a deep pool of analytics expertise and a regulatory environment that balances innovation with data privacy mandates. Meanwhile, Latin American markets are accelerating cloud migrations and exploring localized loyalty programs to engage mobile-first consumers.

Europe, Middle East & Africa (EMEA) presents a heterogeneous landscape with varying levels of digital maturity. Western European countries lead in AI-driven personalization and compliance frameworks, while emerging markets in Eastern Europe and the Middle East are rapidly embracing cloud-based CI platforms to leapfrog legacy systems. African enterprises face connectivity challenges but demonstrate strong interest in mobile-centric loyalty and engagement models.

Asia-Pacific represents the fastest-growing region for customer intelligence adoption, fueled by digital commerce expansion, high smartphone penetration, and progressive government initiatives promoting digital transformation. Leading economies deploy advanced analytics for hyper-localized marketing, while Southeast Asian and South Asian markets rely on integrated loyalty and personalization to differentiate in competitive consumer segments. The convergence of fintech innovation and e-commerce growth in this region underscores its strategic significance for CIP vendors and buyers alike.

This comprehensive research report examines key regions that drive the evolution of the Customer Intelligence Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Customer Intelligence Platform Vendors and Emerging Innovators Shaping the Future of Data-Driven Engagement Strategies

A diverse vendor ecosystem powers the customer intelligence market, ranging from established enterprise suites to emerging point solutions. BuildBetter.ai’s platform has gained traction among product-focused teams by automating customer feedback loops, while Qualtrics XM stands out for its capacity to process billions of interactions annually and transform them into predictive insights. Salesforce Customer 360 continues to extend its CRM backbone with unified profiles and workflow automation, and Adobe Experience Platform leverages real-time data streams for dynamic journey orchestration.

Specialized innovators such as Gong.io and Leadspace address niche use cases in sales engagement and B2B buyer profiling, respectively, and tools like Mixpanel and Medallia carve out positions in product analytics and experience management. SymphonyAI’s AI-driven demand prediction and decision automation services have secured marquee clients and aim for a public listing, signaling strong investor interest in applied intelligence solutions.

Consolidation trends continue, as large technology firms pursue acquisitions to broaden their AI and data capabilities, while partnerships between cloud providers and analytics specialists integrate best-of-breed features into comprehensive offerings. This dynamic blend of proven incumbents and agile challengers underscores the competitive intensity shaping innovation trajectories across the customer intelligence platform landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Intelligence Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ActionIQ, Inc.

- Adobe Inc.

- Amperity, Inc.

- Audiense, Ltd.

- BlueConic, Inc.

- Brandwatch, Ltd.

- Google LLC

- HubSpot, Inc.

- Insider Inc.

- Intercom, Inc.

- Klaviyo, Inc.

- Microsoft Corporation

- Oracle Corporation

- Qualtrics, LLC

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Sprinklr, Inc.

- Tealium, Inc.

- Treasure Data, Inc.

Strategic Recommendations for Industry Leaders to Harness Advanced Analytics and Transformative Technologies to Strengthen Customer Intelligence Capabilities

Industry leaders should prioritize the integration of explainable AI frameworks to ensure transparency in automated decision-making, fostering customer trust and mitigating compliance risks. By embedding interpretability modules into analytics workflows, organizations can demystify algorithmic outputs and align recommendations with ethical standards.

To optimize total cost of ownership, businesses must evaluate the trade-offs between on-premise infrastructure and cloud-native deployments. A hybrid architecture can deliver both security and scalability, enabling critical workloads to remain on private environments while bursting analytics functions into the public cloud as needed.

Enterprises should also invest in modular loyalty and personalization engines that support dynamic segmentation and real-time execution. By empowering marketing teams with self-service analytics and campaign orchestration, organizations can accelerate time-to-market for targeted initiatives.

Finally, fostering vendor ecosystems through strategic partnerships and reseller networks extends implementation expertise and accelerates integration across ERP, CRM, and digital experience platforms. A collaborative approach ensures that customer intelligence capabilities are embedded within broader digital transformation programs, driving measurable business outcomes.

Rigorous Research Methodology Combining Primary Stakeholder Interviews Secondary Market Analysis and Robust Data Validation to Ensure Insight Accuracy

This study employed a rigorous multi-stage methodology to ensure the validity and relevance of its findings. Primary research included structured interviews and workshops with senior executives and decision-makers across leading enterprises, service providers, and technology vendors. These engagements provided firsthand insights into adoption drivers, deployment challenges, and investment priorities.

Secondary research encompassed a systematic review of industry publications, government trade notices, tariff databases, and credible technology blogs. Quantitative data on tariff measures and regulatory frameworks were sourced from official trade documents and corroborated via reputable news outlets. Market segmentation structures were verified through cross-comparison of vendor documentation and analyst reports.

Data validation procedures incorporated triangulation techniques, reconciling primary input with secondary sources to mitigate bias and ensure consistency. Insights were peer-reviewed by subject-matter experts to confirm factual accuracy and contextual relevance. This comprehensive approach underpins the reliability of the strategic recommendations and sector analyses presented in this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Intelligence Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Intelligence Platform Market, by Component

- Customer Intelligence Platform Market, by Deployment Model

- Customer Intelligence Platform Market, by Application

- Customer Intelligence Platform Market, by Organization Size

- Customer Intelligence Platform Market, by Industry Vertical

- Customer Intelligence Platform Market, by Region

- Customer Intelligence Platform Market, by Group

- Customer Intelligence Platform Market, by Country

- United States Customer Intelligence Platform Market

- China Customer Intelligence Platform Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding Insights Highlighting the Imperative of Adaptive Customer Intelligence Strategies to Navigate Complex Market Dynamics and Fuel Sustainable Growth

In conclusion, the customer intelligence platform market stands at the crossroads of technological innovation and shifting regulatory landscapes. Organizations that embrace advanced AI-driven analytics, prioritize data governance, and adapt to evolving tariff environments will be best positioned to deliver personalized and compliant customer experiences.

The conflation of real-time data processing, omnichannel integration, and transparent AI safeguards is defining the next wave of customer engagement strategies. Enterprises must leverage modular, scalable architectures and cultivate ecosystems that support rapid innovation and dynamic segmentation.

By synthesizing the insights contained in this executive summary, decision-makers can chart a clear course toward sustainable growth, improved loyalty metrics, and differentiated market positioning. Embracing a proactive, intelligence-driven mindset will enable businesses to turn customer data into a competitive advantage, navigating complexity with agility and foresight.

Take the Next Step: Connect with Ketan Rohom to Secure Your Comprehensive Customer Intelligence Market Research Report and Unlock Actionable Insights

Connect directly with Ketan Rohom to explore the full breadth of actionable insights captured in this comprehensive market research report. By engaging with an experienced sales and marketing professional, you can discuss how these findings align with your organization’s specific challenges and objectives.

Gain clarity on the strategic pathways laid out in each section and understand how advanced customer intelligence platforms can elevate your business performance. Ketan Rohom is ready to guide you through the report’s detailed analyses, from segmentation and regional perspectives to tariff impacts and technology trends. This personalized conversation will help you identify the most relevant insights to prioritize for your growth initiatives.

Don’t miss the opportunity to leverage exclusive research outcomes that illuminate competitive dynamics, vendor capabilities, and transformative shifts shaping the customer intelligence platform landscape today. Contact Ketan Rohom to secure your copy of the report and schedule a briefing tailored to your unique requirements. Unlock the strategic advantages of data-driven engagement by taking this next critical step toward informed decision-making and sustained market leadership.

- How big is the Customer Intelligence Platform Market?

- What is the Customer Intelligence Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?