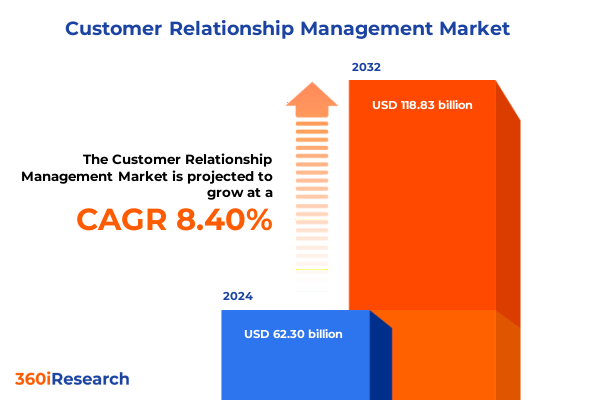

The Customer Relationship Management Market size was estimated at USD 67.55 billion in 2025 and expected to reach USD 72.83 billion in 2026, at a CAGR of 8.40% to reach USD 118.83 billion by 2032.

Setting the Stage for Modern Customer Relationship Management Success in an Era of Digital Transformation and Unprecedented Market Complexity

In today’s hypercompetitive business environment, the ability to cultivate and sustain meaningful customer relationships has become a defining factor for success. Organizations across industries are grappling with rapidly shifting customer expectations, the proliferation of digital channels, and intensifying regulatory scrutiny around data privacy and security. As technology continues to evolve, businesses must not only manage vast volumes of customer data but also derive actionable insights that drive personalized experiences and foster long-term loyalty.

Amidst these pressures, Customer Relationship Management (CRM) emerges as both a strategic imperative and a catalyst for growth. Beyond serving as a repository for contact information and interaction history, modern CRM platforms now harness artificial intelligence, advanced analytics, and unified data architectures to predict customer needs, automate critical workflows, and orchestrate seamless omnichannel experiences. This transformative potential makes it essential for decision-makers to understand the current landscape, identify key inflection points, and chart a roadmap that aligns technology investments with broader organizational goals.

Harnessing AI, Unified Analytics, and Agile Customization to Redefine Customer Relationship Management for the Digital-First Enterprise

The CRM landscape is undergoing profound transformation, driven in large part by the integration of artificial intelligence. Sophisticated AI use cases-ranging from automated lead scoring and predictive sales forecasting to contextual chatbots and sentiment analysis-are reshaping how organizations engage prospects and customers. These capabilities enable businesses to personalize communications at scale, accelerate decision-making, and free teams from routine tasks, allowing them to focus on strategic initiatives and relationship building.

Parallel to AI-driven enhancements, advanced data analytics are empowering enterprises with deeper customer insights and strategic foresight. By unifying data across multiple sources-including transaction histories, social media interactions, and feedback channels-organizations can identify emerging trends, optimize the customer journey, and uncover new revenue opportunities. This data-centric approach underpins real-time dashboards and predictive models that elevate operational agility and support proactive decision-making.

Finally, the pursuit of seamless omnichannel experiences and agile customization has catalyzed the adoption of low-code/no-code platforms and privacy-centric design. CRM systems are evolving into unified hubs that integrate web, mobile, social, and in-person interactions while maintaining compliance with global data regulations. As organizations embrace democratized customization through intuitive drag-and-drop development environments, they can rapidly tailor workflows and interfaces to changing business requirements-delivering cohesive experiences without extensive IT overhead.

Unraveling the Extensive Consequences of the 2025 U.S. Tariff Measures on IT Infrastructure, Procurement Strategies, and Cloud Adoption

The cumulative impact of U.S. tariffs implemented in 2025 has introduced notable headwinds for businesses reliant on global supply chains and imported IT hardware. With tariffs on Chinese imports reaching as high as 145%, companies faced steeper costs for essential technology components such as servers, networking equipment, and endpoint devices. These import taxes translated into price increases that ranged from 5% to 20% for critical infrastructure, compelling enterprises to re-evaluate procurement strategies and pass through higher costs to end-users.

Beyond hardware, the ripple effects on software deployments and cloud initiatives should not be underestimated. As on-premises equipment became more expensive, many organizations accelerated their shift to cloud-based SaaS models to hedge against rising capital expenditures. However, increased networking and data center costs due to tariffs on routers, switches, and wireless infrastructure indirectly elevated operational expenses for public cloud usage. The dual pressures of hardware tariffs and elevated service costs prompted a rebalancing of digital transformation roadmaps.

In response, industry leaders have pursued a multifaceted resilience strategy. Vendor diversification emerged as a priority, with procurement teams expanding partnerships to include suppliers located in non-tariff-impacted regions and nearshoring select manufacturing operations. Life-cycle extension programs were strengthened through preventive maintenance and software optimizations, delaying costly refresh cycles by up to 18 months. Meanwhile, hybrid infrastructure models gained traction as organizations sought to optimize workloads across cloud and on-premises environments, maximizing cost efficiency while preserving performance and compliance requirements.

Illuminating Key Segmentation Dimensions Across Deployment, Functionality, Industry Verticals, and Organizational Scales to Guide CRM Strategy

Comprehensive CRM evaluation demands a nuanced understanding of how solutions perform across diverse deployment models, functionality tiers, and customer use cases. Deployment mode segmentation reveals a growing preference for cloud installations-encompassing infrastructure, platform, and software as a service-driven by the agility and scalability they offer. Nonetheless, single-tenant and multi-tenant on-premises architectures continue to serve organizations with stringent data residency or integration demands.

Solution type distinctions underscore the pivotal role of professional services alongside core software platforms. Consulting engagements guide implementation strategy and change management, implementation services translate requirements into tailored configurations, and support and maintenance services ensure ongoing system health and optimization. Application segmentation further clarifies system usage, with analytical, collaborative, and operational CRM modules addressing customer segmentation, channel management, and sales and service execution.

Industry-specific adoption patterns highlight the criticality of vertical alignment in CRM functionality. From banking and insurance in the BFSI sector to patient engagement in healthcare, discrete and process manufacturing, retail commerce channels, and telecom network operations, each vertical imposes unique requirements on CRM capabilities. Finally, scaling considerations across small and medium enterprises versus large organizations shape platform selection priorities, with larger enterprises often requiring advanced integration, security, and governance features.

This comprehensive research report categorizes the Customer Relationship Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Organization Size

- Deployment Mode

- Application

- End User Industry

Exploring Regional Dynamics of CRM Adoption Highlighting Leadership in the Americas, Growth Drivers in EMEA, and Rapid Digitalization in APAC

The Americas continue to lead global CRM adoption, registering the highest spend per employee and commanding a substantial share of the global market. In 2025, the Americas are projected to generate over fifty-five billion U.S. dollars in CRM software revenue, underpinned by robust digital transformation investments and high SaaS penetration in both mature and emerging markets. The United States remains the epicenter of innovation, driving demand for predictive analytics, AI-enabled customer engagement tools, and verticalized cloud solutions.

Across Europe, the Middle East, and Africa, adoption trajectories exhibit regional nuances driven by industry concentration, regulatory environments, and infrastructure maturity. Western European economies have embraced cloud-first CRM deployments-particularly in manufacturing and retail sectors-while regulatory rigor around data privacy in the region underscores the importance of privacy-by-design architectures. Meanwhile, Middle East and African markets are rapidly digitalizing, with financial services and telecommunications emerging as early adopters bolstered by government modernization initiatives.

Asia-Pacific presents the fastest growth outlook, fueled by expanding e-commerce ecosystems, rising digital literacy, and governmental support for innovation. China, India, and Southeast Asian markets are investing heavily in AI-infused CRM platforms to enhance customer loyalty and retention. Agile, cloud-native solutions are displacing traditional on-premises systems, and partnerships between global vendors and local integrators are accelerating deployments in sectors ranging from manufacturing to consumer goods.

This comprehensive research report examines key regions that drive the evolution of the Customer Relationship Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Analysis of Market Leaders Demonstrating AI-Driven Innovation and Industry-Specific Strategies Among Top CRM Providers

Salesforce remains the undisputed leader in CRM, holding a commanding market share exceeding twenty-three percent globally. The company’s continuous investment in agentic AI-branded as Agentforce-and its integration of Einstein GPT across sales, service, and marketing clouds have fortified its competitive position. High-profile customer success stories, such as the deployment of autonomous AI for web inquiries at leading enterprises and a reported eighty-four percent resolution rate of support tickets, underscore the transformative impact of Salesforce’s AI strategy. As verticalized cloud solutions gain traction, Salesforce is leveraging its robust partner ecosystem and prebuilt industry templates to drive rapid adoption across regulated sectors.

Microsoft Dynamics 365 follows as a formidable challenger, capturing approximately fifteen to eighteen percent of the global CRM market. With deep integration into the Microsoft ecosystem-spanning Azure, Microsoft 365, and the Power Platform-Dynamics 365 differentiates itself through a unified data model and native productivity enhancements. Recognition as a Leader in the Q1 2025 Forrester Wave for CRM, coupled with innovative Copilot AI agents for sales qualification and case management, has reinforced Microsoft’s momentum. Strategic emphasis on industry-specific vertical solutions further cements Dynamics 365’s position among enterprises seeking end-to-end business application integration.

Oracle, SAP, and Adobe also deliver compelling CRM value propositions through distinct approaches. Oracle’s Fusion Cloud CX platform has introduced generative AI agents that streamline sales engagement and service workflows, bolstered by a cloud infrastructure growth rate surpassing fifty percent. SAP has pivoted to subscription-driven cloud services, with its Business AI offerings like Joule agents and an AI foundation underlying over two hundred forty embedded scenarios. Adobe’s Experience Cloud has expanded to include purpose-built AI orchestrators and GenStudio for scalable content production, driving thirty to fifty percent year-over-year growth in new customer acquisition. Collectively, these vendors illustrate diverse strategies for embedding AI and industry-specific capabilities into their CRM suites.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Relationship Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ActiveCampaign, LLC

- Adobe Inc.

- Apptivo Inc.

- Capsule CRM Ltd.

- Copper CRM, Inc.

- Creatio LLC

- Freshworks Inc.

- HubSpot, Inc.

- Insightly, Inc.

- Keap, Inc.

- Microsoft Corporation

- Nimble LLC

- Oracle Corporation

- Pipedrive, Inc.

- Really Simple Systems Ltd.

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- SugarCRM Inc.

- Zendesk, Inc.

- Zoho Corporation Pvt. Ltd.

Implement Strategic AI, Supply Chain Resilience, and Personalization Frameworks to Elevate CRM’s Impact Across the Enterprise

To thrive in this rapidly evolving CRM ecosystem, industry leaders must adopt a clear, multi-pronged action plan. First, organizations should accelerate AI adoption by prioritizing use cases that deliver immediate business value-such as predictive lead scoring, automated customer segmentation, and AI-driven chatbots-while simultaneously building data governance frameworks to ensure accuracy, transparency, and compliance. Closing the gap between AI intent and data readiness is essential, given that fewer than forty percent of enterprises report fully implemented data strategies.

Second, supply chain resilience must be embedded into IT procurement decisions. Businesses should expand their vendor portfolio to include domestic and nearshore suppliers, extend the lifecycle of existing infrastructure through preventive maintenance, and leverage hybrid deployment architectures to optimize cost and performance. By diversifying sourcing strategies and investing in cloud-native solutions, companies can mitigate the financial and operational risks introduced by tariffs and geopolitical uncertainties.

Finally, personalization and customer experience orchestration must remain central to CRM roadmaps. This entails integrating unified customer data platforms that consolidate behavioral, transactional, and engagement data, deploying low-code/no-code tools to accelerate workflow customization, and implementing robust privacy-by-design principles to build trust with end customers. As customers increasingly demand seamless, contextually relevant interactions across channels, these capabilities will differentiate market leaders and drive higher customer lifetime value.

Detailed Explanation of the Multi-Method Research Approach Combining Secondary Data Analysis, Primary Expert Interviews, and Triangulation Techniques

This research report is grounded in a rigorous methodology that combines comprehensive secondary research with primary insights from industry stakeholders. Secondary sources included proprietary databases, press releases, earnings filings, regulatory documents, and expert analyses to establish current market dynamics and technology trends. Primary research encompassed structured interviews with C-level executives, line-of-business leaders, and technology specialists to validate assumptions, capture implementation challenges, and identify emerging use cases. Data triangulation ensured consistency across qualitative and quantitative inputs, while cross-validation with multiple sources strengthened the accuracy of segmentation and competitive positioning. The findings were synthesized through a structured analytical framework, enabling clear articulation of strategic recommendations and regional insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Relationship Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Relationship Management Market, by Solution Type

- Customer Relationship Management Market, by Organization Size

- Customer Relationship Management Market, by Deployment Mode

- Customer Relationship Management Market, by Application

- Customer Relationship Management Market, by End User Industry

- Customer Relationship Management Market, by Region

- Customer Relationship Management Market, by Group

- Customer Relationship Management Market, by Country

- United States Customer Relationship Management Market

- China Customer Relationship Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding Reflections on Aligning Technological Innovation, Operational Resilience, and Customer-Centric Strategies for CRM Excellence in 2025 and Beyond

As CRM platforms continue to evolve from transactional repositories to intelligent, autonomous business hubs, organizations must navigate an increasingly complex landscape of technological innovation, supply chain uncertainties, and shifting customer expectations. The strategic integration of AI, unified analytics, and privacy-centric designs offers a clear path forward, enabling businesses to deliver personalized, seamless experiences at scale.

By aligning deployment strategies with market-specific segmentation, regional dynamics, and vendor capabilities, decision-makers can optimize investments and accelerate digital transformation. Whether advancing AI maturity, reinforcing supply chain resilience, or orchestrating omnichannel engagement, the imperative is clear: embrace agility, foster data-driven cultures, and partner with leaders who can translate vision into tangible customer impact.

Act Now to Secure Your Exclusive Access to the Complete CRM Market Research Report and Gain a Competitive Edge

To acquire comprehensive insights and detailed analysis tailored to your strategic needs, connect with Ketan Rohom, Associate Director, Sales & Marketing. Secure your copy of the market research report today to empower your organization’s CRM initiatives and navigate emerging challenges with confidence.

- How big is the Customer Relationship Management Market?

- What is the Customer Relationship Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?