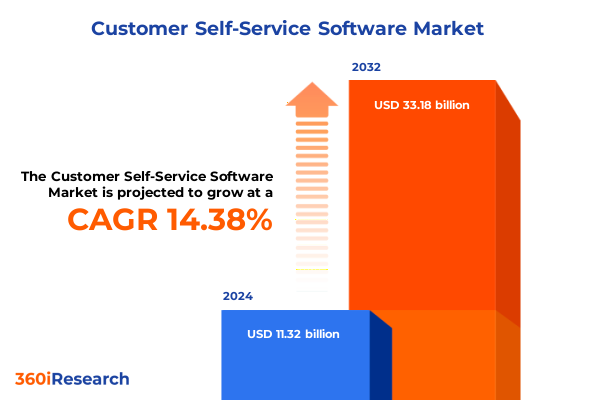

The Customer Self-Service Software Market size was estimated at USD 12.96 billion in 2025 and expected to reach USD 14.69 billion in 2026, at a CAGR of 14.36% to reach USD 33.18 billion by 2032.

Establishing the Imperative for Customer Self-Service Software as a Foundational Driver of Digital Engagement Operational Efficiency and Customer Empowerment

In today’s rapidly evolving business environment organizations are under intense pressure to offer seamless customer experiences while optimizing operational efficiency. Customer self-service software has emerged as a foundational pillar in addressing both objectives by empowering end users to find answers independently reducing support costs and enhancing satisfaction simultaneously. Transitional technologies such as artificial intelligence natural language processing and adaptive analytics now underpin modern self-service platforms transforming them from static knowledge repositories into dynamic conversational interfaces that anticipate needs and proactively deliver solutions. This shift reflects a broader demand for immediacy personalization and contextual relevance across every digital touchpoint.

As enterprises navigate an increasingly complex landscape of customer expectations and competitive differentiation strategies the adoption of self-service software represents a strategic imperative rather than a tactical enhancement. Whether it is reducing inbound support tickets accelerating onboarding processes or elevating customer engagement through contextual recommendations these platforms have become synonymous with digital maturity and operational excellence. By setting a standard for self-reliant interactions organizations can reallocate human expertise toward higher-value tasks foster innovation and cultivate loyal brand advocates who perceive the brand as intuitive efficient and customer-centric.

Unveiling the Fundamental Shifts Shaping Customer Self-Service Software from AI-Powered Automation to Omnichannel Integration Across Diverse Business Ecosystems

The customer self-service software landscape has undergone transformative shifts driven by breakthroughs in machine learning scalable cloud infrastructures and omnichannel integration strategies. Advanced automation capabilities now enable real-time resolution of routine inquiries through intelligent chatbots underpinned by deep learning models that continuously refine their responses based on user interactions. At the same time the fusion of self-service portals across web mobile and voice interfaces has repositioned the customer journey as a seamless continuum rather than a sequence of isolated touchpoints.

Equally significant is the move from monolithic on-premises deployments toward hybrid and multi-cloud architectures that offer both the agility of public cloud ecosystems and the control of private environments. This architectural flexibility grants organizations the ability to optimize performance security and compliance requirements while ensuring consistent user experiences. Moreover the integration of self-service platforms with enterprise systems such as customer relationship management and analytics suites has unlocked new dimensions of data-driven personalization ensuring that every customer interaction draws on a unified view of history preferences and sentiment.

Examining the Cumulative Impact of United States Tariffs Implemented Through 2025 on Customer Self-Service Software Supply Chains Technology Sourcing and Strategic Investment Choices

The imposition of tariffs on technology imports by the United States through the first half of 2025 has exerted upward pressure on hardware provisioning costs and cloud infrastructure expenditures critical to the deployment and maintenance of self-service solutions. Companies reliant on server hardware and networking equipment sourced from affected regions have experienced margin compression that, in turn, influences decisions between on-premises and cloud-based models. This dynamic has catalyzed a renewed emphasis on cloud adoption to mitigate capital outlays and circumvent supply chain constraints.

At the same time technology vendors have been compelled to reassess pricing structures contract terms and vendor relationships to accommodate increased input costs. Many have introduced subscription-based licensing models and consumption-based pricing to distribute cost increases over time and align vendor incentives with performance outcomes. As a result businesses are now evaluating self-service investments within a broader context of trade policy volatility with a keener appreciation for the role of flexible infrastructure strategies in buffering against future tariff escalations.

Deriving Critical Insights from Segmentation by Deployment Models Organizational Scale Channel Types Application Use Cases and Industry Verticals within Self-Service Software Markets

A nuanced examination of customer self-service software reveals distinct patterns across deployment models organizational scales channel types application purposes and industry verticals. When analyzing deployment options organizations are increasingly favoring cloud architectures including private cloud for heightened security controls, multi-cloud to leverage best-of-breed services, hybrid cloud to balance performance requirements, and public cloud to maximize scalability and cost efficiency. This spectrum of choices underscores the necessity of aligning technical environments with unique compliance, performance and operational agility needs.

Conversely organizational size remains a defining dimension of adoption complexity and resource allocation. Large enterprises tend to pursue comprehensive, end-to-end self-service ecosystems that integrate advanced analytics modules and virtual assistant capabilities, whereas small and medium enterprises often prioritize out-of-the-box solutions with rapid deployment cycles and minimal customization overhead. Similarly the choice of interaction channels-from web self-service portals to mobile apps, email support systems and conversational chatbots-reflects strategic objectives such as customer reach, cost containment and brand differentiation.

Within application categories customer analytics platforms are harnessed to uncover behavioral insights that inform content personalization and proactive outreach, while knowledge management systems ensure the governance and quality of information assets. Surveys and forums facilitate community-driven support and peer-to-peer engagement, and virtual assistants deliver intuitive conversational interactions that mirror human-like support. Across verticals from banking financial services and insurance to healthcare, IT and ITeS, retail and telecommunications, differentiation emerges through tailored feature sets compliance adherence and integration with industry-specific workflows.

This comprehensive research report categorizes the Customer Self-Service Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Channel Type

- Application Type

- Organization Size

- Industry Vertical

Deriving Strategic Regional Perspectives on Customer Self-Service Software Adoption Trends Across the Americas Europe Middle East & Africa and Asia-Pacific Market Dynamics

Geographic nuances profoundly influence the trajectory of customer self-service software adoption. In the Americas, robust digital infrastructure and a mature regulatory landscape have fostered accelerated uptake of omnichannel platforms and AI-driven virtual assistants that deliver personalized support at scale. By contrast Europe Middle East & Africa exhibit varied maturity levels with Western Europe leading through stringent data protection standards and advanced open banking initiatives, while Middle Eastern and African markets exhibit rapid growth fueled by mobile-first strategies and leapfrog adoption of cloud-native platforms.

Turning to the Asia-Pacific region, digital transformation agendas across major economies underscore a convergence of public sector modernization initiatives, burgeoning e-commerce ecosystems and an expanding middle class demanding seamless digital experiences. Governments in markets such as Australia, Japan and Singapore are championing self-service and automation to reduce public sector burdens, whereas emerging economies in Southeast Asia and India are embracing unified customer engagement platforms to differentiate in highly competitive consumer markets. These regional dynamics necessitate tailored go-to-market approaches that account for disparate infrastructure capabilities, regulatory environments and customer behavior profiles.

This comprehensive research report examines key regions that drive the evolution of the Customer Self-Service Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Competitive Dynamics and Strategic Priorities among Leading Customer Self-Service Software Vendors and Emerging Market Entrants Driving Innovation and Growth

The competitive landscape of customer self-service software features an evolving mix of global incumbents and specialized challengers bringing innovative capabilities to market. Leading vendors continuously invest in research and development to enhance natural language understanding, predictive analytics and cognitive search features that distinguish their platforms. At the same time, emerging entrants leverage open source frameworks and low-code development environments to expedite feature rollouts and integrate seamlessly with upstream CRM and downstream ticketing solutions.

Strategic partnerships and alliances have become pivotal as vendors seek to extend their footprints through system integrators cloud service providers and specialized consultancy firms. These collaborative ecosystems enable vendors to deliver end-to-end implementation services, mitigating customer risk and accelerating time to value. Furthermore, customer success frameworks emphasizing outcome-based metrics and co-innovation models are increasingly prevalent, reflecting an industry-wide pivot from transactional license sales to partnership-driven deployment strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Self-Service Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acquire Inc.

- Atlassian Corporation Plc

- BMC Software, Inc.

- Consolto Ltd.

- eGain Corporation

- Freshworks Inc.

- Gladly Software, Inc.

- HappyFox Inc.

- Help Scout, Inc.

- Kaseya Limited

- Kayako Limited

- Khoros, LLC

- KMS Lighthouse Ltd.

- Lithium Technologies, LLC

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- Sparkcentral NV

- Tidio LLC

- Verint Systems Inc.

- Zendesk, Inc.

- Zoho Corporation Pvt. Ltd.

Formulating Actionable Strategic Recommendations for Industry Leaders to Maximize Value Capture Through Customer Self-Service Software Adoption Innovation and Operational Excellence

To capitalize on the momentum behind customer self-service software, industry leaders should first align their technology roadmaps with overarching digital transformation goals. This entails prioritizing platforms that offer modular architectures and API-driven integrations to ensure seamless connectivity across the enterprise technology stack. In parallel organizations must cultivate cross-functional governance structures that bring together IT security compliance and customer experience teams to manage deployment risks and uphold regulatory standards.

Next, investing in data quality initiatives and user experience design will amplify the impact of self-service tools by ensuring that knowledge bases are current comprehensive and easily navigable. Organizations should also develop a robust change management strategy that emphasizes continuous learning and feedback loops, thereby driving user adoption and identifying areas for iterative enhancement. Finally, forging strategic vendor partnerships based on transparent performance metrics and outcome-oriented service level agreements will enable sustained innovation and alignment with evolving customer expectations.

Outlining the Comprehensive Research Methodology Employed to Unveil Insights into Customer Self-Service Software Trends Using Rigorous Data Collection Analysis and Validation Techniques

This research employed a multi-phased methodology designed to capture comprehensive insights into customer self-service software dynamics. Initially, a rigorous literature review was conducted across academic journals industry white papers and proprietary interviews with senior decision-makers to establish a foundational understanding of market drivers and technology evolution. Subsequently, a series of in-depth qualitative interviews with solution architects product managers and IT leaders provided contextual perspectives on deployment challenges and best practices.

Complementing these interviews, a quantitative survey of end users and corporate stakeholders validated hypothesis statements and quantified adoption patterns across deployment models, channel preferences and industry requirements. Data analysis techniques including thematic coding cluster analysis and cross-segmentation correlation mapping ensured that insights were statistically significant and actionable. Throughout this process, findings were subjected to multiple peer reviews and validation workshops with subject matter experts to maintain accuracy, relevance and strategic value.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Self-Service Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Self-Service Software Market, by Deployment Model

- Customer Self-Service Software Market, by Channel Type

- Customer Self-Service Software Market, by Application Type

- Customer Self-Service Software Market, by Organization Size

- Customer Self-Service Software Market, by Industry Vertical

- Customer Self-Service Software Market, by Region

- Customer Self-Service Software Market, by Group

- Customer Self-Service Software Market, by Country

- United States Customer Self-Service Software Market

- China Customer Self-Service Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Implications for Stakeholders on the Evolving Landscape of Customer Self-Service Software Solutions and Future Market Trajectories

The evolving customer self-service software landscape underscores a paradigm shift in how organizations engage with their audiences and optimize support functions. This study’s findings reveal that AI-driven automation, cloud-centric architectures and omnichannel integration are not only technology trends but strategic imperatives shaping competitive advantage. Equally important is the recognition that segmentation across deployment preferences organizational scales channel types application needs and industry verticals drives nuanced adoption strategies and value realization trajectories.

Regional disparities further highlight the need for context-sensitive approaches tailored to regulatory, infrastructure and customer behavior differences. Meanwhile, tariff-driven cost considerations underscore the strategic value of flexible infrastructure models and consumption-based pricing in buffering against policy volatility. By synthesizing competitive dynamics and actionable recommendations this report equips stakeholders with the insights necessary to navigate complexity, mitigate risks and harness the full potential of customer self-service software solutions in pursuit of operational excellence and elevated customer experiences.

Engage with Ketan Rohom Associate Director Sales Marketing to Unlock Full Market Research Insights and Drive Strategic Implementation of Customer Self-Service Software Solutions

If you are seeking a deeper understanding of customer self-service software trends and wish to leverage actionable insights for strategic advantage please reach out directly to Ketan Rohom Associate Director Sales & Marketing to purchase the comprehensive market research report tailored to your needs

Engaging with our research offering will provide you with a detailed analysis of market drivers technology adoption strategies and competitive positioning insights that will empower your organization to make informed decisions and unlock growth opportunities in the evolving self-service landscape

Contact Ketan Rohom today to explore report customization options pricing structures and delivery timelines ensuring you gain immediate access to the intelligence required to drive customer experience excellence and operational efficiency with confidence

- How big is the Customer Self-Service Software Market?

- What is the Customer Self-Service Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?