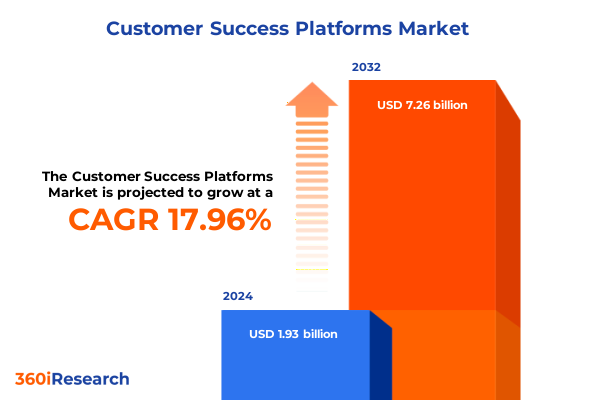

The Customer Success Platforms Market size was estimated at USD 2.28 billion in 2025 and expected to reach USD 2.67 billion in 2026, at a CAGR of 17.96% to reach USD 7.26 billion by 2032.

Unveiling the Strategic Imperatives and Market Dynamics Shaping the Future of Customer Success Platforms in Modern Enterprises

Organizations across industries face an escalating imperative to transform how they engage, retain, and expand relationships with customers. In response, customer success platforms have emerged as foundational technology stacks that unite data, automation, and human expertise to proactively guide customers toward value realization. This introduction establishes the importance of these platforms by highlighting the shift from reactive support models to holistic success-driven strategies that align service delivery with measurable business outcomes.

In today’s landscape, digital transformation initiatives have elevated customer experience to a strategic priority, with cross-functional teams demanding insight into usage patterns, health metrics, and renewal triggers. Adoption of customer success platforms addresses this need by centralizing disparate data sources-ranging from product telemetry to support tickets-thereby creating a single source of truth that fuels predictive analytics and personalized engagement. As enterprises navigate increasing competition and heightened retention targets, these platforms deliver both the technological backbone and the methodological framework necessary for scaling customer success functions.

This executive summary sets the stage for a deep dive into the forces reshaping the customer success platform ecosystem, the impact of recent policy shifts, and the actionable intelligence required to segment markets, assess regional dynamics, and benchmark leading providers. The ensuing sections offer an integrated perspective designed to equip decision-makers with the strategic insights and operational guidance necessary to harness customer success platforms as catalysts for sustained growth.

Navigating the Transformative Forces Redefining Customer Success Platforms in an Era of AI-Driven Personalization and Seamless Digital Experiences

Customer success platforms have undergone a profound evolution catalyzed by broader shifts in enterprise technology adoption and customer expectations. The advent of artificial intelligence and machine learning has redefined the way organizations anticipate customer needs, with predictive health scores and churn risk models now central to proactive engagement strategies. At the same time, seamless integration with core systems such as CRM, ERP, and help desk tools enables holistic visibility across the customer lifecycle, breaking down silos that historically impeded cross-functional collaboration.

Concurrently, digital-native business models have raised the bar for personalization, driving the demand for contextual, real-time engagement via in-app messaging, automated playbooks, and event-triggered workflows. These capabilities empower customer success teams to transition from labor-intensive manual outreach to data-driven orchestration of renewal campaigns and expansion conversations. Moreover, rising expectations for self-service and on-demand support have stimulated the incorporation of knowledge base platforms and community forums directly within the customer success architecture.

As remote and hybrid work models become entrenched, the need for cloud-first deployment and accessibility has intensified. Organizations require solutions that not only deliver robust functionality but also scale elastically and support distributed teams. This shift toward modular, API-driven platforms reflects a broader trend toward composable enterprise architectures, positioning customer success platforms as integral components of agile technology stacks rather than monolithic, closed systems.

Assessing the Ripple Effects of 2025 United States Tariffs on Customer Success Platform Adoption and Pricing Structures Across the Technology Ecosystem

In mid-2025, the United States government implemented new tariffs targeting a range of imported technology components and software services, a policy move that reverberated throughout the technology ecosystem. Customer success platform vendors reliant on hardware accelerators, international data center operations, or imported SaaS modules experienced increased supply chain costs. As a result, these providers have had to reassess pricing structures, renegotiate contracts with Channel partners, and in some cases localize infrastructure investments to mitigate the financial impact.

The tariff-induced cost pressures have translated into heightened procurement scrutiny among enterprise buyers. Many large organizations have extended evaluation cycles and demanded greater transparency on total cost of ownership, including ancillary expenses such as professional services, managed operations, and technical support. In response, vendors have strengthened their managed services portfolios and optimized support tiers to deliver predictable pricing. Strategic alliances with domestic system integrators and regional hosting providers have emerged as a hedge against future policy shifts, enabling smoother deployment across geographically diverse footprints.

Despite these headwinds, the industry has demonstrated resilience through innovation and operational agility. Alternative sourcing strategies have prioritized open-source technologies and modular licensing models that reduce dependency on imported components. At the same time, some vendors have leveraged the tariff environment as an opportunity to differentiate by offering turnkey packages that bundle software licenses with locally delivered services, thereby enhancing value and reinforcing customer trust in a volatile regulatory landscape.

Deriving Actionable Insights from Core Segmentation Dimensions to Illuminate Customer Success Platform Adoption Patterns and Preferences

Understanding customer success platform adoption patterns requires a deep dive into core segmentation dimensions that reveal nuanced preferences and investment rationales. From a component standpoint, the software layer remains the cornerstone of platform adoption, providing analytics engines, workflow orchestration, and user interfaces, while services complement these capabilities through managed operations, professional implementation expertise, and ongoing support services targeted at optimizing configuration.

The deployment dimension underscores a clear bifurcation: cloud implementations dominate new deployments by offering rapid time to value and seamless updates, but on-premise configurations retain their appeal in sectors where data residency and compliance requirements take precedence. Organizational size further differentiates adoption curves; large enterprises leverage comprehensive, customizable suites to standardize success processes across sprawling divisions, whereas small and medium enterprises gravitate toward packaged offerings that minimize setup complexity and deliver out-of-the-box best practices.

Industry verticals present distinct imperatives for platform capabilities. Financial services and telecommunications prioritize regulatory compliance and advanced analytics to monitor risk and usage patterns, government entities emphasize citizen experience and data sovereignty, while healthcare providers integrate into patient engagement workflows. IT and telecom vendors use these platforms to drive renewals, manufacturing firms focus on post-deployment service optimization, and retail companies harness usage insights to inform loyalty programs. Finally, end users within each organization-spanning customer support, marketing, product management, and sales teams-draw on tailored dashboards and automated workflows to align daily operations with broader retention and expansion objectives.

This comprehensive research report categorizes the Customer Success Platforms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Organization Size

- End User

- Industry

Uncovering Regional Nuances in Customer Success Platform Utilization and Growth Trajectories Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping how organizations select and deploy customer success platforms. In the Americas, the United States leads adoption with a mature ecosystem of cloud infrastructure, abundant capital allocation for digital initiatives, and a strong emphasis on customer lifetime value metrics, while Canada reflects similar trends on a slightly smaller scale, with additional focus on bilingual support requirements.

Europe, Middle East & Africa (EMEA) showcases a mosaic of adoption patterns, as Western European enterprises prioritize GDPR-compliant solutions and multilingual interfaces, while governments across the GCC invest in citizen success portals that leverage similar technology frameworks. In sub-Saharan Africa, nascent digital ecosystems drive interest in modular, scalable platforms that can adapt to inconsistent connectivity and integrate with mobile-first channels.

Asia-Pacific markets exhibit rapid uptake driven by aggressive cloud-first strategies in mature economies such as Australia and Japan, alongside fast-growing digital transformation agendas in China and India. Adoption in Southeast Asia is buoyed by government digitization programs and rising demand for customer retention tools among e-commerce and fintech vendors. Across the region, data privacy regulations and local hosting requirements encourage partnerships between global platform providers and regional data center operators to balance performance, compliance, and cost considerations.

This comprehensive research report examines key regions that drive the evolution of the Customer Success Platforms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Customer Success Platform Landscape Through Technological Differentiation and Strategic Alliances

Leading vendors continue to innovate across product capabilities, partnership ecosystems, and service offerings to differentiate in a competitive market. One prominent player has advanced its predictive analytics engine to deliver real-time health scoring powered by machine learning models that dynamically adjust based on feature usage trends and support interactions. Another innovator positions modular success microservices that allow enterprises to pick and choose capabilities-from renewal management to usage optimization-without committing to an all-or-nothing suite.

Some established CRM incumbents have deepened integration between their native customer success modules and core sales automation tools, enabling seamless data flows between health indicators and pipeline forecasting models. This tight coupling of success and revenue operations underscores a strategic pivot toward revenue orchestration. Meanwhile, specialist managed services firms bolster their offerings by embedding customer success playbooks within delivery frameworks, ensuring that technology adoption is accompanied by best-practice methodology and change management support.

A rising cohort of start-ups emphasizes user-centric design, offering intuitive dashboards that synthesize complex metrics into actionable recommendations tailored to distinct functional audiences such as customer support, marketing, product, and sales teams. These vendors often differentiate with transparent pricing, self-service onboarding, and prebuilt connectors to popular data sources, which accelerates time to value. Strategic alliances between platform vendors and cloud hyperscalers further enhance global reach and performance, creating a robust ecosystem that addresses both technical scalability and localized delivery requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Success Platforms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bolstra, Inc.

- Catalyst Software, Inc.

- ChurnZero, Inc.

- ClientSuccess, Inc.

- Custify Ltd.

- Freshworks Inc.

- Gainsight Software Private Limited

- Gainsight, Inc.

- HubSpot, Inc.

- Kapta, Inc.

- Pendo.io, Inc.

- SmartKarrot, Inc.

- Strikedeck, Inc.

- SuccessCOACHING, Inc.

- SuperOffice AS

- Totango, Inc.

- UserIQ, Inc.

- Vitally, Inc.

Empowering Enterprise Leaders with Strategic Recommendations to Maximize Customer Success Platform Value and Drive Sustainable Business Outcomes

To maximize the impact of customer success platforms, industry leaders should prioritize the integration of AI-driven analytics that surface predictive insights into account health and churn risk. Doing so enables proactive engagement and ensures that customer success teams allocate resources to high-value opportunities. It is equally important to unify data sources by establishing a robust data integration layer that ingests signals from CRM, support ticketing systems, product usage logs, and financial records to create a holistic customer view.

Organizations must develop personalized success plans tailored to the unique requirements of large enterprises and small-to-medium businesses alike, ensuring that service level agreements, communication cadences, and value-realization milestones align with stakeholder expectations. Empowering end users-whether in customer support, marketing, product, or sales functions-with contextual guidance through in-app playbooks and automated nudges enhances adoption and drives measurable outcomes. Cross-functional alignment is critical, so leaders should establish governance forums that bring together success, sales, and product teams to synchronize objectives and refine joint metrics.

Leaders should also conduct periodic total cost of ownership assessments that account for licensing fees, implementation services, managed operations, and ongoing support costs, thus enabling more accurate budgeting and ROI measurement. A phased roll-out approach, beginning with pilot deployments in high-value segments and expanding to additional regions or lines of business, allows organizations to gather feedback, refine best practices, and scale efficiently.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Validate Insights and Ensure Data Integrity in the Study

This study synthesizes insights derived from a multi-pronged research methodology designed to ensure both depth and rigor. The analysis commenced with extensive secondary research, reviewing industry publications, vendor whitepapers, regulatory filings, and financial disclosures to establish foundational knowledge of market drivers and vendor capabilities. These secondary insights informed the development of targeted primary research instruments.

Primary research comprised in-depth interviews with senior executives in customer success, sales, and marketing roles, alongside consultations with technology analysts and system integrators. Data triangulation techniques validated qualitative perspectives against quantitative metrics sourced from usage trend reports and publicly available procurement data. The research team employed a structured analytical framework to segment the market by component, deployment, organization size, industry vertical, and end-user persona, thereby illuminating distinct adoption patterns.

Throughout the process, stringent quality assurance measures-including cross-review by subject matter experts and editorial validation-were applied to maintain data integrity and ensure that insights reflect contemporary industry realities. The resulting framework integrates multiple lenses to present a cohesive narrative of customer success platform evolution, vendor strategies, and buyer considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Success Platforms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Success Platforms Market, by Component

- Customer Success Platforms Market, by Deployment

- Customer Success Platforms Market, by Organization Size

- Customer Success Platforms Market, by End User

- Customer Success Platforms Market, by Industry

- Customer Success Platforms Market, by Region

- Customer Success Platforms Market, by Group

- Customer Success Platforms Market, by Country

- United States Customer Success Platforms Market

- China Customer Success Platforms Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Synthesis of Key Findings Underscoring the Critical Role of Customer Success Platforms in Driving Organizational Excellence

The convergence of artificial intelligence, data integration, and shifting regulatory landscapes positions customer success platforms as indispensable engines of growth and retention for modern enterprises. While U.S. tariff measures introduced cost headwinds in early 2025, the industry’s innovative response-through cloud localization, managed services, and open-source adoption-highlights its capacity for resilience.

Segmentation by component, deployment, organization size, industry, and end user reveals that no single approach fits all scenarios; rather, success stems from aligning platform capabilities with unique operational contexts and stakeholder needs. Regional insights underscore the importance of compliance, performance, and localization, while competitive profiling illustrates how technological differentiation and partnerships can accelerate value realization.

Equipped with these insights and actionable recommendations, decision-makers are well positioned to select, implement, and optimize customer success platforms that drive measurable business outcomes, transform customer experiences, and sustain competitive advantage in an increasingly complex market.

Engage with Ketan Rohom to Secure Exclusive Access to Comprehensive Customer Success Platform Market Research and Empower Your Strategic Decisions

Join Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to gain exclusive insights and secure your organization’s competitive advantage by obtaining the comprehensive market research report tailored to inform strategic decisions in customer success platforms. Reach out today to begin a customized discussion on how the report’s in-depth analyses and actionable recommendations can empower your roadmap and accelerate measurable outcomes across customer engagement, retention, and expansion.

- How big is the Customer Success Platforms Market?

- What is the Customer Success Platforms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?