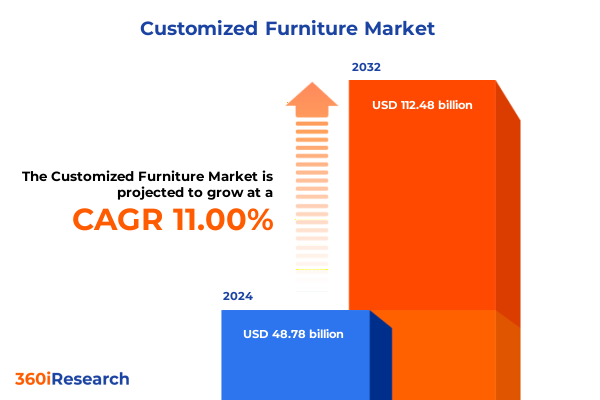

The Customized Furniture Market size was estimated at USD 54.16 billion in 2025 and expected to reach USD 59.73 billion in 2026, at a CAGR of 11.00% to reach USD 112.48 billion by 2032.

Discover How Customization Trends and Consumer Preferences are Redefining the Executive Outlook for Tailored Furniture Solutions in 2025

The executive summary offers a strategic lens on how demand for personalized and customizable furniture solutions is reshaping competitive dynamics and consumer expectations. Across residential, institutional, and commercial environments, a convergence of technological innovation, aesthetic aspirations, and operational efficiency has driven decisionmakers to prioritize tailor-made furnishings that reflect individual identity and functional needs. Today’s marketplace rewards companies that can bridge the gap between mass production and artisanal craftsmanship, delivering pieces that align with evolving lifestyles while maintaining costeffectiveness and sustainability.

Against this backdrop, this report synthesizes the primary forces redefining the landscape, from shifting consumer mindsets to new regulatory and trade scenarios. It highlights the transformative impact of digital design platforms, modular manufacturing techniques, and circulareconomy initiatives in accelerating product development cycles. By examining the cumulative effect of recent policy interventions and the nuanced interplay of regional dynamics, the summary equips executives with a holistic understanding of both challenges and opportunities. The aim is to empower stakeholders to craft strategies that leverage core competencies, harness emerging technologies, and foster collaborative networks for sustained growth.

Unpacking the Transformational Forces Shaping the Customized Furniture Market’s Competitive Dynamics and Innovation Priorities Across Segments

Industry leaders and innovators are navigating a period of extraordinary transformation driven by a wave of technologyenabled processes and shifting cultural norms. The rise of digital configurators and virtual reality showrooms has dismantled traditional barriers, allowing consumers to visualize and personalize every aspect of their furniture, from dimensions and colors to functional features and material overlays. In parallel, additive manufacturing and modular systems have reduced lead times and enabled justintime production, offering the agility necessary to respond to volatile demand patterns without compromising on quality or design integrity.

Moreover, sustainability has emerged as a defining criterion across the buyer journey, compelling manufacturers to integrate reclaimed woods, ecofriendly adhesives, and recyclable materials into core product lines. These environmental commitments are reinforced by transparent labeling and certification programs that validate green claims. Concurrently, the mainstreaming of subscriptionbased and ownership models underscores a shift in consumer philosophy, where access and lifecycle value often eclipse outright purchase. As a result, stakeholders must adapt their supply chains and aftersales services to support circular flows, refurbishment pathways, and endoflife disassembly.

Exploring the Compound Effect of Newly Imposed U.S. Tariffs on Imported Components and Finished Goods Within the Custom Furnishing Industry

The United States’ tariff adjustments implemented in early 2025 have had a material bearing on the cost structure of imported components and finished furniture goods. With duties raised on select raw materials-particularly exotic woods and composite materials-and an expanded tariff schedule covering finished items over specific price thresholds, manufacturers are confronting upward pressure on production expenses. Over the first half of 2025, many vendors have absorbed part of these increases to preserve market share, though endusers have begun to feel the ripple effect through higher delivered prices.

In response, leading companies are recalibrating their sourcing strategies, augmenting nearshore production capabilities and diversifying supplier bases to dilute the impact of concentrated tariff exposure. Some enterprises have renegotiated longterm contracts to lock in pretariff pricing or to leverage volume discounts that offset higher duty costs. Concurrently, product portfolios are being reengineered to reduce reliance on hightariff inputs, incorporating alternative materials and redesigning joinery techniques to maintain performance standards while controlling expenses. These tactical shifts underscore the necessity for robust scenario planning and continuous monitoring of policy developments, as further trade actions could alter the competitive equilibrium in the months ahead.

Deriving Strategic Intelligence from Diverse Product Types, Materials, End Users, and Distribution Channels That Drive Custom Furniture Demand

A nuanced understanding of product type segmentation reveals differentiated growth trajectories and innovation focal points. Bedroom furniture, encompassing beds and dressers, is experiencing heightened demand as consumers seek multifunctional units with integrated storage and smart lighting features. Kitchen furniture-specifically cabinets and countertops-is evolving toward modular islands and customizable storage configurations that cater to compact living environments and openplan layouts. In living room settings, sectional sofas and media units are being redefined through bespoke upholstery options and builtin connectivity ports. Office furniture is likewise benefiting from adjustable ergonomic solutions, while outdoor furnishings are integrating weatherresistant materials with tailored comfort elements.

Materialbased insights illustrate a pronounced shift toward wood derivatives that balance sustainability and aesthetic warmth, while metal frameworks offer structural versatility for contemporary silhouettes. Fabric coverings are increasingly engineered for stain resistance and antimicrobial performance, and glass accents are incorporated to impart a minimalist, highend look. Enduser segmentation indicates that residential buyers remain the primary adopters of fully tailored offerings, driven by lifestyle personalization and the proliferation of home office use. Institutional clients-such as hospitality and healthcare-are collaborating closely with manufacturers to develop standardized custom ranges that accelerate deployment timelines. Commercial tenants are focusing on branded design assets that reinforce corporate culture and employee wellness.

Examining distribution channels underscores a dual narrative: offline showrooms continue to provide tactile experiences and design consultations, while digital platforms facilitate seamless configuration journeys, realtime pricing, and rapid prototyping. The coexistence of both channels demands a cohesive omnichannel strategy that merges immersive inperson guidance with the efficiency and scalability of online interfaces.

This comprehensive research report categorizes the Customized Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

Unlocking Regional Growth Strategies by Examining Market Dynamics and Consumer Preferences Across Key Global Territories

Regional dynamics display pronounced variations in consumer behavior, regulatory environments, and supply chain configurations. In the Americas, North American markets are characterized by high consumer spending power and an accelerated embrace of ecommerce customization tools. Latin American territories, by contrast, are witnessing emerging interest in modular furniture solutions that reconcile urban density with aspirational design, albeit tempered by import duties and logistical bottlenecks.

Within Europe, Middle East & Africa, regulatory frameworks emphasizing product safety, chemical compliance, and circulareconomy obligations have galvanized manufacturers to adopt standardized processes for traceability and materials certification. Western European nations are leading in sustainable sourcing initiatives, while Gulf Cooperation Council states are investing in localized manufacturing hubs to reduce lead times and import dependency. African markets, though nascent, present longterm growth potential as infrastructure investments and rising disposable incomes enable broader access to premium custom furnishings.

Asia-Pacific remains a pivotal nexus of production and consumption. China continues to dominate component manufacturing capability, supplying a diverse range of wood substrates and hardware systems. Meanwhile, markets such as India and Southeast Asia are emerging as both competitively priced production centers and rapidly expanding end markets, driven by urbanization and rising middleclass preferences for personalized interiors. Australia and New Zealand showcase mature consumer bases with strong demand for ecocertified products and bespoke design collaborations.

This comprehensive research report examines key regions that drive the evolution of the Customized Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators Who Are Shaping the Competitive Landscape of Customized Furnishing Solutions

Key industry participants demonstrate a spectrum of strategic emphases, from heritage brands reinforcing artisanal craftsmanship to technologydriven disruptors optimizing mass personalization. Legacy manufacturers with established global footprints are capitalizing on brand equity and supply chain integration to offer premium customization tiers alongside flagship collections. Simultaneously, nimble entrants are leveraging digital platforms and automated production cells to reduce cycle times and enable localized fulfillment at scale.

Several market leaders have unveiled partnerships with software providers to enhance customer engagement through virtual showrooms, AIpowered design recommendations, and realtime fabrication tracking. Others are investing in advanced robotics and automated material handling to facilitate flexible batch runs. In addition, alliances between raw material suppliers and furniture producers are deepening, ensuring sustainable wood procurement and closedloop recycling initiatives. Venture capitalbacked startups are introducing novel business models-such as membershipbased lending of modular furniture-that challenge traditional ownership paradigms.

Collectively, these developments underscore a shifting competitive frontier where mastery of digital enablement, supply chain resilience, and sustainability credentials defines market leadership. Organizations that integrate these capabilities holistically will be positioned to capture shifting customer expectations and secure longterm value creation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customized Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baker Furniture Company

- Cappellini S p A

- Cassina S p A

- Christopher Guy Furniture Limited

- Decor Cabinets Ltd

- Durian Furniture India Ltd

- Ethan Allen Interiors Inc

- Furniture Roots India Pvt Ltd

- Godrej & Boyce Manufacturing Company Limited

- Herman Miller Inc

- IKEA Systems B V

- La Z Boy Incorporated

- Lehni AG

- Nilkamal Limited

- OPPEIN Home Group Inc

- Picket & Rail Pte Ltd

- Snimay Home Collection Co Ltd

- Steelcase Inc

- Urban Ladder Home Decor Solutions Limited

- Williams Sonoma Inc

Actionable Pathways for Executive Decision Makers to Leverage Customization Trends and Mitigate Supply Chain Challenges in Furniture

Industry leaders should prioritize investment in endtoend digital platforms that unify design configuration, virtual prototyping, and production scheduling into a single user experience. By integrating augmented reality tools into both online and instore environments, companies can reduce return rates and accelerate decision cycles, thereby boosting customer satisfaction and operational efficiency. Concurrently, diversifying the supplier base to include nearshore and allied regional partners will mitigate the risk posed by trade policy fluctuations and enable rapid response to changing duty structures.

In addition, embedding sustainability at the core of product development through ecocertified materials, takeback programs, and lifecycle assessments will not only satisfy regulatory requirements but also resonate with increasingly ecoconscious consumers. Collaborations with material innovators and recycling specialists can streamline circular flows and introduce new revenue streams through refurbishment services. Furthermore, expanding into emerging segments-such as smart office solutions and modular hospitality interiors-can unlock adjacent growth opportunities while leveraging existing design and manufacturing capabilities.

To operationalize these recommendations, executive teams should establish crossfunctional innovation councils that align R&D, supply chain, marketing, and customer success functions. Regular scenarioplanning workshops will ensure that tariff impacts and geopolitical shifts are factored into strategic roadmaps, preserving agility and competitive advantage.

Detailing the Robust Research Framework and Methodical Approach Behind the Comprehensive Custom Furniture Market Analysis

This report’s findings are underpinned by a multistage research framework that combines primary qualitative insights with rigorous secondary validation. Primary research involved indepth interviews with csuite executives, product development leaders, and procurement specialists across manufacturing, distribution, and enduser organizations. These dialogues explored key themes such as design customization, supply chain resilience, and sustainability practices.

Secondary research encompassed the systematic review of trade and customs databases, regulatory filings, industry white papers, and corporate disclosures to map tariff schedules, material certifications, and production footprints. The collected data were triangulated against macroeconomic indicators, housing and construction trends, and ecommerce adoption metrics to ensure contextual accuracy. Additionally, a panel of domain experts convened in a series of workshops to validate emerging hypotheses and stresstest strategic scenarios.

The segmentation schema-incorporating product type, material, end user, and channel analyses-enabled a granular assessment of demand drivers and competitive intensity across geographies. Rigorous quality checks and data verification protocols were applied at every stage to uphold the integrity of insights, ensuring that the final deliverables reflect the most current and reliable perspective on the customized furniture market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customized Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customized Furniture Market, by Product Type

- Customized Furniture Market, by Material

- Customized Furniture Market, by End User

- Customized Furniture Market, by Distribution Channel

- Customized Furniture Market, by Region

- Customized Furniture Market, by Group

- Customized Furniture Market, by Country

- United States Customized Furniture Market

- China Customized Furniture Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate Strategic Advantages and Future Directions in the Evolving Customized Furniture Sector Landscape

The synthesis of technological acceleration, tariff recalibrations, and evolving consumer priorities presents a powerful mandate for organizations to reimagine their strategic playbooks. By internalizing the core insights-ranging from modular manufacturing efficiencies and digital design platform integration to diversified sourcing approaches and sustainability imperatives-executives can chart a clear path toward competitive differentiation and resilient growth.

This report underscores that the future winners in customized furniture will be those capable of orchestrating seamless omnichannel experiences, embedding agility into supply chains, and fostering continuous innovation in materials and design processes. Moreover, regional nuances and the evolving landscape of trade policy demand constant vigilance and adaptability in strategic planning. Companies that invest in robust scenario planning, crossfunctional collaboration, and targeted market expansion will be optimally positioned to capitalize on the transformative shifts detailed herein.

Ultimately, the momentum behind customization is not a transient trend but a structural realignment of buyer expectations and manufacturing capabilities. Organizations that embrace this paradigm proactively will not only capture incremental market share but also establish enduring brand loyalty and operational excellence.

Seize Exclusive Insights and Drive Business Growth Today by Acquiring the In-Depth Customized Furniture Market Report Directly from Associate Director

Engaging with our in-depth report offers a strategic advantage for organizations seeking to capitalize on customized furniture trends and navigate complex multinational trade environments. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure exclusive access to comprehensive analysis, proprietary data, and forward-looking insights that will empower your team to make informed decisions and accelerate market growth. By partnering with our research team, you will benefit from expert guidance tailored to your unique business challenges and receive premium support for integrating findings into your strategic roadmap. Don’t miss this opportunity to transform your market intelligence into actionable strategy-connect with Ketan Rohom today to explore service options, pricing, and delivery timelines for the full customized furniture market report.

- How big is the Customized Furniture Market?

- What is the Customized Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?