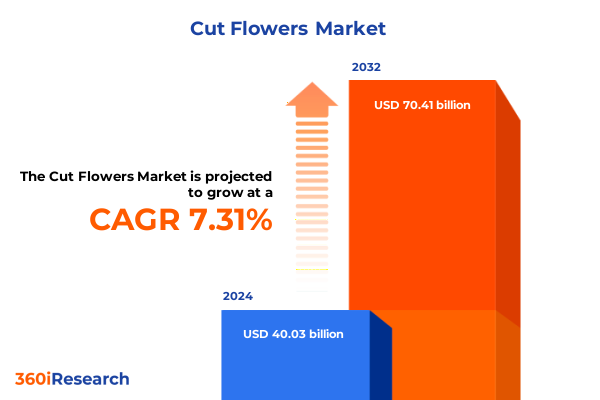

The Cut Flowers Market size was estimated at USD 42.53 billion in 2025 and expected to reach USD 45.18 billion in 2026, at a CAGR of 7.46% to reach USD 70.41 billion by 2032.

An in-depth exploration unveiling the critical dynamics shaping the global cut flower market and setting the stage for transformative executive insights

The global cut flower sector stands at a pivotal juncture as evolving consumer preferences and supply chain complexities converge to reshape industry priorities. Emotional resonance and social connection remain at the heart of floral purchases, yet decision-makers now face a mosaic of strategic considerations ranging from sustainable cultivation practices to logistics resilience. This executive summary delivers an integrated exploration of the forces redefining the cut flower landscape, weaving together historical context and forward-thinking analysis to equip stakeholders with actionable intelligence.

Through a lens of multidisciplinary insight, this summary begins by outlining the seismic shifts reverberating across production, distribution, and consumption channels. It then delves into the repercussions of recent trade policy adjustments that have reset cost structures and sourcing models. A nuanced segmentation review follows, illuminating how diverse flower types, organic cultivation, usage formats, channel strategies, and application contexts create differentiated value propositions. From regional market dynamics to corporate innovation narratives, each section builds upon the last, guiding readers through a coherent narrative arc. In closing, industry leaders will find targeted recommendations and an overview of the rigorous research methodology underpinning these insights, ensuring a transparent view into data integrity and analytical rigor.

Revolutionary transitions and emerging trends are redefining cultivation, distribution, and consumer behavior across the global cut flower value chain

The cut flower industry is undergoing a profound metamorphosis driven by technological adoption and shifting consumer behaviors. Digital platforms have emerged as pivotal enablers, with virtual exhibitions allowing growers and breeders to showcase novel varieties and extend market reach beyond traditional auction floors. For instance, leading breeders have introduced over a hundred new color palettes and vase-life–optimized cultivars, reflecting a strategic pivot toward innovation and differentiation. At the same time, real-time supply chain visibility tools have expanded cold-chain capabilities, enabling fresh stems to traverse longer distances without compromising quality.

Simultaneously, consumer engagement has shifted toward e-commerce interfaces and personalized subscription services, diminishing the seasonality constraints once inherent to brick-and-mortar florists. This democratization of access has amplified demand for unique and sustainably produced blooms, prompting both conventional and organic cultivation operators to refine resource-efficient growing methods and eco-friendly post-harvest protocols. Against this backdrop, capital investments in greenhouse automation and hydroponic systems are proliferating, signaling a strategic reallocation of resources toward controlled-environment agriculture. As a result, market participants are repositioning their portfolios to capture emerging revenue streams driven by technology-courting consumers and regulations that favor traceable and responsible sourcing.

Analysis of the 2025 United States tariff impositions on imported cut flowers affecting pricing, supply chain resilience, and strategic sourcing outcomes

As of April 2025, new United States tariff measures have imposed a baseline 10 percent levy on fresh cut flower imports from major producing nations, recalibrating cost pressures throughout the supply chain. Exemptions under USMCA preserve tariff-free access for Canadian and Mexican blooms, insulating this corridor from the broader global adjustments. Conversely, Colombian flowers, which previously benefited from a zero-duty arrangement, now incur the full 10 percent charge, while Ecuadorian imports carry a combined tariff of approximately 16.8 percent due to stacking on an earlier 6.8 percent Most-Favored-Nation rate. These revisions extend to ancillary inputs such as plant cuttings and starter materials sourced from Costa Rica, Guatemala, and Kenya, amplifying cost implications for domestic growers and importers alike.

The immediate financial impact has materialized in elevated wholesale pricing, with mixed bouquets retaining flexibility through adjustable stem counts to manage cost ratios, while single-variety bunches face the steepest consumer price shifts. Retailers report pre-planned Mother’s Day orders offered limited levers for rapid cost absorption, prompting supply-side actors to renegotiate terms and optimize logistics to mitigate margin erosion. In the longer term, these tariff developments may catalyze strategic sourcing recalibrations, encouraging accelerated investment in local production capacity, cold-chain infrastructure, and vertical integration models to attenuate exposure to geopolitical trade fluctuations.

In-depth exploration of how varying flower types, cultivation methods, usage categories, distribution channels, and applications collectively define market pathways

Cut flower market participants must navigate a tapestry of consumer preferences and operational paradigms, beginning with the rich variety of flower types in demand-from the timeless allure of roses and the spirited vibrance of gerbera to the refined elegance of orchids and the delicate charm of lisianthus. Each species commands unique cultivation requirements and end-use aesthetics, challenging producers to align breeding priorities with shifting performance criteria. Concurrently, growers are balancing conventional methods, exemplified by hydroponic systems and greenhouse-based fertilization regimes, against a burgeoning organic segment driven by consumer concerns over chemical inputs and environmental stewardship.

Beyond production, end-use considerations bifurcate into fresh stems celebrated for immediate visual impact and dried or preserved arrangements prized for longevity and design versatility. Distribution channels further segment based on service and scale, spanning traditional florists and specialized boutiques to mass-market hypermarkets, burgeoning online retail platforms, and expansive wholesale flower markets serving B2B clients. Finally, the application context-whether commercial installations for hospitality and corporate events or personal gifting and home décor-dictates logistical intricacies around fulfillment timelines, presentation standards, and packaging innovation. Collectively, these intersecting dimensions shape the competitive landscape, compelling stakeholders to develop finely tuned value propositions that resonate across each segment.

This comprehensive research report categorizes the Cut Flowers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Cultivation Method

- Usage

- Distribution Channel

- Application

Examination of regional trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific underscoring localized growth drivers and challenges

Regional landscapes within the cut flower industry exhibit distinct catalysts and constraints. In the Americas, the expansion of domestic production has been buoyed by substantial investments in advanced greenhouse technology, leading to periods-from mid-March through October-where nearly 70 percent of stems available in U.S. markets are American-grown, reducing exposure to international logistic volatility. This shift supports fresher product cycles and deepens local supply networks, even as seasonal import dependencies persist during off-peak months.

In Europe, Middle East and Africa, the legacy of the Dutch floricultural auction model remains a cornerstone, with leading cooperatives leveraging vast centralized facilities to orchestrate global price discovery and logistics optimization. Growers in key markets such as Kenya and Ethiopia benefit from established export corridors, though rising regulatory scrutiny around pesticide use and environmental footprints now demands greater traceability and compliance. Economic growth in Gulf Cooperation Council states is concurrently driving demand for premium and bespoke floral experiences in high-end retail and event venues.

Asia-Pacific markets are marked by surging domestic consumption and government-backed floriculture initiatives. China’s expanding middle class is fostering robust demand for cut flowers in urban centers, while India’s traditional gifting culture underpins year-round volumes. Investments in cold storage infrastructure and transportation networks are evolving to connect remote high-altitude growers with metropolitan consumers, reshaping distribution models and enabling new partnerships between local cooperatives and multinational retailers.

This comprehensive research report examines key regions that drive the evolution of the Cut Flowers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insight into leading corporate strategies and innovations from top global cut flower companies driving competitive advantage and shaping industry evolution

Leading companies across the cut flower sector have adopted distinct strategies to cement competitive positions and drive growth. Major breeders such as Dümmen Orange and Syngenta Flowers have accelerated R&D investments to introduce disease-resistant and vase-life-enhanced varieties, underpinned by licensing alliances that broaden global reach and portfolio depth. Meanwhile, cooperative auction giants continue to refine digital bidding platforms, integrating real-time quality assessment and logistics scheduling to streamline the flow of millions of stems through their global hubs.

Other participants are forging differentiated paths: Selecta One has embraced virtual showrooms to connect growers directly with international buyers, reducing transaction friction and amplifying exposure for emerging varieties. Ball Horticultural Company and Florensis, each boasting proprietary breeding clusters, emphasize sustainability through reduced input breeding programs and circular nutrient management. Additionally, vertically integrated operations such as Oserian Development Company layer farm-to-customer traceability systems with community empowerment initiatives, enhancing brand equity among socially conscious adopters. These convergent strategies underscore an industry where innovation, digital enablement, and responsible practices are increasingly prerequisites for market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cut Flowers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Australian Flower Group

- Ball Horticultural Company

- CamFlor, Inc.

- Champali Garden Pvt Ltd.

- Continental Flowers

- Danziger Group

- David Austin Roses

- Dümmen Orange Group

- Elite Flower

- Farm Fresh Flowers

- Florius Flowers

- Flowerflow Pty Ltd. by Vegpro Group

- Helix Australia

- Holland America Flowers, LLC

- Jet Fresh Flower Distributors, Inc.

- Karen Roses

- Marginpar BV

- Mellano & Company

- MULTIFLORA GROUP

- Primarosa Flowers by Zuri Group Global

- RoozenGaarde/Tulips.com

- Rosa Flora Limited

- Selecta Group B.V.

- Sher Holland B.V.

- Soex Flora Private Limited

- Sunshine Bouquet Company

- Syngenta AG

- Turkish Flower Group

- Van den Berg Roses

- Wans Roses

Strategic and actionable recommendations empowering industry leaders to optimize sourcing, enhance sustainability, and resilience in the cut flower value chain

To navigate current headwinds and seize emerging opportunities, industry leaders should prioritize strategic diversification of sourcing ecosystems. By blending domestic greenhouse capacity with targeted imports from tariff-advantaged neighbors, stakeholders can optimize cost structures while maintaining seasonal availability. Simultaneously, cultivating direct relationships with primary producers will enhance supply flexibility and foster collaborative quality improvements.

Investment in end-to-end supply chain transparency-leveraging digital traceability platforms and demand-forecasting algorithms-will enable more precise inventory management and minimize waste. Emphasis on expanded cold-chain capabilities and modular transport solutions can mitigate the risk of quality degradation during transit. From a product innovation standpoint, developing value-added offerings such as curated preserved flower collections can unlock new revenue streams and appeal to sustainability-minded consumers.

Collaborative industry initiatives that share best practices around tariff compliance, regulatory navigation, and sustainability benchmarking will strengthen sector resilience. Finally, fostering an integrated omnichannel presence-where online retail interfaces seamlessly complement brick-and-mortar partnerships-will ensure comprehensive market coverage, aligning brand experiences with shifting purchasing behaviors.

Overview of the research methodology integrating primary interviews, secondary data sources, and frameworks underpinning this cut flower market study

The insights presented in this summary are derived from a rigorous multi-phase research methodology. Primary data collection included in-depth interviews with senior executives across breeding, production, distribution, and retail segments, ensuring direct perspectives on operational challenges and strategic priorities. Secondary research encompassed analysis of international trade databases, tariff schedules, and peer-reviewed studies to triangulate quantitative trends and policy impacts.

Supplementing these efforts, specialized data providers and auction house reports furnished real-time transaction volumes and varietal performance metrics. An iterative validation process cross-checked emerging findings against publicly disclosed corporate reports and industry association briefs, maintaining analytical integrity. Finally, advanced frameworks-spanning value-chain mapping and risk-scenario modeling-underpinned the synthesis of actionable insights and recommendations. This methodological rigor ensures that stakeholders can place confidence in both the depth of qualitative understanding and the robustness of supporting evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cut Flowers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cut Flowers Market, by Type

- Cut Flowers Market, by Cultivation Method

- Cut Flowers Market, by Usage

- Cut Flowers Market, by Distribution Channel

- Cut Flowers Market, by Application

- Cut Flowers Market, by Region

- Cut Flowers Market, by Group

- Cut Flowers Market, by Country

- United States Cut Flowers Market

- China Cut Flowers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding exploration of executive insights revealing strategic imperatives and perspectives for stakeholders in the evolving cut flower industry landscape

This executive summary has unpacked the multifaceted dynamics that are reshaping the cut flower industry-from technological inflection points and evolving consumer expectations to trade policy shifts and segmentation nuances. The convergence of these forces underscores the need for agile business models that balance innovation with operational resilience. Strategic imperatives include reinforcing diversified sourcing networks, deepening digital integration across the value chain, and advancing sustainability commitments to meet mounting regulatory and consumer demands.

As regional markets continue to exhibit unique growth drivers and logistical constraints, stakeholders must tailor approaches that reflect localized conditions while maintaining global best practices. Leading companies demonstrate that success hinges on marrying breeding breakthroughs and digital customer engagement with transparent, collaborative supply chain relationships. Moving forward, organizations that proactively align investments in technology, sustainability, and cross-sector partnerships will be best positioned to capture value amid ongoing market evolution.

Connect with Ketan Rohom, Associate Director Sales and Marketing, to discuss your needs and obtain the comprehensive cut flower market research report

Connect with Ketan Rohom, Associate Director Sales and Marketing, to discuss your needs and obtain the comprehensive cut flower market research report provided by our expert team at your convenience

- How big is the Cut Flowers Market?

- What is the Cut Flowers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?