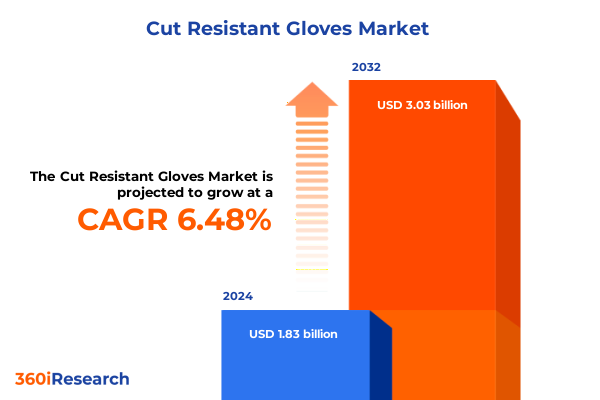

The Cut Resistant Gloves Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.06 billion in 2026, at a CAGR of 6.47% to reach USD 3.03 billion by 2032.

Comprehensive overview of the cut resistant gloves market highlighting evolving safety demands and emerging material innovations driving industry growth

Over the past decade, demand for cut resistant gloves has gained unprecedented momentum as organizations prioritize worker safety and compliance standards. With industrial activities expanding globally, the need for protective handwear has evolved beyond basic coverage to encompass advanced materials and ergonomic design. Consequently, manufacturers have directed significant resources toward developing solutions that offer superior cut resistance, enhanced dexterity, and reduced fatigue.

Moreover, shifting regulatory frameworks in key markets have raised the bar for safety equipment, compelling employers to reassess personal protective strategies and invest in higher-performance gloves. This heightened scrutiny has catalyzed innovation in fiber technology and coating compositions, accelerating the adoption of lightweight composites without sacrificing durability. As a result, the landscape now features an array of specialized products tailored to distinct operational hazards.

Against this backdrop, this executive summary synthesizes the most critical insights needed for informed decision making. It outlines transformative shifts in material science and supply chain dynamics, examines the cumulative impact of United States tariff measures in 2025, unveils segmentation and regional nuances, and highlights leading corporate strategies. By presenting these findings in a structured format, the summary aims to equip stakeholders with the knowledge required to navigate complexity and harness emerging opportunities in the cut resistant gloves domain.

Examination of transformative shifts in material technology and digital integration reshaping supply chains and elevating performance standards across the industry

In recent years, the cut resistant gloves market has undergone transformative shifts driven by breakthroughs in material engineering and the embrace of digitalized supply chains. Advanced composites such as high modulus polyethylene blends with metal fibers have redefined performance benchmarks, enabling gloves to deliver unprecedented levels of protection without compromising tactile sensitivity. At the same time, sustainability imperatives have guided development toward recyclable substrates and eco-friendly coatings, reinforcing the sector’s commitment to environmental stewardship.

Furthermore, the integration of Industry 4.0 principles has begun to reshape manufacturing and distribution practices. Real-time monitoring of production lines, predictive maintenance algorithms, and automated quality control systems now play instrumental roles in ensuring consistent product integrity. Meanwhile, digital platforms facilitate demand forecasting and inventory optimization, reducing lead times and minimizing stock-outs. Taken together, these developments are carving out a competitive landscape where agility and technical excellence form the cornerstones of success.

Transitioning from traditional paradigms to these dynamic models requires companies to reassess legacy processes and invest in cross-functional collaboration. From material suppliers to end-use partners, stakeholders must align on performance specifications, compliance protocols, and digital interoperability standards. In doing so, they can collectively unlock new avenues for differentiation, cost containment, and customer satisfaction.

Analysis of the cumulative impact of 2025 United States tariffs on input costs, supply chain strategies and competitive positioning in the cut resistant gloves market

The introduction of updated United States tariffs in 2025 has generated a ripple effect across the cut resistant gloves supply chain, significantly altering cost structures and strategic considerations. Tariffs on critical input materials, particularly stainless steel fibers and specialty polymer composites, have elevated procurement expenses. As a result, manufacturers have been prompted to reevaluate sourcing strategies, balancing the benefits of overseas production with the imperative to mitigate financial exposure.

Consequently, some producers have accelerated investments in domestic facilities, leveraging state-of-the-art equipment to process alternative raw materials that fall outside tariff classifications. This strategic pivot has not only dampened cost volatility but also shortened lead times, enabling swifter responses to sudden shifts in demand. Nonetheless, these adjustments involve upfront capital commitments and require close coordination with local regulators to ensure compliance with labor and environmental standards.

Moreover, distributors and end-use customers now face price adjustments that reflect the changed import duties. Many have negotiated revised contracts or explored value-engineering opportunities to maintain margin integrity. Looking ahead, the industry appears poised for continued evolution as stakeholders refine their supply chain frameworks, optimize material selections, and pursue collaborative partnerships to offset tariff impacts without compromising on performance criteria.

Insight into key market segmentation revealing how material composition, end-use industry demands, coating variations, glove designs and distribution channels drive market dynamics

Material composition has emerged as a primary differentiator in the cut resistant gloves market, with fiberglass and high modulus polyethylene leading the charge due to their lightweight profiles and high tensile strength. In parallel, Kevlar fibers continue to set industry benchmarks for multi-hazard protection, while stainless steel and metal fiber blends gain traction in extreme cut risk scenarios that demand the highest levels of abrasion resistance.

Simultaneously, end-use industry dynamics reveal distinct consumption patterns. Within the automotive and manufacturing sectors-especially chemical processing, electronics assembly, and metal fabrication-stringent safety regulations and precision work requirements have driven robust demand. Construction and oil and gas applications rely on heavy-duty gloves designed for rugged environments, whereas food processing mandates seamless compatibility between cut resistance and hygiene standards.

The choice of coating type further refines product performance. Foam nitrile coatings are winning favor in food handling settings for their combination of grip and breathability, while latex and nitrile options deliver cost-effective versatility across general assembly tasks. Polyurethane and PVC provide specialized protection in contexts where chemical exposure and puncture risks prevail.

Finally, glove style and distribution channel play critical roles in market outreach. Full finger designs remain the default solution for comprehensive hazard coverage, although fingerless variants capture a niche in light-duty functions and gauntlets serve high-exposure work zones. Distribution through e-commerce platforms has broadened accessibility, even as retail stores and wholesale distributors retain essential roles in delivering large-volume or region-specific orders.

This comprehensive research report categorizes the Cut Resistant Gloves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Coating Type

- Glove Type

- End-Use Industry

- Distribution Channel

Key regional insights into market dynamics across the Americas, Europe Middle East and Africa, and Asia-Pacific reflecting regulatory frameworks and growth opportunities

Regional analysis of the cut resistant gloves market underscores a range of divergent growth trajectories shaped by local regulations, industrial composition, and supply chain maturity. In the Americas, the United States and Canada stand out for their rigorous occupational safety frameworks, which compel widespread adoption of premium protective solutions. Mexico has emerged as a complementary manufacturing hub, offering cost efficiencies that appeal to North American distributors seeking to balance price and performance.

Shifting focus to Europe, the Middle East, and Africa, stringent EU directives have fostered a high-performance niche market in Germany, France, and the United Kingdom, emphasizing certifications and eco-friendly materials. The Middle East’s oil and gas sector continues to demand heavy-duty gloves engineered for extreme temperatures and abrasive environments. Emerging African markets are beginning to integrate cut resistant hand protection into large-scale construction and mining projects, laying the foundation for future expansion.

In the Asia-Pacific region, China and India remain dominant in global production, offering extensive capacities and a diverse materials base. Japan and South Korea differentiate themselves through rigorous quality control, technological integration, and development of premium high-performance fibers. Across Southeast Asia, growing industrialization in electronics, automotive, and food processing sectors fuels incremental demand, with local manufacturers increasingly partnering with international material innovators to meet evolving standards.

This comprehensive research report examines key regions that drive the evolution of the Cut Resistant Gloves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic overview of leading companies highlighting innovation initiatives, partnership strategies and competitive moves shaping the cut resistant gloves competitive landscape

The competitive landscape of the cut resistant gloves market is characterized by a handful of established global players and a rising contingent of specialized innovators. Leading companies have pursued aggressive research and development agendas to advance material science and introduce proprietary fiber blends that offer differentiated cut protection and ergonomic comfort. Strategic partnerships with raw material suppliers and coatings specialists have become commonplace as firms seek to secure reliable input streams and accelerate product cycles.

At the same time, mergers and acquisitions have reshaped the market structure, enabling larger entities to integrate specialized competencies and expand their geographic reach. Concurrently, nimble mid-tier manufacturers are carving out niche positions by focusing on industry-specific glove variants, such as anti-static models for electronics assembly or oil-resistant gauntlets for petrochemical applications. Across the board, digital marketing initiatives and e-commerce platforms have emerged as vital tools for enhancing customer engagement, shortening sales cycles, and collecting usage feedback that informs iterative design improvements.

Looking ahead, the companies that can seamlessly blend technological innovation with scalable production and keen market intelligence will secure the strongest positioning. Proactive engagement with regulatory bodies, investment in sustainable manufacturing methods, and a relentless focus on end-user ergonomics and safety requirements will differentiate winners from laggards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cut Resistant Gloves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adolf Würth GmbH & Co. KG

- Ansell Ltd.

- Atlas Protective Products

- Cromwell Group (Holdings) Limited

- Honeywell International Inc.

- Jarvis Products Corporation

- Karam Safety Private Limited

- Kite Packaging Group Limited

- Mechanix Wear LLC

- Merck KGaA

- Midas Safety Inc.

- NoCry

- PIP Global

- PPSS Group

- Scandia Gear

- STALSEN

- Sure Safety

- Tilsatec Limited

Actionable recommendations for industry leaders to capitalize on material advances, optimize supply chains and expand market reach in the evolving safety gloves sector

Industry leaders must embrace a proactive approach to capitalize on shifts in material technology and tariff environments while optimizing market penetration. Investing in research to develop next-generation composites and eco-friendly coatings will enhance product differentiation and align with tightening environmental regulations. Equally important is the strategic diversification of supply chains to mitigate the financial impact of fluctuating duties and reduce dependency on any single geographic source.

Furthermore, building out digital capabilities-especially predictive analytics for demand forecasting and online direct-to-end-user channels-can accelerate time to market and strengthen margins. Collaboration with certification bodies and safety organizations will ensure product compliance remains ahead of evolving standards, while developing ergonomic design solutions can drive higher adoption rates by addressing worker comfort.

By prioritizing targeted geography expansion, such as leveraging regional strengths in the Americas, EMEA, and Asia-Pacific, companies can capture growth pockets and build resilient distribution networks. Cultivating strategic partnerships, whether through joint ventures or technology licensing, will unlock new applications and broaden entry into specialized segments such as food processing and heavy-industry petrochemicals. Taken together, these initiatives will provide a roadmap for sustainable growth and robust competitive advantage.

Detailed research methodology outlining the combination of primary interviews, secondary sources, data triangulation and analytical frameworks employed to ensure accuracy

This analysis draws on a multi-tiered research methodology designed to ensure the highest degree of accuracy, relevance, and strategic value. Primary research included in-depth interviews with safety managers, procurement executives, and R&D leaders across key industries such as automotive manufacturing, construction, and food processing. These conversations provided firsthand perspectives on performance requirements, purchasing criteria, and emerging application challenges.

Secondary research involved a thorough review of regulatory documents, patent filings, technical standards, and industry journal publications to map historical trends and anticipated technological breakthroughs. Quantitative data points were sourced from publicly available customs and trade databases, augmented by proprietary supply chain analytics to identify shifts in production volumes and shipment patterns.

To validate findings, iterative workshops were conducted with senior stakeholders from major glove manufacturers and distribution partners. Feedback loops refined segmentation frameworks and regional assumptions, ensuring that insights reflect real-world complexities. Finally, a rigorous data triangulation process reconciled primary and secondary inputs, while peer reviews by subject-matter experts confirmed the integrity of analytical models and key conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cut Resistant Gloves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cut Resistant Gloves Market, by Material

- Cut Resistant Gloves Market, by Coating Type

- Cut Resistant Gloves Market, by Glove Type

- Cut Resistant Gloves Market, by End-Use Industry

- Cut Resistant Gloves Market, by Distribution Channel

- Cut Resistant Gloves Market, by Region

- Cut Resistant Gloves Market, by Group

- Cut Resistant Gloves Market, by Country

- United States Cut Resistant Gloves Market

- China Cut Resistant Gloves Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Conclusive synthesis of market trends, tariff implications, segmentation drivers and regional nuances informing strategic decision making for safety glove stakeholders

In conclusion, the landscape for cut resistant gloves is marked by rapid material innovation, shifting regulatory parameters, and evolving supply chain dynamics. Stakeholders must remain vigilant in monitoring developments such as high-performance fiber composites and eco-friendly coating technologies that redefine protection standards. Concurrently, the recalibration of sourcing strategies in response to 2025 tariff adjustments will influence cost management and production agility.

Segmentation insights reveal that distinct requirements across automotive, construction, food processing, manufacturing, and oil and gas sectors necessitate targeted product portfolios. Regional variances across the Americas, EMEA, and Asia-Pacific highlight the importance of localized strategies informed by regulatory frameworks and industrial growth trajectories. Competitive positioning will hinge on the ability to integrate research and development, operational excellence, and digital engagement.

By synthesizing these elements, organizations can chart a clear path forward-anchored in innovation, resilience, and customer-centric design. Robust strategic planning, underpinned by accurate market intelligence and actionable recommendations, will empower stakeholders to navigate uncertainty, optimize resource allocation, and seize emerging opportunities.

Call to action to connect with Ketan Rohom for acquiring comprehensive cut resistant gloves market research report and unlocking strategic business insights

At the heart of every strategic safety initiative lies access to precise, actionable market insights tailored to your unique business objectives. By engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, you gain privileged entry to the full breadth of our market research report on cut resistant gloves. His expertise ensures that organizations of all sizes can quickly align these findings with operational goals, whether optimizing procurement strategies, anticipating material cost fluctuations, or enhancing product development roadmaps.

Connecting with Ketan opens a direct channel for personalized consultations designed to address your most pressing challenges. Beyond simply acquiring a comprehensive document, you benefit from bespoke guidance on navigating tariff impacts, leveraging emerging materials, and identifying high-growth segments. This consultative approach transforms static data into dynamic strategies, empowering you to drive tangible improvements in safety protocols, cost management, and competitive positioning.

Take the next step toward deeper market intelligence by reaching out to Ketan Rohom today. He stands ready to discuss how this report can plug critical information gaps, illuminate hidden opportunities, and support your organization’s long-term growth trajectory in the cut resistant gloves sector. Secure your competitive edge now by initiating a conversation with an industry expert who can translate thorough research into real-world results.

- How big is the Cut Resistant Gloves Market?

- What is the Cut Resistant Gloves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?