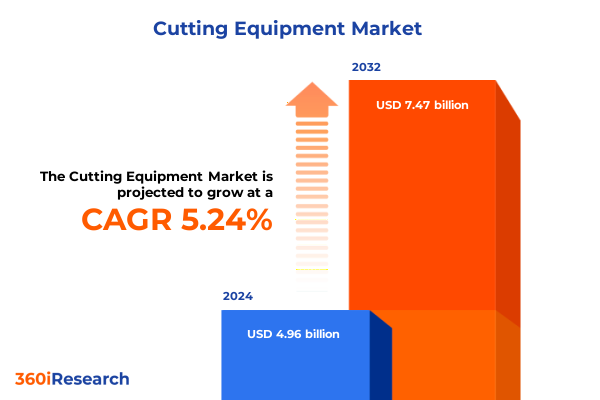

The Cutting Equipment Market size was estimated at USD 5.20 billion in 2025 and expected to reach USD 5.45 billion in 2026, at a CAGR of 5.30% to reach USD 7.47 billion by 2032.

How Cutting Edge Technological Advances and Strategic Digital Integration Are Reshaping the Global Precision Cutting Equipment Landscape

In an era where manufacturing precision and operational efficiency define competitive advantage, cutting equipment technology stands at the forefront of industrial transformation. The cutting equipment landscape encompasses an array of advanced machinery-from high-power fiber lasers to precision waterjets-each tailored to the rigorous demands of modern production. As global manufacturers strive to meet tightening tolerances, accelerate throughput, and minimize material waste, the selection and integration of cutting solutions become pivotal to maintaining profitability and fostering innovation. Transitioning from legacy oxyfuel systems to next-generation CNC‐driven laser platforms delivers substantial gains in speed, quality, and versatility, shaping investment priorities across sectors.

The evolution of cutting equipment has been propelled by digitization and automation across shop floors. Embedded sensors, real-time analytics, and closed-loop control systems have transformed standalone machines into interconnected nodes within smart factories. These technological advancements enable predictive maintenance, adaptive process optimization, and remote diagnostics, reducing unplanned downtime and driving sustainable improvements in machine utilization rates. Moreover, strategic partnerships between OEMs, software providers, and component specialists have accelerated the convergence of industrial Internet of Things (IIoT) frameworks with advanced cutting methods, setting the stage for a new wave of productivity enhancements.

Amid this rapid innovation, market participants face multifaceted challenges, including supply chain disruptions, escalating raw material costs, and evolving regulatory landscapes. However, these pressures have also spurred creative responses-ranging from vertical integration and localized manufacturing to modular equipment architectures that support faster changeovers. As the industry navigates the crossroads of digital transformation and material science breakthroughs, stakeholders equipped with a nuanced understanding of emerging trends and best practices will be uniquely positioned to capture market share and sculpt the future of precision manufacturing.

Exploring the Synergy of Fiber Laser Innovation Automation Integration and Sustainable Practices Driving Next Generation Cutting Equipment Evolution

The cutting equipment sector is undergoing several transformative shifts that are redefining performance benchmarks and rewiring competitive dynamics. A primary catalyst in this evolution is the widespread adoption of fiber laser technology, which has eclipsed traditional CO2 sources by delivering higher beam quality, greater wall‐plug efficiency, and lower total cost of ownership. Fiber lasers now form the backbone of operations in metal fabrication shops worldwide, empowering manufacturers to process thicker materials at higher speeds while reducing energy consumption and maintenance overhead.

Concurrent with hardware advancements, automation and robotics integration is accelerating the transition to fully autonomous cutting cells. By coupling cutting heads with articulated robots and flexible material handling systems, shop floors achieve shorter cycle times, enhanced repeatability, and reduced human exposure to hazardous processes. These automated solutions, underpinned by machine vision and artificial intelligence algorithms, facilitate seamless nesting, real‐time defect detection, and dynamic path planning, effectively transforming traditional production lines into agile, lights-out factories.

Sustainability imperatives are also reshaping buying criteria, as manufacturers and end users prioritize equipment that maximizes resource efficiency and minimizes environmental impact. Waterjet systems now frequently employ closed-loop water reclamation and abrasive recycling, while plasma systems incorporate advanced filtration to capture particulate emissions. Furthermore, the rise of hybrid cutting platforms-combining laser, plasma, and waterjet modules-enables single-machine versatility, reducing factory footprint and capital expenditures. These converging trends underscore a paradigm in which performance, connectivity, and environmental stewardship coalesce to unlock next-generation possibilities.

Analyzing the Multifaceted Consequences of Recent United States Tariff Policies on Cutting Equipment Supply Chain Resilience and Strategic Sourcing

In 2025, a series of tariff adjustments implemented by U.S. trade authorities has cumulatively reshaped the importing and sourcing strategies of cutting equipment manufacturers and end users alike. Building on previous Section 232 steel and aluminum tariffs, new duties targeted specialized machine tool components, cutting heads, and precision optics originating from key exporter countries. These incremental measures raised landed costs, compelling OEMs to reevaluate supply chain configurations, negotiate localized production agreements, and pursue duty mitigation strategies such as foreign‐trade zones and bonded warehouses.

The impact of these tariffs reverberates across the value chain, driving a deluge of nearshoring and onshoring initiatives as companies seek to insulate operations from geopolitical volatility. Domestic machine tool builders have capitalized on this reshuffling by expanding capacity, enhancing aftermarket networks, and investing in advanced manufacturing to repatriate critical production capabilities. Meanwhile, importers have navigated complexity by diversifying component sourcing to tariff‐exempt suppliers and leveraging preferential trade agreements under USMCA and other bilateral pacts to secure lower duty classifications.

Although input costs have risen, many industry participants have counterbalanced the burden through process automation improvements, lean manufacturing programs, and long-term supplier alliances. The strategic application of digital procurement platforms has enhanced visibility into landed cost structures, enabling procurement teams to optimize order quantities and timing. As these realignments continue to mature, stakeholders gaining mastery over tariff management and supply chain agility will secure stronger positioning for sustainable growth in the domestic cutting equipment marketplace.

Leveraging a Comprehensive Segmentation Framework Across Equipment Types Power Sources Control Systems Industries and Channels to Unlock Tailored Market Opportunities

A nuanced understanding of market segmentation reveals opportunities to tailor solutions across diverse equipment types, energy sources, control systems, machine footprints, industries, applications, and distribution channels. Segmentation by equipment type highlights distinct growth patterns: laser cutting encompasses subsegments such as Co2, fiber, and Nd:YAG platforms, each offering unique trade-offs in power, precision, and cost considerations; plasma systems range from conventional high amperage cutting heads to high-definition multi-stage torches that drive more intricate kerf profiles; while waterjet technologies span pure waterjet for less abrasive applications and abrasive waterjet for high-precision composite and metal cutting.

Power source segmentation further delineates market dynamics, as electrically powered machines dominate light to medium gauge operations for their efficiency, while hydraulic systems underpin high-force waterjets and pneumatic systems remain prevalent in specialized plasma applications. Control typology divides adoption between CNC architectures-favored for complex nested cutting paths and integrated CAD/CAM workflows-and manual setups that persist in entry-level workshops. Similarly, machine size varies from compact bench‐top units for low-volume job shops to large gantry systems optimized for heavy plate and structural fabrication.

End-user industry segmentation uncovers differentiated demand drivers. Aerospace manufacturers require micron-level precision and stringent quality protocols; automotive producers seek high throughput and consistency; the construction sector leverages cutting solutions for both commercial and residential projects; metal fabricators and job shops prioritize flexibility; and shipbuilders adopt high-capacity machines for structural steel applications. Application-based segmentation further isolates markets for pipe, plate, profile, sheet, and tile cutting, each with distinct cycle requirements. Distribution channels bifurcate between direct OEM sales through offline dealer networks and digital e-commerce platforms, underscoring the importance of omnichannel strategies. This holistic segmentation framework equips stakeholders to align product development, positioning, and service offerings with targeted market needs.

This comprehensive research report categorizes the Cutting Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Power Source

- Control Type

- Machine Size

- End User Industry

- Application

- Distribution Channel

Navigating Divergent Regional Market Dynamics Influenced by Infrastructure Investment Regulatory Incentives and Industrial Automation Trends

Regional dynamics exert a profound influence on competitive positioning, with distinct macroeconomic, regulatory, and technological factors shaping market evolution across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust infrastructure investments, an expanding advanced manufacturing base, and government incentives for domestic production have fueled demand for high-end laser and waterjet solutions. The region’s strategic focus on onshoring critical industries has bolstered OEM expansion of service networks and localized production facilities to meet stringent lead time requirements.

Within Europe, Middle East & Africa, a blend of established manufacturing powerhouses and emerging markets drives a heterogeneous landscape. Western European nations emphasize sustainability and digitization, investing in energy-efficient plasma and fiber laser platforms integrated with IIoT capabilities. Meanwhile, Middle Eastern energy projects and infrastructure development spur demand for large gantry systems capable of processing thick plate in shipbuilding and construction. Africa’s burgeoning fabrication sector, although nascent, offers long-term growth potential as governments prioritize industrialization and skills development.

Asia-Pacific remains the apex of production volume, underpinned by extensive metal forming industries in China, Japan, South Korea, and Taiwan. Competitive pressures and rising labor costs have catalyzed automation uptake, while government initiatives in Southeast Asia target technology transfer and advanced manufacturing clusters. The confluence of localized production, cost competitiveness, and rapid industrialization ensures that Asia-Pacific will sustain its role as both a manufacturing powerhouse and a critical export hub for cutting equipment.

This comprehensive research report examines key regions that drive the evolution of the Cutting Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Manufacturers Are Advancing Their Product Innovations Service Models and Strategic Collaborations to Gain Competitive Edge

Leading equipment manufacturers have responded to evolving market demands by strengthening their technology portfolios, expanding service ecosystems, and forging strategic partnerships. A prominent OEM renowned for pioneering fiber laser innovation has accelerated R&D to introduce multi-kilowatt systems with integrated beam shaping modules that enhance edge quality and throughput. This same provider has broadened its aftermarket offerings with subscription-based service models, remote monitoring capabilities, and rapid replacement part distribution to minimize downtime.

Another global player specializing in waterjet technologies has invested in hybrid machine designs, combining abrasive and pure waterjet heads on a single gantry to support a wider range of materials and applications. The firm’s recent collaboration with a leading software developer delivers seamless CAD/CAM integration and real-time performance analytics, enabling end users to optimize abrasive consumption and cycle times. Similarly, a key plasma equipment supplier has launched high-definition torches alongside advanced filtration systems to ensure compliance with tightening emissions standards.

In parallel, several mid-tier and regional machine tool builders have carved out niches by focusing on personalized service, rapid delivery, and flexible financing options. These companies capitalize on deep local market knowledge to tailor solutions for small and medium-sized fabricators. Their agility in adopting additive manufacturing for spare parts reproduction and embracing cloud-based maintenance platforms has allowed them to compete effectively against larger incumbents, underscoring the varied strategies shaping competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cutting Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amada Co., Ltd.

- Bystronic AG

- DMG MOR I Aktiengesellschaft

- Doosan Machine Tools Co., Ltd.

- Haas Automation, Inc.

- ISCAR Ltd.

- JTEKT Corporation

- Kennametal Inc.

- Komatsu Ltd.

- LVD Company nv

- Makino Milling Machine Co., Ltd.

- Mitsuboshi Belting Ltd.

- Okuma Corporation

- OSG Corporation

- Sandvik AB

- Trumpf GmbH + Co. KG

- Tungaloy Corporation

- Yamazaki Mazak Corporation

Empowering Industry Leaders with a Roadmap for Digitalization Resilience Sustainability and Collaborative Innovation Strategies

To thrive in the complex cutting equipment market, industry leaders should pursue a multifaceted strategy aligned with emerging trends and operational imperatives. First, accelerating digital transformation across equipment portfolios will enable real-time process optimization and service differentiation; investing in IIoT platforms, predictive analytics, and cloud-based maintenance portals will drive new recurring revenue streams while enhancing machine uptime. Transitioning from transactional sales to outcome-based subscription models can strengthen customer loyalty and open avenues for continuous innovation.

Second, building supply chain resilience is paramount; diversifying sourcing to include qualified regional partners, adopting tariff mitigation mechanisms, and leveraging advanced procurement analytics will reduce vulnerability to geopolitical disruptions. Establishing localized assembly and service hubs near key markets will satisfy lead time expectations and foster stronger client relationships. Third, sustainability must be integrated across product development and operational practices; designing energy-efficient cutting systems, promoting abrasive recycling, and adhering to stringent emissions compliance will meet both regulatory requirements and corporate social responsibility goals.

Finally, cultivating talent and fostering cross-functional collaboration between engineering, sales, and data science teams will expedite the translation of customer feedback into product enhancements. Forming partnerships with software developers, materials science innovators, and academic institutions will nurture an ecosystem of continuous improvement. By adopting these actionable recommendations, equipment manufacturers and end users alike can position themselves for long-term success amid shifting technological and market landscapes.

Employing a Multi Layered Research Approach Combining Secondary Analysis Primary Interviews Quantitative Surveys and Competitive Benchmarking

This research leverages a rigorous methodology designed to ensure comprehensive coverage and actionable insights. An extensive review of publicly available information provided the foundational understanding of technological advancements, regulatory changes, and macroeconomic influences. This secondary research encompassed industry reports, patent filings, trade publications, and regulatory documentation, establishing a solid baseline of market context and competitive positioning.

Primary research involved in-depth interviews with senior executives at OEMs, component suppliers, distributors, and end users across key regions. These interviews were structured to uncover strategic priorities, deployment challenges, and future investment plans, facilitating the validation of secondary findings. Additionally, structured questionnaires distributed to shop floor managers and maintenance teams yielded quantitative data on equipment utilization, maintenance cycles, and decision criteria.

Data triangulation was achieved by cross-referencing qualitative and quantitative inputs with financial disclosures, trade data, and aftermarket service records. Competitive benchmarking analyzed product portfolios, pricing models, and service offerings to identify best practices and gaps. Finally, iterative data review sessions with subject matter experts ensured the accuracy and relevance of key insights. This multi-layered research design underpins the credibility of the report’s findings and supports the derivation of robust strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cutting Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cutting Equipment Market, by Equipment Type

- Cutting Equipment Market, by Power Source

- Cutting Equipment Market, by Control Type

- Cutting Equipment Market, by Machine Size

- Cutting Equipment Market, by End User Industry

- Cutting Equipment Market, by Application

- Cutting Equipment Market, by Distribution Channel

- Cutting Equipment Market, by Region

- Cutting Equipment Market, by Group

- Cutting Equipment Market, by Country

- United States Cutting Equipment Market

- China Cutting Equipment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Technological Innovation Strategic Resilience and Customer Centric Models to Forecast the Future Trajectory of the Cutting Equipment Market

The cutting equipment industry is at a pivotal juncture, propelled by advanced laser, plasma, and waterjet technologies that are redefining performance thresholds. As digitization and automation continue to permeate manufacturing ecosystems, the emphasis on connectivity, sustainability, and precision will intensify, creating fertile ground for breakthrough innovations. Nevertheless, escalating geopolitical tensions and tariff measures underscore the necessity for supply chain agility and strategic sourcing initiatives.

Stakeholders equipped with a deep understanding of equipment type differentiation, regional dynamics, and evolving end user requirements will be better positioned to tailor solutions that address core operational challenges. The segmentation framework outlined within this analysis provides a roadmap for aligning product development and go-to-market strategies with the unique needs of aerospace, automotive, construction, and fabrication industries. Meanwhile, regional insights highlight the importance of localized service networks and regulatory compliance in fostering market penetration.

Looking ahead, manufacturers that invest in modular, hybrid architectures, integrate sustainable design practices, and embrace outcome-based service models will capture disproportionate value. Collaborative ecosystems that bridge hardware, software, and materials science domains will accelerate time to market and strengthen competitive moats. In aggregate, the interplay between technological innovation, strategic resilience, and customer-centric business models will define the next chapter in the cutting equipment market’s evolution.

Unlock Critical Market Intelligence with Personalized Access to Expert Sales Support for Cutting Equipment Market Research Insights

Eager to harness the strategic insights and competitive intelligence detailed throughout this report, decision makers are invited to engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure a comprehensive copy tailored to your organization’s priorities. By partnering directly with Ketan, you’ll gain access to extended analyses of technology adoption trajectories, customized deep dives into specific end user verticals, and dedicated support to interpret the implications for your unique operational footprint. Reach out today to schedule a consultation that will refine your market entry strategies, optimize your supply chain resilience, and elevate your product development roadmap. Let Ketan guide you through the process of acquiring this essential resource, ensuring you leave no strategic angle unexplored as you position your business for sustainable growth in the dynamic cutting equipment landscape

- How big is the Cutting Equipment Market?

- What is the Cutting Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?