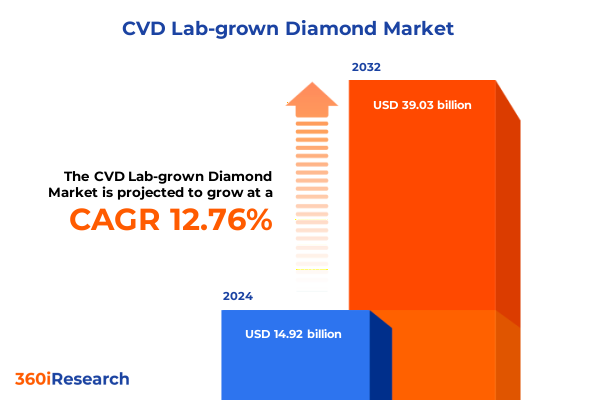

The CVD Lab-grown Diamond Market size was estimated at USD 16.87 billion in 2025 and expected to reach USD 18.50 billion in 2026, at a CAGR of 12.72% to reach USD 39.03 billion by 2032.

Exploring the Dynamic Rise of CVD Lab-Grown Diamonds as Cutting-Edge Sustainable Materials Revolutionizing Multiple High-Value Industry Applications

The field of Chemical Vapor Deposition (CVD) lab-grown diamonds has experienced a profound metamorphosis in recent years, driven by innovations in process control, reactor design, and material purity. Rather than replicating geological processes over millions of years, CVD technology enables diamond formation in controlled environments within days, leveraging hydrocarbon gas mixtures and plasma reactors. This shift from traditional mining underscores a new era in which precision engineering can generate gem-quality diamonds with predictable properties.

Beyond gem applications, the CVD process unlocks a spectrum of industrial uses, from high-performance cutting tools to advanced thermal management substrates. Its inherently lower environmental footprint compared to extractive mining resonates with eco-conscious consumers and manufacturers alike. Concurrently, advancements in color grading and inclusions have narrowed the quality gap between lab-grown and mined variants, bolstering confidence among jewelers, electronics firms, and research institutions. These developments point toward a future in which CVD diamonds redefine notions of value and sustainability across multiple verticals.

Unveiling Pivotal Technological Consumer and Sustainability Shifts That Are Redefining the Industry-Wide Competitive Landscape of CVD Lab-Grown Diamond Innovations

Technological acceleration has been at the forefront of the CVD lab-grown diamond narrative, with incremental improvements in plasma density control and substrate seeding driving higher yields and crystal clarity. This has coincided with a marked shift in consumer sentiment: a growing segment of end buyers views lab-grown diamonds as ethical alternatives, free from supply chain opacity and associated geopolitical risks. Consequently, luxury brands and boutique designers are integrating CVD diamonds into bespoke collections, reframing them as symbols of progress rather than compromise.

Parallel to consumer trends, corporate sustainability commitments have spurred procurement teams to favor lab-grown over mined diamonds in industrial tooling and semiconductor applications. Lifecycle assessments now frequently showcase lower carbon emissions for CVD production, reinforcing procurement guidelines that prioritize decarbonization. At the same time, digital platforms and augmented reality tools have democratized diamond selection, allowing buyers to visualize cut, color, and clarity in virtual environments. Together, these forces illustrate a transformative convergence of technology, ethics, and commerce that is reshaping the industry’s competitive contours.

Evaluating How Tariff Tranches and Reciprocal Duty Measures Imposed This Year Have Reshaped the Economics Supply Chains and Pricing Dynamics of CVD Lab-Grown Diamonds

Early in April of this year, a 10 percent base tariff on diamond imports took effect, followed by a reciprocal levy rising to 27 percent on lab-grown diamonds originating from major production hubs such as India. These tiered duties were intended to rebalance trade flows but instead introduced immediate cost pressures along the supply chain. Retailers reported passing through portions of the additional import duty to end customers, while some distributors accelerated shipments ahead of the full duty implementation to mitigate price volatility. In response, industry associations launched advocacy campaigns urging exemption based on diamonds’ unique value chain characteristics and the absence of domestic mining operations.

The cumulative effect of these duties has been a reconfiguration of sourcing strategies. Suppliers with diversified manufacturing footprints outside high-tariff jurisdictions were able to maintain more stable price structures, prompting a reevaluation of long-term partnerships. Conversely, producers in regions facing the steepest levies have explored cost-optimization initiatives, including vertical integration of cutting and polishing operations. Ultimately, the shifting cost calculus underscores the need for agile supply chains that can adapt to policy fluctuations while preserving the quality and traceability that define the CVD lab-grown diamond proposition.

Decoding Market Dynamics Through Application Profiles Carat Weight Varieties Product Type Differentiation and Omni-Channel Distribution Pathways in CVD Lab-Grown Diamond Sector

When examining application domains, CVD lab-grown diamonds have transcended traditional jewelry uses to deliver performance gains in electronics, where wafer and substrate integration enable enhanced thermal conductivity. Industrial applications have also surged, spanning high-precision cutting tools, optical windows and semiconductor substrates, as well as components for thermal management devices that benefit from diamond’s exceptional heat dissipation.

In the jewelry segment, consumer tastes have diversified beyond solitaire rings to include bracelets, necklaces and stud earrings that leverage lab-grown clarity and color consistency. Engagement rings with customizable carat weights between half and two carats remain a core offering, while larger stones above two carats and delicate under-half-carat settings cater to niche design preferences. Concurrently, a growing interest in fancy colored diamonds has opened new avenues for bespoke collections alongside the established market for colorless stones.

Sales channels reflect this complexity. Offline retail continues to serve high-net-worth customers seeking in-person certification and valuation, whereas online platforms facilitate broader reach, transparency and interactive selection tools. Wholesale distribution remains integral for industrial supply, enabling bulk procurement of standardized substrates. Together, these segmentation dimensions reveal a multifaceted ecosystem in which product attributes, application requirements and go-to-market strategies intersect to define competitive positioning.

This comprehensive research report categorizes the CVD Lab-grown Diamond market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Carat Weight

- Product Type

- Application

- Sales Channel

Illuminating How the Americas EMEA and Asia Pacific Regions Exhibit Distinct Drivers Adoption Trends Investment Dynamics and Value Propositions Within the CVD Lab-Grown Diamond Marketplace

Across the Americas, North American demand is closely tied to premium jewelry trends and consumer awareness campaigns emphasizing sustainability and ethical sourcing. Latin American markets are gradually embracing lab-grown alternatives, influenced by local gemological initiatives and growing confidence in certification processes that assure traceability and quality.

In Europe, the Middle East and Africa, heritage in natural diamond craftsmanship coexists with a burgeoning interest in innovative materials. Retailers in key Western European capitals have introduced dedicated lab-grown collections, while luxury conglomerates in the Middle East are leveraging CVD diamonds in bespoke high-jewelry pieces. In sub-Saharan Africa, pilot programs are exploring local manufacturing to capture higher value-add from the supply chain.

The Asia-Pacific region represents both a major production base and a vast consumer landscape. India’s established cutting and polishing infrastructure has begun to integrate CVD crystal cultivation, while Southeast Asian centers incubate specialized applications for electronics and thermal management. In East Asia, consumer-facing brands are driving demand for both colorless and fancy colored lab-grown stones through digital-first retail models. These regional nuances underscore the importance of tailored market strategies that reflect local regulatory frameworks, cultural preferences and supply chain capabilities.

This comprehensive research report examines key regions that drive the evolution of the CVD Lab-grown Diamond market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Innovators Producers and Collaborators Shaping the Future Trajectory of the CVD Lab-Grown Diamond Market

Leading participants in the CVD lab-grown diamond domain are deploying a combination of proprietary reactor designs, strategic partnerships and vertical integration to secure competitive advantages. One prominent producer has invested in next-generation microwave plasma reactors to enhance crystal homogeneity and reduce grain boundaries, thereby improving optical and mechanical performance.

Another key player has forged collaborations with electronics manufacturers to co-develop thermal management solutions that integrate diamond substrates at the wafer level. This partnership model not only accelerates time to market but also validates diamond’s role in high-reliability applications. In parallel, consumer-oriented brands are engaging directly with design houses, offering white-label lab-grown stones that underscore consistency in cut and color grading standards aligned with established gemological institutes.

Smaller innovators are assembling localized pilot facilities to serve niche markets, such as high-purity diamond films for semiconductor R&D and quantum sensing applications. Across the board, companies that blend deep technical IP with agile production capabilities are best positioned to navigate policy headwinds and capitalize on the expanding use cases for CVD lab-grown diamonds.

This comprehensive research report delivers an in-depth overview of the principal market players in the CVD Lab-grown Diamond market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adamas One Corp.

- Bonas & Co

- Brilliant Earth

- Chatham Created Gems

- D.NEA Diamonds

- Diamond Foundry Inc.

- Ethereal Green Diamond

- Finegrown Diamonds

- Greenlab Diamonds

- Hari Krishna Exports

- Krishna Diamonds

- Lusix

- Meylor Global

- New Diamond Technology

- Pure Grown Diamonds

- Scio Diamond Technology Corporation

- Trosman Diamond

- Washington Diamonds Corporation

- WD Lab Grown Diamonds

Formulating Pragmatic Strategic Recommendations for Industry Leaders to Navigate Regulatory Volatility Optimize Value Chains and Accelerate Innovation in CVD Lab-Grown Diamond Ecosystems

To thrive amid evolving regulations and competitive pressures, industry leaders should prioritize investment in advanced reactor technologies that yield higher crystal uniformity and throughput. Strategic diversification of manufacturing geographies can mitigate exposure to tariff fluctuations while fostering local partnerships that enhance supply chain resilience.

Enhancing transparency through blockchain-based traceability systems will strengthen brand equity and reassure end customers regarding provenance. Additionally, collaborating with downstream application developers-whether in electronics, optics or jewelry design-will deepen market penetration and accelerate innovation cycles. It is also essential to engage proactively with policy makers to advocate for nuanced tariff frameworks or targeted exemptions that reflect diamonds’ distinct value chains.

Finally, amplifying digital marketing initiatives and immersive customer experiences, including augmented reality gem visualization, will differentiate offerings and streamline purchase decisions. By orchestrating these strategic moves, industry leaders can position their organizations to capture new growth opportunities and maintain agile response capabilities in a dynamic environment.

Outlining a Robust Research Framework Employing Comprehensive Primary Interviews Secondary Data Validation and Multi-Tier Segmentation Analysis for CVD Lab-Grown Diamond Insights

The research underpinning this analysis combined qualitative and quantitative approaches to ensure robustness. Primary insights were gathered through in-depth interviews with C-suite executives, process engineers and purchase managers across multiple regions. These conversations provided firsthand perspectives on technology roadmaps, supply chain adaptations and customer preferences.

Secondary data streams were sourced from public filings, trade association reports and peer-reviewed journals, followed by rigorous validation against proprietary production data shared by select industry participants. A multi-tier segmentation framework was applied to categorize findings across application domains, carat weight ranges, product types and distribution channels. Analytical techniques, including SWOT and PESTEL assessments, were employed to triangulate market drivers, regulatory influences and competitive dynamics. This methodology enabled a comprehensive view of the CVD lab-grown diamond landscape, ensuring actionable insights and strategic clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CVD Lab-grown Diamond market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CVD Lab-grown Diamond Market, by Carat Weight

- CVD Lab-grown Diamond Market, by Product Type

- CVD Lab-grown Diamond Market, by Application

- CVD Lab-grown Diamond Market, by Sales Channel

- CVD Lab-grown Diamond Market, by Region

- CVD Lab-grown Diamond Market, by Group

- CVD Lab-grown Diamond Market, by Country

- United States CVD Lab-grown Diamond Market

- China CVD Lab-grown Diamond Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Insights on Emerging Technological Opportunities Supply Chain Challenges and Regulatory Headwinds to Guide Strategic Decision-Making and Sustainable Growth in the CVD Lab-Grown Diamond Sector

The convergence of technological innovation, sustainability imperatives and shifting consumer values has firmly established CVD lab-grown diamonds as versatile materials with expanding industrial and jewelry applications. Advances in reactor design and process optimization continue to narrow performance differentials, while digital commerce platforms unlock new customer segments and engagement models.

However, tariff interventions and geopolitical headwinds underscore the importance of diversified sourcing strategies and agile supply chain configurations. Companies that proactively embrace transparency, cultivate strategic partnerships and invest in differentiated product capabilities will navigate regulatory complexities more effectively. Moreover, regional market nuances-from North America’s sustainability focus to Asia-Pacific’s integration strengths-demand tailored approaches.

Ultimately, the CVD lab-grown diamond sector stands at a strategic inflection point. Organizations that align technical excellence with customer-centric value propositions, and that engage collaboratively with policy stakeholders, will be best positioned to harness emerging opportunities and drive long-term resilience in this rapidly evolving domain.

Connecting with Ketan Rohom Associate Director of Sales Marketing to Access Premium CVD Lab-Grown Diamond Market Intelligence Tailored Solutions and Strategic Partnership Opportunities

To explore the comprehensive research and gain tailored guidance on navigating the evolving CVD lab-grown diamond landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise can connect you with detailed insights, proprietary analyses, and customized strategic support designed to address your specific challenges and objectives. Engaging directly with Ketan provides an opportunity to schedule a personalized briefing, discuss partnership frameworks, and secure access to the full market intelligence report. By leveraging this collaboration, you can position your organization at the forefront of innovation, capitalize on emerging trends, and build resilient supply chains in a competitive environment. Take the next step toward strategic growth by contacting Ketan Rohom to unlock the detailed findings and actionable recommendations essential for success in the CVD lab-grown diamond industry

- How big is the CVD Lab-grown Diamond Market?

- What is the CVD Lab-grown Diamond Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?